netarchitech

Well-known member

@HighBredCloud GOT IT!

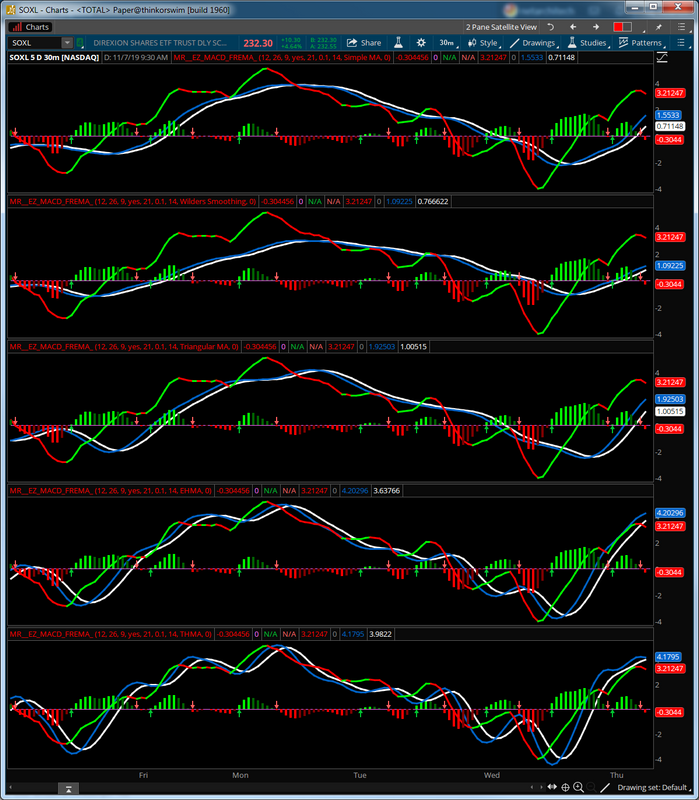

MACD/FREMA now has the ability to harness 12 different Moving Averages! Below is a sample of 5 for your review:

And the code is below:

Looking forward to your thoughts, feedback and analysis when you have a chance

MACD/FREMA now has the ability to harness 12 different Moving Averages! Below is a sample of 5 for your review:

And the code is below:

Code:

# filename: MR__EZ_MACD_FREMA_

# source: https://usethinkscript.com/threads/blast-off-indicator-for-thinkorswim.621/post-7785

# MACD with a more Normal Distribution

# Mobius

# V01.09.2015

#Hint: Plots a Gaussian distribution. If Normal Distribution is met, then at minimum, 68.2% of the close values should be inside a One Standard Deviation Envelope and 95.4% of the close values should be inside a 2 Standard Deviation Envelope.

# V11.01.2019 - netarchitech added standard TOS Breakout Signals per HighBredCloud request

# V11.01.2019 - netarchitech added Ehlers and Mobius Forward/Reverse EMA per HighBredCloud request

# V11.07.2019 - netarchitech added multiple Moving Average selection per HighBredCloud request

declare lower;

input fastLength = 12;

input slowLength = 26;

input MACDLength = 9;

input showBreakoutSignals = yes;

input ma_length = 21; #Length(180-200 for floating S/R , 55 for swing entry)

# Four Pole Filter

script g {

input length = 4;

input betaDev = 2;

input price = OHLC4;

def c;

def w;

def beta;

def alpha;

def G;

c = price;

w = (2 * Double.Pi / length);

beta = (1 - Cos(w)) / (Power(1.414, 2.0 / betaDev) - 1 );

alpha = (-beta + Sqrt(beta * beta + 2 * beta));

G = Power(alpha, 4) * c +

4 * (1 – alpha) * G[1] – 6 * Power( 1 - alpha, 2 ) * G[2] +

4 * Power( 1 - alpha, 3 ) * G[3] - Power( 1 - alpha, 4 ) * G[4];

plot Line = G;

}

# Modified MACD

plot MACD_Value = g(length = fastLength) - g(length = slowLength);

MACD_Value.Hide();

plot MACD_Avg = g(price = MACD_Value, length = MACDLength);

MACD_Avg.Hide();

plot Diff = MACD_Value - MACD_Avg;

plot ZeroLine = 0;

MACD_Value.SetDefaultColor(GetColor(1));

MACD_Avg.SetDefaultColor(GetColor(8));

Diff.SetDefaultColor(GetColor(5));

Diff.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Diff.SetLineWeight(3);

Diff.DefineColor("Positive and Up", Color.GREEN);

Diff.DefineColor("Positive and Down", Color.DARK_GREEN);

Diff.DefineColor("Negative and Down", Color.RED);

Diff.DefineColor("Negative and Up", Color.DARK_RED);

Diff.AssignValueColor(if Diff >= 0 then if Diff > Diff[1] then Diff.Color("Positive and Up") else Diff.Color("Positive and Down") else if Diff < Diff[1] then Diff.Color("Negative and Down") else Diff.Color("Negative and Up"));

ZeroLine.SetDefaultColor(GetColor(0));

plot UpSignal = if Diff crosses above ZeroLine then ZeroLine else Double.NaN;

plot DownSignal = if Diff crosses below ZeroLine then ZeroLine else Double.NaN;

UpSignal.SetHiding(!showBreakoutSignals);

DownSignal.SetHiding(!showBreakoutSignals);

UpSignal.SetDefaultColor(Color.UPTICK);

UpSignal.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

DownSignal.SetDefaultColor(Color.DOWNTICK);

DownSignal.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

# Forward / Reverse EMA

# (c) 2017 John F. Ehlers

# Ported to TOS 07.16.2017

# Mobius

# Inputs:

input AA = .1;

# Vars:

def CC;

def RE1;

def RE2;

def RE3;

def RE4;

def RE5;

def RE6;

def RE7;

def RE8;

def EMA;

plot EMA_Signal;

plot plot0;

CC = if CC[1] == 0 then .9 else 1 – AA;

EMA = AA * close + CC * EMA[1];

RE1 = CC * EMA + EMA[1];

RE2 = Power(CC, 2) * RE1 + RE1[1];

RE3 = Power(CC, 4) * RE2 + RE2[1];

RE4 = Power(CC, 8) * RE3 + RE3[1];

RE5 = Power(CC, 16) * RE4 + RE4[1];

RE6 = Power(CC, 32) * RE5 + RE5[1];

RE7 = Power(CC, 64) * RE6 + RE6[1];

RE8 = Power(CC, 128) * RE7 + RE7[1];

EMA_Signal = EMA – AA * RE8;

EMA_Signal.AssignValueColor(if EMA_Signal > EMA_Signal[1]

then Color.GREEN

else Color.RED);

EMA_Signal.SetLineWeight(3);

plot0 = if IsNaN(close) then Double.NaN else 0;

plot0.SetDefaultColor(Color.GRAY);

#addCloud(0, Signal, color.RED, color.GREEN);

# Multi-moving average Component

input length = 14; #hint Length: Number of periods to average the data.

input movingAverageType = {default "Simple MA", "Exponential MA", "Wilders Smoothing", "Weighted MA", "Hull MA", "Adaptive MA", "Triangular MA", "Variable MA", "Dema MA", "Tema MA", "EHMA", "THMA"};

input displace = 0;

def avg_MACD_Value = ExpAverage(2 * ExpAverage(MACD_Value, ma_length / 2) - ExpAverage(MACD_Value, ma_length), Round(Sqrt(ma_length)));

def avg_MACD_Avg = ExpAverage(2 * ExpAverage(MACD_Avg, ma_length / 2) - ExpAverage(MACD_Avg, ma_length), Round(Sqrt(ma_length)));

plot X;

X.SetDefaultColor(CreateColor(0, 102, 204));

X.SetLineWeight(3);

plot Y;

Y.SetDefaultColor(Color.WHITE);

Y.SetLineWeight(3);

switch (movingAverageType) {

case "Simple MA":

X = Average(MACD_Value, ma_length);

Y = Average(MACD_Avg, ma_length);

case "Exponential MA":

X = ExpAverage(MACD_Value, ma_length);

Y = ExpAverage(MACD_Avg, ma_length);

case "Wilders Smoothing":

X = WildersAverage(MACD_Value, ma_length);

Y = WildersAverage(MACD_Avg, ma_length);

case "Weighted MA":

X = wma(MACD_Value, ma_length);

Y = wma(MACD_Avg, ma_length);

case "Hull MA":

X = HullMovingAvg(MACD_Value, ma_length);

Y = HullMovingAvg(MACD_Avg, ma_length);

case "Adaptive MA":

X = MovAvgAdaptive(MACD_Value, ma_length);

Y = MovAvgAdaptive(MACD_Avg, ma_length);

case "Triangular MA":

X = MovAvgTriangular(MACD_Value, ma_length);

Y = MovAvgTriangular(MACD_Avg, ma_length);

case "Variable MA":

X = VariableMA(MACD_Value, ma_length);

Y = VariableMA(MACD_Avg, ma_length);

case "Dema MA":

X = DEMA(MACD_Value, ma_length);

Y = DEMA(MACD_Avg, ma_length);

case "Tema MA":

X = TEMA(MACD_Value, ma_length);

Y = TEMA(MACD_Avg, ma_length);

case EHMA:

X = ExpAverage(2 * ExpAverage(MACD_Value, ma_length / 2) - ExpAverage(MACD_Value, ma_length), Round(Sqrt(ma_length)));

Y = ExpAverage(2 * ExpAverage(MACD_Avg, ma_length / 2) - ExpAverage(MACD_Avg, ma_length), Round(Sqrt(ma_length)));

case THMA:

X = WMA(WMA(MACD_Value, (ma_length / 2) / 3) * 3 - WMA(MACD_Value, (ma_length / 2) / 2) - WMA(MACD_Value, (ma_length / 2)), (ma_length / 2));

Y = WMA(WMA(MACD_Avg, (ma_length / 2) / 3) * 3 - WMA(MACD_Avg, (ma_length / 2) / 2) - WMA(MACD_Avg, (ma_length / 2)), (ma_length / 2));

}

;Looking forward to your thoughts, feedback and analysis when you have a chance