Author Message:

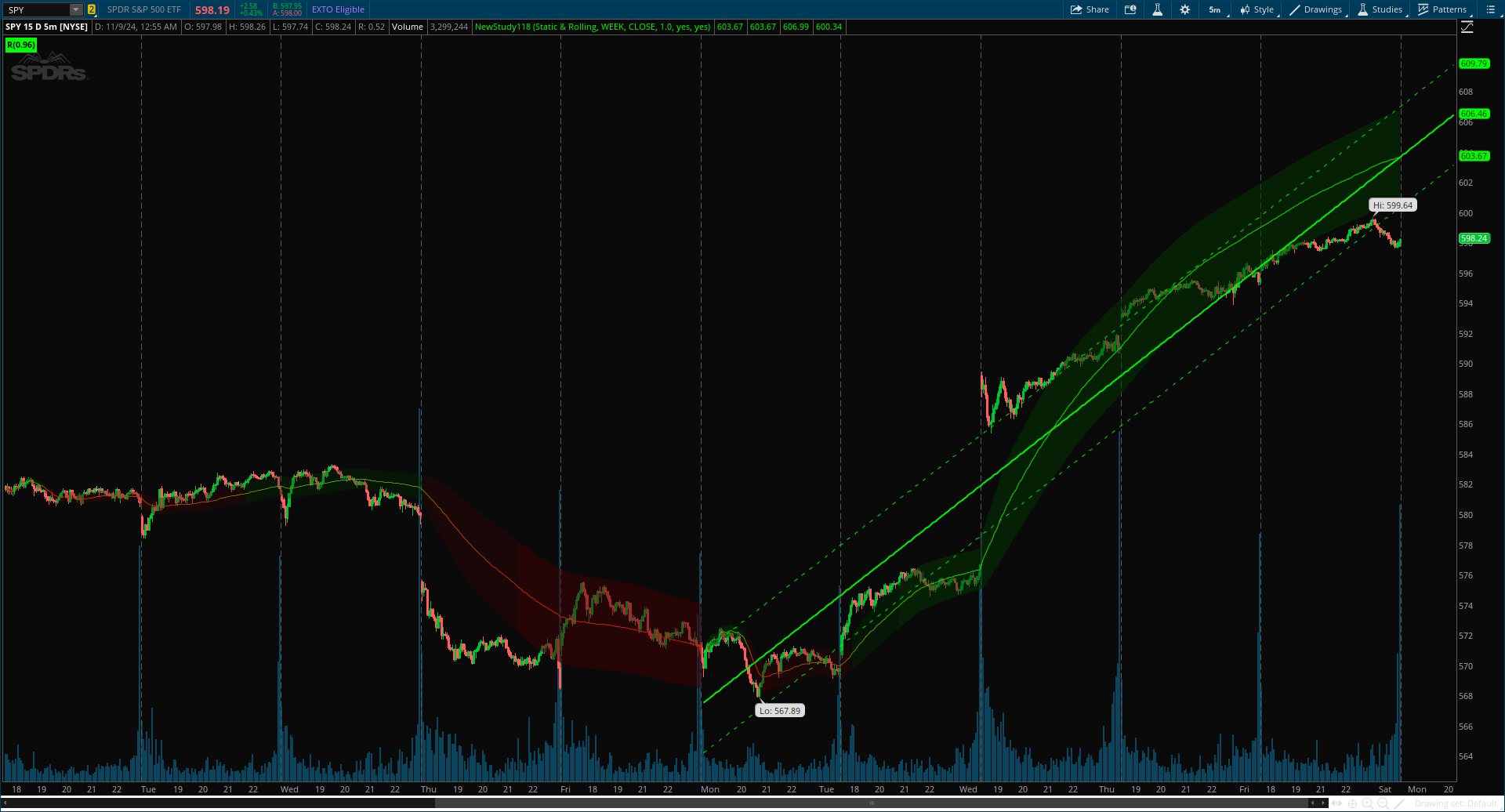

The Periodic Linear Regressions (PLR) indicator calculates linear regressions periodically (similar to the VWAP indicator) based on a user-set period (anchor).

