Author Message:

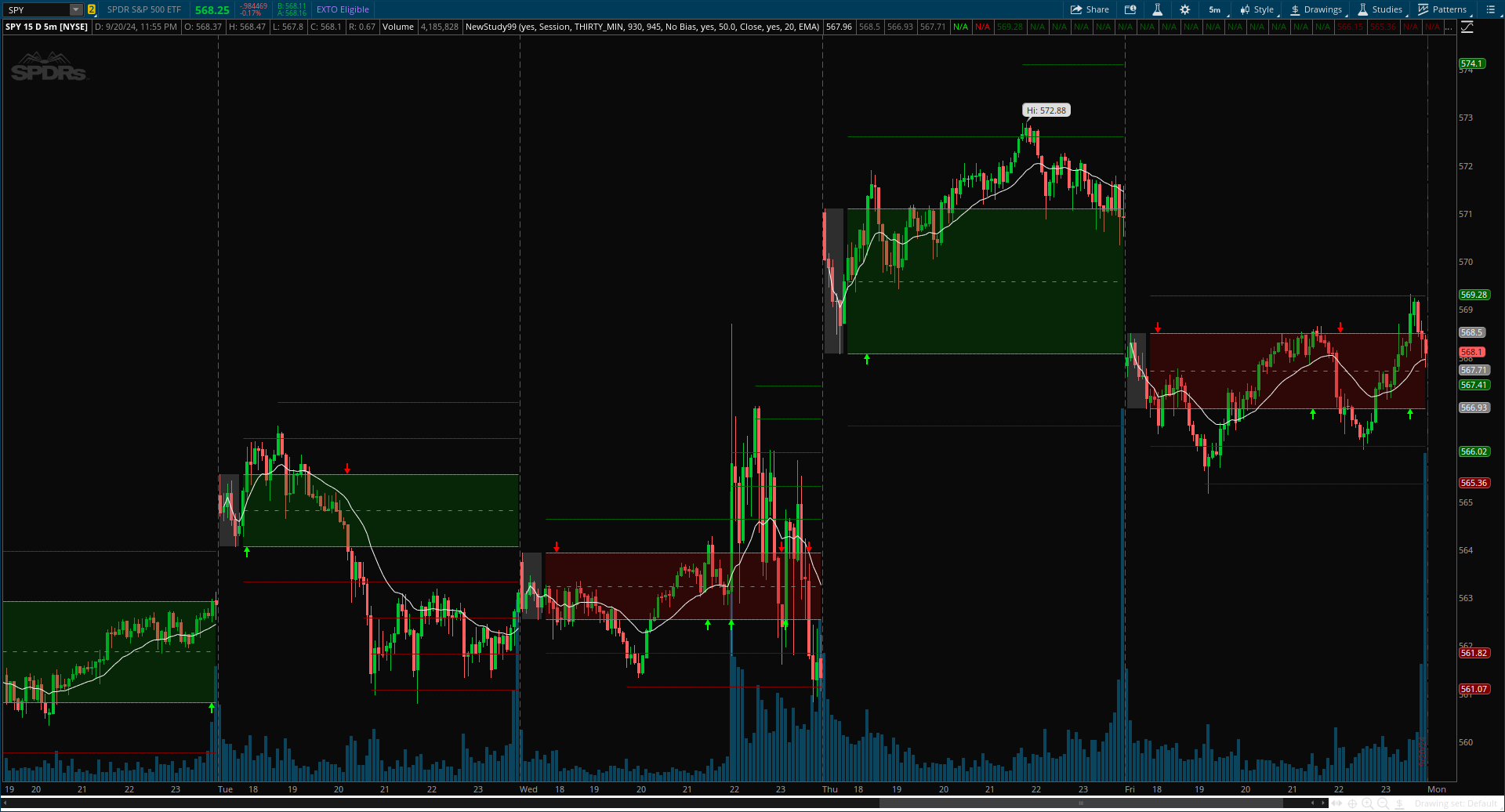

Opening Range with Breakouts & Targets is based on the long-standing Opening Range Breakout strategy popularized by traders such as Toby Crabel and Mark Fisher.

This indicator measures and displays the price range created from the first period within a new trading session, along with price breakouts from that range and targets associated with the range width.

