Author Message:

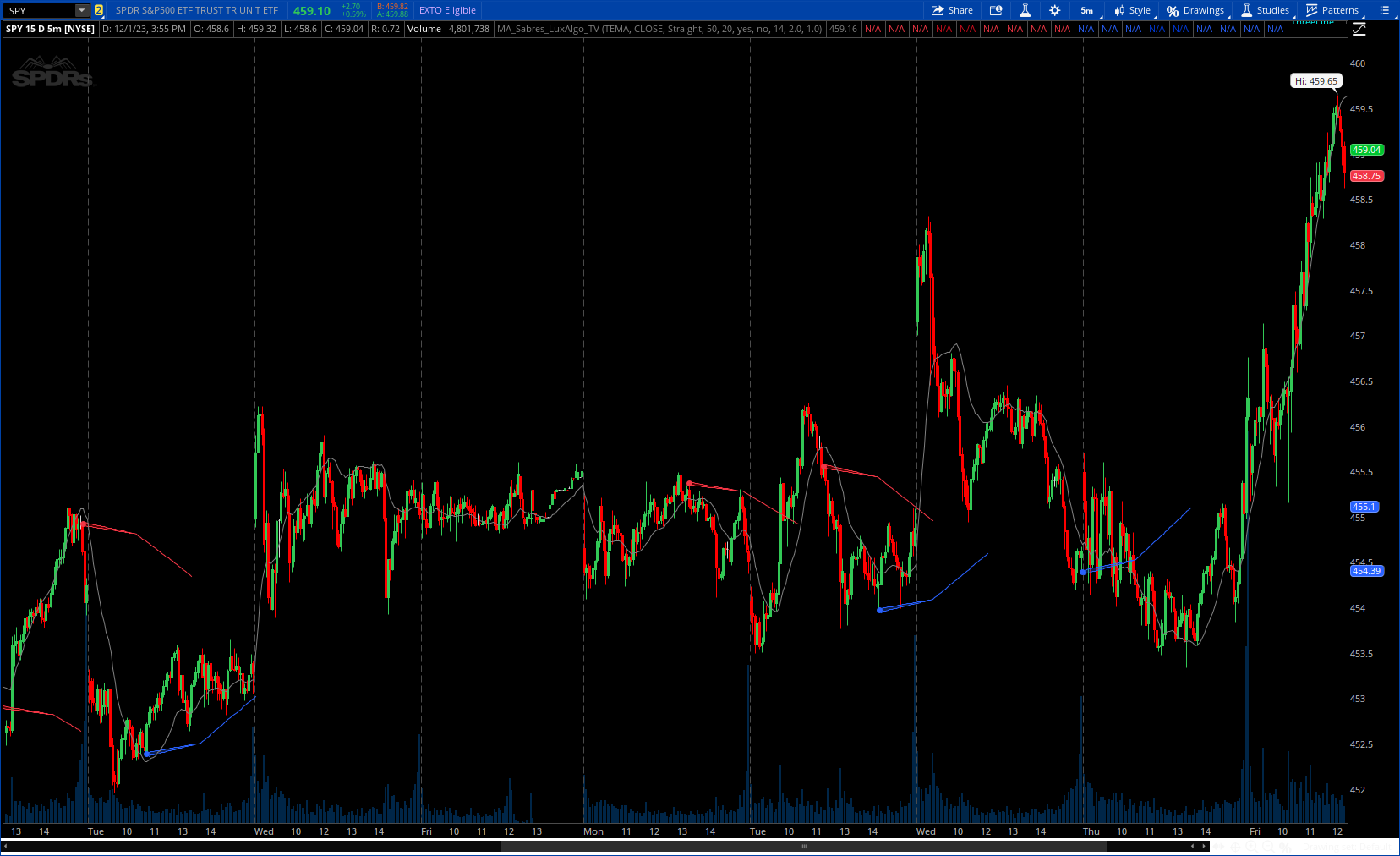

The "MA Sabres" indicator highlights potential trend reversals based on a moving average direction. Detected reversals are accompanied by an extrapolated "Sabre" looking shape that can be used as support/resistance and as a source of breakouts