This allows for estimating underlying trends in the price, as well as providing potential supports/resistances.

CODE:

Code:

#// Indicator for TOS

#// © LuxAlgo

#indicator('Periodic Linear Regressions [LuxAlgo]' , shorttitle='LuxAlgo - Periodic Linear Regressions'

# Converted by Sam4Cok@Samer800 - 11/2024

input showLabel = yes;

input Method = {"Static", default "Rolling", "Static & Rolling"}; # 'Method'

input AnchorPeriod = AggregationPeriod.WEEK;

input Source = close; # 'Source'

input Multiple = 1.0; # 'Multiple'

input ShowExtremities = yes; # , 'Show Extremities'

input extendStaticLinesToRight = no;

def na = Double.NaN;

def last = IsNaN(close);

def extend = extendStaticLinesToRight;

def current = GetAggregationPeriod();

def tf = Max(current, AnchorPeriod);

def bar = if !last then bar[1] + 1 else bar[1]; #if !last then BarNumber() else bar[1];

def n = if bar <=0 then 1 else bar;

def tgChage = if !last then close(Period = tf) else tgChage[1];

def ch = CompoundValue(1, tgChage!=tgChage[1], yes);

#-- Color

DefineGlobalColor("up", CreateColor(0, 52, 0));

DefineGlobalColor("dn", CreateColor(62, 0, 0));

script StDevTS {

input data = close;

input len = 12;

def length = Max(len , 1);

def avgData = (fold j = 0 to length with p do

p + GetValue(data, j)) / length;

def StDevTS = Sqrt((fold i = 0 to length with SD do

SD + Sqr(GetValue(data, i) - avgData)) / length);

plot out = StDevTS;

}

script covarianceTS {

input data1 = close;

input data2 = close;

input len = 12;

def length = Max(len , 1);

def avgData = (fold j = 0 to length with p do

p + GetValue(data1, j) * GetValue(data2, j)) / length;

def avgData1 = (fold j1 = 0 to length with p1 do

p1 + GetValue(data1, j1)) / length;

def avgData2 = (fold j2 = 0 to length with p2 do

p2 + GetValue(data2, j2)) / length;

plot CovarianceTS = avgData - avgData1 * avgData2;

}

#//add x & y values to array

def x1;

def Ex1;

def Ey1;

def Ex21;

def Exy1;

def aX1;

def aY1;

def Ex = Ex1[1] + n;

def Ey = Ey1[1] + Source;

def Ex2 = Ex21[1] + Power(n, 2);

def Exy = Exy1[1] + n * Source;

def x = Max(x1[1] + 1, 1);

def m = (x * Exy - Ex * Ey) / (x * Ex2 - power(Ex, 2));

def b = (Ey - m * Ex) / x;

def yMx = m * n + b;

def cov = covarianceTS(Source, n, x);

def x_var = Sqr(StDevTS(Source, x));

def a_ = cov / x_var;

def avgSrc = (fold j = 0 to x with q do

q + GetValue(Source, j)) / x;

def avgN = (fold i = 0 to x with p do

p + GetValue(n, i)) / x;

def b_ = avgSrc - a_ * avgN;

def r2 = power(cov / (StDevTS(Source, x) * StDevTS(n, x)), 2);

def rss = x_var - r2 * x_var;

def dist = sqrt(rss) * Multiple;

if ch {

Ex1 = 0;

Ey1 = 0;

Ex21 = 0;

Exy1 = 0;

x1 = 0;

aX1 = 0;

aY1 = 0;

} else {

Ex1 = Ex;

Ey1 = Ey;

Ex21 = Ex2;

Exy1 = Exy;

x1 = x;

aX1 = n;

aY1 = Source;

