Author Message:

Introduction

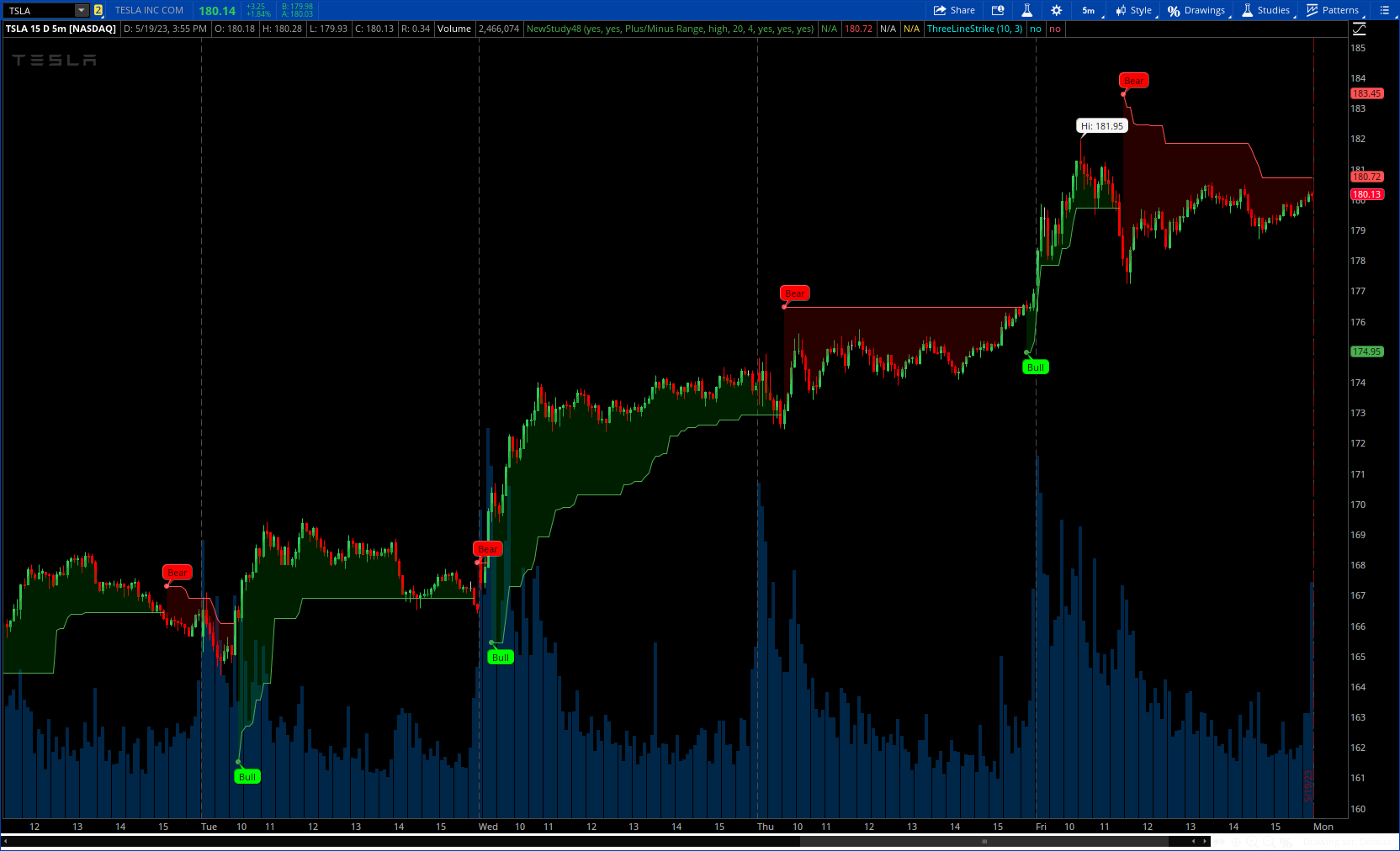

Supertrend is a popular technical indicator used by traders to identify potential trend reversals and determine entry and exit points in financial markets. It is a trend-following indicator that combines price and volatility to generate its signals. Generally supertrend is calculated based on ATR and multiplier value which is used for calculation of stops. In these adaptions, we look to provide few variations to classical methods.

more information may found here:

https://www.tradingview.com/v/vHpsE0Ft/

CODE:

CSS:

#// This work is licensed under Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

#// © Trendoscope Pty Ltd

#indicator("Master Supertrend [Trendoscope]", "MST [Trendoscope]", overlay = true)

# converted and mod by Sam4Cok@Samer800 - 05/2023 - Not Typical Conv

input ShowTrendLine = yes;

input ShowSignals = yes;

input supertrendType = {default "Plus/Minus Range", "Ladder TR", "True Range", "Standard Deviation"};

input rangeType = {sma, ema, hma, rma, wma, default "high", median, medianHigh, medianLow}; #'Applied Calculation'

input length = 20; # 'Supertrend range calculation length'

input multiplier = 4; # 'Supertrend range multiplier'

input useClosePrices = yes; # 'Use Close Price'

input waitForClose = yes; # 'Wait for Close'

input useDiminishingRange = yes; # 'Diminishing Stop Distance'

def na = Double.NaN;

def bodyMiddle = OHLC4;

DefineGlobalColor("up", CreateColor(76,175,80));

DefineGlobalColor("dn", CreateColor(255,82,82));

script ma {

input src = close;

input matype = "EMA";

input length = 20;

def ma1;

# if array.size(source) >= length

def sliced = Average(src, length);

def ma = if matype == "sma" then sliced else

if matype == "ema" then ExpAverage(src, length) else

if matype == "rma" then WildersAverage(src, length) else

if matype == "wma" then WMA(src, length) else

if matype == "hma" then HullMovingAvg(src, length) else

if matype == "high" then Highest(src, length) else

if matype == "low" then Lowest(src, length) else

if matype == "median" then Median(src, length) else

if matype == "medianHigh" then Median(src, length) else

if matype == "medianLow" then Median(src, length) else

Double.NaN;

if (matype == "medianHigh") {

ma1 = Highest(ma, length);

} else

if (matype == "medianLow") {

ma1 = Lowest(ma, length);

} else {

ma1 = ma;

}

plot out = ma1;

}

#def bar = AbsValue(CompoundValue(1, BarNumber(), 0));

def tr = TrueRange(high, close, low);

def trUp = fold i = 0 to length * 3 with p do

if (open[i] < close[i]) then Max(trUp[1], tr) else trUp[1];

def trDn = fold j = 0 to length * 3 with q do

if (open[j] >= close[j]) then Max(trDn[1], tr) else trDn[1];

def upTr = fold i1 = 0 to length * 3 with p1 do

if trUp[i1] < length then tr[i1] else upTr[1];

def dnTr = fold j1 = 0 to length * 3 with q1 do

if trDn[j1] < length then tr[j1] else dnTr[1];

def plusLadderAtr = upTr;

def minusLadderAtr = dnTr;

def ladderPositiveAtr = ma(plusLadderAtr, rangeType, length);

def ladderNegativeAtr = ma(minusLadderAtr, rangeType, length);

def range = supertrendType == supertrendType."Plus/Minus Range";

def ladder = supertrendType == supertrendType."Ladder TR";

def True = supertrendType == supertrendType."True Range";

def plusRange = if range then Max(high - open, high - close[1]) else

if ladder then ladderPositiveAtr else

if True then tr else StDev(close, length);

def minusRange = if range then Max(open - low, close[1] - low) else

if ladder then ladderNegativeAtr else

if True then tr else StDev(close, length);

def appliedPlusRange = if ladder then plusRange else ma(plusRange, rangeType, length);

def appliedMinusRange = if ladder then minusRange else ma(minusRange, rangeType, length);

def direction;

def derivedPlusRange;def derivedMinusRange; def buyStop; def sellStop;

def currentDerivedPlusRange = appliedPlusRange * multiplier;

def currentDerivedMinusRange = appliedMinusRange * multiplier;

def Plus = if derivedPlusRange[1]==0 then currentDerivedPlusRange else derivedPlusRange[1];

def Minus = if derivedMinusRange[1]==0 then currentDerivedMinusRange else derivedMinusRange[1];

derivedPlusRange = if direction[1] < 0 and useDiminishingRange then

Min(Plus, currentDerivedPlusRange) else currentDerivedPlusRange;

derivedMinusRange = if direction[1] > 0 and useDiminishingRange then

Min(Minus, currentDerivedMinusRange) else currentDerivedMinusRange;

def buyStopCurrent = (if useClosePrices then close else low) - derivedMinusRange;

def sellStopCurrent = (if useClosePrices then close else high) + derivedPlusRange;

def buy = if buyStop[1]==0 then buyStopCurrent else buyStop[1];

def sell = if sellStop[1]==0 then sellStopCurrent else sellStop[1];

buyStop = if direction[1] > 0 then Max(buy, buyStopCurrent) else buyStopCurrent;

sellStop = if direction[1] < 0 then Min(sell, sellStopCurrent) else sellStopCurrent;

direction = if direction[1] > 0 and (if waitForClose then close else low) < buyStop then -1 else

if direction[1] < 0 and (if waitForClose then close else high) > sellStop then 1 else

if direction[1] == 0 then 1 else direction[1];

def supertrend = if direction[1] > 0 then buyStop else sellStop;

plot upTrend = if !ShowTrendLine then na else if direction[1]>0 then supertrend else na;#, 'Supertrend'

upTrend.SetDefaultColor(GlobalColor("up"));

plot downTrend = if !ShowTrendLine then na else if direction[1]<0 then supertrend else na;#, 'Supertrend'

downTrend.SetDefaultColor(GlobalColor("dn"));

#ST.AssignValueColor(if direction[1]>0 then Color.GREEN else Color.RED);

#-- Singal

def crossUp = ShowSignals and crosses(direction[1], 0, CrossingDirection.ABOVE);

def CrossDn = ShowSignals and crosses(direction[1], 0, CrossingDirection.BELOW);

AddChartBubble(crossUp, if ShowTrendLine then supertrend else low, "Bull", Color.GREEN, no);# 'Supertrend Bullish Breakout')

AddChartBubble(CrossDn, if ShowTrendLine then supertrend else high, "Bear", Color.RED, yes);#'Supertrend Bearish Breakout')

def LongTrigger = direction!=direction[1] and direction[1]<0;

def ShortTrigger = direction!=direction[1] and direction[1]>0;

plot LongDot = if ShowTrendLine and LongTrigger[1] then upTrend else na;

LongDot.SetPaintingStrategy(PaintingStrategy.POINTS);

LongDot.AssignValueColor(GlobalColor("up"));

LongDot.SetLineWeight(3);

plot ShortDot = if ShowTrendLine and ShortTrigger[1] then downTrend else na;

ShortDot.SetPaintingStrategy(PaintingStrategy.POINTS);

ShortDot.AssignValueColor(GlobalColor("dn"));

ShortDot.SetLineWeight(3);

AddCloud(bodyMiddle, upTrend, Color.DARK_GREEN);

AddCloud(downTrend, bodyMiddle, Color.DARK_RED);

#---