Author Message:

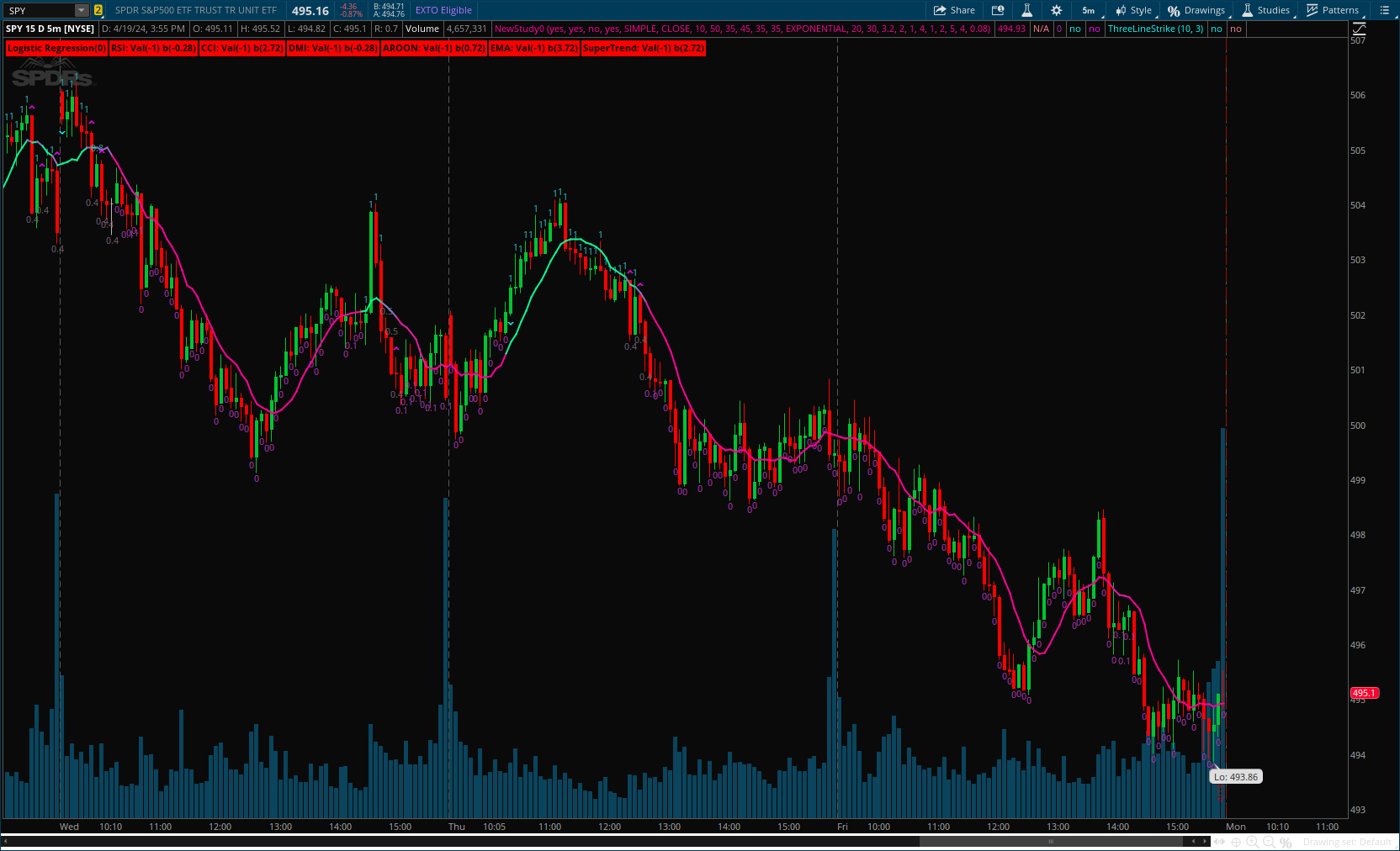

The Logistic Regression Indicator for TradingView is a versatile tool that employs multiple logistic regression based on various technical indicators to generate potential buy and sell signals. By utilizing key indicators such as RSI, CCI, DMI, Aroon, EMA, and SuperTrend, the indicator aims to provide a systematic approach to decision-making in financial markets.

Read More: https://www.tradingview.com/v/YHuROcQY/

CODE:

CSS:

# https://www.tradingview.com/v/YHuROcQY/

#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © VanHe1sing

# Machine Learning: Multiple Logistic Regression

# indicator('Multiple Logistic Regression', overlay=true, max_labels_count = 500)

# Converted by Sam4Cok@Samer800 - 04/2024

input colorBars = yes;

input onBarRegValue = yes;

input showLabels = yes;

input showSignals = no;

input useMovAvgFilter = yes;

input movAvgType = AverageType.SIMPLE;

input src = close;

input movAvgLength = 10;

input zScoreLength = 50; #, "Z score Length",

input rsi_length = 35; #, "RSI", group = group_x)

input cci_length = 45; #, "CCI", group = group_x)

input dmi_length = 35; #, "DMI", group = group_x)

input aroon_length = 35; #, "AROON", group = group_x)

input indicatorMovAvgType = AverageType.EXPONENTIAL;

input fastMovAvgLength = 20; #, "EMA", group = group_x)

input slowMovAvgLength = 30; #, "EMA", group = group_x)

input supertrendFactor = 3.2; #, "factor (SuperTrend)", step = 0.1, group = "SuperTrend")

input supertrendAtrPeriod = 2; #, "atrPeriod (SuperTrend)", step = 1, group = "SuperTrend")

input rsiWeight = 1; #, "?1 (rsi)", step = 1, minval = 1, group = group_b)

input cciWeight = 4; #, "?2 (cci)", step = 1, minval = 1, group = group_b)

input dmiWeight = 1; #, "?3 (dmi)", step = 1, minval = 1, group = group_b)

input aroonWeight = 2; #, "?4 (aroon)", step = 1, minval = 1, group = group_b)

input movAvgWeight = 5; #, "?5 (ema)", step = 1, minval = 1, group = group_b)

input supertrendWeight = 4; #, "?6 (SuperTrend)", step = 1, minval = 1, group = group_b)

input StepOfLearing = 0.08; #, 'Step of learing',

def na = Double.NaN;

DefineGlobalColor("up", CreateColor(0, 137, 123));

DefineGlobalColor("dn", CreateColor(255, 82, 82));

#pine_supertrend(src, factor, atrPeriod) =>

script supertrend {

input factor = 3;

input atrPeriod = 10;

def src = hl2;

def nATR = ATR(Length = atrPeriod);

def lowerBand;

def upperBand;

def upBand = src + factor * nATR;

def loBand = src - factor * nATR;

def prevLowerBand = if lowerBand[1] then lowerBand[1] else loBand;

def prevUpperBand = if upperBand[1] then upperBand[1] else upBand;

lowerBand = if (loBand > prevLowerBand) or (close[1] < prevLowerBand) then loBand else prevLowerBand;

upperBand = if (upBand < prevUpperBand) or (close[1] > prevUpperBand) then upBand else prevUpperBand;

def direction ;# = na

def superTrend;# = na

def prevSuperTrend = if superTrend[1] then superTrend[1] else prevUpperBand;

if (IsNaN(prevUpperBand) or IsNaN(prevLowerBand)) {

direction = 1;

} else

if prevSuperTrend == prevUpperBand {

direction = if close > upperBand then -1 else 1;

} else {

direction = if close < lowerBand then 1 else -1;

}

superTrend = if direction == -1 then lowerBand else upperBand;

plot dir = direction ;

}

#// Z score Function for normalization of data

script z_score {

input src = close;

input Length = 50;

def std = StDev(src, Length);

def basis = Average(src, Length);

def zscore = (src - basis) / std;

plot out = zscore;

}

#// Multiple Logic Regression

script logistic {

input x1 = 0;

input x2 = 0;

input x3 = 0;

input x4 = 0;

input x5 = 0;

input x6 = 0;

input b1 = 0;

input b2 = 0;

input b3 = 0;

input b4 = 0;

input b5 = 0;

input b6 = 0;

def logistic = 1 / (1 + Exp(-(1 + b1 * x1 + b2 * x2 + b3 * x3 + b4 * x4 + b5 * x5 + b6 * x6)));

plot out = logistic;

}

#// Error Function (cross-entropy loss)

script loss {

input y = 1;

input p = 1;

def loss = -y * Log(p) - (1 - y) * Log(1 - p);

plot out = loss;

}

#// DATA VARIABLES

#// Variables

def rsi_value = RSI(Price = src, Length = rsi_length);

def cci_value = CCI(Length = cci_length);

def plus = DMI(Length = dmi_length)."DI+";

def minus = DMI(Length = dmi_length)."DI-";

def upper = AroonIndicator(Length = aroon_length).up;

def lower = AroonIndicator(Length = aroon_length).down;

def ema1 = MovingAverage(indicatorMovAvgType, src, fastMovAvgLength);

def ema2 = MovingAverage(indicatorMovAvgType, src, slowMovAvgLength);

def direction = supertrend(supertrendFactor, supertrendAtrPeriod);

#// Normalized close (dependent variable)

def y = if z_score(src, ZScoreLength) > 0 then 1 else -1;

#// normalized RSI

def x1 = if rsi_value > 50 then 1 else -1;

#// normalized CCI

def x2 = if (cci_value Crosses Above 100) then 1 else

if (cci_value Crosses Below -100) then -1 else x2[1];

#// normalized DMI

def x3 = if plus > minus then 1 else -1;

