Here's the McClellan Summation Index indicator for ThinkorSwim.

Bonus: ThinkorSwim also provides a list of different index indicators. You can find their ticker symbol below.

There is NO % Above or % Below ANY average. I have asked a programmer at TDA directly. For whatever reason, the answer is that they aren't easily able to do it.

NYSE listed: listed on NYSE trades only on NYSE

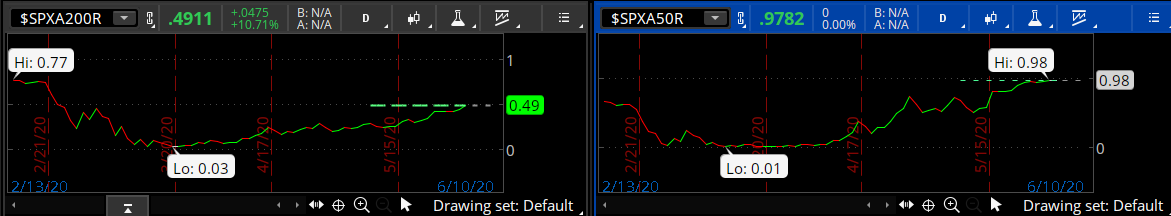

It's the % of stocks above the 200 day SMA.

$SPXA50R is, of course, the 50 day.

I have no idea which other ones work, unfortunately.

Code:

declare lower;

input exchange = {default NYSE, NASDAQ, AMEX};

input fastLength = 19;

input slowLength = 39;

input ratioAdjusted = No;

input isCumulative = Yes;

def advances;

def declines;

switch (exchange) {

case NYSE:

advances = close("$ADVN");

declines = close("$DECN");

case NASDAQ:

advances = close("$ADVN/Q");

declines = close("$DECN/Q");

case AMEX:

advances = close("$ADVA");

declines = close("$DECA");

}

def breadth;

def neutral_level;

def over_bought;

def over_sold;

if (ratioAdjusted) {

breadth = 1000 * (advances - declines) / (advances +

declines);

neutral_level = 0;

over_bought = 500;

over_sold = -500;

} else {

breadth = advances - declines;

neutral_level = 1000;

over_bought = Double.NaN;

over_sold = Double.NaN;

}

def emaFastCorr = ExpAverage(CompoundValue(1, if !IsNaN(breadth) then breadth else emaFastCorr[1], 0), fastLength);

def emaSlowCorr = ExpAverage(CompoundValue(1, if !IsNaN(breadth) then breadth else emaSlowCorr[1], 0), slowLength);

def mcClellanOsc = if !IsNaN(close) then emaFastCorr - emaSlowCorr else Double.NaN;

def mcClellanSummationIndex = mcClellanSummationIndex[1] + if !IsNaN(breadth) then mcClellanOsc else 0;

plot SummationIndex;

if IsNaN(close) {

SummationIndex = Double.NaN;

} else if (isCumulative) {

SummationIndex = neutral_level + mcClellanSummationIndex;

} else {

SummationIndex = neutral_level + mcClellanOsc - (10 * emaFastCorr + 20 * emaSlowCorr);

}

plot OverBought = over_bought;

plot OverSold = over_sold;

plot NeutralLevel = neutral_level;

SummationIndex.SetDefaultColor(GetColor(1));

OverBought.SetDefaultColor(GetColor(5));

OverSold.SetDefaultColor(GetColor(5));

NeutralLevel.SetDefaultColor(GetColor(7));Bonus: ThinkorSwim also provides a list of different index indicators. You can find their ticker symbol below.

There is NO % Above or % Below ANY average. I have asked a programmer at TDA directly. For whatever reason, the answer is that they aren't easily able to do it.

NYSE listed: listed on NYSE trades only on NYSE

- $ADD NYSE Advancing Issues - Declining Issues Difference

- $ADVN NYSE Advanced issues

- $DECN NYSE Declined issues

- $DVOL NYSE Declined volume

- $TICK NYSE TICK

- $TRIN NYSE TRIN

- $TVOL NYSE Total volume

- $UNCN NYSE Unchanged issues

- $UVOL NYSE Advanced volume

- $VOLD NYSE Up Volume - Down Volume Difference

- $ADDC NYSE Composite Advancing Issues - Declining Issues Difference

- $ADVNC NYSE Composite Advanced issues

- $DECNC NYSE Composite Declined issues

- $DVOLC NYSE Composite Declined volume

- $TICKC NYSE Composite TICK

- $TRINC NYSE Composite TRIN

- $TVOLC NYSE Composite Total volume

- $UNCNC NYSE Composite Unchanged issues

- $UVOLC NYSE Composite Advanced volume

- $VOLDC NYSE Composite Up Volume - Down Volume Difference

- $ADAD NYSE MKT (AMEX) Advancing Issues - Declining Issues Difference

- $ADVA NYSE MKT (AMEX) Advanced issues

- $DECA NYSE MKT (AMEX) Declined issues

- $DVOA NYSE MKT (AMEX) Declined volume

- $TICKA NYSE MKT (AMEX) TICK

- $TRINA NYSE MKT (AMEX) TRIN

- $TVOA NYSE MKT (AMEX) Total volume

- $UNCA NYSE MKT (AMEX) Unchanged issues

- $UVOA NYSE MKT (AMEX) Advanced volume

- $VOLAD NYSE MKT (AMEX) Up Volume - Down Volume Difference

- $ADADC NYSE MKT (AMEX) Composite Advancing Issues - Declining Issues Difference