CODE:

CSS:

# Indicator for TOS

#// © LuxAlgo

#indicator("Opening Range with Breakouts & Targets [LuxAlgo]",shorttitle = "LuxAlgo - ORB & Targets"

#Hint OpeningRangePeriod: Sets the Length of Time used for determining Opening Range.

#Hint SignalBias: OR Fill Color is directional based on if the current Day/Session ORM is Above or Below the Previous ORM.\nExamples:\nNo Bias: Signals Occur Regardless of OR Color.\nDaily Bias: Signals do not fire until Target 1 when Breakout is in opposite direction of OR Color.\nDon't Show Signals : No signals will be displayed.

#Hint TargetPercentageOfRange: Uses this % of OR Width to use as the distance for targets.

#Hint TargetCrossSource: Uses this Source to tell the script when a target is hit in order to draw the next target.

# Converted by Sam4Cok@Samer800 - 09/2024

input ShowHistoricalData = yes; # "Show Historical Data"

input OpeningRangeResetOptions = {Default "Session", "Daily", "Custom"};

input OpeningRangePeriod = AggregationPeriod.THIRTY_MIN; # "Time Period", group = "Opening Range",

input customStartTime = 0930;

input customEndTime = 0945;

input SignalBias = {default "No Bias", "Daily Bias", "Don't Show Signals"}; # "Signal Bias"

input ShowTargets = yes; # "Show Targets"

input TargetPercentageOfRange = 50.0; # "Target % of Range"

input TargetCrossSource = {default "Close", "Highs/Lows"}; # "Target Cross Source"

input showSessionMovAvg = no; # "Session Moving Average Enable"

input SessionMovAvgLength = 20; # "Session Moving Average Length"

input SessionMovAvgType = {"SMA",Default "EMA", "RMA", "WMA", "VWMA"}; # "Session Moving Average Type"

def na = Double.NaN;

def bar_index = BarNumber();

def current = GetAggregationPeriod();

def tf = Max(current, OpeningRangePeriod);

def orCustom = OpeningRangeResetOptions==OpeningRangeResetOptions."Custom";

def orSession = OpeningRangeResetOptions==OpeningRangeResetOptions."Session";

def day = GetYYYYMMDD();

def time = GetTime();

def today = GetDay() == GetLastDay();

def dayChange = GetYYYYMMDD()!=GetYYYYMMDD()[1];

def last = if isNaN(close) then yes else if ShowHistoricalData then no else if !today then yes else no;

def RTH = time >= RegularTradingStart(day) and time <= RegularTradingEND(day);

def ETH = if !RTH then yes else ETH[1];

def Session = if ETH then RTH!=RTH[1] else dayChange;

def tfClose = if !isNaN(close) then close(Period = tf) else tfClose[1];

def tfChange = tfClose!=tfClose[1];

def tPer = TargetPercentageOfRange * 0.01;

def crSesh = SecondsTillTime(customEndTime) > 0 and SecondsFromTime(customStartTime) >= 0;

def h_src;

def l_src;

Switch (TargetCrossSource) {

Case "Highs/Lows" :

h_src = high;

l_src = low;

Default :

h_src = close;

l_src = close;

}

#// Function to calculate WMA

Script f_wma {

input source = close;

input length = 20;

def norm = fold i = 0 to length with p do

p + (length - i) * length;

def sum = fold j = 0 to length with q do

q + GetValue(source, j) * (length - j) * length;

def f_wma = sum / norm;

plot out = f_wma;

}

Script day_ma {

input _start = no;

input _type = "EMA";

input l = 20;

def fz = if _start then 0 else fz[1] + 1;

def bs_nd = if fz==0 then 1 else fz;

def v_len = if bs_nd < l then bs_nd else l;

def k = 2 / (v_len + 1);

def a = 1 / v_len;

def sumS = fold i = 0 to v_len with p do

p + GetValue(close, i);

def sumVol = fold v = 0 to v_len with q do

q + GetValue(Volume, v);

def sumSrcVol = fold v1 = 0 to v_len with q1 do

q1 + GetValue(Volume * close, v1);

def nom = sumSrcVol / v_len;

def den = sumVol / v_len;

def ma = if _start then close else

if _type == "EMA" then (close * k ) + (ma[1]*(1-k)) else

if _type == "RMA" then a * close + (1 - a) * ma[1] else

if _type == "SMA" then sumS / v_len else

if _type == "WMA" then f_wma(close, v_len) else

if _type == "VWMA" then nom / den else Double.NaN;

plot out = if _start then Double.NaN else ma;

}

Script get_1up {

input _val = close;

def floorVal = Floor(_val);

def ceilVal = Ceil(_val);

def intVal = if _val > 0 then floorVal else ceilVal;

def intVal1 = if (floorVal + 1) > 0 then Floor(floorVal + 1) else Ceil(floorVal + 1);

def up = if (_val - floorVal) > 0 then intVal1 else intVal;

plot out = if isNaN(up) then 0 else up;

}

#//Calculations

def or_sesh;

Switch (OpeningRangeResetOptions) {

Case "Custom" :

or_sesh = crSesh;

Case "Daily" :

or_sesh = if dayChange then yes else if !dayChange and tfChange then no else or_sesh[1];

Default :

or_sesh = if Session then yes else if !Session and tfChange then no else or_sesh[1];

}

def or_start = or_sesh and !or_sesh[1];

def or_end = or_sesh[1] and !or_sesh;

def orh; def orl;def hh; def ll; def prev_orm;

def up_check; def up_check1; def down_check; def down_check1;

def orm = (orh[1] + orl[1]) / 2;

def orw = AbsValue(orh[1] - orl[1]);

if or_start {

orh = high;

orl = low;

prev_orm = orm[1];

hh = if (orCustom or ETH) then high else high(Period = tf);

ll = if (orCustom or ETH) then low else low(Period = tf);

up_check1 = yes;

down_check1 = yes;

} else if or_sesh {

orh = Max(orh[1], high);

orl = Min(orl[1], low);

prev_orm = prev_orm[1];

hh = if (orCustom or ETH) then orh else high(Period = tf);

ll = if (orCustom or ETH) then orl else low(Period = tf);

up_check1 = up_check[1];

down_check1 = down_check[1];

} else {

orh = orh[1];

orl = orl[1];

prev_orm = prev_orm[1];

hh = na;

ll = na;

up_check1 = up_check[1];

down_check1 = down_check[1];

}

def day_dir; def hst1; def lst1;

def hst; def lst;

if or_end {

day_dir = if orm > prev_orm then 1 else if orm < prev_orm then -1 else 0;

hst1 = orh + (orw * tPer);

lst1 = orl - (orw * tPer);

} else {

day_dir = day_dir[1];

hst1 = hst[1];

lst1 = lst[1];

}

def dirUp = day_dir>0;

def dirDn = day_dir<0;

def inOrbHi = if !last and or_sesh and hh then hh else na;

def inOrbLo = if !last and or_sesh and ll then ll else na;

def dayMa = if last then na else day_ma(or_start, SessionMovAvgType, SessionMovAvgLength);

#-- MOV

plot movAvg = if showSessionMovAvg then dayMa else na;

movAvg.SetDefaultColor(Color.WHITE);

#-- ORB

plot OrbHi = if !last and !or_sesh and orh then orh else na;

plot OrbLo = if !last and !or_sesh and orl then orl else na;

plot midOrb = (OrbHi + OrbLo) / 2;

midOrb.SetStyle(Curve.SHORT_DASH);

OrbHi.SetDefaultColor(Color.GRAY);

OrbLo.SetDefaultColor(Color.GRAY);

midOrb.SetDefaultColor(Color.GRAY);

AddCloud(inOrbHi, inOrbLo, Color.GRAY);

AddCloud(if dirUp then OrbHi else na, OrbLo, Color.DARK_GREEN);

AddCloud(if dirDn then OrbHi else na, OrbLo, Color.DARK_RED);

#//Target Calculations

if h_src > hst1 {

hst = h_src;

lst = lst1;

} else if l_src < lst1 {

lst = l_src;

hst = hst1;

} else {

hst = hst1;

lst = lst1;

}

#def up_max = get_1up((hst - orh)/(orw * tPer));

#def down_max = get_1up((orl - lst)/(orw * tPer));

def tgt1U = orh + orw * tPer * 1;

def tgt1D = orl - orw * tPer * 1;

def up_cur = max(0, get_1up((h_src - orh)/(orw * tPer)));

def down_cur = max(0, get_1up((orl - l_src)/(orw * tPer)));

def crossUp1 = (close Crosses Above orh);

def crossUp2 = (close Crosses Above tgt1U);

def crossDn1 = (close Crosses Below orl);

def crossDn2 = (close Crosses Below tgt1D);

#/Signal Calcs

def biasUp; def biasDn;

Switch (SignalBias) {

Case "Don't Show Signals" :

biasUp = no;

biasDn = no;

Case "Daily Bias" :

biasUp = (day_dir !=-1 and crossUp1) or (day_dir ==-1 and crossUp2);

biasDn = (day_dir != 1 and crossDn1) or (day_dir == 1 and crossDn2);

Default :

biasUp = crossUp1;

biasDn = crossDn1;

}

def down_signal;

if (close > orm and down_check1 == no) {

down_signal = no;

down_check = yes;

} else if biasDn and down_check1 {

down_signal = yes;

down_check = no;

} else {

down_signal = no;

down_check = down_check1;

}

def up_signal;

if (close < orm and up_check1 == no) {

up_signal = no;

up_check = yes;

} else if biasUp and up_check1 {

up_signal = yes;

up_check = no;

} else {

up_signal = no;

up_check = up_check1;

}

plot sigUp = if !last and up_signal then orl else na;

plot sigDn = if !last and down_signal then orh else na;

sigUp.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

sigDn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

sigUp.SetDefaultColor(Color.GREEN);

sigDn.SetDefaultColor(Color.RED);

#-- Targets

def tgtPup = if !ShowTargets then na else orh + (orw * tPer * up_cur);

def tgtNup = if !ShowTargets then na else orh + (orw * tPer * (up_cur-2));

def tgtPdn = if !ShowTargets then na else orl - (orw * tPer * (down_cur-2));

def tgtNdn = if !ShowTargets then na else orl - (orw * tPer * down_cur);

def tgt2U = orh + orw * tPer * 2;

def tgt3U = orh + orw * tPer * 3;

def tgt4U = orh + orw * tPer * 4;

def tgt5U = orh + orw * tPer * 5;

def tgt6U = orh + orw * tPer * 6;

def tgt7U = orh + orw * tPer * 7;

def tgt8U = orh + orw * tPer * 8;

def tgt9U = orh + orw * tPer * 9;

def tgt10U = orh + orw * tPer * 10;

def tgt11U = orh + orw * tPer * 11;

def tgt12U = orh + orw * tPer * 12;

def tgt13U = orh + orw * tPer * 13;

def tgt14U = orh + orw * tPer * 14;

def tgt15U = orh + orw * tPer * 15;

def tgt2D = orl - orw * tPer * 2;

def tgt3D = orl - orw * tPer * 3;

def tgt4D = orl - orw * tPer * 4;

def tgt5D = orl - orw * tPer * 5;

def tgt6D = orl - orw * tPer * 6;

def tgt7D = orl - orw * tPer * 7;

def tgt8D = orl - orw * tPer * 8;

def tgt9D = orl - orw * tPer * 9;

def tgt10D = orl - orw * tPer * 10;

def tgt11D = orl - orw * tPer * 11;

def tgt12D = orl - orw * tPer * 12;

def tgt13D = orl - orw * tPer * 13;

def tgt14D = orl - orw * tPer * 14;

def tgt15D = orl - orw * tPer * 15;

def tgtU1 = if or_start then na else if or_end then tgt1U else

if (tgtPup >= tgt1U) and (tgtNup <= tgt1U) then tgtU1[1] else tgtU1[1];

def tgtU2 = if or_start then na else if (tgtPup >= tgt2U) and (tgtNup <= tgt2U) then tgt2U else tgtU2[1];

def tgtU3 = if or_start then na else if (tgtPup >= tgt3U) and (tgtNup <= tgt3U) then tgt3U else tgtU3[1];

def tgtU4 = if or_start then na else if (tgtPup >= tgt4U) and (tgtNup <= tgt4U) then tgt4U else tgtU4[1];

def tgtU5 = if or_start then na else if (tgtPup >= tgt5U) and (tgtNup <= tgt5U) then tgt5U else tgtU5[1];

def tgtU6 = if or_start then na else if (tgtPup >= tgt6U) and (tgtNup <= tgt6U) then tgt6U else tgtU6[1];

def tgtU7 = if or_start then na else if (tgtPup >= tgt7U) and (tgtNup <= tgt7U) then tgt7U else tgtU7[1];

def tgtU8 = if or_start then na else if (tgtPup >= tgt8U) and (tgtNup <= tgt8U) then tgt8U else tgtU8[1];

def tgtU9 = if or_start then na else if (tgtPup >= tgt9U) and (tgtNup <= tgt9U) then tgt9U else tgtU9[1];

def tgtU10 = if or_start then na else if (tgtPup >= tgt10U) and (tgtNup <= tgt10U) then tgt10U else tgtU10[1];

def tgtU11 = if or_start then na else if (tgtPup >= tgt11U) and (tgtNup <= tgt11U) then tgt11U else tgtU11[1];

def tgtU12 = if or_start then na else if (tgtPup >= tgt12U) and (tgtNup <= tgt12U) then tgt12U else tgtU12[1];

def tgtU13 = if or_start then na else if (tgtPup >= tgt13U) and (tgtNup <= tgt13U) then tgt13U else tgtU13[1];

def tgtU14 = if or_start then na else if (tgtPup >= tgt14U) and (tgtNup <= tgt14U) then tgt14U else tgtU14[1];

def tgtU15 = if or_start then na else if (tgtPup >= tgt15U) and (tgtNup <= tgt15U) then tgt15U else tgtU15[1];

def tgtD1 = if or_start then na else if or_end then tgt1D else

if (tgtPdn >= tgt1D) and (tgtNdn <= tgt1D) then tgt1D else tgtD1[1];

def tgtD2 = if or_start then na else if (tgtPdn >= tgt2D) and (tgtNdn <= tgt2D) then tgt2D else tgtD2[1];

def tgtD3 = if or_start then na else if (tgtPdn >= tgt3D) and (tgtNdn <= tgt3D) then tgt3D else tgtD3[1];

def tgtD4 = if or_start then na else if (tgtPdn >= tgt4D) and (tgtNdn <= tgt4D) then tgt4D else tgtD4[1];

def tgtD5 = if or_start then na else if (tgtPdn >= tgt5D) and (tgtNdn <= tgt5D) then tgt5D else tgtD5[1];

def tgtD6 = if or_start then na else if (tgtPdn >= tgt6D) and (tgtNdn <= tgt6D) then tgt6D else tgtD6[1];

def tgtD7 = if or_start then na else if (tgtPdn >= tgt7D) and (tgtNdn <= tgt7D) then tgt7D else tgtD7[1];

def tgtD8 = if or_start then na else if (tgtPdn >= tgt8D) and (tgtNdn <= tgt8D) then tgt8D else tgtD8[1];

def tgtD9 = if or_start then na else if (tgtPdn >= tgt9D) and (tgtNdn <= tgt9D) then tgt9D else tgtD9[1];

def tgtD10 = if or_start then na else if (tgtPdn >= tgt10D) and (tgtNdn <= tgt10D) then tgt10D else tgtD10[1];

def tgtD11 = if or_start then na else if (tgtPdn >= tgt11D) and (tgtNdn <= tgt11D) then tgt11D else tgtD11[1];

def tgtD12 = if or_start then na else if (tgtPdn >= tgt12D) and (tgtNdn <= tgt12D) then tgt12D else tgtD12[1];

def tgtD13 = if or_start then na else if (tgtPdn >= tgt13D) and (tgtNdn <= tgt13D) then tgt13D else tgtD13[1];

def tgtD14 = if or_start then na else if (tgtPdn >= tgt14D) and (tgtNdn <= tgt14D) then tgt14D else tgtD14[1];

def tgtD15 = if or_start then na else if (tgtPdn >= tgt15D) and (tgtNdn <= tgt15D) then tgt15D else tgtD15[1];

plot target1U = if !last and !or_sesh and tgtU1 then tgtU1 else na;

plot target2U = if !last and !or_sesh and tgtU2 then tgtU2 else na;

plot target3U = if !last and !or_sesh and tgtU3 then tgtU3 else na;

plot target4U = if !last and !or_sesh and tgtU4 then tgtU4 else na;

plot target5U = if !last and !or_sesh and tgtU5 then tgtU5 else na;

plot target6U = if !last and !or_sesh and tgtU6 then tgtU6 else na;

plot target7U = if !last and !or_sesh and tgtU7 then tgtU7 else na;

plot target8U = if !last and !or_sesh and tgtU8 then tgtU8 else na;

plot target9U = if !last and !or_sesh and tgtU9 then tgtU9 else na;

plot target10U = if !last and !or_sesh and tgtU10 then tgtU10 else na;

plot target11U = if !last and !or_sesh and tgtU11 then tgtU11 else na;

plot target12U = if !last and !or_sesh and tgtU12 then tgtU12 else na;

plot target13U = if !last and !or_sesh and tgtU13 then tgtU13 else na;

plot target14U = if !last and !or_sesh and tgtU14 then tgtU14 else na;

plot target15U = if !last and !or_sesh and tgtU15 then tgtU15 else na;

plot target1D = if !last and !or_sesh and tgtD1 then tgtD1 else na;

plot target2D = if !last and !or_sesh and tgtD2 then tgtD2 else na;

plot target3D = if !last and !or_sesh and tgtD3 then tgtD3 else na;

plot target4D = if !last and !or_sesh and tgtD4 then tgtD4 else na;

plot target5D = if !last and !or_sesh and tgtD5 then tgtD5 else na;

plot target6D = if !last and !or_sesh and tgtD6 then tgtD6 else na;

plot target7D = if !last and !or_sesh and tgtD7 then tgtD7 else na;

plot target8D = if !last and !or_sesh and tgtD8 then tgtD8 else na;

plot target9D = if !last and !or_sesh and tgtD9 then tgtD9 else na;

plot target10D = if !last and !or_sesh and tgtD10 then tgtD10 else na;

plot target11D = if !last and !or_sesh and tgtD11 then tgtD11 else na;

plot target12D = if !last and !or_sesh and tgtD12 then tgtD12 else na;

plot target13D = if !last and !or_sesh and tgtD13 then tgtD13 else na;

plot target14D = if !last and !or_sesh and tgtD14 then tgtD14 else na;

plot target15D = if !last and !or_sesh and tgtD15 then tgtD15 else na;

target1U.SetDefaultColor(Color.DARK_GREEN);

target2U.SetDefaultColor(Color.DARK_GREEN);

target3U.SetDefaultColor(Color.DARK_GREEN);

target4U.SetDefaultColor(Color.DARK_GREEN);

target5U.SetDefaultColor(Color.DARK_GREEN);

target6U.SetDefaultColor(Color.DARK_GREEN);

target7U.SetDefaultColor(Color.DARK_GREEN);

target8U.SetDefaultColor(Color.DARK_GREEN);

target9U.SetDefaultColor(Color.DARK_GREEN);

target10U.SetDefaultColor(Color.DARK_GREEN);

target11U.SetDefaultColor(Color.DARK_GREEN);

target12U.SetDefaultColor(Color.DARK_GREEN);

target13U.SetDefaultColor(Color.DARK_GREEN);

target14U.SetDefaultColor(Color.DARK_GREEN);

target15U.SetDefaultColor(Color.DARK_GREEN);

target1D.SetDefaultColor(Color.DARK_RED);

target2D.SetDefaultColor(Color.DARK_RED);

target3D.SetDefaultColor(Color.DARK_RED);

target4D.SetDefaultColor(Color.DARK_RED);

target5D.SetDefaultColor(Color.DARK_RED);

target6D.SetDefaultColor(Color.DARK_RED);

target7D.SetDefaultColor(Color.DARK_RED);

target8D.SetDefaultColor(Color.DARK_RED);

target9D.SetDefaultColor(Color.DARK_RED);

target10D.SetDefaultColor(Color.DARK_RED);

target11D.SetDefaultColor(Color.DARK_RED);

target12D.SetDefaultColor(Color.DARK_RED);

target13D.SetDefaultColor(Color.DARK_RED);

target14D.SetDefaultColor(Color.DARK_RED);

target15D.SetDefaultColor(Color.DARK_RED);

#-- END of CODE