#// normalized Aroon

def x4 = if upper > lower then 1 else -1;

#// normalized ema

def x5 = if ema1 > ema2 then 1 else -1;

#// normalized SuperTrend

def x6 = direction * -1;

#/ MULTIPLE LOGISTIC REGRESSION

#// Pre Multiple Logic Regression

def p = logistic(x1, x2, x3, x4, x5, x6, rsiWeight, cciWeight, dmiWeight, aroonWeight, movAvgWeight, supertrendWeight);

#// Loss

def loss = loss(y, p);

#// Adjusting model weights using gradient descent

def b11 = rsiWeight - StepOfLearing * (p + loss) * x1;

def b22 = cciWeight - StepOfLearing * (p + loss) * x2;

def b33 = dmiWeight - StepOfLearing * (p + loss) * x3;

def b44 = aroonWeight - StepOfLearing * (p + loss) * x4;

def b55 = movAvgWeight - StepOfLearing * (p + loss) * x5;

def b66 = supertrendWeight - StepOfLearing * (p + loss) * x6;

#// Multiple Logic Regression With adjusted weights based on loss function

def l_reg = logistic(x1, x2, x3, x4, x5, x6, b11, b22, b33, b44, b55, b66);

#-- Reg Line

def trendLine = MovingAverage(movAvgType, src, movAvgLength);

def RegCol = if src > trendLine and trendLine > trendLine[1] then 1 else

if src < trendLine and trendLine < trendLine[1] then -1 else 0;

def midReg = l_reg - 0.5;

def col = if l_reg > 1 then 100 else if l_reg < 0 then 0 else AbsValue(midReg) * 100;

def col1 = if l_reg > 1 then 100 else if l_reg < 0 then 0 else l_reg * 100;

def ncol = 100 - col;

def eCol = col * 2.54 + nCol;

plot movAvgLine = trendLine;

movAvgLine.SetLineWeight(2);

movAvgLine.AssignValueColor(CreateColor(255- col1*2.5, col1*2.5, 100 + ncol));

# label

def RoundReg = Round(l_reg, 1);

plot labUp = if onBarRegValue and l_reg > 0.5 then RoundReg else na;

plot labDn = if !onBarRegValue or l_reg > 0.5 then na else RoundReg;

labUp.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

labDn.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

labUp.AssignValueColor(CreateColor(nCol, ecol, ecol));

labDn.AssignValueColor(CreateColor(eCol, ncol, ecol));

#--bar color.

AssignPriceColor(if !colorBars then Color.CURRENT else CreateColor(255- col1*2.5, col1*2.5, 100 + ncol));

#// Signals

def regUp = if useMovAvgFilter then RegCol>0 else yes;

def regDn = if useMovAvgFilter then RegCol<0 else yes;

def sigUp = (l_reg crosses above 0.5) and regUp;

def sigDn = (l_reg crosses below 0.5) and regDn;

plot chHi = sigUp and !sigUp[1];

plot chLo = sigDn and !sigDn[1];

chHi.SetDefaultColor(Color.CYAN);

chLo.SetDefaultColor(Color.MAGENTA);

chHi.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

chLo.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_UP);

AddChartBubble(showSignals and chHi[1] and RoundReg == 1, low, "B", Color.GREEN, no);

AddChartBubble(showSignals and chLo[1] and RoundReg == 0, high, "S", Color.RED);

AddLabel(showLabels,"Logistic Regression(" + RoundReg + ")", if l_reg > 0.5 then Color.GREEN else Color.RED);

#AddLabel(showLabels,"Learning Step(" + Round(StepOfLearing, 2) + ")", Color.GRAY);

AddLabel(showLabels,"RSI: Val(" + Round(x1, 0) + ") " + "b(" + Round(b11, 2) + ")", if x1 > 0 then Color.GREEN else Color.RED);

AddLabel(showLabels,"CCI: Val(" + Round(x2, 0) + ") " + "b(" + Round(b22, 2) + ")", if x2 > 0 then Color.GREEN else Color.RED);

AddLabel(showLabels,"DMI: Val(" + Round(x3, 0) + ") " + "b(" + Round(b33, 2) + ")", if x3 > 0 then Color.GREEN else Color.RED);

AddLabel(showLabels,"AROON: Val(" + Round(x4, 0) + ") " + "b(" + Round(b44, 2) + ")", if x4 > 0 then Color.GREEN else Color.RED);

AddLabel(showLabels,"EMA: Val(" + Round(x5, 0) + ") " + "b(" + Round(b55, 2) + ")", if x5 > 0 then Color.GREEN else Color.RED);

AddLabel(showLabels,"SuperTrend: Val(" + Round(x6, 0) + ") " + "b(" + Round(b66, 2) + ")",if x6 > 0 then Color.GREEN else Color.RED);

#-- END of CODE

Last edited: