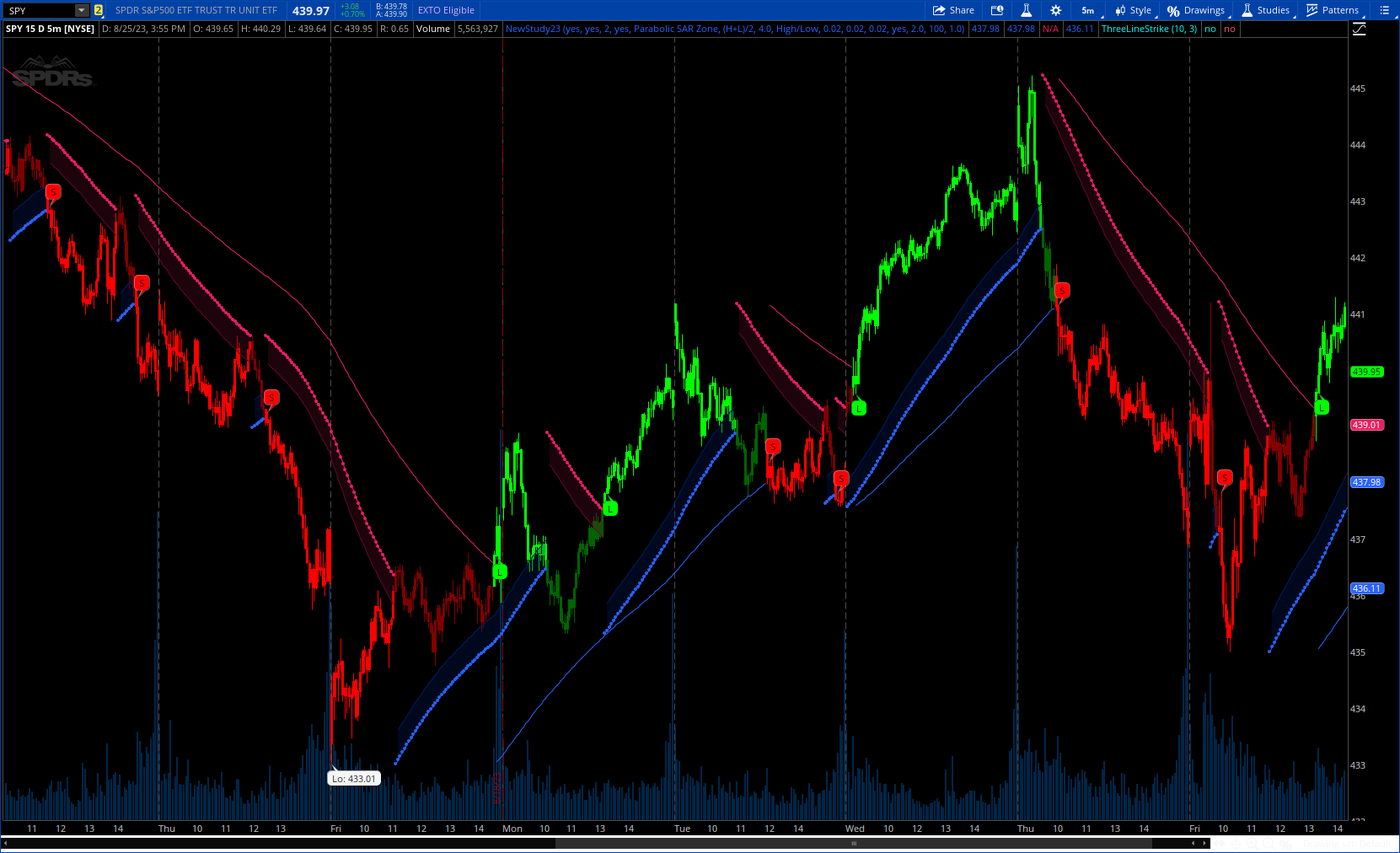

I combined PSAR and ST to select from with options. I added option to enable HeikinAshi source instead of normal source, Not totally new indicator but it can be helpful tool.

Author Message:

The tool designed to help traders identify the best zone to enter in a position revisiting the usage of the standard Parabolic SAR and SuperTrend indicator.

