gravityflyer

New member

Hi all,

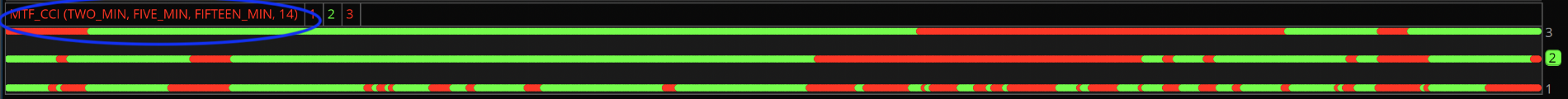

I created a MTF lower indicator for the CCI.

It works exactly as intended, but kindly requesting assistance with two slight modifications to the existing code:

I created a MTF lower indicator for the CCI.

It works exactly as intended, but kindly requesting assistance with two slight modifications to the existing code:

- How can I condense the spacing between each row of dots? Even if I resize the lower window in ToS there still seems to be a limit of how closely I can squish the dots together.

- I'd like the indicator title (circled in blue) to be red if all three lines of dots are red, and green if all three lines of dots are green.

Code:

#MTF_CCI_LowerStudy_Dots

# gravityflyer

# v1.0 - 2021.09.23

declare lower;

input timeFrameOne = AggregationPeriod.TWO_MIN;

input timeFrameTwo = AggregationPeriod.FIVE_MIN;

input timeFrameThree = AggregationPeriod.FIFTEEN_MIN;

input length = 14;

#CCI Two Minutes

def priceTWO_MIN = close(period = timeFrameOne) + low(period = timeFrameOne) + high(period = timeFrameOne);

def linDev2 = lindev(priceTWO_MIN, length);

def CCI_2 = if linDev2 == 0 then 0 else (priceTWO_MIN - Average(priceTWO_MIN, length)) / linDev2 / 0.015;

#CCI Five Minutes

def priceFIVE_MIN = close(period = timeFrameTwo) + low(period = timeFrameTwo) + high(period = timeFrameTwo);

def linDev5 = lindev(priceFIVE_MIN, length);

def CCI_5 = if linDev5 == 0 then 0 else (priceFIVE_MIN - Average(priceFIVE_MIN, length)) / linDev5 / 0.015;

#CCI Fifteen Minutes

def priceFIFTEEN_MIN = close(period = timeFrameThree) + low(period = timeFrameThree) + high(period = timeFrameThree);

def linDev15 = lindev(priceFIFTEEN_MIN, length);

def CCI_15 = if linDev15 == 0 then 0 else (priceFIFTEEN_MIN - Average(priceFIFTEEN_MIN, length)) / linDev15 / 0.015;

#Row 1

plot rowOne = if IsNaN(close) then Double.NaN else 1;

rowOne.SetPaintingStrategy(PaintingStrategy.POINTS);

rowOne.AssignValueColor(if CCI_2 > 0 then Color.GREEN else Color.RED);

rowOne.SetLineWeight(3);

#Row 2

plot rowTwo = if IsNaN(close) then Double.NaN else 2;

rowTwo.SetPaintingStrategy(PaintingStrategy.POINTS);

rowTwo.AssignValueColor(if CCI_5 > 0 then Color.GREEN else Color.RED);

rowTwo.SetLineWeight(3);

#Row 3

plot rowThree = if IsNaN(close) then Double.NaN else 3;

rowThree.SetPaintingStrategy(PaintingStrategy.POINTS);

rowThree.AssignValueColor(if CCI_15 > 0 then Color.GREEN else Color.RED);

rowThree.SetLineWeight(3);