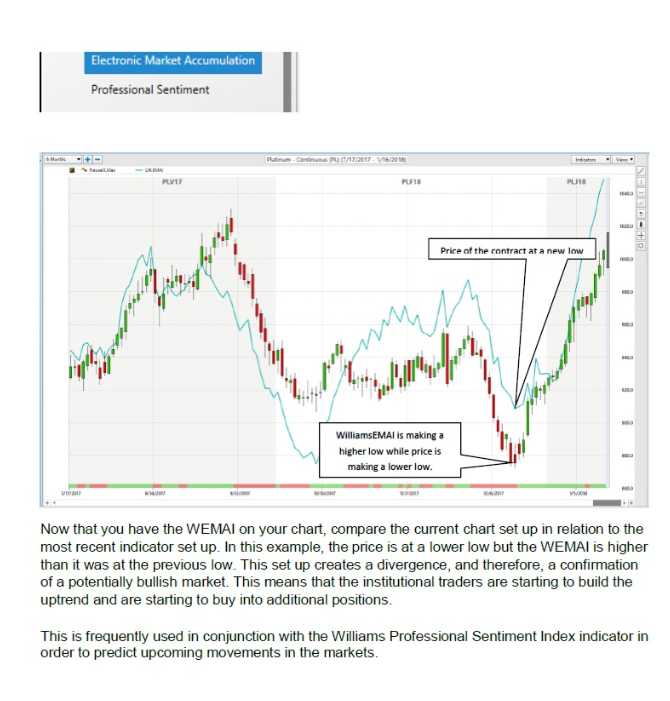

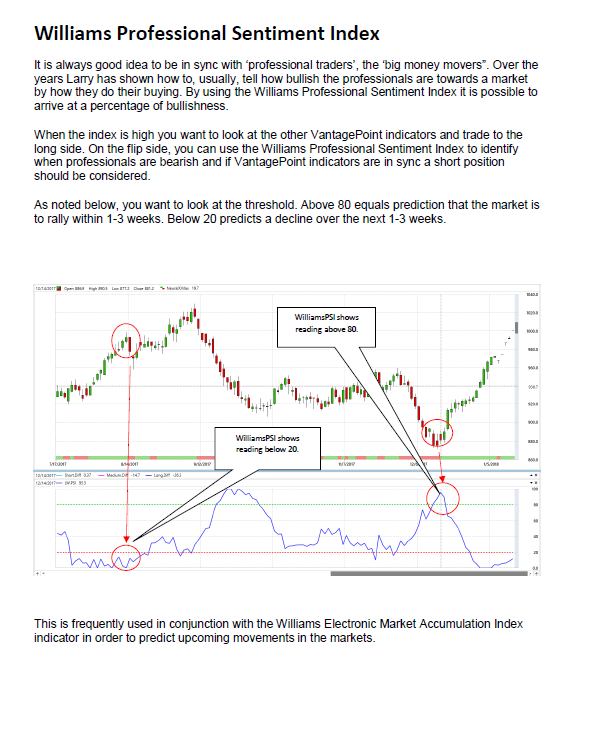

snow 22 - great to have another VP user here. i also find the grey next day predictive bar is as you say very accurate, certainly directionally. i find that really you need to look at the neural index value w the grey next day predictive to predict if it will overshoot in the direction it is predicted to go. For most markets, it rare that it gets the next day directional move wrong. i am experimenting doing 0DTE (mostly spreads) w SPX (using the /ES market in VP as there is no SPX in VP) as well as the neural index and ST and MT Pred differences and i also use a very cool gauge in VP called Bull/Bear. I've just paper traded it for about 2 months M,W,F weeklys on SPX- so far it has been exceptional because with the spreads i'm betting on the direction, not just range bound butterflies or iron condors that most use for this trade. If you want to really learn how the LW PSI and EMAI are used together, i suggest you join their Live Trading Room at least for a month or two (you can cancel after that i think because you've learned basically the keys strategy and you can record the sessions for reviewing later), because the trainer on Tuesday and Friday uses these exclusively to find all kinds of trades and how to manage them together w the shorter term VP indicators (but not forex or options - those are for the other days of the week). He explains the set up well and the key takeaway for me is that PSI is a 3-10 day predictive move, as you say when it hits the 80/20 levels, the EMAI is good for a.) 2-6 wk early indicator while looking for the divergence w price or less effective but also helpful if once in a trending mode, price should generally follow it or better said, don't go against it. another analogy is EMAI are binoculars, PSI is your human eye and the VP NI, pred hi low next day, S/MT crossover, Pred differences are like a microscope. BTW, if you are looking for the equivalent of the VP triple cross for TOS, the Slim Ribbon indicator is essentially exactly the same.

http://tos.mx/2lD0Mkd