CODE:

CSS:

#https://www.tradingview.com/v/tABUf27g/

#/ © OmegaTools

#indicator("Parabolic SAR Zone", overlay = true)

#indicator("SuperTrend Zone", overlay = true, timeframe = "")

# Converted, Combined and mod by Sam4Cok@Samer800 - 08/2023

input colorBars = yes;

input showSignals = yes;

input signalWaitingBar = 2;

input useHeikinAshi = no;

input selectIndicator = {Default "Parabolic SAR Zone", "SuperTrend Zone"};

input supertrendPriceType = hl2;

input SupertrendFactor = 4.00; # "Supertrend factor"

input TrendCalculationMethod = {default "High/Low" , "Open/Close"};

input sarStartingvalue = 0.02; # "Starting value"

input sarIncrement = 0.02; # "Increment"

input sarMaxValue = 0.02; # "Max Value"

input changeATR = yes;

input secondPlotMulti = 2.0;

input atrLength = 100;

input Zonewidth = 1.00; # "Zone width"

def na = Double.NaN;

def PAR = selectIndicator==selectIndicator."Parabolic SAR Zone";

def f = secondPlotMulti;

def haClose = (open + high + low + close) / 4;

def haOpen = if !haOpen[1] then (open + close) / 2 else

(haOpen[1] + haClose[1]) / 2;

def haHigh = Max(Max(high, haOpen), haClose);

def haLow = Min(Min(low, haOpen), haClose);

def haSrc = (haHigh + haLow) / 2;

def Src = if useHeikinAshi then haSrc else supertrendPriceType;

def c = if useHeikinAshi then haClose else close;

def op = if useHeikinAshi then haOpen else open;

def hi = if useHeikinAshi then haHigh else high;

def lo = if useHeikinAshi then haLow else low;

def max = Max(op, c);

def min = Min(op, c);

def h; def l;

switch (TrendCalculationMethod) {

case "High/Low" :

h = hi;

l = lo;

case "Open/Close" :

h = Max;

l = Min;

}

def h1 = h;

def l1 = l;

def c1 = c;

#-- Color

DefineGlobalColor("up", CreateColor(41, 98, 255));

DefineGlobalColor("Dn", CreateColor(233, 30, 99));

DefineGlobalColor("dup", CreateColor(0, 27, 100));

DefineGlobalColor("dDn", CreateColor(97, 9, 39));

#pine_supertrend(src, factor, atrPeriod) =>

script supertrend {

input src = hl2;

input factor = 3;

input atrPeriod = 10;

input changeATR = yes;

input h = high;

input l = low;

input c = close;

def tr = TrueRange(h, c, l);

def nATR = if changeATR then WildersAverage(tr, atrPeriod) else Average(tr, atrPeriod);

def lowerBand;

def upperBand;

def upBand = src + factor * nATR;

def loBand = src - factor * nATR;

def prevLowerBand = if lowerBand[1] then lowerBand[1] else loBand;

def prevUpperBand = if upperBand[1] then upperBand[1] else upBand;

lowerBand = if (loBand > prevLowerBand) or (c[1] < prevLowerBand) then loBand else prevLowerBand;

upperBand = if (upBand < prevUpperBand) or (c[1] > prevUpperBand) then upBand else prevUpperBand;

def direction ;# = na

def superTrend;# = na

def prevSuperTrend = if superTrend[1] then superTrend[1] else prevUpperBand;

if (IsNaN(prevUpperBand) or IsNaN(prevLowerBand)) {

direction = 1;

} else

if prevSuperTrend == prevUpperBand {

direction = if c > upperBand then -1 else 1;

} else {

direction = if c < lowerBand then 1 else -1;

}

superTrend = if direction == -1 then lowerBand else upperBand;

plot ST = superTrend;

plot dir = direction ;

}

#-- TV PSAR

script sar {

input start = 0.02;

input inc = 0.02;

input max = 0.2;

input h = high;

input l = low;

input c = close;

Assert(start > 0, "'acceleration factor' must be positive: " + start);

Assert(max >= start, "'acceleration limit' (" + max + ") must be greater than or equal to 'acceleration factor' (" + start + ")");

def nATR = ATR(Length = 14);

def state = {default init, long, short};

def extreme;

def SAR;

def acc;

switch (state[1]) {

case init:

state = if c > c[1] then state.long else state.short;

acc = start;

extreme = if c > c[1] then h else l;

SAR = if c > c[1] then l else h;

case short:

if (SAR[1] < h)

then {

state = state.long;

acc = start;

extreme = h;

SAR = extreme[1];

} else {

state = state.short;

if (l < extreme[1])

then {

acc = Min(acc[1] + inc, max);

extreme = l;

