billionmetrics

New member

Thanks @METAL. I believe those are for Windows. I use a mac machine and wanted to see the hot keys. Thanks again.He has a video link in this thread that shows you how to use it.

Thanks @METAL. I believe those are for Windows. I use a mac machine and wanted to see the hot keys. Thanks again.He has a video link in this thread that shows you how to use it.

I may be wrong, but I think I saw where someone was using Macro Recorder on Mac.Thanks @METAL. I believe those are for Windows. I use a mac machine and wanted to see the hot keys. Thanks again.

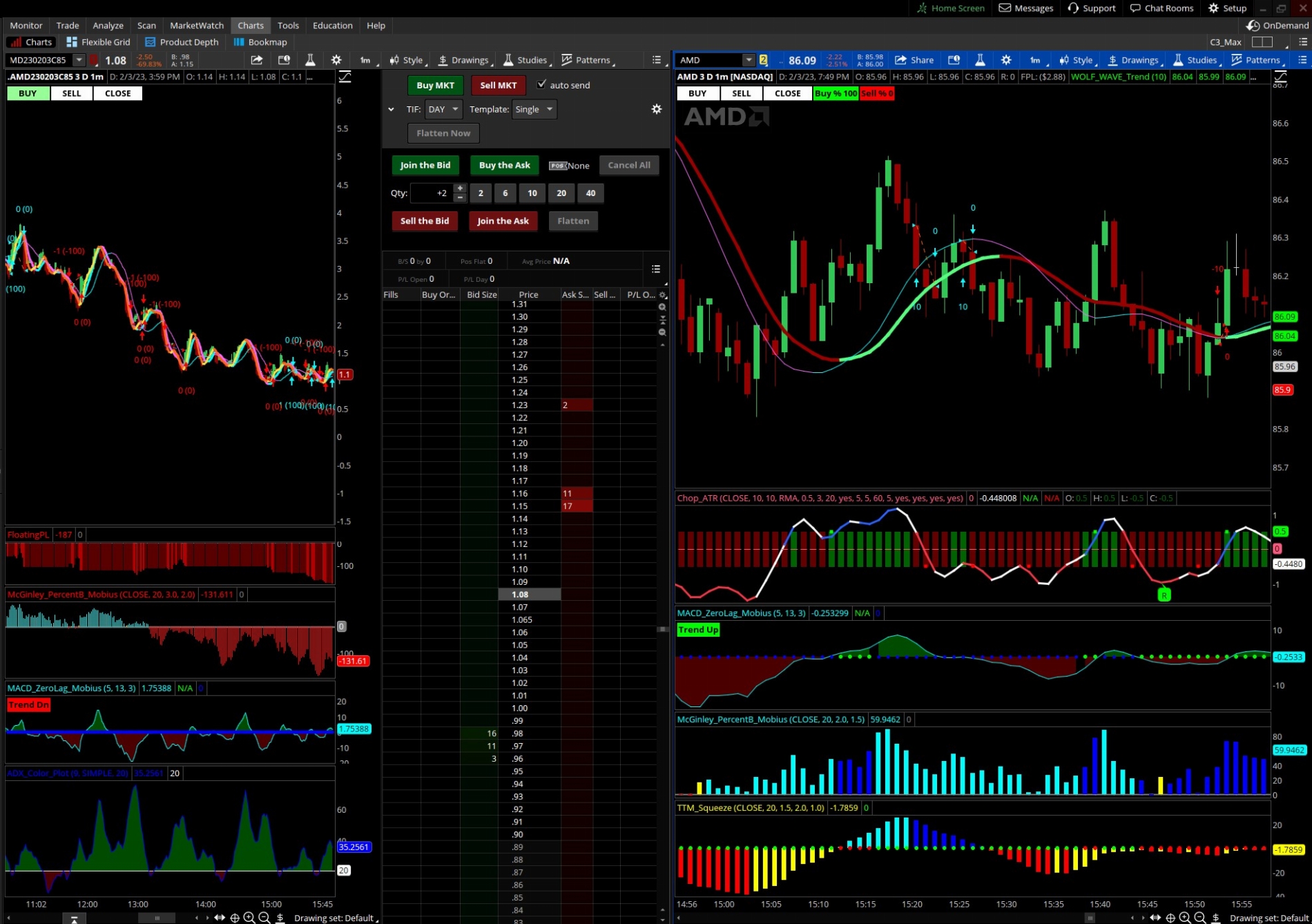

Check you Y and X axis point on MR. That's what it uses to spot the pixel color. Likely an issue with that. You will need to customize those axis trigger points every time you move the charts around. Also, give the pixel color like 20 to 30% tolerance. (you'll see a setting there for that)I have a question about MR that you may know the answer to. Since I primarily trade options, I really need the trigger to come from the chart with the stock on it as the options chain does not work properly with Strategies. When I first tested MR, I could not get it to trigger the hot key for AT and I think that was because I had the labels on my stock chart and not the options chain chart that is connected to AT. when I moved the strategy to the chart connected to AT, the hokeys worked with MR. It doesn't make since though. As I do not see how TOS and determine what is triggering the hotkey. Hopefully, this makes since. Here is an example:

I would like to use the labels on the right to trigger the hotkeys to buy,sell, and close.

That isn't it. My y and x axis is good. It actually triggers in MR but not in TOS. The hotkey does not work unless I am using the label on the same chart that is connected to AT. weird. Doesn't make sense at all. Like I said b4, TOS shouldn't care what triggers the hotkey function. I have tried a few times and cannot get it to work. I believe I saw a video where someone else used it the way i want to with no issues. Maybe someone will know what the issue is.Check you Y and X axis point on MR. That's what it uses to spot the pixel color. Likely an issue with that. You will need to customize those axis trigger points every time you move the charts around. Also, give the pixel color like 20 to 30% tolerance. (you'll see a setting there for that)

That should help.

The only other thing I can think of is placing a mouse click on that part of the option chain screen before going to your BUY or SELL sequence. So TOS knows which panel its working with before firing the HotKeys.That isn't it. My y and x axis is good. It actually triggers in MR but not in TOS. The hotkey does not work unless I am using the label on the same chart that is connected to AT. weird. Doesn't make sense at all. Like I said b4, TOS shouldn't care what triggers the hotkey function. I have tried a few times and cannot get it to work. I believe I saw a video where someone else used it the way i want to with no issues. Maybe someone will know what the issue is.

I did think of that. I have not tried it yet. I had my mouse click at top of TOS like @dap711 showed in his video. I will give it a try.The only other thing I can think of is placing a mouse click on that part of the option chain screen before going to your BUY or SELL sequence. So TOS knows which panel its working with before firing the HotKeys.

Thanks @eugnis. Just started playing around. Is it possible for you to share the MRF file? I downloaded one from but thats for windows and learning from it.@billionmetrics - i use it on a Mac. Once you get passed the admin set up portion (follow the MR website) works perfectly fine. I am actually trying to tune it to do multiple stocks at once now.

@METAL @dap711 - have you gents had any luck setting MR logic to run charts at once ? Assuming both are on the same timeframe ?

How does it deal with stop for profit/loss?@eugnis , thanks for sharing this. Sorry I took extra time to come back. This is working in MAC now and have used it today. Need to test a lot with the timing and settings, but a good start. Thanks for your help.

@eugnis , thanks for sharing this. Sorry I took extra time to come back. This is working in MAC now and have used it today. Need to test a lot with the timing and settings, but a good start. Thanks for your help.

Ugh Dwain!!! I feel for ya, Dealing with L4 L5 S1 stenosis and disk degeneration w/ pinched nerves as well..... at least I dont think of it much when Im focused on building my solutions. I would love to see your code w/ python, I have my own Gamma Exposure live calculations graphed in a web browser attached to option chains in SCHWAB API to see Option dealer hedge levels. My next step is to see if I can get auto trade for my best strategy to run as you seem to have on the way. Any code and support files you could share would be awesome! Good luck in your journey.Guess who's back?

Had a long fight with 3 ruptured disks in my back that were pinching my sciatic nerve and after 3 surgeries and a few years (yes years) in bed, I'm fighting my way back. But the good news? I didn't let my brain just sit there! LOL I've been working on a way to automate options trading! AND IT'S WORKING!

Here is the juicy stuff and the things you need (are you listening Metal? I know you are telling me to hurry up with the details! LOL)

Intro: I've given up trying to catch ever little up and down in the very noisy lower timeframes. It was driving me absolutely crazy trying to code for ever possible outcome and have moved to trading swing style on inter-day. It'll make better sense once we get to the part of how to select the stocks to trade. Just remember this is a living breathing development and I will most likely change things on daily bases. Just today, I added the "green-day shut down" feature (allows me to automatically shut down the system after reaching a percentage gain for the day). Mine is set to 10% and I normally hit it within 30 minutes of trading.

What you will need:

1. Two scans. One for Buys and one for Sells. (These are the stocks that will take a call or put option.)

2. Python (I'm using version 3.12) with PyCharm IDE.

3. Access to the Market and Account Schwab API.

This doesn't sound like much, but it will take you a few days just to get that setup.

