need help plotting these arrows ias a higher agg in a lower time frame chart https://tos.mx/nRGF2qR

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

need help to get the arrows to plot higher agg in a lower time frame chart

- Thread starter Piper2808t

- Start date

@Piper2808t Could you please post the code here using the </> post formatting bar icon, using Ruby for syntax highlighting... Members shouldn't be required to import your code in order to review it in an effort to help... Most issues can be resolved via brief visual review alone... Posting the code should always be the practice, whether a shared link is also provided or not...

wont allow me to

Please explain how/why you can't post Study code... You don't need to post the chart because you could, and should, also post an image if that would help us understand your problem... Remember, it is up to you to help us help you...

@Piper2808t Please read the tutorial of how to post to this forum. It explains the correct way to include scripts and images in your post.

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-58016

Your question doesn't make any sense. You already have all your arrows on your chart. Please be more clear about what the problem is. Mark up your chart in photoshop pointing to the problems. Follow the instructions on how to post in the above link.

Here is what your post should look like:

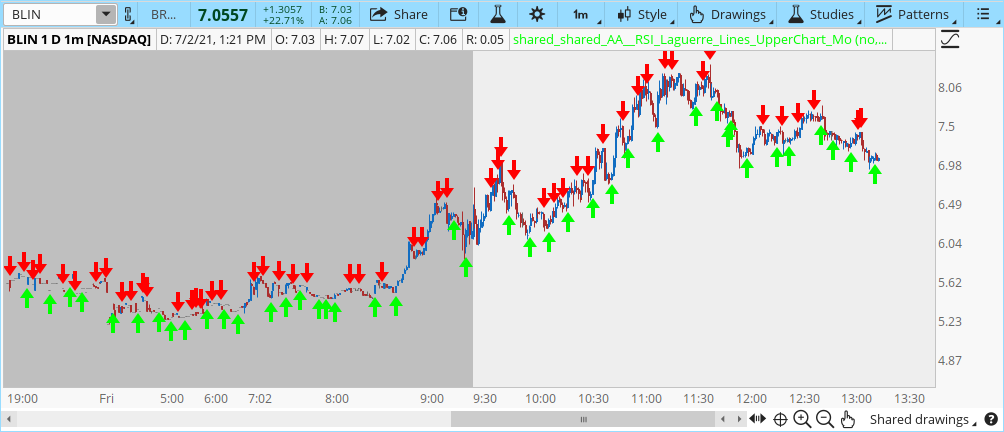

@Piper2808t has a question about how to plot RSI_Laguerre_Lines_wTargets 15min arrows on a 1min chart.

The chart shows the arrows are already plotting.

Here is the code being used:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/#post-58016

Your question doesn't make any sense. You already have all your arrows on your chart. Please be more clear about what the problem is. Mark up your chart in photoshop pointing to the problems. Follow the instructions on how to post in the above link.

Here is what your post should look like:

@Piper2808t has a question about how to plot RSI_Laguerre_Lines_wTargets 15min arrows on a 1min chart.

The chart shows the arrows are already plotting.

Here is the code being used:

Code:

#StudyName: RSI_Laguerre_Lines_wTargets

#Version/Date: v1 5/30/17

#TOS.mx Link:

#Type: [Study]

#Description: RSI in Laguerre Time MTF plotted on Upper chart

#Author: jcseattle

#Copyright: Copyright jcseattle/amalia 2016. All rights reserved.

#Copyleft: This program is free software: you can redistribute it and/or modify

# it under the terms of the GNU General Public License as published by

# the Free Software Foundation, either version 3 of the License, or

# (at your option) any later version. See <http://www.gnu.org/licenses/>

#Requested By: ""

#History: Ver Date Auth Change

#First draft v1 5/30/17 jcseattle - No changes

# Notes :Based off original script in

# RSI in Laguerre Time MTF Option_v3

# Mobius

# V02.07.2014

# translation of J Elher's code

# Annotation : ""

# Trading Notes : ""

# Start Code

input MTF = no;

input timeframe = AggregationPeriod.FIFTEEN_MIN ;

def na = Double.NaN;

script R {

input gamma = .2;

input usecandletype = {candle_hybrid, default candle};

input usehigheraggperiod = {default "Current", "Higher"};

input outputformat = {default Rounded, "Not Rounded"};

;#Hint outputformat: 'Not Rounded' is used for notes, bonds (eg: 109'110), forex, etc type format.

input atrlength = 21;

input agg = AggregationPeriod.ten_MIN;

input overbought = .8;

input oversold = .2;

def o;

def h;

def l;

def c;

def CU1;

def CU2;

def CU;

def CD1;

def CD2;

def CD;

def L0;

def L1;

def L2;

def L3;

plot RSI;

plot OS;

plot OB;

def error = usehigheraggperiod == usehigheraggperiod."Higher" and GetAggregationPeriod() > agg;

switch (usehigheraggperiod) {

case Current:

if usecandletype == usecandletype.candle_hybrid {

o = (open + close[1]) / 2;

h = Max(high, close[1]);

l = Min(low, close[1]);

c = (o + h + l + close) / 4;

} else {

o = open;

h = high;

l = low;

c = close;

}

case Higher:

if error {

o = Double.NaN;

h = Double.NaN;

l = Double.NaN;

c = Double.NaN;

} else {

if usecandletype == usecandletype.candle_hybrid {

o = (open(period = agg) + close(period = agg)[1]) / 2;

h = Max(high(period = agg) , close(period = agg)[1]);

l = Min(low(period = agg) , close(period = agg)[1]);

c = ((open(period = agg) + close(period = agg)[1]) / 2

+ Max(high(period = agg), close(period = agg)[1])

+ Min(low(period = agg) , close(period = agg)[1])

+ close(period = agg)) / 4;

} else {

o = open(period = agg);

h = high(period = agg);

l = low(period = agg);

c = close(period = agg);

}

}

}

L0 = (1 – gamma) * c + gamma * L0[1];

L1 = -gamma * L0 + L0[1] + gamma * L1[1];

L2 = -gamma * L1 + L1[1] + gamma * L2[1];

L3 = -gamma * L2 + L2[1] + gamma * L3[1];

if L0 >= L1

then {

CU1 = L0 - L1;

CD1 = 0;

} else {

CD1 = L1 - L0;

CU1 = 0;

}

if L1 >= L2

then {

CU2 = CU1 + L1 - L2;

CD2 = CD1;

} else {

CD2 = CD1 + L2 - L1;

CU2 = CU1;

}

if L2 >= L3

then {

CU = CU2 + L2 - L3;

CD = CD2;

} else {

CU = CU2;

CD = CD2 + L3 - L2;

}

RSI = if IsNaN(close) then Double.NaN

else if CU + CD <> 0

then CU / (CU + CD) else 0;

OS = if IsNaN(close)

then Double.NaN else oversold;

OB = if IsNaN(close)

then Double.NaN

else overbought;

def mid = if IsNaN(close) then Double.NaN else 0.5;

def lineh = 1.2;

def linel = -.2;

# End Code Basic RSI Laguerre - Author: Mobius

}

def Up = if R() crosses above R().OS then 1 else 0;

def u = if R() crosses above R().OB then 1 else 0;

def Dn = if R() crosses below R().OB then 1 else 0;

def d = if R() crosses below R().OS then 1 else 0;

def Green = if Up

#or u

then low else 0;

def Red = if Dn

#or d

then high else 0;

def showLines = 1;

def trendchange = if Green then low else if Red then high else trendchange[1];

def PL = if !IsNaN(trendchange)

then trendchange

else PL[1];

plot pivotLine = if PL > 0

then PL

else Double.NaN;

pivotLine.SetPaintingStrategy(PaintingStrategy.LINE);

pivotLine.SetHiding(!showLines);

input showArrows = yes;

plot ArrUp = if showArrows and Green then low else 0;

ArrUp.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

ArrUp.SetDefaultColor(Color.GREEN);

plot ArrDn = if showArrows and Red then high else 0;

ArrDn.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

ArrDn.SetDefaultColor(Color.RED);

pivotLine.AssignValueColor(if R() < R().OB then Color.RED else if R() > R().OS then Color.GREEN else Color.BLACK);

input ShowLabels = yes;

#Multipliers for ATR targets

input firsttgt = 1.618;

input secondtgt = 3.447;

input thirdtgt = 4.25;

input ATRLength = 8;#default is 14

def agg = if GetAggregationPeriod() > AggregationPeriod.FIFTEEN_MIN then GetAggregationPeriod() else AggregationPeriod.FIFTEEN_MIN;#You can edit this to just (GetAggregationPeriod())

def ATR = Average(TrueRange(High(period = agg),Close(period = agg),Low(period = agg)),ATRLength);

#addlabel(ShowLabels, "ATR = " + Round((ATR) / TickSize(),0)*TickSize(), Color.GRAY);

input showStrategy = yes;

def co = if PL[1] and R()[1] > R().OS[1] then 1 else 0;

def firstlongtarget = if co then (PivotLine + ATR*firsttgt) else 0;

def secondlongtarget = if co then (PivotLine + ATR*secondtgt) else 0;

def thirdlongtarget = if co then (PivotLine + ATR*thirdtgt) else 0;

def sto = if PL and R() < R().OB then 1 else 0;

def firstshorttarget = if sto then (PivotLine - ATR*firsttgt) else 0;

def secondshorttarget = if sto then (PivotLine - ATR*secondtgt) else 0;

def thirdshorttarget = if sto then (PivotLine - ATR*thirdtgt) else 0;

# Internal Script Reference

# Author: Mobius

def LineLimit = 30;

def Detrend = 0;

def OnExpansion = yes;

def data = firstlongtarget;

def bar = 0;

def ShowAllPlots = 0;

def ThisBar = HighestAll(bar) - Detrend;

def cLine = if ShowAllPlots == 0

then if bar == ThisBar

then data

else Double.NaN

else data;

def cond1 = CompoundValue(1, if IsNaN(data)

then cond1[1]

else data, data);

def P = if ShowAllPlots == 0

then if ThisBar - LineLimit <= bar

then HighestAll(cLine)

else Double.NaN

else cLine;

plot firstLTarget = if OnExpansion and

IsNaN(data[-1])

then cond1

else Double.NaN;

firstLTarget.SetDefaultColor(Color.GREEN);

#addlabel(ShowLabels, if R() > R().OS then "Long Target = " + Round((firstLTarget) / TickSize(),0)*TickSize() else "", Color.GREEN);

#AddChartBubble(IsNaN(close) and !isNaN(close[1]),

## firstLTarget,

# "First Target = " + Round((firstLTarget) / TickSize(),0)*TickSize(),

# Color.GREEN,

# yes);

def difflongtarget = if close < firstlongtarget then (firstlongtarget - close) else (close - firstlongtarget);

#addLabel(ShowLabels, if R() > R().OS then "Diff 1st L tgt = " + (Round((difflongtarget) / TickSize(),0)*TickSize()) else "", Color.LIGHT_GREEN);

def LineLimit3 = 30;

def Detrend3 = 0;

def OnExpansion3 = yes;

def data3 = secondlongtarget;

def bar3 = 0;

def ShowAllPlots3 = 0;

def ThisBar3 = HighestAll(bar) - Detrend;

def cLine3 = if ShowAllPlots3 == 0

then if bar3 == ThisBar3

then data3

else Double.NaN

else data3;

def cond3 = CompoundValue(1, if IsNaN(data3)

then cond3[1]

else data3, data3);

def P3 = if ShowAllPlots3 == 0

then if ThisBar3 - LineLimit3 <= bar3

then HighestAll(cLine3)

else Double.NaN

else cLine3;

plot secondLTarget = if OnExpansion3 and

IsNaN(data3[-1])

then cond3

else Double.NaN;

secondLTarget.SetDefaultColor(Color.GREEN);

#addlabel(ShowLabels, if R() > R().OS then "2nd Long Target = " + Round((secondLTarget) / TickSize(),0)*TickSize() else "", Color.GREEN);

#AddChartBubble(IsNaN(close) and !isNaN(close[1]),

# secondLTarget,

# "2nd Long Target = " + Round((secondLTarget) / TickSize(),0)*TickSize(),

# Color.GREEN,

# yes);

def difflongtarget2 = if close < secondlongtarget then (secondlongtarget - close) else (close - secondlongtarget);

#addLabel(ShowLabels, if R() > R().OS then "Diff 2nd L tgt = " + Round((difflongtarget2) / TickSize(),0)*TickSize() else "", Color.LIGHT_GREEN);

def LineLimit9 = 30;

def Detrend9 = 0;

def OnExpansion9 = yes;

def data9 = thirdlongtarget;

def bar9 = 0;

def ShowAllPlots9 = 0;

def ThisBar9 = HighestAll(bar9) - Detrend9;

def cLine9 = if ShowAllPlots9 == 0

then if bar9 == ThisBar9

then data9

else Double.NaN

else data9;

def cond9 = CompoundValue(1, if IsNaN(data9)

then cond9[1]

else data9, data9);

def P9 = if ShowAllPlots9 == 0

then if ThisBar9 - LineLimit9 <= bar9

then HighestAll(cLine9)

else Double.NaN

else cLine9;

plot thirdLTarget = if OnExpansion9 and

IsNaN(data9[-1])

then cond9

else Double.NaN;

thirdLTarget.SetDefaultColor(Color.GREEN);

#addlabel(ShowLabels, if R() > R().OS then "3rd Long Target = " + Round((thirdLTarget) / TickSize(),0)*TickSize() else "", Color.GREEN);

#AddChartBubble(IsNaN(close) and !isNaN(close[1]),

# thirdLTarget,

# "3rd Long Target = " + Round((thirdLTarget) / TickSize(),0)*TickSize(),

# Color.GREEN,

# yes);

def difflongtarget9 = if close < thirdlongtarget then (thirdlongtarget - close) else (close - thirdlongtarget);

#addLabel(ShowLabels, if R() > R().OS then "Diff 3rd L tgt = " + Round((difflongtarget9) / TickSize(),0)*TickSize() else "", Color.LIGHT_GREEN);

def LineLimit2 = 30;

def Detrend2 = 0;

def OnExpansion2 = yes;

def data2 = firstshorttarget;

def bar2 = 0;

def ShowAllPlots2 = 0;

def ThisBar2 = HighestAll(bar2) - Detrend2;

def cLine2 = if ShowAllPlots2 == 0

then if bar2 == ThisBar2

then data2

else Double.NaN

else data2;

def cond2 = CompoundValue(1, if IsNaN(data2)

then cond2[1]

else data2, data2);

def P2 = if ShowAllPlots2 == 0

then if ThisBar2 - LineLimit2 <= bar2

then HighestAll(cLine2)

else Double.NaN

else cLine2;

plot firstSTarget = if OnExpansion2 and

IsNaN(data2[-1])

then cond2

else Double.NaN;

firstSTarget.SetDefaultColor(Color.RED);

#addlabel(ShowLabels, if R() < R().OB then "1st Short Target = " + Round((firstSTarget) / TickSize(),0)*TickSize() else "", Color.RED);

#AddChartBubble(IsNaN(close) and !IsNaN(Close[1]),

# firstSTarget,

# "Short Target = " + Round((firstSTarget) / TickSize(),0)*TickSize(),

# Color.RED,

# no);

def diffshorttarget = if close < data2 then (data2 - close) else (close - data2);

#addLabel(ShowLabels, if R() < R().OB then "Diff 1st S tgt = " + Round((diffshorttarget) / TickSize(),0)*TickSize() else "", Color.LIGHT_RED);

#

def LineLimit4 = 30;

def Detrend4 = 0;

def OnExpansion4 = yes;

def data4 = secondshorttarget;

def bar4 = 0;

def ShowAllPlots4 = 0;

def ThisBar4 = HighestAll(bar4) - Detrend4;

def cLine4 = if ShowAllPlots4 == 0

then if bar4 == ThisBar4

then data4

else Double.NaN

else data4;

def cond4 = CompoundValue(1, if IsNaN(data4)

then cond4[1]

else data4, data4);

def P4 = if ShowAllPlots4 == 0

then if ThisBar4 - LineLimit4 <= bar4

then HighestAll(cLine4)

else Double.NaN

else cLine4;

plot secondSTarget = if OnExpansion4 and

IsNaN(data4[-1])

then cond4 #

else Double.NaN;

secondSTarget.SetDefaultColor(Color.RED);

#Round((close + (atr)) / TickSize(), 0) * TickSize()

#addlabel(ShowLabels, if R() < R().OB then "2nd Short Target = " + Round((secondSTarget) / TickSize(),0)*TickSize() else "", Color.RED);

#AddChartBubble(IsNaN(close) and !IsNaN(Close[1]),

# secondSTarget,

## "2nd Short Target = " + Round((secondSTarget) / TickSize(),0)*TickSize(),

# Color.RED,

# no);

def diffshorttgt2 = if close < secondshorttarget then (secondshorttarget - close) else (close - secondshorttarget);

#addLabel(ShowLabels, if R() < R().OB then "Diff 2nd S tgt = " + Round((diffshorttgt2) / TickSize(),0)*TickSize() else "", Color.LIGHT_RED);

def LineLimit8 = 30;

def Detrend8 = 0;

def OnExpansion8 = yes;

def data8 = thirdshorttarget;

def bar8 = 0;

def ShowAllPlots8 = 0;

def ThisBar8 = HighestAll(bar8) - Detrend8;

def cLine8 = if ShowAllPlots8 == 0

then if bar8 == ThisBar8

then data8

else Double.NaN

else data8;

def cond8 = CompoundValue(1, if IsNaN(data8)

then cond8[1]

else data8, data8);

def P8 = if ShowAllPlots8 == 0

then if ThisBar8 - LineLimit8 <= bar8

then HighestAll(cLine8)

else Double.NaN

else cLine8;

plot thirdSTarget = if OnExpansion8 and

IsNaN(data8[-1])

then cond8

else Double.NaN;

thirdSTarget.SetDefaultColor(Color.RED);

#addlabel(ShowLabels, if R() < R().OB then "3rd Short Target = " + Round((thirdSTarget) / TickSize(),0)*TickSize() else "", Color.RED);

#AddChartBubble(IsNaN(close) and !isNaN(close[1]),

# thirdSTarget,

# "3rd Short Target = " + Round((thirdSTarget) / TickSize(),0)*TickSize(),

# Color.RED,

# no);

def diffshorttarget3 = if close < thirdshorttarget then (thirdshorttarget - close) else (close - thirdshorttarget);

#addLabel(ShowLabels, if R() < R().OB then "Diff 3rd S tgt = " + Round((diffshorttarget3) / TickSize(),0)*TickSize() else "", Color.LIGHT_RED);looking for higher aggregation 5 min plotted arrows on a 1 min time frame chart

i copied the code from the studies and it will not allow me to paste it in to send in this forum

@Piper2808t To plot 5min arrows on your 1min chart,

Change this two lines from:

To these two lines:

Change this two lines from:

Ruby:

input MTF = no;

input timeframe = AggregationPeriod.FIFTEEN_MIN ;

Ruby:

input MTF = yes;

input timeframe = AggregationPeriod.FIVE_MIN ;tried that already something in the script not allowing it to happen

@Piper2808t The link you provided has MTF turned off and is NOT set to 5min.

Please share the link when you have made the changes.

The code seems to be working correctly.

Please share the link when you have made the changes.

The code seems to be working correctly.

Last edited:

i set it to on with 5 min higher agg 1 hr etc the arrows do not change the code as is is not working correctly

i copied the code from the studies and it will not allow me to paste it in to send in this forum

@Piper2808t Personally, I find this hard to believe... Copy & Paste works, period...!!! There is absolutely no reason why, if you can see the code, that you can't use Ctrl + A to Select All, Ctrl + C to Copy, and Ctrl + V to Paste into the code box using the </> icon in the post formatting toolbar, selecting Ruby for code syntax, and saving... Unless you have a problem with your PC this should work... It surely isn't a problem with TOS if you have closed, rebooted, and restarted TOS...

I highlighted the script , copied it and when i tried to paste it in here nada, if it is such a big deal to get help as a vip member in here i will go elsewhere, not the end of the world

I highlighted the script , copied it and when i tried to paste it in here nada, if it is such a big deal to get help as a vip member in here i will go elsewhere, not the end of the world

VIP gives you access to additional scripts, not preferential support here in these forums and, if that was the case it would be @BenTen who would need to provide it as the rest of us simply help because we can - without compensation... I'm still chalking it up to operator error as to why only you seem to have a problem posting code here... Copy & Paste isn't something that can be enabled/disabled in the forum software...

This being a busy holiday weekend I don't know if I'll have time to import your link in the first post and take a look into this for you but if I can I will...

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| D | need help removing extra arrows | Questions | 1 | |

|

|

Need help plotting arrows | Questions | 1 | |

| R | Need help adding arrows to price trend | Questions | 2 | |

| Z | Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD | Questions | 3 | |

| F | Need Help Creating Scan from Multiple Mobius Studies Please | Questions | 1 |

Similar threads

-

-

-

-

Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD

- Started by Zlotko

- Replies: 3

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

799

Online

Similar threads

-

-

-

-

Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD

- Started by Zlotko

- Replies: 3

-

Similar threads

-

-

-

-

Need help with New Code for SuperTrend Fusion Pro — Trend + Momentum + VWAP + CVD

- Started by Zlotko

- Replies: 3

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.