Been trading options for years, have had great success with SPX 0DTE with this setup, and sometimes weeklies depending on the VIX.

1st, here's the Chart Setup, strictly the Ichimoku Cloud on an Option Premium Chart.

As Price gets below the cloud, chops and gets very-thin-in-price-action, that's where I sometimes load in. Other times I want an EMA or an EMA Ribbon to cross over, but sometimes you've already missed the 100% spike, but can still ride another 100% to 500% which is still great.

I've messed with thousands of other indicators on this pattern. And I can't seem to find anything that gives me extra confidence that price as been pretty flat and there's a high potential of the curl going into a Very Thick SPAN Cloud.

If anyone has thoughts, I'm all ears.

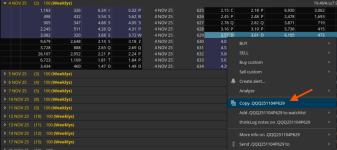

Here's the setup twice in two weeks on PLTR lately. NOTE works best on 5Min, 10Min and 15Min MAX

shared chart link: https://tos.mx/!V9FKoErn

1st, here's the Chart Setup, strictly the Ichimoku Cloud on an Option Premium Chart.

As Price gets below the cloud, chops and gets very-thin-in-price-action, that's where I sometimes load in. Other times I want an EMA or an EMA Ribbon to cross over, but sometimes you've already missed the 100% spike, but can still ride another 100% to 500% which is still great.

I've messed with thousands of other indicators on this pattern. And I can't seem to find anything that gives me extra confidence that price as been pretty flat and there's a high potential of the curl going into a Very Thick SPAN Cloud.

If anyone has thoughts, I'm all ears.

Here's the setup twice in two weeks on PLTR lately. NOTE works best on 5Min, 10Min and 15Min MAX

shared chart link: https://tos.mx/!V9FKoErn

Last edited by a moderator: