Internet Name

Member

Is it possible to have a strategy buy and sell an ATM option rather than shares of stock? I couldn't find anything in the documentation.

Another one today.Thanks for all you have shared here so far. What in your plan of action when the non-colored (black) bars appear?

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

SlimRibbon and B4 Indicator are both trying to paint the bar color btw.Sorry! You should prepare for an entry short or long depending on whether they cross. I added the SMA below.

http://tos.mx/bgpa3LB

You cannot mix the candle coloring between 2 indicators. You will need to pick one. If you want to use the slim ribbon colors, you can go into the B4 Indicator's setting and change the candle coloring to "none". You can look at the latest version here. https://usethinkscript.com/threads/balanced-bb-breakout.5708/. I believe the setting input is calledBarbarosa - thank you for that comment, you might have just identified why sometimes it seemed off just a bit. Thanks to your observation, I now realize that there is a competition for candle painting, so I need to go back and restudy the correct individual painting and separate the indicators. I think the yellow is a more intuitive color (caution or pause) versus black which can easily be lost on darker backgrounds, and perhaps this is why the ribbon was added? If anyone has time an expertise to make sure it is done correctly, I wonder if we could just eliminate the Ribbon altogether and just have the black is painted yellow in a slightly revised BlackFlag Script - that might affect the namesake but it certainly would put everything in one script. It would be important to know the script does not change - just a color change. Once the main script has everything built in, it is easy to turn off or on other lower indicators that might want to complement the original? I think it is a good script but this might make it better?

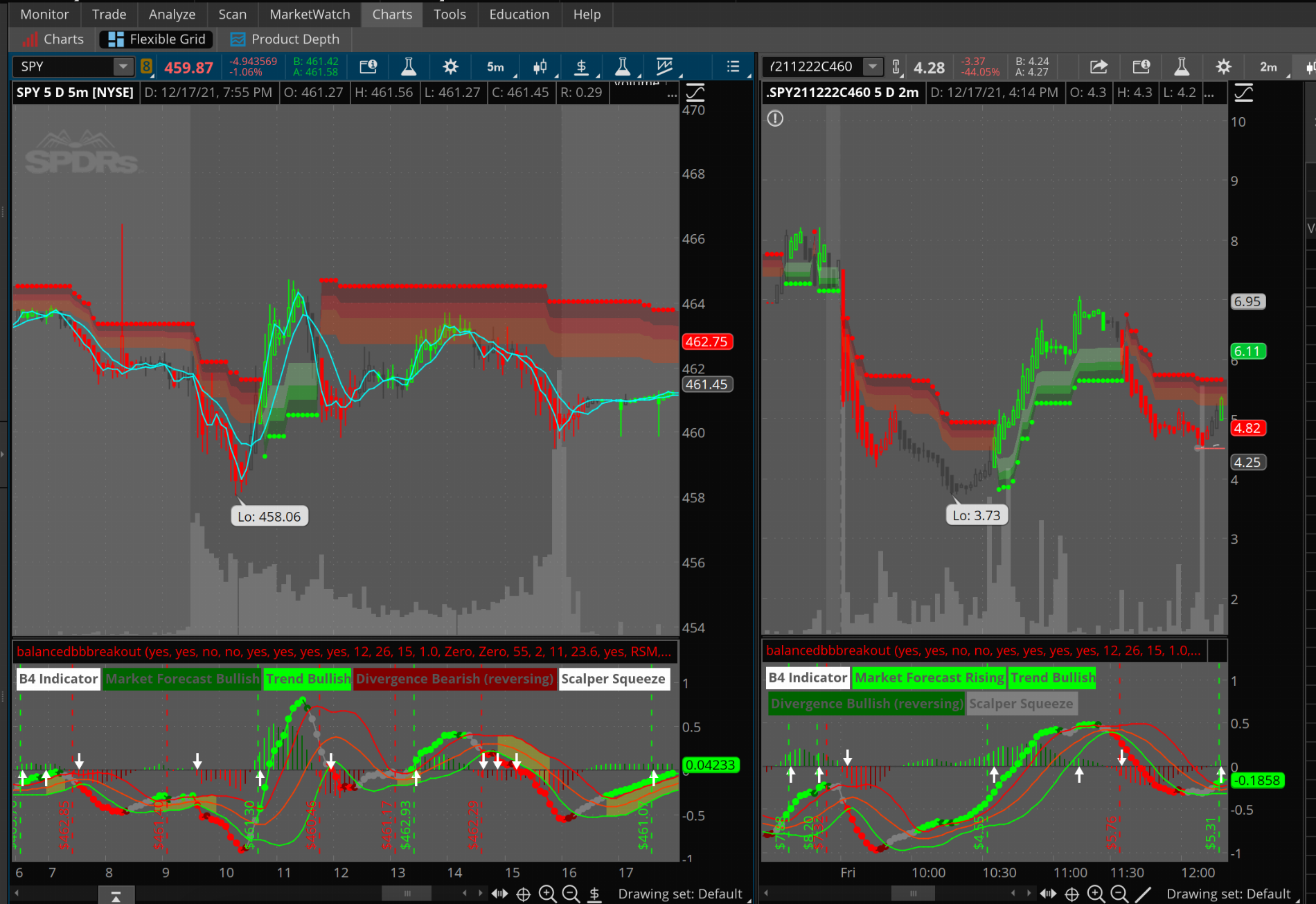

barColor. I had a feeling that was happening but I ignored it as the slim was showing nicely on my chart. I believe you can turn off the colorbars in the settings. The BB breakout is only for confirmation. I trade off the price action. If you study the blackflag indicator and how it goes you will learn how price behaves in relation to it. For instance, if its overextended, it will retest the green zones. If it is oversold, it will retest the red zone. Hence my purchase of the option on the 2 min, it would retest the red zones. Do not use this indicator on any other volatile stock. This is mainly for futures and S&P stocks. Obviously SPY and SPX too.Barbarosa - thank you for that comment, you might have just identified why sometimes it seemed off just a bit. Thanks to your observation, I now realize that there is a competition for candle painting, so I need to go back and restudy the correct individual painting and separate the indicators. I think the yellow is a more intuitive color (caution or pause) versus black which can easily be lost on darker backgrounds, and perhaps this is why the ribbon was added? If anyone has time an expertise to make sure it is done correctly, I wonder if we could just eliminate the Ribbon altogether and just have the black is painted yellow in a slightly revised BlackFlag Script - that might affect the namesake but it certainly would put everything in one script. It would be important to know the script does not change - just a color change. Once the main script has everything built in, it is easy to turn off or on other lower indicators that might want to complement the original? I think it is a good script but this might make it better?

I do see your observations, and thank you for sharing them. I am not good at coding, but I was just thinking if the BF script is painting black, it might be modified to paint yellow instead? I use a dark background and so the black is hard to see and I was trying not to add any other confounding scripts so I could just see what you have shared in the BF. I think it has great potential and I am just learning how to use it, so it helps to just have it as a stand alone. Thanks for these comments as we learn.I had a feeling that was happening but I ignored it as the slim was showing nicely on my chart. I believe you can turn off the colorbars in the settings. The BB breakout is only for confirmation. I trade off the price action. If you study the blackflag indicator and how it goes you will learn how price behaves in relation to it. For instance, if its overextended, it will retest the green zones. If it is oversold, it will retest the red zone. Hence my purchase of the option on the 2 min, it would retest the red zones. Do not use this indicator on any other volatile stock. This is mainly for futures and S&P stocks. Obviously SPY and SPX too.

I do see your observations, and thank you for sharing them. I am not good at coding, but I was just thinking if the BF script is painting black, it might be modified to paint yellow instead? I use a dark background and so the black is hard to see and I was trying not to add any other confounding scripts so I could just see what you have shared in the BF. I think it has great potential and I am just learning how to use it, so it helps to just have it as a stand alone. Thanks for these comments as we learn.

Thank you for the new link - that is very helpful. I have not watched them all yet, but I found some YouTube videos from the original author who seems to like the idea of specific combinations of aggregation periods. I see you are using 5 and 2 minute which looks good to me, but curious if you tried different combinations also? Beyond the shorter time frames, I think there is also potential on higher time frames as well, so what would you like to see with like a 1D chart? Also some of the video's it looked like he superimposed the two different aggregation sets in the same chart and he commented about the price turning from one set of arms into the other set. I might like your side-by-side better , but it would seem whether overlapping or viewed separately it would be critical to have the right period combination?And yes it can be modifed! Just go in the slimribbon settings, scroll down and you can chose colors in the tabs!

Thank you for the new link - that is very helpful. I have not watched them all yet, but I found some YouTube videos from the original author who seems to like the idea of specific combinations of aggregation periods. I see you are using 5 and 2 minute which looks good to me, but curious if you tried different combinations also? Beyond the shorter time frames, I think there is also potential on higher time frames as well, so what would you like to see with like a 1D chart? Also some of the video's it looked like he superimposed the two different aggregation sets in the same chart and he commented about the price turning from one set of arms into the other set. I might like your side-by-side better , but it would seem whether overlapping or viewed separately it would be critical to have the right period combination?

Thank you very much. I completely agree to keep things as simple as possible, and multiple arms seems really challenging - in fact, I thought I heard incorrectly listening to the YouTube videos because it seems unnecessary. I think instead of watching any more of those videos, I will just look at a lot of historical charts and learn for myself and from your commentary / posts. For now, I will just be using your modified black flags (the one without the black colored bars) as the only indicator, then I will add the B4BB, and I may not add the ribbon at all if it does not add value. I think the pivot lines are important so I will keep those also. This way I can learn each piece before combining them.No worries! I have! The 5 min and 1 minute chart is pretty good as well! You can do 5 min with 1 min as well! It just goes a bit quicker. I have found 5 & 10 minutes to be very good in terms of finding zones. 30 mins and 4 hours is also very good. You would change the timeframes up depending on the duration you want for your trade. I personally want to be done trading in 20 minutes or less, hence why I use 5 mins and 2. A break of 30 mins you would be well off buying weekly calls/puts. I think the author makes it too hard with the two arms swinging back and forth. Just focus on what works and do not make it any more confusing id say. I had the same problem you had thinking a set particular timeframe was the correct one. But you gotta see what works best for you and your goal.

Thank you very much. I completely agree to keep things as simple as possible, and multiple arms seems really challenging - in fact, I thought I heard incorrectly listening to the YouTube videos because it seems unnecessary. I think instead of watching any more of those videos, I will just look at a lot of historical charts and learn for myself and from your commentary / posts. For now, I will just be using your modified black flags (the one without the black colored bars) as the only indicator, then I will add the B4BB, and I may not add the ribbon at all if it does not add value. I think the pivot lines are important so I will keep those also. This way I can learn each piece before combining them.

Since you are way ahead of us on this approach, are there specific instruments you like for your approach and times of day we should start using our 2min / 5min? When do you have your 20 minute time period - I am in Texas - Central Time.

I will be doing a lot of historical analysis over the holidays with the approach & modified indicator you have shared! I will also be looking at swing trading applications on the daily charts probably with a larger intraday, but regardless of the periods chosen, I do think the same indicators and approach will work for more of a swing trading interval for options as well. If it does, the intraday trading could just be the larger picture to trade and trade the intraday in alignment with it? No doubt it works for intraday, but I just have a sense it will work for swing trading (meaning several day holding period) as well - especially given the name right? I will also try to study the implied volatility changes as price approaches / departs the swing arm.

Can't wait till Monday to try it in Paper Money first. Early testing looks good so far.http://tos.mx/NLMLRwo

Make sure you update the right hand chart to the call/Put you want.

Buy call on the 2 min when 5 min 9 & 3 SMA crosses. Sell on exhaustion.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| Z | indicators for Sizzle Index low → options activity + expected movement? | Questions | 1 | |

|

|

Supply/Demand options trading | Questions | 1 | |

|

|

indicators for Sell Put Options | Questions | 3 | |

|

|

Entry/Exit Signals (Options Trading) | Questions | 12 | |

|

|

Watchlist Study for Options Trading | Questions | 1 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.