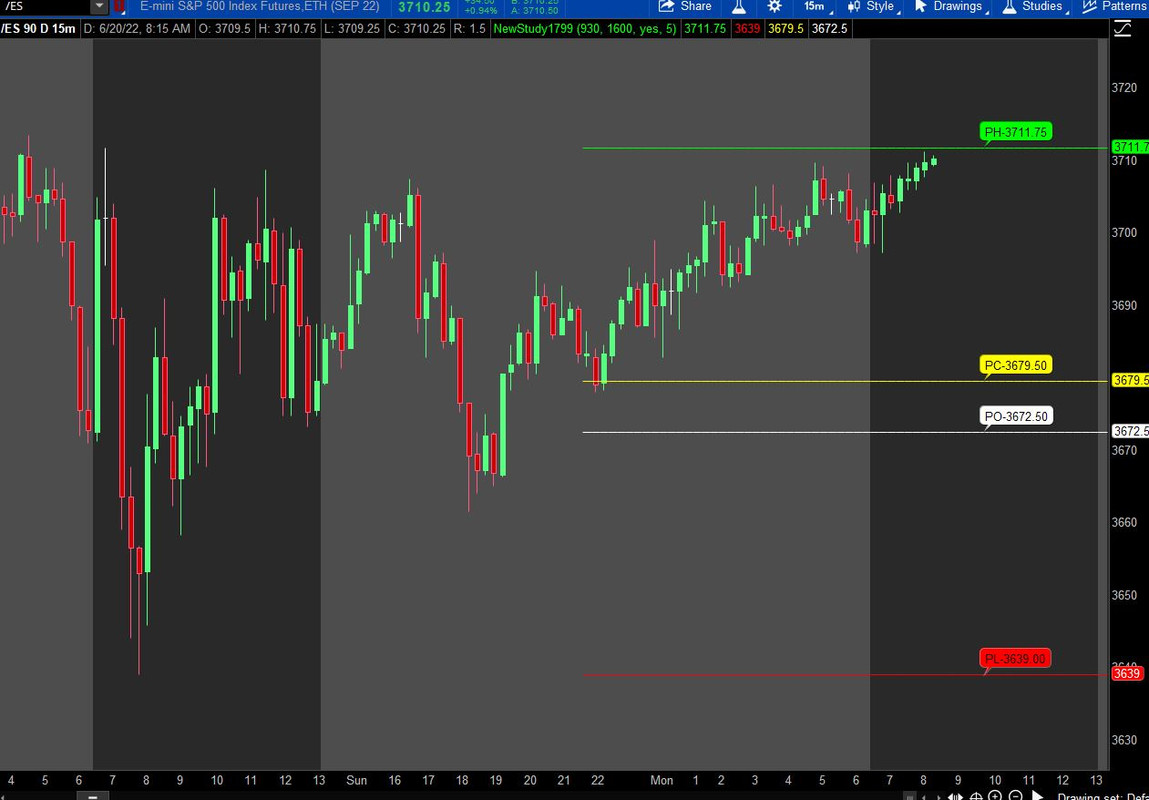

This plots the RTH (0930:1600) for HLCO for the previous day on today's chart

Ruby:

#Prior Day HLC RegularTradingHours

input rthbegin = 0930;

input rthend = 1600;

def pastOpen = If((SecondsTillTime(rthbegin) > 0), 0, 1);

def pastClose = If((SecondsTillTime(rthend) > 0), 0, 1);

def marketOpen = If(pastOpen and !pastClose, 1, 0);

def date = GetYYYYMMDD();

def c = close;

def h = high;

def l = low;

def o = open;

#Highest High during RTH from Previous Day Determined

def begin = CompoundValue(1, if getday()==getday()[1]

then if SecondsFromTime(rthbegin) == 0

then h

else if h > begin[1] and marketOpen

then h

else begin[1]

else 0, begin[1]);

def beginbn = if GetDay() == GetLastDay()

then 0

else if getday()==getday()[1]

then if h == begin and marketOpen

then BarNumber()

else beginbn[1]

else 0;

def beginprice = if getday()==getday()[1]

then if BarNumber() == HighestAll(beginbn)

then h

else beginprice[1]

else beginprice[1];

#Lowest Low During RTH from Previous Day Determined

def begin1 = CompoundValue(1, if getday()==getday()[1]

then if SecondsFromTime(rthbegin) == 0

then l

else if l < begin1[1] and marketOpen

then l

else begin1[1]

else 0, l);

def beginbn1 = if GetDay() == GetLastDay()

then 0

else if l == begin1

then BarNumber()

else beginbn1[1];

def beginprice1 = if date == date[1]

then if BarNumber() == HighestAll(beginbn1)

then l

else beginprice1[1]

else beginprice1[1];

#Close During RTH from Previous Day Determined

def begin2 = CompoundValue(1, if date == date[1]

then if SecondsFromTime(rthend) == 0

then c

else begin2[1]

else 0, c);

def beginbn2 = if GetDay() == GetLastDay()

then 0

else if c == begin2

then BarNumber()

else beginbn2[1];

def beginprice2 = if date == date[1]

then if BarNumber() == HighestAll(beginbn2)

then c

else beginprice2[1]

else beginprice2[1];

#Open During RTH from Previous Day Determined

def begin3 = CompoundValue(1, if date == date[1]

then if SecondsFromTime(rthbegin) == 0

then o

else begin3[1]

else 0, 0);

def beginbn3 = if GetDay() == GetLastDay()

then 0

else if date==date[1] and o == (begin3)

then BarNumber()

else beginbn3[1];

def beginprice3 = if date == date[1]

then if BarNumber() == (beginbn3)

then o

else beginprice3[1]

else beginprice3[1];

plot ph = if getday()!=getlastday() then double.nan else beginprice;

ph.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ph.setdefaultColor(color.green);

plot pl = if getday()!=getlastday() then double.nan else beginprice1;

pl.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pl.setdefaultColor(color.red);

plot pc = if getday()!=getlastday() then double.nan else beginprice2;

pc.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pc.setdefaultColor(color.yellow);

plot po = if getday()!=getlastday() then double.nan else beginprice3;

po.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

po.setdefaultColor(color.white);

input showbubbles_Prior_OHLC = yes;

input n = 5;

def n1 = n + 1;

def StartPlot = if showbubbles_Prior_OHLC == yes

then (IsNaN(c[n]) and !IsNaN(c[n1]))

else Double.NaN;

AddChartBubble(StartPlot, Round(ph[n1], 2), "PH-" + astext(Round(ph[n1], 2)), Color.GREEN, yes);

AddChartBubble(StartPlot, Round(pl[n1], 2), "PL-" + astext(Round(pl[n1], 2)), Color.RED, yes);

AddChartBubble(StartPlot, Round(pc[n1], 2), "PC-" + astext(Round(pc[n1], 2)), Color.YELLOW, yes);

AddChartBubble(StartPlot, Round(po[n1], 2), "PO-" + astext(Round(po[n1], 2)), Color.white, yes);

Last edited by a moderator: