I want to play around with pairs trading and using Heikin Ashi on a lower chart with a second symbol. Turns out Heikin Ashi code doesn't seem to work with code not in the upper chart. There seems to be problems with the simple arrays being created. Anybody have some ideas or is this a limitation of thinkscript?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Heikin Ashi For ThinkOrSwim

- Thread starter Vision

- Start date

Drgrcrpilot

New member

Hi, I understand the need to use heikin ashi candles for the averages and to smooth out the chart. but, is there a way to run normal candlestick bars like a shadow/overlay? I like to watch the exact price point. (Yes I know I can watch the bid/ask, but i like to watch the candle forming). Thanks

@Drgrcrpilot You can use this code below to display Heikin Ashi as a lower study:

Code:

#TSI_HeikinAshi_Bars

# (c) 2009

#Copyright Authorship: ThinkSwimIndicators.com

#==========================================================================

# >>> H E I K I N - A S H I B A R S <<< [

#.........................................................................[

# [

# -----=== O ===----- [

# [

#****COPYRIGHT NOTICE: "Heikin-Ashi Bars" is free to use by the general [

# public. Distribution or modification is prohibited. All content, form, [

# and style, likewise, is protected by copyright. [

# [

# -----=== x ===----- [

# [

# ThinkSwimIndicators.com will CONTINUE to release FREE indicators--of [

# the highest quality and caliber--for the Thinkorswim Trading platform, [

# for use by all. Many of our free indicators surpass the Quality & Use- [

# fulness of indicators offered for "purchase" by other sites. We suggest [

# that you visit the free "Learning Center" at our website for further [

# information on the use of this indicator. "GO: Master the Markets!" (TM)[

#==========================================================================

declare lower;

def haclose = (open + high + low + close) / 4;

rec haopen = compoundValue(1, (haopen[1] + haclose[1]) / 2, (open[1] +

close[1]) / 2);

def diff = haclose - haopen;

plot HA_Down = if diff > 0 and diff[1] >= 0 then 0 else 1;

plot HA_Up = if diff < 0 and diff[1] <= 0 then 0 else 1;

HA_Up.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

HA_Up.AssignValueColor(color.GREEN);

HA_Up.SetLineWeight(5);

HA_Down.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

HA_Down.AssignValueColor(color.RED);

HA_Down.SetLineWeight(5);This will show you the exact price point on Heikin Ashi

Code:

# sdi_closeLevel

plot cl = close;

cl.setpaintingStrategy(PaintingStrategy.HORIZONTAL);

#hint: plot the close level as a horizontal line with the color determined by its relationship to the heiken-ashi body.

cl.defineColor("above h-a body", color.GREEN);

cl.defineColor("inside h-a body", color.dark_gray);

# author: allen everhart

# date: 7jun2015

cl.defineColor("below h-a body", color.RED);

# copylefts reserved. This is free software. That means you are free

# to use or modify it for your own usage but not for resale.

# Help me get the word out about my blog by keeping this header

# in place.

cl.assignValueColor(

if close>ohlc4 && heikinAshiDiff()>0 then cl.color("above h-a body")

else if close<ohlc4 && heikinAshiDiff()<0 then cl.color("below h-a body")

# copylefts reserved. This is free software. That means you are free

# to use or modify it for your own usage but not for resale.

else if heikinAshiDiff()<0 and close>ohlc4-heikinAshiDiff() then cl.color("above h-a body")

else if heikinAshiDiff()>0 and close<ohlc4-heikinAshiDiff() then cl.color("below h-a body")

else cl.color("inside h-a body"));I’m just looking for the indicator. The coding for it. I’ve looked everywhere. I just want it displayed on my chart, not overlap current candlesWhat do you mean create the heikin ashi indicator into the candles? Are you trying to display heikin ashi candlesticks on your chart? Or do you want to overlay heikin ashi candles on top of the default candles?

@Parker427 Go to your chart't setting > Appearance > Chart Type > Heikin Ashi

@Parker427 Maybe this is what you're looking for? Full credit goes to MTS1 of the TSL.

and here is a MTF version -

Code:

# HeikinAshiPaintBars_MTSmod180412

# MTS1 1804 based on JQ shared script TSL

# http://tos.mx/jKArTG##

# Updated formula based on http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:heikin_ashi which seems to match ToS HA Chart

def o = open;

def h = high;

def l = low;

def c = close;

def HAopen;

def HAhigh;

def HAlow;

def HAclose;

HAopen = CompoundValue(1, (haopen[1] + haclose[1]) / 2, (o[1] + c[1]) / 2);

HAhigh = Max(Max(h, haopen), haclose[1]);

HAlow = Min(Min(l, haopen), haclose[1]);

HAclose = (open + high + low + close) / 4;

AssignPricecolor(if haclose > haopen

then Color.Green

else Color.Red);and here is a MTF version -

Code:

# HeikinAshiPaintBars_MTSmod180412

# MTS1 1804 based on JQ shared script TSL

# http://tos.mx/jKArTG##

# Updated formula based on http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:heikin_ashi which seems to match ToS HA Chart

# Pensar - added MTF 7/30/2020

input agg = aggregationPeriod.TEN_MIN;

def o = open(period = agg);

def h = high(period = agg);

def l = low(period = agg);

def c = close(period = agg);

def HAopen;

def HAhigh;

def HAlow;

def HAclose;

HAopen = CompoundValue(1, (haopen[1] + haclose[1]) / 2, (o[1] + c[1]) / 2);

HAhigh = Max(Max(h, haopen), haclose[1]);

HAlow = Min(Min(l, haopen), haclose[1]);

HAclose = (o + h + l + c) / 4;

AssignPricecolor(if haclose > haopen

then Color.Green

else Color.Red);

T

Thomas

Guest

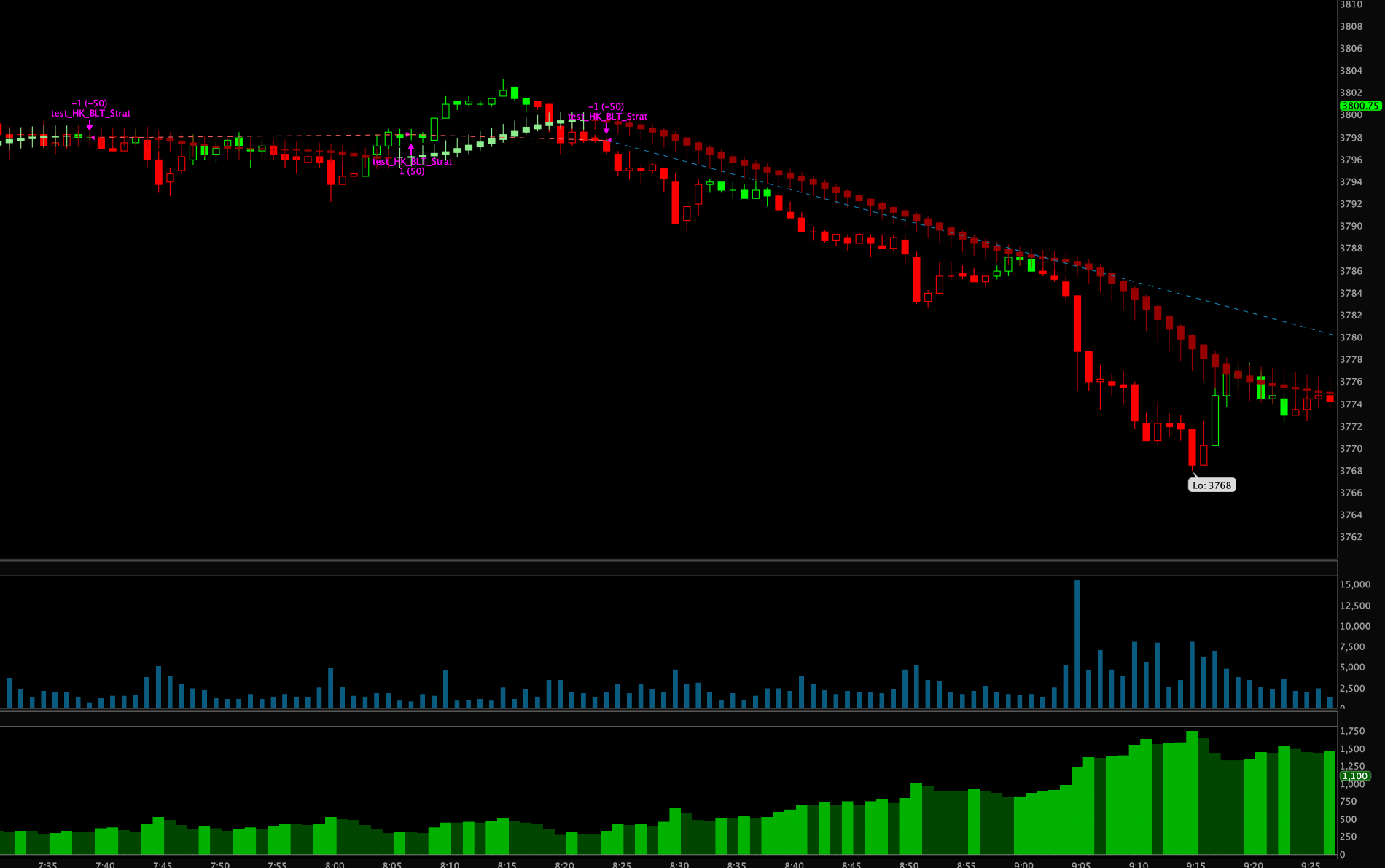

Here is a stupid version to test performance. I didn't spend more than a few minutes on this and I am not familiar with how to use it. Excuse the poor coding and interpretation if I am wrong. You need to add it as a strategy.

Python:

#study(title = "Smoothed Heiken Ashi Candles", shorttitle="Smoothed Ha Candles", overlay=true)

#translated and modified by BLT 20170804

#v1 - added HACO (HACOLT by S Vervoot) and HACO_Mod (by D Valcu) smoothing options

#version whatever - added orders for strategy testing by Barbaros

input onlyTradeTime = yes;

input startTime = 930;

input stopTime = 1500;

def tradeTime = if onlyTradeTime then SecondsFromTime(startTime) >= 0 and SecondsTillTime(stopTime) >= 0 else yes;

input candleSmoothing = {default HACO, HACO_Mod};

input avg = averageType.EXPONENTIAL;

input len = 8;#=input(10)

def o = movingAverage(avg,open, len);

def c = movingAverage(avg,close, len);

def h = movingAverage(avg,high, len);

def l = movingAverage(avg,low, len);

def HAopen;

def HAclose;

switch(candleSmoothing) {

case HACO:

haOpen = CompoundValue(1, ( (haOpen[1] + (o[1] + h[1] + l[1] + c[1]) /4)/2), open);

haClose = ((((O + H + L + C)/4) + haOpen + Max(H, haOpen) + Min(L, haOpen))/4);

case HACO_Mod:

haOpen = CompoundValue(1, ( (haOpen[1] + (o[1] + h[1] + l[1] + c[1]) /4)/2), open);

haClose = ((o + h + l + c)/4) ;

}

def HAhigh = Max( h, Max( HAopen, HAclose ) );

def HAlow = Min( l, Min( HAopen, HAclose ) );

input len2 = 17;#input(10)

def o2 = movingAverage(avg,HAopen, len2);

def c2 = movingAverage(avg,HAclose, len2);

def h2 = movingAverage(avg,HAhigh, len2);

def l2 = movingAverage(avg,HAlow, len2);

input charttype=chartType.CANDLE;

def o3 = o2;

def h3 = h2;

def l3 = l2;

def c3 = c2;

input nowicks = yes;

def o4 = if o3<c3 then if nowicks then l3 else o3 else double.nan;

def c4 = if o3<c3 then if nowicks then h3 else c3 else double.nan;

def h4 = if o3<c3 then h3 else double.nan;

def l4 = if o3<c3 then l3 else double.nan;

def o5 = if o3 >=c3 then if nowicks then h3 else o3 else double.nan;

def h5 = h3;

def l5 = l3;

def c5 = if o3 >=c3 then if nowicks then l3 else c3 else double.nan;

