input Percent = 100;

input Days = 40;

input Weeks = 8;

def iAgg =

getAggregationPeriod()

;

def iOffset =

if iAgg == aggregationPeriod.WEEK then Weeks

else if iAgg == aggregationPeriod.Day then Days

else 0

;

def bRange =

isNaN(close[-iOffset])

;

def bEdge =

bRange and !isNaN(close[-(iOffset - 1)])

;

def rTrackLow =

if bEdge then Low

else if bRange then Min(low,rTrackLow[1])

else Double.NaN

;

def dSeekLow =

if bEdge then GetValue(rTrackLow,-(iOffSet -1))

else if bRange then dSeekLow[1]

else Double.NaN;

;

def dBase =

if !bRange then Double.NaN

else if bEdge then dSeekLow

else dBase[1]

;

def dTop =

dBase + (dBase * (Percent / 100));

;

def bBreach =

if bRange and high > dTop then Yes else bBreach[1]

;

def dCloud =

dBase + 0

;

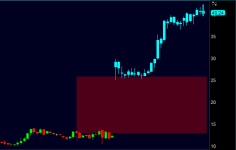

AddCloud(

dCloud,dTop,color.cyan

);

assignpriceColor(

if bBreach then color.cyan

else color.current

);

Plot Scan = bBreach and BarNumber() > iOffset and bRange;

Scan.hide();