Shooters_Gotta_Shoot

Member

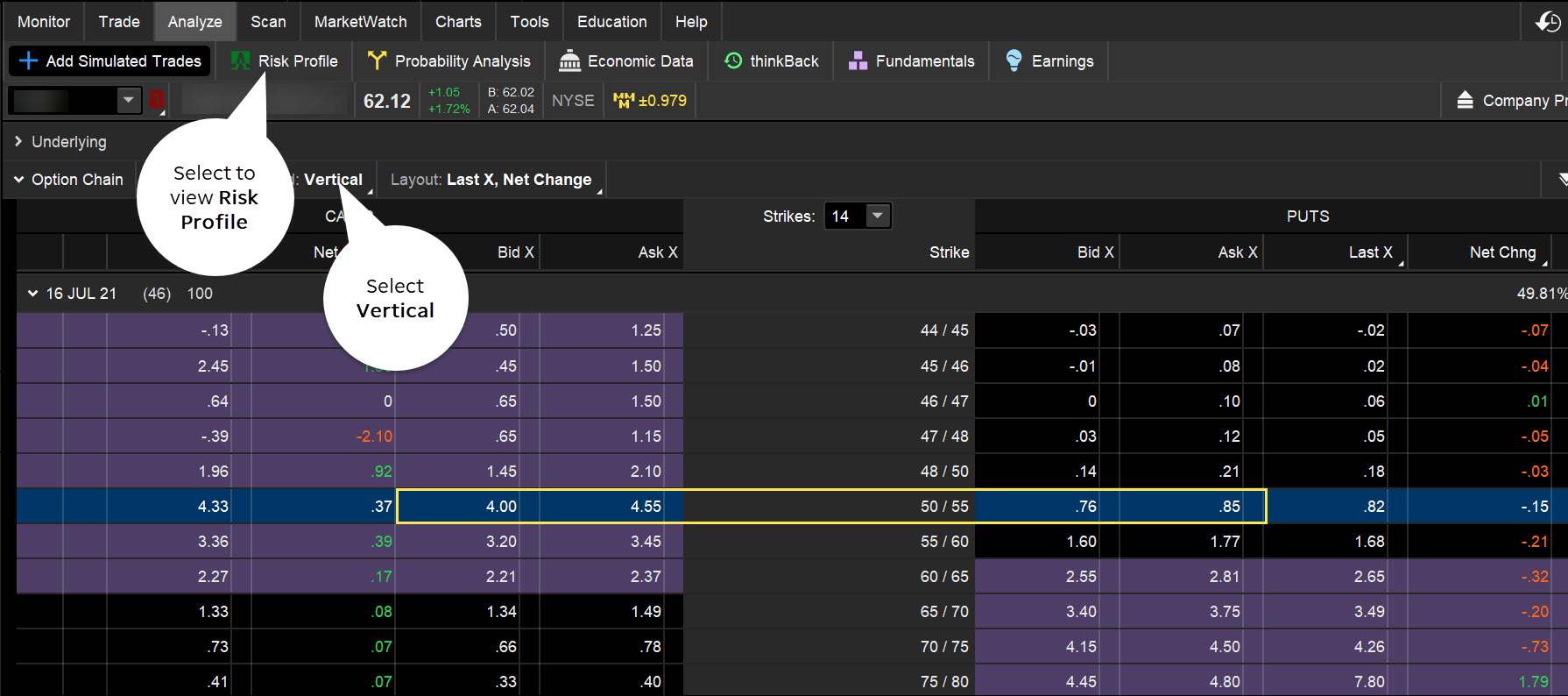

Didn't know this existed till today after some digging, but this was super helpful for me so I didn't have to click into each strike just to do the math on how much a spread play would cost. This makes calculating a spread way quicker and easier. You can select all different types of spreads and it instantly displays the price for you! Definitely not a scanner by any means, but if you already know the underlying equity you want to trade and what spread you are going after, this displays the data much more efficiently.

From TD Ameritrade:

"From the Analyze tab on the thinkorswim® platform, enter a symbol and, under Add Simulated Trades, expand the Option Chain of the underlying. Select Vertical from the Spread menu, then choose the put spread you’re considering (see figure 1). Next, select Analyze sell trade and then Vertical."

From TD Ameritrade:

"From the Analyze tab on the thinkorswim® platform, enter a symbol and, under Add Simulated Trades, expand the Option Chain of the underlying. Select Vertical from the Spread menu, then choose the put spread you’re considering (see figure 1). Next, select Analyze sell trade and then Vertical."