AddOrder(type = OrderType.BUY_AUTO, tradeSize = 1, condition = !isNaN(c4) and tradeTime);

AddOrder(type = OrderType.SELL_AUTO, tradeSize = 1, condition = !isNaN(c5) and tradeTime);

AddOrder(type = OrderType.SELL_TO_CLOSE, tradeSize = 1, condition = !tradeTime);

AddOrder(type = OrderType.BUY_TO_CLOSE, tradeSize = 1, condition = !tradeTime);Hello,

I found what I was looking for in this post. Some of the questions here was asking for displaying Heinkin Ashi candle on the same chart of the standard candle. I didn't see any code posted, so here it is:

#Draw the Heinkin Ashi candle

def HAhigh;

def HAlow;

def HAclose;

rec HAopen = CompoundValue(1, (HAopen[1] + HAclose[1]) / 2, (open[1] + close[1]) / 2);

HAclose = (open + high + low + close) / 4;

HAhigh = Max(Max(high, HAopen), HAclose[1]);

HAlow = Min(Min(low, HAopen), HAclose[1]);

def HA_open = round(HAopen, 2);

def diff = HAclose - HAopen;

AddChart(HAhigh, HAlow, HA_open, HAclose, type = ChartType.candle, growcolor = color.light_orange);

#Edit the plot for these as boolean type and use up/down arrow to show on your chart if you want to add Heinkin Ashi Signal for trend changing

plot HA_Down = if diff > 0 and diff[1] <= 0 then 1 else 0;

plot HA_Up = if diff < 0 and diff[1] >= 0 then 1 else 0;

I found what I was looking for in this post. Some of the questions here was asking for displaying Heinkin Ashi candle on the same chart of the standard candle. I didn't see any code posted, so here it is:

#Draw the Heinkin Ashi candle

def HAhigh;

def HAlow;

def HAclose;

rec HAopen = CompoundValue(1, (HAopen[1] + HAclose[1]) / 2, (open[1] + close[1]) / 2);

HAclose = (open + high + low + close) / 4;

HAhigh = Max(Max(high, HAopen), HAclose[1]);

HAlow = Min(Min(low, HAopen), HAclose[1]);

def HA_open = round(HAopen, 2);

def diff = HAclose - HAopen;

AddChart(HAhigh, HAlow, HA_open, HAclose, type = ChartType.candle, growcolor = color.light_orange);

#Edit the plot for these as boolean type and use up/down arrow to show on your chart if you want to add Heinkin Ashi Signal for trend changing

plot HA_Down = if diff > 0 and diff[1] <= 0 then 1 else 0;

plot HA_Up = if diff < 0 and diff[1] >= 0 then 1 else 0;

I was on tradingview and really have been testing this SSS indicator, going to copy paste the code below. I am **** at coding but this was very close to what you posted.Here is a stupid version to test performance. I didn't spend more than a few minutes on this and I am not familiar with how to use it. Excuse the poor coding and interpretation if I am wrong. You need to add it as a strategy.

Python:#study(title = "Smoothed Heiken Ashi Candles", shorttitle="Smoothed Ha Candles", overlay=true) #translated and modified by BLT 20170804 #v1 - added HACO (HACOLT by S Vervoot) and HACO_Mod (by D Valcu) smoothing options #version whatever - added orders for strategy testing by Barbaros input onlyTradeTime = yes; input startTime = 930; input stopTime = 1500; def tradeTime = if onlyTradeTime then SecondsFromTime(startTime) >= 0 and SecondsTillTime(stopTime) >= 0 else yes; input candleSmoothing = {default HACO, HACO_Mod}; input avg = averageType.EXPONENTIAL; input len = 8;#=input(10) def o = movingAverage(avg,open, len); def c = movingAverage(avg,close, len); def h = movingAverage(avg,high, len); def l = movingAverage(avg,low, len); def HAopen; def HAclose; switch(candleSmoothing) { case HACO: haOpen = CompoundValue(1, ( (haOpen[1] + (o[1] + h[1] + l[1] + c[1]) /4)/2), open); haClose = ((((O + H + L + C)/4) + haOpen + Max(H, haOpen) + Min(L, haOpen))/4); case HACO_Mod: haOpen = CompoundValue(1, ( (haOpen[1] + (o[1] + h[1] + l[1] + c[1]) /4)/2), open); haClose = ((o + h + l + c)/4) ; } def HAhigh = Max( h, Max( HAopen, HAclose ) ); def HAlow = Min( l, Min( HAopen, HAclose ) ); input len2 = 17;#input(10) def o2 = movingAverage(avg,HAopen, len2); def c2 = movingAverage(avg,HAclose, len2); def h2 = movingAverage(avg,HAhigh, len2); def l2 = movingAverage(avg,HAlow, len2); input charttype=chartType.CANDLE; def o3 = o2; def h3 = h2; def l3 = l2; def c3 = c2; input nowicks = yes; def o4 = if o3<c3 then if nowicks then l3 else o3 else double.nan; def c4 = if o3<c3 then if nowicks then h3 else c3 else double.nan; def h4 = if o3<c3 then h3 else double.nan; def l4 = if o3<c3 then l3 else double.nan; def o5 = if o3 >=c3 then if nowicks then h3 else o3 else double.nan; def h5 = h3; def l5 = l3; def c5 = if o3 >=c3 then if nowicks then l3 else c3 else double.nan; AddOrder(type = OrderType.BUY_AUTO, tradeSize = 1, condition = !isNaN(c4) and tradeTime); AddOrder(type = OrderType.SELL_AUTO, tradeSize = 1, condition = !isNaN(c5) and tradeTime); AddOrder(type = OrderType.SELL_TO_CLOSE, tradeSize = 1, condition = !tradeTime); AddOrder(type = OrderType.BUY_TO_CLOSE, tradeSize = 1, condition = !tradeTime);

I was not able to use your code above in TOS not sure why or if i need to change some chart settings etc.....

anyways here is a code if anyone can help translate this to thinkscript or update your code with parts of this code.

Code:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Sultan_shaya

//@version=5

strategy("SSS", overlay=true, initial_capital=1000,currency=currency.USD,default_qty_type=strategy.percent_of_equity,default_qty_value=100,pyramiding=0)

//SSS = Sultan+Saud Strategy

//The original idea of the code belonges to saudALThaidy

//The strategy code is basically made out of two other indicators, edited and combined by me.

// 1- NSDT HAMA Candles => https://www.tradingview.com/script/k7nrF2oI-NSDT-HAMA-Candles/

// 2- SSL Channel => https://www.tradingview.com/script/6y9SkpnV-SSL-Channel/

//MA INFO

WickColor = input.color(color.rgb(80, 80, 80, 100), title='Wick Color', tooltip='Suggest Full Transparency.')

LengthMA = input.int(100, minval=1, title='MA Line Length', inline='MA Info')

TakeProfit = input.float(1, minval=0, title='Take Profit Percentage', step=1)

UseStopLose = input.bool(false, title='Use Stop Percentage')

StopLose = input.float(1, minval=0, title='StopLose Percentage', step=1)

MASource = close

ma(source, length, type) =>

type == "SMA" ? ta.sma(source, length) :

type == "EMA" ? ta.ema(source, length) :

type == "SMMA (RMA)" ? ta.rma(source, length) :

type == "WMA" ? ta.wma(source, length) :

type == "VWMA" ? ta.vwma(source, length) :

na

ma1_color = color.green

ma1 = ma(high, 200, "SMA")

ma2_color = color.red

ma2 = ma(low, 200, "SMA")

Hlv1 = float(na)

Hlv1 := close > ma1 ? 1 : close < ma2 ? -1 : Hlv1[1]

sslUp1 = Hlv1 < 0 ? ma2 : ma1

sslDown1 = Hlv1 < 0 ? ma1 : ma2

Color1 = Hlv1 == 1 ? ma1_color : ma2_color

fillColor1 = color.new(Color1, 90)

highLine1 = plot(sslUp1, title="UP", linewidth=2, color = Color1)

lowLine1 = plot(sslDown1, title="DOWN", linewidth=2, color = Color1)

OpenLength = 25

HighLength = 20

LowLength = 20

CloseLength = 20

SourceOpen = (open[1] + close[1]) / 2

SourceHigh = math.max(high, close)

SourceLow = math.min(low, close)

SourceClose = (open + high + low + close) / 4

funcCalcMA1(src1, len1) => ta.ema(src1, len1)

funcCalcOpen(SourceOpen, OpenLength) => ta.ema(SourceOpen, OpenLength)

funcCalcHigh(SourceHigh, HighLength) => ta.ema(SourceHigh, HighLength)

funcCalcLow(SourceLow, LowLength) => ta.ema(SourceLow, LowLength)

funcCalcClose(SourceClose, CloseLength) => ta.ema(SourceClose, CloseLength)

MA_1 = funcCalcMA1(MASource, LengthMA)

CandleOpen = funcCalcOpen(SourceOpen, OpenLength)

CandleHigh = funcCalcHigh(SourceHigh, HighLength)

CandleLow = funcCalcLow(SourceLow, LowLength)

CandleClose = funcCalcClose(SourceClose, CloseLength)

//PLOT CANDLES

//-------------------------------NSDT HAMA Candels

BodyColor = CandleOpen > CandleOpen[1] ? color.green : color.red

barcolor(BodyColor)

plotcandle(CandleOpen, CandleHigh, CandleLow, CandleClose, color=BodyColor, title='HAMA Candles', wickcolor=WickColor, bordercolor=na)

plot(MA_1, title='MA Line', color=BodyColor, style=plot.style_line, linewidth=2)

//------------------------------SSL Channel

plot_buy = false

avg = ((high-low)/2)+low

LongCondition = (Hlv1 == 1 and Hlv1[1] == -1) and (BodyColor == color.green) and (MA_1 < avg) and (CandleHigh < avg) and (strategy.opentrades == 0)

if LongCondition

strategy.entry("BUY HERE", strategy.long)

plot_buy := true

base = strategy.opentrades.entry_price(0)

baseProfit = (base+((base/100)*TakeProfit))

baseLose = (base-((base/100)*StopLose))

strategy.exit("SELL HERE","BUY HERE",limit = baseProfit)

if UseStopLose and (close < MA_1)

strategy.exit("SELL HERE","BUY HERE",stop = baseLose)

if not UseStopLose and (close < MA_1)

strategy.exit("SELL HERE","BUY HERE", stop = close)

plotshape(plot_buy, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=Color1, textcolor=color.white)

fill(highLine1, lowLine1, color = fillColor1)HotLemon

New member

Median Renko Bars

#Chart Setting - Time Axis - Range - 4 Tick - Renko Bars

input period = 1;

input length = 1;

input hideCandles = yes;

input Points = 1.0;

HidePricePlot(hideCandles);

def base = average(MidBodyVal(),length);

def CBB = if (base > high, base[1]+ Points, base - Points);

def CBT = if (base < low, base[1] + Points, base + Points);

def openMA = CompoundValue(1, ExpAverage(open, period), open);

def closeMA = CompoundValue(1, ExpAverage(close, period), close);

def highMA = CompoundValue(1, ExpAverage(high, period), high);

def lowMA = CompoundValue(1, ExpAverage(low, period), low);

def haOpen = CompoundValue(1,((haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1] + midBodyVal()) / 5.0) / 2.0), open);

def haClose = ((openMA + highMA + lowMA + closeMA) / 4.0) ;