}

def R1 = cov / (StDevTS(Source, x) * StDevTS(n, x));

def R = if isNaN(R1) then 0 else R1;

def startBar = if ch then n else startBar[1];

def startSrc = if ch then Source else startSrc[1] ;

def lastDis = highestAll(inertiaAll(dist, 2, extendToRight = yes));

def cond = n > highestAll(inertiaAll(startBar, 2, extendToRight = yes));

def ln = if cond then Source else ln[1];

def lnU = if cond then Source + lastDis else lnU[1];

def lnD = if cond then Source - lastDis else lnD[1];

def endSrc = highestAll(inertiaAll(ln, 2, extendToRight = yes));

def plrRoll; def plrUpRoll; def plrDnRoll;

def plrStat; def plrUpStat; def plrDnStat;

Switch (Method) {

Case "Static & Rolling" :

plrRoll = if yMx then yMx else na;

plrUpRoll = if yMx and ShowExtremities then yMx + dist else na;

plrDnRoll = if yMx and ShowExtremities then yMx - dist else na;

plrStat = if cond then inertiaAll(ln, extendToRight = extend) else na;

plrUpStat = if cond and ShowExtremities then inertiaAll(lnU, extendToRight = extend) else na;

plrDnStat = if cond and ShowExtremities then inertiaAll(lnD, extendToRight = extend) else na;

Case "Static" :

plrRoll = na;

plrUpRoll = na;

plrDnRoll = na;

plrStat = if cond then inertiaAll(ln, extendToRight = extend) else na;

plrUpStat = if cond and ShowExtremities then inertiaAll(lnU, extendToRight = extend) else na;

plrDnStat = if cond and ShowExtremities then inertiaAll(lnD, extendToRight = extend) else na;

Default :

plrRoll = if yMx then yMx else na;

plrUpRoll = if yMx and ShowExtremities then yMx + dist else na;

plrDnRoll = if yMx and ShowExtremities then yMx - dist else na;

plrStat = na;

plrUpStat = na;

plrDnStat = na;

}

def endStat = if !isNaN(plrStat) then plrStat else endStat[1];

def staStat = if cond and !cond[1] then plrStat else staStat[1];

def colStatic1 = if (endStat > staStat) then 1 else 0;

def colStatic = if !isNaN(colStatic1) then colStatic1 else if isNaN(colStatic[1]) then 0 else colStatic[1];

def colRolling = if R > 1 then 4 else if R < -1 then 0 else (R + 1) * 2;

def upRolling = if plrUpRoll then plrUpRoll else na;

def dnRolling = if plrDnRoll then plrDnRoll else na;

plot midRolling = if plrRoll then plrRoll else na;

plot midStatic = if plrStat then plrStat else na;

plot upStatic = if plrUpStat then plrUpStat else na;

plot dnStatic = if plrDnStat then plrDnStat else na;

midRolling.AssignValueColor(CreateColor(255 - colRolling * 63, colRolling * 63, 0));

midStatic.SetLineWeight(2);

upStatic.SetStyle(Curve.SHORT_DASH);

dnStatic.SetStyle(Curve.SHORT_DASH);

midStatic.SetDefaultColor(Color.GRAY);

upStatic.SetDefaultColor(Color.GRAY);

dnStatic.SetDefaultColor(Color.GRAY);

midStatic.AssignValueColor(if colStatic>0 then Color.GREEN else Color.RED);

upStatic.AssignValueColor(if colStatic>0 then Color.GREEN else Color.RED);

dnStatic.AssignValueColor(if colStatic>0 then Color.GREEN else Color.RED);

AddCloud(if r >=0.65 then upRolling else na, dnRolling, GlobalColor("up"));

AddCloud(if r >=0 then upRolling else na, dnRolling, GlobalColor("up"));

AddCloud(if r <=-0.65 then upRolling else na, dnRolling, GlobalColor("dn"));

AddCloud(if r <=0 then upRolling else na, dnRolling, GlobalColor("dn"));

AddLabel(showLabel, "R (" + AsText(R) + ")", if R>0 then color.GREEN else Color.RED);

#-- END of CODE