You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

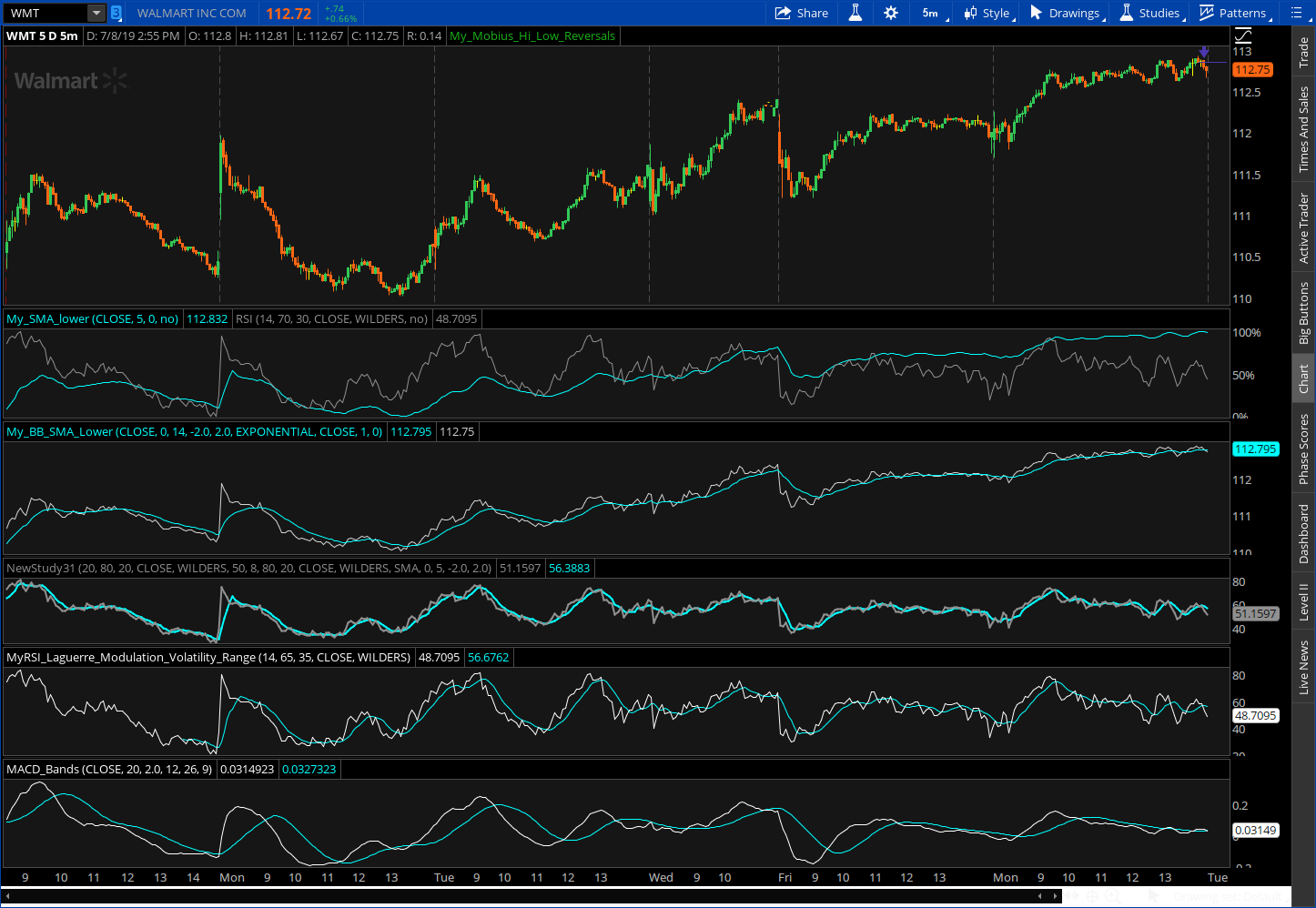

Hello Horserider,Just as a heads up to people that may be using this version of Market Mover. ToS will not correctly display the RSI and SMA in the same study or same chart window if you have added separate RSI and SMA studies as described. If you place them together it will plot but if you go back to beginning of your chart time interval and scroll forward you will see the SMA shift in position relative to RSI. Looks like this can be solved by zooming in to a short part of your chart. The question is how much to zoom. Also now to see the whole chart as it relates to your zoomed area is not possible.

