Author Message: - Modified -

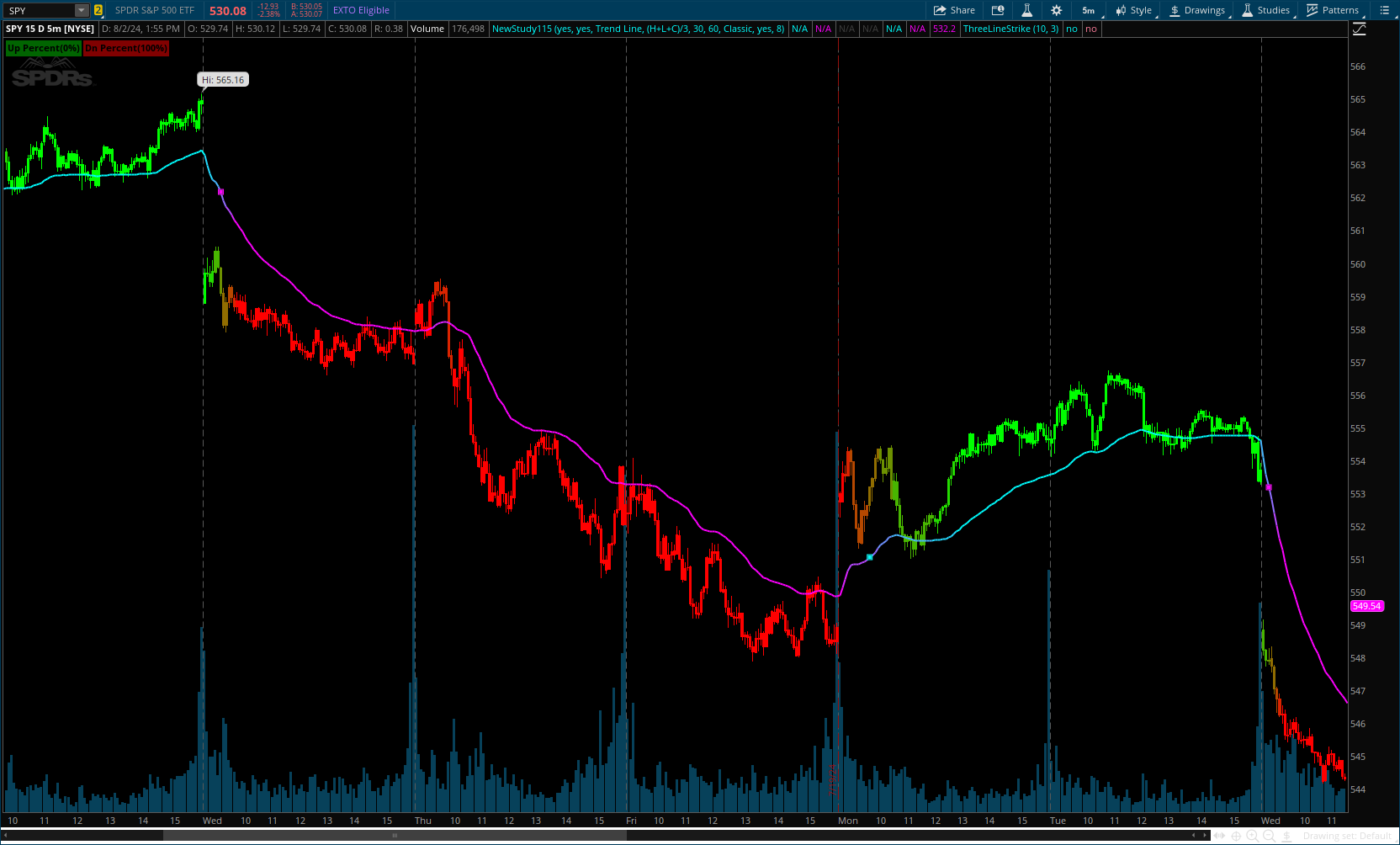

The Multi Deviation Scaled Moving Average is an analysis tool that combines multiple Deviation Scaled Moving Averages (DSMAs) to provide a comprehensive view of market trends. The DSMA, originally created by John Ehlers, is a sophisticated moving average that adapts to market volatility. This indicator offers a unique approach to trend analysis by utilizing a series of DSMAs with different periods and presenting the results through a color-coded line and a visual histogram.

CODE:

CSS:

#// Indicator for TOS

#// © ChartPrime

#indicator("Multi Deviation Scaled Moving Average [ChartPrime]", "Multi DSMA - [ChartPrime]", overlay=true)

#Hint Sensitivity: The Lower input Lower sensitivity.

#Hint noOfMovAvg: Max = 12 MovAvg, Min = 2 MovAvg.

# Converted and mod by Sam4Cok@Samer800 - 08/2024

input showLabel = yes;

input colorBars = yes;

input displayOptions = {default "Trend Line", "Trend Cloud", "Trend Line & Cloud"};

input src = hlc3;

input period = 30; #, title="Period")

input Sensitivity = 60; #, "Sensitivity", minval = 0, maxval = 100

input cloudTheme = {default Select, Classic, Mono, Modren};

input showCloudGrid = no;

input noOfMovAvg = 8;

def na = Double.NaN;

def last = IsNaN(close);

def both = displayOptions == displayOptions."Trend Line & Cloud";

def ribbon = displayOptions == displayOptions."Trend Cloud" or both;

def avgLine = displayOptions == displayOptions."Trend Line" or both;

def step = 100 - Min(Max(Sensitivity, 0), 100);

def n = Min(Max(noOfMovAvg, 2), 12);

#-- Color

def rUp;

def gUp;

def bUp;

def rDn;

def gDn;

def bDn;

switch (cloudTheme) {

case Classic :

rUp = 1;

gUp = 101;

bUp = 1;

rDn = 129;

gDn = 1;

bDn = 1;

case Modren :

rUp = 4;

gUp = 156;

bUp = 179;

rDn = 123;

gDn = 3;

bDn = 143;

case Mono :

rUp = 178;

gUp = 181;

bUp = 190;

rDn = 64;

gDn = 64;

bDn = 64;

default :

rUp = 0;

gUp = 101;

bUp = 0;

rDn = 129;

gDn = 0;

bDn = 0;

}

DefineGlobalColor("up", CreateColor(rUp, gUp, bUp));

DefineGlobalColor("dn", CreateColor(rDn, gDn, bDn));

#DefineGlobalColor("up", CreateColor(178, 181, 190));

#DefineGlobalColor("dn", CreateColor(64, 64, 64));

#// @function Calculates the Deviation Scaled Moving Average (DSMA)

#// @param src (series float) Source price series

#// @param period (int) Calculation period

#// @returns (float) DSMA value

script dsma {

input src = hlc3;

input period = 30;

def wma = WildersAverage(src, Floor(period / 2));

def pi = Double.Pi;

def g = Sqrt(2);

def s = 2 * pi / period;

def a1 = Exp(-g * pi / (0.5 * period));

def b1 = 2 * a1 * Cos(g * s / (0.5 * period));

def c2 = b1;

def c3 = -a1 * a1;

def c1 = 1 - c2 - c3;

def zeros = (close - close[2]);

def avg = (zeros + zeros[1]) / 2;

def filt = CompoundValue(1, c1 * avg + c2 * filt[1] + c3 * filt[2], 0);

def sqrVal = Sqr(filt);

def ema = ExpAverage(sqrVal, period);

def rms = Sqrt(ema);

def scaled_filt = if rms != 0 then filt / rms else 0;

def alpha1 = AbsValue(scaled_filt) * 5 / period;

def dsma = CompoundValue(1, alpha1 * close + (1 - alpha1) * dsma[1], wma);

plot out = dsma;

}

# // Calculate DSMAs with increasing periods

def val = 1 / (n - 1);

def length1 = period;

def length2 = length1 + step;

def length3 = length2 + step;

def length4 = length3 + step;

def length5 = length4 + step;

def length6 = length5 + step;

def length7 = length6 + step;

def length8 = length7 + step;

def length9 = length8 + step;

def length10 = length9 + step;

def length11 = length10 + step;

def length12 = length11 + step;

def dsma1 = dsma(src, length1);

def dsma2 = dsma(src, length2);

def dsma3 = if n < 3 then 0 else dsma(src, length3);

def dsma4 = if n < 4 then 0 else dsma(src, length4);

def dsma5 = if n < 5 then 0 else dsma(src, length5);

def dsma6 = if n < 6 then 0 else dsma(src, length6);

def dsma7 = if n < 7 then 0 else dsma(src, length7);

def dsma8 = if n < 8 then 0 else dsma(src, length8);

def dsma9 = if n < 9 then 0 else dsma(src, length9);

def dsma10 = if n < 10 then 0 else dsma(src, length10);

def dsma11 = if n < 11 then 0 else dsma(src, length11);

def dsma12 = if n < 12 then 0 else dsma(src, length12);

def longDsma = if n > 11 then dsma12 else if n > 10 then dsma11 else if n > 9 then dsma10 else

if n > 8 then dsma9 else if n > 7 then dsma8 else if n > 6 then dsma7 else

if n > 5 then dsma6 else if n > 4 then dsma5 else if n > 3 then dsma4 else

if n > 2 then dsma3 else dsma2;

def score1 = if dsma1 > longDsma then val else 0;