- $ADVAC NYSE MKT (AMEX) Composite Advanced issues

- $DECAC NYSE MKT (AMEX) Composite Declined issues

- $DVOAC NYSE MKT (AMEX) Composite Declined volume

- $TICKAC NYSE MKT (AMEX) Composite TICK

- $TRINAC NYSE MKT (AMEX) Composite TRIN

- $TVOAC NYSE MKT (AMEX) Composite Total volume

- $UNCAC NYSE MKT (AMEX) Composite Unchanged issues

- $UVOAC NYSE MKT (AMEX) Composite Advanced volume

- $VOLADC NYSE MKT (AMEX) Composite Up Volume - Down Volume Difference

- $ADARD NYSE ARCA Advancing Issues - Declining Issues Difference

- $ADVAR NYSE ARCA Advanced issues

- $DECAR NYSE ARCA Declined issues

- $DVOAR NYSE ARCA Declined volume

- $TICKAR NYSE ARCA TICK

- $TRINAR NYSE ARCA TRIN

- $TVOAR NYSE ARCA Total volume

- $UNCAR NYSE ARCA Unchanged issues

- $UVOAR NYSE ARCA Advanced volume

- $VOLARD NYSE ARCA Up Volume - Down Volume Difference

- $ADARDC NYSE ARCA Composite Advancing Issues - Declining Issues Difference

- $ADVARC NYSE ARCA Composite Advanced issues

- $DECARC NYSE ARCA Composite Declined issues

- $DVOARC NYSE ARCA Composite Declined volume

- $TICKARC NYSE ARCA Composite TICK

- $TRINARC NYSE ARCA Composite TRIN

- $TVOARC NYSE ARCA Composite Total volume

- $UNCARC NYSE ARCA Composite Unchanged issues

- $UVOARC NYSE ARCA Composite Advanced volume

- $VOLARDC NYSE ARCA Composite Up Volume - Down Volume Difference

- $ADQD NASDAQ Advancing Issues - Declining Issues Difference

- $ADVN/Q NASDAQ Advanced issues

- $DECN/Q NASDAQ Declined issues

- $DVOL/Q NASDAQ Declined volume

- $TICK/Q NASDAQ TICK

- $TRIN/Q NASDAQ TRIN

- $TVOL/Q NASDAQ Total volume

- $UNCN/Q NASDAQ Unchanged issues

- $UVOL/Q NASDAQ Advanced volume

- $VOLQD NASDAQ Up Volume - Down Volume Difference

- $ADQDC NASDAQ Composite Advancing Issues - Declining Issues Difference

- $ADVNC/Q NASDAQ Composite Advanced issues

- $DECNC/Q NASDAQ Composite Declined issues

- $DVOLC/Q NASDAQ Composite Declined volume

- $TICKC/Q NASDAQ Composite TICK

- $TRINC/Q NASDAQ Composite TRIN

- $TVOLC/Q NASDAQ Composite Total volume

- $UNCNC/Q NASDAQ Composite Unchanged issues

- $UVOLC/Q NASDAQ Composite Advanced volume

- $VOLQDC NASDAQ Composite Up Volume - Down Volume Difference

- $ADID DJIA Advancing Issues - Declining Issues Difference

- $ADVI DJIA Advanced issues

- $DECLI DJIA Declined issues

- $DVOLI DJIA Declined volume

- $TIKI DJIA TICK

- $TRINI DJIA TRIN

- $TVOLI DJIA Total volume

- $UNCHI DJIA Unchanged issues

- $UVOLI DJIA Advanced volume

- $VOLID DJIA Up Volume - Down Volume Difference

- $ADIDC DJIA Composite Advancing Issues - Declining Issues Difference

- $ADVIC DJIA Composite Advanced issues

- $DECLIC DJIA Composite Declined issues

- $DVOLIC DJIA Composite Declined volume

- $TIKIC DJIA Composite TICK

- $TRINIC DJIA Composite TRIN

- $TVOLIC DJIA Composite Total volume

- $UNCHIC DJIA Composite Unchanged issues

- $UVOLIC DJIA Composite Advanced volume

- $VOLIDC DJIA Composite Up Volume - Down Volume Difference

- $ADSPD SNP 500 Advancing Issues - Declining Issues Difference

- $ADVSP SNP 500 Advanced issues

- $DECLSP SNP 500 Declined issues

- $DVOLSP SNP 500 Declined volume

- $TIKSP SNP 500 TICK

- $TRINSP SNP 500 TRIN

- $TVOLSP SNP 500 Total volume

- $UNCHSP SNP 500 Unchanged issues

- $UVOLSP SNP 500 Advanced volume

- $VOLSPD SNP 500 Up Volume - Down Volume Difference

- $ADSPDC SNP 500 Composite Advancing Issues - Declining Issues Difference

- $ADVSPC SNP 500 Composite Advanced issues

- $DECLSPC SNP 500 Composite Declined issues

- $DVOLSPC SNP 500 Composite Declined volume

- $TIKSPC SNP 500 Composite TICK

- $TRINSPC SNP 500 Composite TRIN

- $TVOLSPC SNP 500 Composite Total volume

- $UNCHSPC SNP 500 Composite Unchanged issues

- $UVOLSPC SNP 500 Composite Advanced volume

- $VOLSPDC SNP 500 Composite Up Volume - Down Volume Difference

- $ADNDD NASDAQ 100 Advancing Issues - Declining Issues Difference

- $ADVND NASDAQ 100 Advanced issues

- $DECLND NASDAQ 100 Declined issues

- $DVOLND NASDAQ 100 Declined volume

- $TIKND NASDAQ 100 TICK

- $TRINND NASDAQ 100 TRIN

- $TVOLND NASDAQ 100 Total volume

- $UNCHND NASDAQ 100 Unchanged issues

- $UVOLND NASDAQ 100 Advanced volume

- $VOLNDD NASDAQ 100 Up Volume - Down Volume Difference

- $ADNDDC NASDAQ 100 Composite Advancing Issues - Declining Issues Difference

- $ADVNDC NASDAQ 100 Composite Advanced issues

- $DECLNDC NASDAQ 100 Composite Declined issues

- $DVOLNDC NASDAQ 100 Composite Declined volume

