Does anyone have any recommended advice to pick the market bottom?

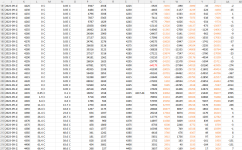

Would you use the RUA, VIX, DJA S&P and treat it like you would any stock entry signal. IE Buy the dip plus your favorite entry indicator.

Use moving averages. Fibonacci retracements. What’s your thoughts.

Would you use the RUA, VIX, DJA S&P and treat it like you would any stock entry signal. IE Buy the dip plus your favorite entry indicator.

Use moving averages. Fibonacci retracements. What’s your thoughts.