#candles

def High_fall = if haOpen >= haClose

then high #then haHigh

else Double.NaN;

def Low_fall = if haOpen >= haClose

then low#then haLow

else Double.NaN;

AddChart(growColor = Color.plum,high = High_fall, low = Low_fall,open = cbt, close = cbb , type = ChartType.CANDLE);

def High_rise = if haOpen <= haClose

then high#then haHigh

else Double.NaN;

def Low_rise = if haOpen <= haClose

then low#then haLow

else Double.NaN;

AddChart(growColor = Color.white, high = High_rise, low = Low_rise, open = cbt, close = cbb, type = ChartType.CANDLE);

#

#Chart Setting - Time Axis - Range - 4 Tick - Renko Bars

input period = 1;

input length = 1;

input hideCandles = yes;

input Points = 1.0;

HidePricePlot(hideCandles);

def base = average(MidBodyVal(),length);

def CBB = if (base > high, base[1]+ Points, base - Points);

def CBT = if (base < low, base[1] + Points, base + Points);

def openMA = CompoundValue(1, ExpAverage(open, period), open);

def closeMA = CompoundValue(1, ExpAverage(close, period), close);

def highMA = CompoundValue(1, ExpAverage(high, period), high);

def lowMA = CompoundValue(1, ExpAverage(low, period), low);

def haOpen = CompoundValue(1,((haOpen[1] + (openMA[1] + highMA[1] + lowMA[1] + closeMA[1] + midBodyVal()) / 5.0) / 2.0), open);

def haClose = ((openMA + highMA + lowMA + closeMA) / 4.0) ;

#candles

def High_fall = if haOpen >= haClose

then high #then haHigh

else Double.NaN;

def Low_fall = if haOpen >= haClose

then low#then haLow

else Double.NaN;

AddChart(growColor = Color.plum,high = High_fall, low = Low_fall,open = cbt, close = cbb , type = ChartType.CANDLE);

def High_rise = if haOpen <= haClose

then high#then haHigh

else Double.NaN;

def Low_rise = if haOpen <= haClose

then low#then haLow

else Double.NaN;

AddChart(growColor = Color.white, high = High_rise, low = Low_rise, open = cbt, close = cbb, type = ChartType.CANDLE);

#

Last edited by a moderator:

Mocnarf1

Member

Here is a Strategy Script using HeikenAshi . Take a look it may give you some ideas.

Code:

# Test script Strategy with HeikenAshi MACD SMA

def buy =

HeikinAshiDiff()."HADiff" from 1 bars ago is less than 0

and HeikinAshiDiff()."HADiff" is greater than 0

and close is greater than open

and low is less than SimpleMovingAvg()."SMA" from 1 bars ago

and SimpleMovingAvg()."SMA" is greater than or equal to SimpleMovingAvg()."SMA" from 1 bars ago

and MACDHistogram()."Diff" is greater than or equal to MACDHistogram()."Diff" from 1 bars ago

OR

HeikinAshiDiff()."HADiff" from 1 bars ago is less than 0

and HeikinAshiDiff()."HADiff" is greater than 0

and close is greater than open

and MACDHistogram()."Diff" is greater than MACDHistogram()."Diff" from 1 bars ago

;

def sell =

HeikinAshiDiff()."HADiff" from 1 bars ago is greater than 0

and HeikinAshiDiff()."HADiff" is less than 0

and close is less than open

and MACDHistogram()."Diff" is less than or equal to MACDHistogram()."Diff" from 1 bars ago

OR

HeikinAshiDiff()."HADiff" from 1 bars ago is greater than 0

and HeikinAshiDiff()."HADiff" is less than 0

and close is less than open

and SimpleMovingAvg()."SMA" is less than or equal to SimpleMovingAvg()."SMA" from 1 bars ago

;

AddOrder(OrderType.BUY_To_open, buy, name = "CrossoverBUY", tickColor = Color.DARK_RED, arrowColor = Color.DARK_RED);

AddOrder(OrderType.SELL_TO_CLOSE, sell, name = "CrossoverSell", tickColor = Color.DARK_GREEN, arrowColor = Color.DARK_GREEN);K_O_Trader

Member

this is great anyway to assign the candle sticks different colors??@Parker427 Maybe this is what you're looking for? Full credit goes to MTS1 of the TSL.