- $TIKNDC NASDAQ 100 Composite TICK

- $TRINNDC NASDAQ 100 Composite TRIN

- $TVOLNDC NASDAQ 100 Composite Total volume

- $UNCHNDC NASDAQ 100 Composite Unchanged issues

- $UVOLNDC NASDAQ 100 Composite Advanced volume

- $VOLNDDC NASDAQ 100 Composite Up Volume - Down Volume Difference

- $ADRLD RUSSELL 2000 Advancing Issues - Declining Issues Difference

- $ADVRL RUSSELL 2000 Advanced issues

- $DECLRL RUSSELL 2000 Declined issues

- $DVOLRL RUSSELL 2000 Declined volume

- $TIKRL RUSSELL 2000 TICK

- $TRINRL RUSSELL 2000 TRIN

- $TVOLRL RUSSELL 2000 Total volume

- $UNCHRL RUSSELL 2000 Unchanged issues

- $UVOLRL RUSSELL 2000 Advanced volume

- $VOLRLD RUSSELL 2000 Up Volume - Down Volume Difference

- $ADRLDC RUSSELL 2000 Composite Advancing Issues - Declining Issues Difference

- $ADVRLC RUSSELL 2000 Composite Advanced issues

- $DECLRLC RUSSELL 2000 Composite Declined issues

- $DVOLRLC RUSSELL 2000 Composite Declined volume

- $TIKRLC RUSSELL 2000 Composite TICK

- $TRINRLC RUSSELL 2000 Composite TRIN

- $TVOLRLC RUSSELL 2000 Composite Total volume

- $UNCHRLC RUSSELL 2000 Composite Unchanged issues

- $UVOLRLC RUSSELL 2000 Composite Advanced volume

- $VOLRLDC RUSSELL 2000 Composite Up Volume - Down Volume Difference

- $ADUSD AllUSA Advancing Issues - Declining Issues Difference

- $ADVUS AllUSA Advanced issues

- $DECLUS AllUSA Declined issues

- $DVOLUS AllUSA Declined volume

- $TIKUS AllUSA TICK

- $TRINUS AllUSA TRIN

- $TVOLUS AllUSA Total volume

- $UNCHUS AllUSA Unchanged issues

- $UVOLUS AllUSA Advanced volume

- $VOLUSD AllUSA Up Volume - Down Volume Difference

- $ADUSDC AllUSA Composite Advancing Issues - Declining Issues Difference

- $ADVUSC AllUSA Composite Advanced issues

- $DECLUSC AllUSA Composite Declined issues

- $DVOLUSC AllUSA Composite Declined volume

- $TIKUSC AllUSA Composite TICK

- $TRINUSC AllUSA Composite TRIN

- $TVOLUSC AllUSA Composite Total volume

- $UNCHUSC AllUSA Composite Unchanged issues

- $UVOLUSC AllUSA Composite Advanced volume

- $VOLUSDC AllUSA Composite Up Volume - Down Volume Difference

- $NYHI1W NYSE New Highs 1W

- $NYHI2W NYSE New Highs 2W

- $NYHI1M NYSE New Highs 1M

- $NYHI3M NYSE New Highs 3M

- $NYHI6M NYSE New Highs 6M

- $NYHI9M NYSE New Highs 9M

- $NYHGH NYSE New Highs 1Y

- $NYLO1W NYSE New Lows 1W

- $NYLO2W NYSE New Lows 2W

- $NYLO1M NYSE New Lows 1M

- $NYLO3M NYSE New Lows 3M

- $NYLO6M NYSE New Lows 6M

- $NYLO9M NYSE New Lows 9M

- $NYLOW NYSE New Lows 1Y

- $AMHI1W NYSE MKT (AMEX) New Highs 1W

- $AMHI2W NYSE MKT (AMEX) New Highs 2W

- $AMHI1M NYSE MKT (AMEX) New Highs 1M

- $AMHI3M NYSE MKT (AMEX) New Highs 3M

- $AMHI6M NYSE MKT (AMEX) New Highs 6M

- $AMHI9M NYSE MKT (AMEX) New Highs 9M

- $AMHGH NYSE MKT (AMEX) New Highs 1Y

- $AMLO1W NYSE MKT (AMEX) New Lows 1W

- $AMLO2W NYSE MKT (AMEX) New Lows 2W

- $AMLO1M NYSE MKT (AMEX) New Lows 1M

- $AMLO3M NYSE MKT (AMEX) New Lows 3M

- $AMLO6M NYSE MKT (AMEX) New Lows 6M

- $AMLO9M NYSE MKT (AMEX) New Lows 9M

- $AMLOW NYSE MKT (AMEX) New Lows 1Y

- $ARHI1W NYSE ARCA New Highs 1W

- $ARHI2W NYSE ARCA New Highs 2W

- $ARHI1M NYSE ARCA New Highs 1M

- $ARHI3M NYSE ARCA New Highs 3M

- $ARHI6M NYSE ARCA New Highs 6M

- $ARHI9M NYSE ARCA New Highs 9M

- $ARHGH NYSE ARCA New Highs 1Y

- $ARLO1W NYSE ARCA New Lows 1W

- $ARLO2W NYSE ARCA New Lows 2W

- $ARLO1M NYSE ARCA New Lows 1M

- $ARLO3M NYSE ARCA New Lows 3M

- $ARLO6M NYSE ARCA New Lows 6M

- $ARLO9M NYSE ARCA New Lows 9M

- $ARLOW NYSE ARCA New Lows 1Y

- $NAHI1W NASDAQ New Highs 1W

- $NAHI2W NASDAQ New Highs 2W

- $NAHI1M NASDAQ New Highs 1M

- $NAHI3M NASDAQ New Highs 3M

- $NAHI6M NASDAQ New Highs 6M

- $NAHI9M NASDAQ New Highs 9M

- $NAHGH NASDAQ New Highs 1Y

- $NALO1W NASDAQ New Lows 1W

- $NALO2W NASDAQ New Lows 2W

- $NALO1M NASDAQ New Lows 1M

- $NALO3M NASDAQ New Lows 3M

- $NALO6M NASDAQ New Lows 6M

- $NALO9M NASDAQ New Lows 9M

- $NALOW NASDAQ New Lows 1Y

- $ETFHI1W ETF New Highs 1W

- $ETFHI2W ETF New Highs 2W

- $ETFHI1M ETF New Highs 1M

- $ETFHI3M ETF New Highs 3M

- $ETFHI6M ETF New Highs 6M

- $ETFHI9M ETF New Highs 9M

- $ETFHGH ETF New Highs 1Y

- $ETFLO1W ETF New Lows 1W

- $ETFLO2W ETF New Lows 2W

- $ETFLO1M ETF New Lows 1M

- $ETFLO3M ETF New Lows 3M

- $ETFLO6M ETF New Lows 6M

- $ETFLO9M ETF New Lows 9M

- $ETFLOW ETF New Lows 1Y

It's the % of stocks above the 200 day SMA.

$SPXA50R is, of course, the 50 day.

I have no idea which other ones work, unfortunately.