def score2 = if n < 3 then 0 else if dsma2 > longDsma then val else 0;

def score3 = if n < 4 then 0 else if dsma3 > longDsma then val else 0;

def score4 = if n < 5 then 0 else if dsma4 > longDsma then val else 0;

def score5 = if n < 6 then 0 else if dsma5 > longDsma then val else 0;

def score6 = if n < 7 then 0 else if dsma6 > longDsma then val else 0;

def score7 = if n < 8 then 0 else if dsma7 > longDsma then val else 0;

def score8 = if n < 9 then 0 else if dsma8 > longDsma then val else 0;

def score9 = if n < 10 then 0 else if dsma9 > longDsma then val else 0;

def score10 = if n < 11 then 0 else if dsma10 > longDsma then val else 0;

def score11 = if n < 12 then 0 else if dsma11 > longDsma then val else 0;

def Avgdsma1 = (dsma1 + dsma2 + dsma3 + dsma4 + dsma5 + dsma6 + dsma7 +

dsma8 + dsma9 + dsma10 + dsma11 + dsma12) / n;

def Avgdsma = Average(Avgdsma1, 1);

def scoreTot = score1 + score2 + score3 + score4 + score5 + score6 +

score7 + score8 + score9 + score10 + score11;

def score = if IsNaN(scoreTot) then 0 else

if scoreTot > 1 then 1 else if scoreTot < 0 then 0 else scoreTot;

def col = score * 255;

#// Detect crossovers for signal generation

def cross_up = (score crosses above 0.3);

def cross_dn = (score crosses below 0.7);

#-- Plots

plot up = if cross_up then Avgdsma else na;

plot dn = if cross_dn then Avgdsma else na;

plot up1 = if cross_up then Avgdsma else na;

plot dn1 = if cross_dn then Avgdsma else na;

plot up2 = if cross_up then Avgdsma else na;

plot dn2 = if cross_dn then Avgdsma else na;

plot dsmaLine = if avgLine and Avgdsma then Avgdsma else na;

dsmaLine.AssignValueColor(CreateColor(255 - col, col, 255));

dsmaLine.SetLineWeight(2);

up.SetDefaultColor(Color.CYAN);

dn.SetDefaultColor(Color.MAGENTA);

up.SetPaintingStrategy(PaintingStrategy.SQUARES);

dn.SetPaintingStrategy(PaintingStrategy.SQUARES);

up1.SetDefaultColor(Color.DARK_GRAY);

dn1.SetDefaultColor(Color.DARK_GRAY);

up1.SetPaintingStrategy(PaintingStrategy.SQUARES);

dn1.SetPaintingStrategy(PaintingStrategy.SQUARES);

up1.SetLineWeight(2);

dn1.SetLineWeight(2);

up2.SetDefaultColor(Color.CYAN);

dn2.SetDefaultColor(Color.MAGENTA);

up2.SetPaintingStrategy(PaintingStrategy.SQUARES);

dn2.SetPaintingStrategy(PaintingStrategy.SQUARES);

up2.SetLineWeight(4);

dn2.SetLineWeight(4);

#-- LAbel

def up_percent = Round(score * 100, 0);

def dn_percent = 100 - up_percent;

AddLabel(showLabel, "Up Percent(" + up_percent + "%)", GlobalColor("up"));

AddLabel(showLabel, "Dn Percent(" + dn_percent + "%)", GlobalColor("dn"));

#-- Bar Color

AssignPriceColor(if !colorBars then Color.CURRENT else CreateColor(255 - col, col, 0));

#-- Cloud

def "12" = if ribbon and dsma12 then dsma12 else na;

def "11" = if ribbon and dsma11 then dsma11 else na;

def "10" = if ribbon and dsma10 then dsma10 else na;

def "9" = if ribbon and dsma9 then dsma9 else na;

def "8" = if ribbon and dsma8 then dsma8 else na;

def "7" = if ribbon and dsma7 then dsma7 else na;

def "6" = if ribbon and dsma6 then dsma6 else na;

def "5" = if ribbon and dsma5 then dsma5 else na;

def "4" = if ribbon and dsma4 then dsma4 else na;

def "3" = if ribbon and dsma3 then dsma3 else na;

def "2" = if ribbon and dsma2 then dsma2 else na;

def "1" = if ribbon and dsma1 then dsma1 else na;

#### Signals

def start = ohlc4;

AddCloud("12", "11", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("11", "10", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("10", "9", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("9", "8", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("8", "7", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("7", "6", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("6", "5", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("5", "4", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("4", "3", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("3", "2", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("2", "1", GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

AddCloud("1", start,GlobalColor("dn"), GlobalColor("up"), showCloudGrid);

#-- end of code