Since ToS presents this scaling problem I am proposing several alternatives to the Market Mover that avoid the scaling difficulty.

The difference in one alternative is the cross is now calculated from only RSI data. It becomes a cross of RSI and RSI average.

The 5 day 5 minute chart Signal is RSI (white) crosses SMA(cyan). The top study is Market Mover. You can see does not work well when not zoomed.

The second study is simply the Bollinger Band midline(cyan) and a SMA of 1(white)

The third and fourth are RSI and SMA of RSI.

The fourth is MACD and SMA of MACD.

Results of all but Market Mover are very similar.

In the above chart the 5th study labeled MACD_Bands, where can this be found? Thank you.

I had some spare time so decided to make more what you wanted. MACD with MACD average line and also included a BB midline which will act as a moving average plot of price. You can uncheck whichever line you do not want in study settings. Also can play wih lengths and average types if you choose.

# MACD colored and MACD Average and Bollinger Bands Midline

# MACD average used as cross of MACD

# Bollinger Bands Midline acting as a MovingAverage average of price cross signal for MACD

# Use both of choose one by unchecking a plot in study settings.

# Horserider by request from Rojo Grande 1/5/2020

declare lower;

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input AverageTypeMACD = {SMA, default EMA, HMA, Wilders};

input price = close;

input displace = 0;

def MACD_Data = MACD(fastLength = fastLength, slowLength = slowLength, MACDLength = MACDLength);

plot MACD_Line = MACD_Data;

MACD_Line.DefineColor("Up", Color.GREEN);

MACD_Line.DefineColor("Down", Color.RED);

MACD_Line.DefineColor("Even", Color.WHITE);

MACD_Line.AssignValueColor(if MACD_Line > MACD_Line[1] then MACD_Line.Color("Up") else (if MACD_Line == MACD_Line[1] then MACD_Line.Color("Even") else MACD_Line.Color("Down")));

MACD_Line.SetLineWeight(3);

def Value;

plot Avg;

switch (AverageTypeMACD) {

case SMA:

Value = Average(price, fastLength) - Average(price, slowLength);

Avg = Average(Value, MACDLength);

case EMA:

Value = ExpAverage(price, fastLength) - ExpAverage(price, slowLength);

Avg = ExpAverage(Value, MACDLength);

case HMA:

Value = WMA(2 * WMA(price, fastlength / 2) - WMA( price, slowlength), sqrt(slowlength));

Avg = ExpAverage(Value, MACDLength);

case Wilders:

Value = WildersAverage(price, fastLength) - WildersAverage(price, slowLength);

Avg = ExpAverage(Value, MACDLength);

}

Avg.SetDefaultColor(Color.CYAN);

#plot BB;

input AverageTypeBB = {default SMA, EMA, HMA};

input displaceBB = 0;

input lengthBB = 5;

def midline;

switch (AverageTypeBB) {

case SMA:

midline = reference BollingerBands(MACD_Line, displaceBB, lengthBB ).Midline;

case EMA:

midline = reference BollingerBands(MACD_Line, displaceBB, lengthBB, averageType = AverageType.EXPONENTIAL).Midline;

case HMA:

midline = reference BollingerBands(MACD_Line, displaceBB, lengthBB, averageType = AverageType.HULL).Midline;

}

plot midline1 = midline;

midline1.SetDefaultColor(Color.WHITE);

midline1.SetLineWeight(1);Thank you BenTen. I am new to scripting. I am learning the script coding and will be soon able to contribute.@kaflesu You can find the oscillator using this link https://usethinkscript.com/threads/moving-average-crossover-rsi-indicator-for-thinkorswim.185/

I have one question for you. Whenever I hear backtesting, does that mean manually checking and verifying or is there a automation way ?

Thanks

- Status

- Not open for further replies.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/