} else {

acc = acc[1];

extreme = extreme[1];

}

SAR = Max(Max(h, h[1]), SAR[1] + acc * (extreme - SAR[1]));

}

case long:

if (SAR[1] > l)

then {

state = state.short;

acc = start;

extreme = l;

SAR = extreme[1];

} else {

state = state.long;

if (h > extreme[1])

then {

acc = Min(acc[1] + inc, max);

extreme = h;

} else {

acc = acc[1];

extreme = extreme[1];

}

SAR = Min(Min(l, l[1]), SAR[1] + acc * (extreme - SAR[1]));

}

}

def trend_dir = if state == state.long then 1 else if state == state.short then -1 else trend_dir[1];

plot psar = SAR;

plot dir = trend_dir;

}

def atrs = ATR(Length = atrLength) * Zonewidth;

# PSAR Calc

def sar1 = sar(sarStartingvalue, sarIncrement, sarMaxValue, h1, l1, c1).psar;

def dir1 = sar(sarStartingvalue, sarIncrement, sarMaxValue, h1, l1, c1).dir;

def sar2 = sar(sarStartingvalue / f, sarIncrement / f, sarMaxValue / f, h1, l1, c1).psar;

def dir2 = sar(sarStartingvalue / f, sarIncrement / f, sarMaxValue / f, h1, l1, c1).dir;

def sarOne = sar1;

def dirOne = dir1;

def sarTwo = sar2;

def dirTwo = dir2;

def sarZone = if dirOne > 0 then sarone + atrs else

if dirOne < 0 then sarone - atrs else na;

# ST Calc

def ST1 = supertrend(Src, SupertrendFactor, atrLength, changeATR, h1, l1, c1).ST;

def stDir1 = supertrend(Src, SupertrendFactor, atrLength, changeATR, h1, l1, c1).dir;

def ST2 = supertrend(Src, SupertrendFactor * f, atrLength * f, changeATR, h1, l1, c1).ST;

def stDir2 = supertrend(Src, SupertrendFactor * f, atrLength * f, changeATR, h1, l1, c1).dir;

def supertrend = ST1;

def direction = stDir1;

def supertrend2 = ST2;

def direction2 = stDir2;

def STzone = if direction < 0 then supertrend + atrs else

if direction > 0 then supertrend - atrs else na;

def ind1;def ind2; def ZoneInd; def trend; def trend2;

Switch (selectIndicator) {

Case "Parabolic SAR Zone" :

ind1 = sarone;

ind2 = sartwo;

ZoneInd = sarzone;

trend = dirOne;

trend2 = dirTwo;

Case "SuperTrend Zone" :

ind1 = supertrend;

ind2 = supertrend2;

ZoneInd = STzone;

trend = -direction;

trend2 = -direction2;

}

plot FirstIndicator = if par then ind1 else na; # "Indicator Line"

FirstIndicator.SetPaintingStrategy(PaintingStrategy.POINTS);

FirstIndicator.AssignValueColor(if trend < 0 then GlobalColor("dn") else GlobalColor("up"));

plot STUp = if trend > 0 then ind1 else na;

plot STDn = if trend > 0 then na else ind1;

STUp.SetDefaultColor(GlobalColor("up"));

STDn.SetDefaultColor(GlobalColor("dn"));

plot SecondIndicator = if trend2 == trend2[1] then ind2 else na;#, "Second SAR"

SecondIndicator.AssignValueColor(if trend2 < 0 then GlobalColor("dn") else GlobalColor("up"));

#-- Signal - Clouds - Bar Color

def dirLong = if (trend > 0 and trend2 > 0) then dirLong[1] + 1 else 0;

def dirShort = if (trend < 0 and trend2 < 0) then dirShort[1] + 1 else 0;

AddChartBubble(showSignals and dirLong == signalWaitingBar, low, "L", Color.GREEN, no);

AddChartBubble(showSignals and dirShort == signalWaitingBar, high, "S", Color.RED);

AddCloud(if trend == trend[1] then ind1 else na, ZoneInd, GlobalColor("ddn"), GlobalColor("dup"), yes);

AssignPriceColor(if !colorBars then Color.CURRENT else

if trend > 0 and trend2 > 0 then Color.GREEN else

if trend < 0 and trend2 > 0 then Color.DARK_GREEN else

if trend < 0 and trend2 < 0 then Color.RED else

if trend > 0 and trend2 < 0 then Color.DARK_RED else Color.GRAY);

#-- END of CODE