Code:# HeikinAshiPaintBars_MTSmod180412 # MTS1 1804 based on JQ shared script TSL # http://tos.mx/jKArTG## # Updated formula based on http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:heikin_ashi which seems to match ToS HA Chart def o = open; def h = high; def l = low; def c = close; def HAopen; def HAhigh; def HAlow; def HAclose; HAopen = CompoundValue(1, (haopen[1] + haclose[1]) / 2, (o[1] + c[1]) / 2); HAhigh = Max(Max(h, haopen), haclose[1]); HAlow = Min(Min(l, haopen), haclose[1]); HAclose = (open + high + low + close) / 4; AssignPricecolor(if haclose > haopen then Color.Green else Color.Red);

and here is a MTF version -

Code:# HeikinAshiPaintBars_MTSmod180412 # MTS1 1804 based on JQ shared script TSL # http://tos.mx/jKArTG## # Updated formula based on http://stockcharts.com/school/doku.php?id=chart_school:chart_analysis:heikin_ashi which seems to match ToS HA Chart # Pensar - added MTF 7/30/2020 input agg = aggregationPeriod.TEN_MIN; def o = open(period = agg); def h = high(period = agg); def l = low(period = agg); def c = close(period = agg); def HAopen; def HAhigh; def HAlow; def HAclose; HAopen = CompoundValue(1, (haopen[1] + haclose[1]) / 2, (o[1] + c[1]) / 2); HAhigh = Max(Max(h, haopen), haclose[1]); HAlow = Min(Min(l, haopen), haclose[1]); HAclose = (o + h + l + c) / 4; AssignPricecolor(if haclose > haopen then Color.Green else Color.Red);

Here ya go:

At the bottom of the study. Change this:

Creating Global Colors, will allow you to modify the colors to anything you want.

After changing the code:

1. go to the Studies Setup

2. scroll down and click on Global Colors

3. click on the color, then more, then RGB

4. change the color to your preference

5. when saving, make sure to click on Save as Default at the top of Chart Settings. This will save your preferences and apply them to all future charts.

At the bottom of the study. Change this:

To this:AssignPricecolor(if haclose > haopen

then Color.Green

else Color.Red);

DefineGlobalColor("Green", color.green) ;

DefineGlobalColor("Red", color.red) ;

AssignPricecolor(if haclose > haopen

then GlobalColor("Green")

else GlobalColor("Red"));

Creating Global Colors, will allow you to modify the colors to anything you want.

After changing the code:

1. go to the Studies Setup

2. scroll down and click on Global Colors

3. click on the color, then more, then RGB

4. change the color to your preference

5. when saving, make sure to click on Save as Default at the top of Chart Settings. This will save your preferences and apply them to all future charts.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| P | Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions) | Indicators | 28 | |

|

|

Smoothed Heikin-Ashi for ThinkorSwim | Indicators | 48 | |

|

|

RSI-Heiken Ashi For ThinkOrSwim | Indicators | 29 | |

|

|

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim | Indicators | 17 | |

|

|

Heiken-Ashi Moving Average (HAMA) for ThinkorSwim | Indicators | 32 |

Similar threads

-

Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions)

- Started by petergluis

- Replies: 28

-

-

-

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim

- Started by Welkin

- Replies: 17

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

595

Online

Similar threads

-

Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions)

- Started by petergluis

- Replies: 28

-

-

-

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim

- Started by Welkin

- Replies: 17

-

Similar threads

-

Heikin-Ashi Candles Lower Chart For ThinkorSwim (assorted versions)

- Started by petergluis

- Replies: 28

-

-

-

MA Colored Heiken Ashi Trend with PaintBars for ThinkorSwim

- Started by Welkin

- Replies: 17

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.