Hello Community:

I want to find a script that allows me to:

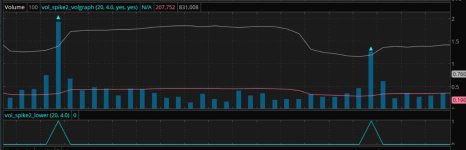

1. search for stocks that have had days with 4x or more than typical volume in a single day relative to average volume in preceding period (upwards, bullish volume).

2. be able to adjust the search time frame to any period - from one day to 360 days ago, or for a period of days, i.e. 90-100 days ago, etc.

3. a price trend line that is either flat or rising both before and after the volume spike

I would appreciate all feedback and references!

thanks,

Realoans

I want to find a script that allows me to:

1. search for stocks that have had days with 4x or more than typical volume in a single day relative to average volume in preceding period (upwards, bullish volume).

2. be able to adjust the search time frame to any period - from one day to 360 days ago, or for a period of days, i.e. 90-100 days ago, etc.

3. a price trend line that is either flat or rising both before and after the volume spike

I would appreciate all feedback and references!

thanks,

Realoans