You should upgrade or use an alternative browser.

Position Size Calculator for ThinkorSwim

- Thread starter GetRichOrDieTrying

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

vollermist

New member

Irrelevant if it ask for a plot...one can just make a label for the variable "shares". In a strategy, just use the variable "shares" in the AddOrder statement instead of the number of shares. I incorporate this code (or a variation of this code) in studies AND strategies. I only trade stocks, so I don't know how it will work on other instruments. I guess you could call this code a "snippet" that can be used standalone by just adding an AddLabel statement. I'm not a programmer, so I don't know if I'm using the correct terms.Are we supposed to add this to a strategy or study? When one tries to add to studies it asks for a plot and strategy asks for an Add order

In the strategy section, I posted a strategy I had been working on which incorporates a version of this code. Most of what I code is coded for range bar charts, and may be suboptimal for time or tick based charts. GrowEquityStrategy including Kelly-based position sizing

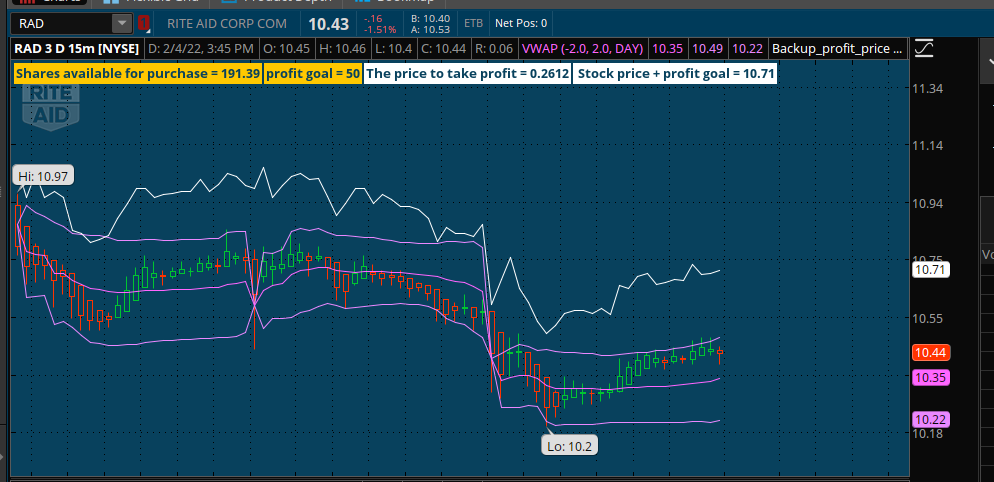

The simplicity of this calculator works very well with my Renko DMI Strategy. Thanks for sharing!I came across a script months ago:

https://usethinkscript.com/threads/position-size-calculator-for-thinkorswim.588/page-3#post-49627

but I felt that it was lacking. I just got around to finishing it. I only wish that it could also highlight the price in the active trader.

http://tos.mx/VviLozV

Code:# Simple Position Calculator # Assembled by BenTen at UseThinkScript.com input Budget = 2000; def current_price = close; def Share_Quantity_purchase_limit = Budget / current_price; ############# labels AddLabel(yes, Concat("Shares available for purchase = ", Round(Share_Quantity_purchase_limit)), Color.ORANGE); ############################################################################################### input profit_goal = 50.00; plot Close_Position = profit_goal/Share_Quantity_purchase_limit ; Close_Position.SetDefaultColor(GetColor(0)); AddLabel(yes, Concat("profit goal = ", Round(profit_goal)), Color.orange); AddLabel(yes, Concat("required price change = ", (Close_Position)), Color.white); def yellow = profit_goal/Share_Quantity_purchase_limit; ##################################################################### plot priceLine = current_price + close_Position;; priceline.SetPaintingStrategy(PaintingStrategy.line); priceLine.SetLineWeight(1); AddLabel(yes, Concat(" Stock price + profit goal = ",Round(current_price + close_Position )), Color.white); #AddLabel(yes, Concat(" The amount of active trader movement = ",Round(Share_Quantity_purchase_limit + close_Position )), Color.white);

Betozenho

New member

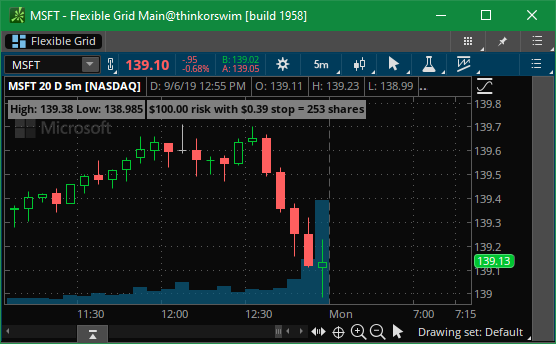

aMAZING SCRIPT!!! IS IT POSSIBLE TO HAVE IT WORKING ON A TICK CHARTS?I reverse engineered what I think the two labels show.

