gravityflyer

New member

Hi all,

I just wanted to share my first thinkScript indicator and kindly seeking your assistance in refining the code.

In short, the indicator works as I intended. Yay for me! That said, the presentation needs more refinement. Some issues I'm having:

That said, the presentation needs more refinement. Some issues I'm having:

I just wanted to share my first thinkScript indicator and kindly seeking your assistance in refining the code.

Code:

# Potential Breakout (PBO) indicator

# gravityflyer

# v1.0 - 2021.04.05

declare lower;

declare real_size;

#Input Price Line

input priceType = PriceType.LAST;

plot LastPrice = close(priceType = priceType);

LastPrice.SetDefaultColor(GetColor(7));

#Input Bolinger Band Width

input averageType = AverageType.Simple;

input price = close;

input displace = 0;

input length = 20;

input Num_Dev_Dn = -1.0;

input Num_Dev_Up = 1.0;

input BulgeLength = 150;

input SqueezeLength = 150;

def upperBand = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).UpperBand;

def lowerBand = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).LowerBand;

def midLine = BollingerBands(price, displace, length, Num_Dev_Dn, Num_Dev_Up, averageType).MidLine;

plot Bandwidth = (upperBand - lowerBand) / midLine * 100;

Bandwidth.SetDefaultColor(Color.WHITE);

#Painting Strategy

LastPrice.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

LastPrice.DefineColor("Normal", Color.GRAY);

LastPrice.DefineColor("BuySignal", Color.GREEN);

LastPrice.DefineColor("SellSignal", Color.RED);

LastPrice.AssignValueColor(if LastPrice > upperBand then LastPrice.Color("BuySignal") else if LastPrice < lowerBand then LastPrice.Color("SellSignal") else LastPrice.Color("Normal"));

#Input Reference Line

plot ZeroLine = 0;

ZeroLine.SetDefaultColor(GetColor(8));

ZeroLine.setStyle(Curve.SHORT_DASH);In short, the indicator works as I intended. Yay for me!

- The scale is obviously not consistent with the price/BB superimposed. I thought "declare real_size" would fix the issue?

- How do I fill the upper and lower bands with a color, ideally with a lower opacity? Would that be with the "Add.Cloud" code? As indicated by the code, buy/sell signals would occur above/below such values.

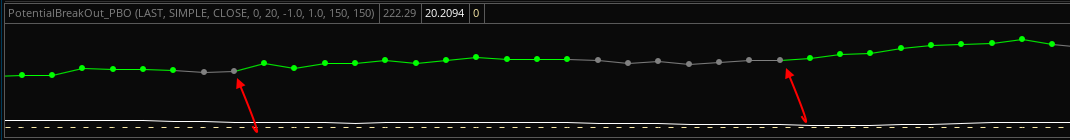

- In terms of painting strategy, you'll notice it's painting the LastPrice and thus the signal is slightly delayed (see pic below). Is there a way to repaint on the current price or should I not worry about it?

- Finally, how can I add buy/sell signals at the bottom of the indicator below the 0 reference line?