Here is how it works .. I add the scans to two watchlists. One watchlist with My_Buy scan and the other with My_Sell scan. Both of these watchlists are detached and running in their own window. I then have my Python code looks for those 2 windows and then OCR's the list and trades the option for each ticker in the list. I have code that pulls the first option list X number of days out from the API and then finds the first OTM option. It takes the Ask + Bid / 2 = my bid and sends the order to the API with my modified bid. When the symbol drops off the list, the system closes the option trade. I'm looking for few brave souls to help me improve the system.

Here is what the system did today:

The scans in a watchlist:

View attachment 25802

The Python output:

[ledger] initialized new file at C:\Python projects\TOS_Bridge\trades_ledger.csv

[ledger] wrote OPEN RGTI RGTI 250926C00030000 x1 @1.5900 preview=Y -> C:\Python projects\TOS_Bridge\trades_ledger.csv

[2025-09-23 08:37:04] SIGNAL BUY SOUN

2025-09-23 08:37:04,332 INFO ORDER_INTENT: OPEN RGTI CALL 2025-09-26 30.0 x1 @ 1.59 (base_mid=1.59) [place=False preview=True]

2025-09-23 08:37:04,865 INFO ORDER_INTENT: OPEN SOUN CALL 2025-09-26 18.0 x1 @ 0.65 (base_mid=0.65) [place=False preview=True]

[ledger] wrote OPEN SOUN SOUN 250926C00018000 x1 @0.6500 preview=Y -> C:\Python projects\TOS_Bridge\trades_ledger.csv

[2025-09-23 08:37:06] UNREALIZED P/L (ledger-open 2 pos): -$5.30

Currently I do not allow the system to actually send the order to the API, as I want to continue testing until I feel VERY comfortable with how it trades. Anyways, I have been manually trading the tickers and have been increasing my account on average 10% per day.

Here is the EOD P/L report :

C:\Programs\Python\Python312\python.exe "C:\Python projects\TOS_Bridge\daily_pl_report.py"

Ledger: C:\Python projects\TOS_Bridge\trades_ledger.csv

2025-09-23 to 2025-09-23

------------------------------------------------------------

Net P/L: $250.80 Trades: 28 Wins: 13 Losses: 15 Avg/Trade: $8.96

By contract:

AMZN 250926P00220000 trades=1 pl=$ 12.35

AMZN 250926P00222500 trades=1 pl=$ 187.35

CDE 251017C00020000 trades=2 pl=$ -13.30

CLSK 250926C00015500 trades=1 pl=$ -43.65

CSX 250926C00020000 trades=1 pl=$ 4.35

HOOD 250926C00127000 trades=2 pl=$ -71.30

INTC 250926C00030000 trades=2 pl=$ -51.30

IONQ 250926C00075000 trades=1 pl=$ 36.35

JOBY 250926C00016500 trades=1 pl=$ 19.35

KGC 250926C00025000 trades=1 pl=$ -13.65

MRVL 250926C00076000 trades=2 pl=$ -101.30

NBIS 250926C00110000 trades=1 pl=$ -95.65

QBTS 250926C00027000 trades=1 pl=$ 46.35

RGTI 250926C00030000 trades=1 pl=$ 128.35

RIVN 250926C00015500 trades=1 pl=$ 4.35

RIVN 250926C00016000 trades=1 pl=$ -2.65

RKLB 250926C00051000 trades=1 pl=$ 145.35

SOUN 250926C00018000 trades=1 pl=$ 16.35

T 250926P00028500 trades=2 pl=$ -15.30

TOST 250926P00037500 trades=2 pl=$ 3.70

TOST 250926P00038000 trades=2 pl=$ 54.70

As you can see the win rate isn't all that great but my account grew 14% today. Small stuff, but it's only a matter of time now.

Let me know if you are interested in improving the system and I will share my watchlist scans and Python code.

Dwain

Dealing with L4 L5 S1 stenosis and disk degeneration w/ pinched nerves as well.....

Ugh Dwain!!! I feel for ya, Dealing with L4 L5 S1 stenosis and disk degeneration w/ pinched nerves as well..... at least I dont think of it much when Im focused on building my solutions. I would love to see your code w/ python, I have my own Gamma Exposure live calculations graphed in a web browser attached to option chains in SCHWAB API to see Option dealer hedge levels. My next step is to see if I can get auto trade for my best strategy to run as you seem to have on the way. Any code and support files you could share would be awesome! Good luck in your journey.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Need Screen Recorder For Streaming | Playground | 4 | |

| J | How do I delete old questions? | Playground | 3 |

Start a new thread and receive assistance from our community.

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.