This is the output of that work.

thinkScript Code

Code:# # PositionSizingCalculator # # Author: Kory Gill, @korygill # # input RiskUnit = 100; input AggregationPeriod = AggregationPeriod.FIFTEEN_MIN; def highVal = high(period = AggregationPeriod); def lowVal = low(period = AggregationPeriod); AddLabel( yes, "High: " + highVal + " Low: " + lowVal, Color.Gray ); def diff = highVal-LowVal; AddLabel( yes, AsDollars(RiskUnit) + " risk with " + AsDollars(diff) + " stop = " + Floor(Round(RiskUnit/diff)) + " shares", Color.Gray );

Link to the study

https://tos.mx/HwObLl

Thanks,

Kory Gill, @korygill

Here is the code:

plot entryPrice;

input showDetails = yes;

input showBasis = yes;

input showProfitLoss = yes;

input showFills = no;

input netProfitLossPastTrades = 0.00;

input MaxShares = yes;

# Entry Price

entryPrice = GetAveragePrice();

entryPrice.AssignValueColor(if close < entryPrice then Color.DOWNTICK else Color.UPTICK);

entryPrice.SetLineWeight(2);

entryPrice.SetStyle(Curve.SHORT_DASH);

# Basis Calculat ion

def qty = GetQuantity();

def openCost = qty * GetAveragePrice();

def basis = (qty * entryPrice);

#add it

def Cash = GetTotalCash ();

def StockPrice = GetAveragePrice ();

def TotalShares= GetAveragePrice () / GetTotalCash ();

#Labels

AddLabel(showDetails, qty + "@" + AsDollars(entryPrice), Color.GRAY);

AddLabel(showBasis and netProfitLossPastTrades == 0.0, "Basis: " + AsDollars(basis), if basis > (qty * close) then Color.DOWNTICK else Color.UPTICK);

AddLabel(showBasis and netProfitLossPastTrades != 0.0, "Basis (adj): " + AsDollars(basis), if basis > (qty * close) then Color.DOWNTICK else Color.UPTICK);

def pl = (close - entryPrice) * qty;

AddLabel(showProfitLoss, "P/L: " + AsDollars(pl), if pl > 0 then Color.UPTICK else if pl == 0 then Color.WHITE else Color.DOWNTICK);

AddLabel(showProfitLoss, "P/L/Share: " + AsDollars(close - entryPrice), if (close - entryPrice) > 0 then Color.UPTICK else if (close - entryPrice) == 0 then Color.WHITE else Color.DOWNTICK);

#add it

AAddLabel(MaxShares, "TotalShares: " + AsDollars(Cash) + " | StockPrice: " + AsDollars(StockPrice), Color.WHITE);

#

# PositionSizingCalculator

#

# Author: Kory Gill, [USER=212]@korygill[/USER]

#

# Modified by Jedo64

input RiskUnit = 100;

input AggregationPeriod = AggregationPeriod.FIFTEEN_MIN;

def highVal = high(period = AggregationPeriod);

def lowVal = low(period = AggregationPeriod);

def lo = low;

def hi = high;

AddLabel(

no,

AsDollars(RiskUnit) + "=1R",

Color.CYAN

);

# Instead of current bar i changed it to previous bar

def diff = hi[1] - lo[1];

def diff0 = hi - lo;

plot SharesSize = Floor(Round(RiskUnit / diff0));

AddLabel(

yes,

"Risk: " + AsDollars(diff * 1.00) + " = " + Floor(Round(RiskUnit / (diff * 1.00))) + " Shares ",

Color.CYAN

);

#added a Green label to see Inside Bar Size for Long trigger

def diffl = (hi[1] - lo[1]) * 1.00;

AddLabel(

yes,

" Long = .7R: " + (RoundDown(hi[1] + diffl*.7)) + " 1R: " + (RoundDown(hi[1] + diffl)) + " 2R: " + (RoundDown(hi[1] + diffl*2)) + " 3R: " + (RoundDown(hi[1] + diffl*3))+ " 4R: " + (RoundDown(hi[1] + diffl*4))+ " 5R: " + (RoundDown(hi[1] + diffl*5)),

Color.GREEN

);

# Added red label to see Inside Bar Size for short trigger

def diffs = (hi[1] - lo[1]) * 1.00;

AddLabel(

yes,

"SHORT = .7R: " + (rounddown(lo[1] - diffs*.7)) + " 1R: " + (rounddown(lo[1] - diffs)) + " 2R: " + (rounddown(lo[1] - diffs*2)) + " 3R: " + (rounddown(lo[1] - diffs*3)) + " 4R: " + (rounddown(lo[1] - diffs*4)) + " 5R: " + (rounddown(lo[1] - diffs*5)) ,

Color.rED

);How to code a stop segregation?below is a position script calculator that measures risk unit (ex. R1) based on the difference of previous bar high and low price. I want it to be change to the current bar - can someone please convert it?

Code:# # PositionSizingCalculator # # Author: Kory Gill, [USER=212]@korygill[/USER] # # Modified by Jedo64 input RiskUnit = 100; input AggregationPeriod = AggregationPeriod.FIFTEEN_MIN; def highVal = high(period = AggregationPeriod); def lowVal = low(period = AggregationPeriod); def lo = low; def hi = high; AddLabel( no, AsDollars(RiskUnit) + "=1R", Color.CYAN ); # Instead of current bar i changed it to previous bar def diff = hi[1] - lo[1]; def diff0 = hi - lo; plot SharesSize = Floor(Round(RiskUnit / diff0)); AddLabel( yes, "Risk: " + AsDollars(diff * 1.00) + " = " + Floor(Round(RiskUnit / (diff * 1.00))) + " Shares ", Color.CYAN ); #added a Green label to see Inside Bar Size for Long trigger def diffl = (hi[1] - lo[1]) * 1.00; AddLabel( yes, " Long = .7R: " + (RoundDown(hi[1] + diffl*.7)) + " 1R: " + (RoundDown(hi[1] + diffl)) + " 2R: " + (RoundDown(hi[1] + diffl*2)) + " 3R: " + (RoundDown(hi[1] + diffl*3))+ " 4R: " + (RoundDown(hi[1] + diffl*4))+ " 5R: " + (RoundDown(hi[1] + diffl*5)), Color.GREEN ); # Added red label to see Inside Bar Size for short trigger def diffs = (hi[1] - lo[1]) * 1.00; AddLabel( yes, "SHORT = .7R: " + (rounddown(lo[1] - diffs*.7)) + " 1R: " + (rounddown(lo[1] - diffs)) + " 2R: " + (rounddown(lo[1] - diffs*2)) + " 3R: " + (rounddown(lo[1] - diffs*3)) + " 4R: " + (rounddown(lo[1] - diffs*4)) + " 5R: " + (rounddown(lo[1] - diffs*5)) , Color.rED );

Px range stop %

1-15 2%

16-30 1.75

31-60 1

61-100 .75

UPDATE:

I believe this may answer my question:

https://usethinkscript.com/threads/convert-tradingview-trailing-stop-loss.15598/

How does this one work, is it a PL ratio?This is fantastic - Thank you. Makes trading so much easier. I copied the format of your code to create what price would be 2% stop and 4% gain (percentages can be edited). Here's the code for those if anyone is interested (saves me a whopping 30 seconds on each trade! haha):

Stop Loss Code:

Code:input amount = 2; def Data = close-(amount/100)*close; def showDiv = yes; AddLabel(showDiv, Data + " stop loss", Color.RED); Sell Limit Code: input amount = 4; def Data = close+(amount/100)*close; def showDiv = yes; AddLabel(showDiv, Data + " sell limit", Color.GREEN);

I'm trying to understand this one. For instance if I use the "Risk_Stop" scenario...With a $25 Risk at a $.10 Stop, shouldn't it show 250 Shares? It just shows "1 Shares".I've got a better one. There's three scenarios:

Scenario 1: You can choose your size and your risk, but not your stop

Scenario 2: You can choose your size and your stop, but not your risk

Scenario 3: You can choose your risk and your stop, but not your size

Why not make it an indicator that lets you see the result of those decisions? I decided to make one. The only issue I'm uncertain of is whether I am making price what it actually is. I decided to go with Mark

Here's the code:

Code:# # PositionSizingCalculator # # Author: RamonDV. AKA Pelonsax # # input Risk_Amount = 100; input Shares = 1000; input Stop_Price = 100.00; input Choose_Size_and_Risk = yes; #can't choose stop input Choose_Size_and_Stop = yes; #can't choose risk input Choose_Risk_and_Stop = yes; #can't choose size def Mark = close(PriceType = PriceType.MARK); def Size = Risk_Amount / (Mark - Stop_Price); def Stop = ((Mark * Shares) - Risk_Amount) / Shares; def Risk = (mark - Stop_Price) * Shares; #Display current price AddLabel(yes, "Current Price: " + AsDollars(Mark), color.gray); #No defined stop AddLabel(Choose_Size_and_Risk, "No defined stop: " + Shares + " Shares with " + AsDollars(Risk_Amount) + " risk with Stop Loss at " + AsDollars(stop) + " .", color.gray); #No defined risk AddLabel(Choose_Size_and_Stop, "No Defined risk: " + Shares + " Shares with " + AsDollars(risk) + " risk with Stop Loss at " + AsDollars(Stop_Price) + " .", color.gray); #No defined size AddLabel(Choose_Risk_and_Stop, "No defined size: " + Floor(Round(size)) + " Shares with " + AsDollars(Risk_Amount) + " risk with Stop Loss at " + AsDollars(Stop_Price) + " .", color.gray);

Here's the link:

https://tos.mx/l2H5IBg

I get an error. Where is "bullstop" or "bearstop" defined?This one I wrote to auto calculate the number of shares to buy based on an input risk % and capital size. You will need to update the stop level based on whatever signal you are using.

Code:######################################## input capital_size = 25000; input risk_percent = 1; def risk_price = close; def risk_percent_calc = risk_percent / 100; def entry_stop_bull = (risk_price - bullstop); def entry_stop_bear = (bearstop - risk_price); def units_to_buy_bull = (risk_percent_calc * capital_size) / (entry_stop_bull) / risk_price; def units_to_buy_bull1 = RoundDown(units_to_buy_bull,0); def total_cost_bull = units_to_buy_bull1 * risk_price; def units_to_buy_bear = (risk_percent_calc * capital_size) / (entry_stop_bear) / risk_price; def units_to_buy_bear1 = RoundDown(units_to_buy_bear,0); ########################################

bargains730

New member

Is it possible to have a script that calculates SHARE SIZE based on a Risk $ amount and a place on the chart where I click my mouse?

I have this script already for another trading software called DAS Trader and use it daily. But I prefer to trade in TOS.

For example:

Risk is set to $50 for every trade.

Stop = Price where I click my mouse (let's say I single-click on the chart at $10.00)

if Current Price: $11, and I single-click on $10, I want the script to tell me the share size I should use.

In this case, $50 risk, $1 stop, Share Size should be = 50 shares.

victor7584

New member

Hi @BenTen. Can you please code this with Ask price instead of Close? Thank you@CDJay I think this should be able to fulfil your request.

Code:# Simple Position Calculator # Assembled by BenTen at UseThinkScript.com input balance = 1000; def current_price = close; def limit = balance / current_price; AddLabel(yes, Concat("Shares available for purchase = ", Round(limit)), color.orange);

dsharpeatl

New member

Hi @markos, I created a simple excel tool that helps me plan my options position size based on risk. It works great for longer day trades and swings, but it's hard to use this for scalping on 1 min chart as the moves are fast. Hope it's helpful to folks looking for a simple position size calculator.@GetRichOrDieTrying props to you for having this made. Also, your journey teaches everyone a valuable lesson or two. Thank you for Sharing.

btw, I have such a tool but is excel based and based on 2 different ways of using "R" multiples.

Unfortunately it is proprietary to Theotrade. If I get enough curiosity, I'll ask permission to share it.

Input requested, please.

Attachments

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/