More details : https://www.tradingview.com/v/viwa6CR8/

CODE:

CSS:

# //https://www.tradingview.com/v/viwa6CR8/

# // This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International

# // © LuxAlgo

#indicator('MA Sabres [LuxAlgo]', shorttitle='LuxAlgo - MA Sabres', max_polylines_count=100, overlay=true)

# Converted by Sam4Cok@Samer800 - 12/2023 - Not exact Conversion

input maTyp = {"SMA", "EMA", "SMMA (RMA)", "HullMA", "WMA", "VWMA", "DEMA", default "TEMA"}; # 'MA Type'

input source = close;

input lineTypes = {"Curved",Default "Straight"};

input Length = 50; # 'Length'

input count = 20; # 'Previous Trend Duration'

input showMovAvg = yes;

input showBand = no;

input atrLength = 14;

input targetMulti = 2.0;

input stoplossMulti = 1.0;

def na = Double.NaN;

def last = isNaN(close);

def hLen = floor(Length / 2);

def curve = lineTypes==lineTypes."Curved";

DefineGlobalColor("colUp" , CreateColor(41,98,255)); # 'Bullish'

DefineGlobalColor("colDn" , CreateColor(242,54,69)); # 'Bearish'

DefineGlobalColor("dcolUp", CreateColor(0,58,220)); # 'Bullish'

DefineGlobalColor("dcolDn", CreateColor(206,13,29)); # 'Bearish'

DefineGlobalColor("colMa" , Color.GRAY); # 'MA'

script rising {

input src = close;

input len = 20;

def rising = fold i = 0 to len with p=yes while p do

src[i] > GetValue(src, i + 1);

plot out = rising;

}

script falling {

input src = close;

input len = 20;

def falling = fold i = 0 to len with p=1 while p do

src[i] < GetValue(src, i + 1);

plot out = falling;

}

#vwma(source, length)

script VWMA {

input src = close;

input len = 14;

input vol = volume;

def nom = Average(src * vol, len);

def den = Average(vol, len);

def VWMA = nom / den;

Plot result = VWMA;

}

#//Method MA

script ma {

input type = "TEMA";

input source = close;

input length = 50;

def ma =

if type == "SMA" then Average(source, length) else

if type == "EMA" then ExpAverage(source, length) else

if type == "SMMA (RMA)" then WildersAverage(source, length) else

if type == "HullMA" then HullMovingAvg(source, length) else

if type == "WMA" then WMA(source, length) else

if type == "VWMA" then vwma(source, length) else

if type == "DEMA" then DEMA(source, length) else

if type == "TEMA" then TEMA(source, length) else TEMA(source, length);

plot out = ma;

}

#/Calculations

def ma = ma(maTyp, source , Length);

def fl = falling(ma , count);

def rs = rising (ma , count);

def up = fl[1] and ma > ma[1];

def dn = rs[1] and ma < ma[1];

def nATR = ATR(Length = atrLength);

plot maLine = if showMovAvg then ma else na;

maLine.SetDefaultColor(GlobalColor("colMa"));

def atrDn; def dnVal; def dnL; def cntDn; def yDn0;def yDn1; def yDn2; def yDn3;

if dn {

atrDn = nATR;

dnVal = high[1];

dnL = dnVal;

cntDn = 1;

yDn0 = dnVal + atrDn / 15;

yDn1 = dnVal - atrDn / 15;

yDn2 = dnVal - atrDn / 2.5;

yDn3 = dnVal - atrDn * targetMulti;

} else {

atrDn = atrDn[1];

dnVal = dnVal[1];

dnL = na;

cntDn = if cntDn[1] > Length then na else cntDn[1] + 1;

yDn0 = yDn0[1];

yDn1 = yDn1[1];

yDn2 = yDn2[1];

yDn3 = yDn3[1];

}

def atrUp; def upVal; def upL; def cntUp; def yUp0;def yUp1; def yUp2; def yUp3;

if up {

atrUp = nATR;

upVal = low[1];

upL = upVal;

cntUp = 1;

yUp0 = upVal - atrUp / 15;

yUp1 = upVal + atrUp / 15;

yUp2 = upVal + atrUp / 2.5;

yUp3 = upVal + atrUp * targetMulti;

} else {

atrUp = atrUp[1];

upVal = upVal[1];

upL = na;

cntUp = if cntUp[1] > Length then na else cntUp[1] + 1;

yUp0 = yUp0[1];

yUp1 = yUp1[1];

yUp2 = yUp2[1];

yUp3 = yUp3[1];

}

#-- Line Slope

def slpDn1 = (yDn2 - yDn1) / hLen;

def slpDn2 = (yDn2 - yDn0) / hLen;

def slpDn3 = (yDn3 - yDn2) / hLen;

def slpUp1 = (yUp2 - yUp1) / hLen;

def slpUp2 = (yUp2 - yUp0) / hLen;

def slpUp3 = (yUp3 - yUp2) / hLen;

# curve & Line

# Bearish

def slpDn = if !isNaN(cntDn) then atrDn / (length * 17.5 / 50) else slpDn[1];

def slopeDn = if cntDn < Length / 10 then -(Length * Sqr(slpDn)) else (cntDn * Sqr(slpDn));

def factorDn = ma(maTyp, slopeDn, Length / 10);

def legDn1 = yDn0 + cntDn * slpDn2;

def legDn0 = yDn2 + ((cntDn- hLen) * slpDn3);

def legDn2 = yDn1 + cntDn * slpDn1;

def curDn11 = if cntDn then

if cntDn < hLen then

if up then yDn0 else legDn1 else

if cntDn == hLen then yDn2 else legDn0 else na;

def curDn22 = if cntDn < hLen then

if up then yDn1 else legDn2 else na;

def curDn1; def curDn2; def curDn3; def curDn4; def linDn1; def linDn2;

if dn {

curDn1 = dnVal + atrDn / 15;

curDn2 = dnVal - atrDn / 15;

curDn3 = dnVal + atrDn * stoplossMulti;

curDn4 = dnVal - atrDn * targetMulti;

linDn1 = dnVal + atrDn * stoplossMulti;

linDn2 = dnVal - atrDn * targetMulti;

} else {

curDn1 = curDn1[1] - factorDn;

curDn2 = curDn2[1] - factorDn;

curDn3 = curDn3[1] - factorDn;

curDn4 = curDn4[1] - factorDn;

linDn1 = linDn1[1];

linDn2 = linDn2[1];

}

def saberLDn1 = curDn11;

def saberLDn2 = curDn22;

def sabresDn1 = curDn1;

def sabresDn2 = curDn2;

def sabresDn3 = curDn3;

def sabresDn4 = curDn4;

def sabresDn5 = linDn1;

def sabresDn6 = linDn2;

def dnCondCurve = curve and !dn[-1] and cntDn;

def dnCondLine = !curve and !dn[-1] and cntDn;

plot PointDn = dnL[-1];

PointDn.SetLineWeight(4);

PointDn.SetPaintingStrategy(PaintingStrategy.POINTS);

PointDn.SetDefaultColor(GlobalColor("colDn"));

plot CurveDn1 = if dnCondCurve then sabresDn1 else na ;

plot CurveDn2 = if dnCondCurve then sabresDn2 else na;

plot CurveDn3 = if showBand and dnCondCurve then sabresDn3 else na;

plot CurveDn4 = if showBand and dnCondCurve then sabresDn4 else na;

plot LineDn1 = if dnCondLine then saberLDn1 else na;

plot LineDn2 = if dnCondLine then saberLDn2 else na;

plot stDn = if showBand and dnCondLine then sabresDn5 else na;

plot tgDn = if showBand and dnCondLine then sabresDn6 else na;

stDn.SetStyle(Curve.SHORT_DASH);

tgDn.SetStyle(Curve.SHORT_DASH);

LineDn1.SetDefaultColor(GlobalColor("colDn"));

LineDn2.SetDefaultColor(GlobalColor("colDn"));

stDn.SetDefaultColor(GlobalColor("colDn"));

tgDn.SetDefaultColor(GlobalColor("colDn"));

CurveDn3.SetStyle(Curve.SHORT_DASH);

CurveDn4.SetStyle(Curve.SHORT_DASH);

CurveDn1.SetDefaultColor(GlobalColor("colDn"));

CurveDn2.SetDefaultColor(GlobalColor("colDn"));

CurveDn3.SetDefaultColor(GlobalColor("dcolDn"));

CurveDn4.SetDefaultColor(GlobalColor("dcolDn"));

AddCloud(CurveDn1, CurveDn2, GlobalColor("colDn"));

AddCloud(LineDn2, LineDn1, GlobalColor("colDn"));

#-- Bulish

def slpUp = if !isNaN(cntUp) then atrUp / (length * 15 / 50) else slpUp[1];

def slopeUp = if cntUp < Length / 10 then -(Length * Sqr(slpUp)) else (cntUp * Sqr(slpUp));

def factorUp = ma(maTyp, slopeUp, Length / 10);

def legUp1 = yUp0 + cntUp * slpUp2;

def legUp0 = yUp2 + ((cntUp - hLen) * slpUp3);

def legUp2 = yUp1 + cntUp * slpUp1;

def curUp11 = if cntUp then

if cntUp < hLen then

if up then yUp0 else legUp1 else

if cntUp == hLen then yUp2 else legUp0 else na;

def curUp22 = if cntUp < hLen then

if up then yUp1 else legUp2 else na;

def curUp1; def curUp2; def curUp3; def curUp4; def linUp1; def linUp2;

if up {

curUp1 = upVal + atrUp / 15;

curUp2 = upVal - atrUp / 15;

curUp3 = upVal + atrUp * targetMulti;

curUp4 = upVal - atrUp * stoplossMulti;

linUp1 = upVal - atrUp * stoplossMulti;

linUp2 = upVal + atrUp * targetMulti;

} else {

curUp1 = curUp1[1] + factorUp;

curUp2 = curUp2[1] + factorUp;

curUp3 = curUp3[1] + factorUp;

curUp4 = curUp4[1] + factorUp;

linUp1 = linUp1[1];

linUp2 = linUp2[1];

}

def saberLUp1 = curUp11;

def saberLUp2 = curUp22;

def sabresUp1 = curUp1;

def sabresUp2 = curUp2;

def sabresUp3 = curUp3;

def sabresUp4 = curUp4;

def sabresUp5 = linUp1;

def sabresUp6 = linUp2;

def upCondCurve = curve and !up[-1] and cntUp;

def upCondLine = !curve and !up[-1] and cntUp;

plot PointUp = upL[-1];

PointUp.SetLineWeight(4);

PointUp.SetPaintingStrategy(PaintingStrategy.POINTS);

PointUp.SetDefaultColor(GlobalColor("colUp"));

plot CurveUp1 = if upCondCurve then sabresUp1[-1] else na;

plot CurveUp2 = if upCondCurve then sabresUp2[-1] else na;

plot CurveUp3 = if showBand and upCondCurve then sabresUp3 else na;

plot CurveUp4 = if showBand and upCondCurve then sabresUp4 else na;

plot LineUp1 = if upCondLine then saberLUp1 else na;

plot LineUp2 = if upCondLine then saberLUp2 else na;

plot stUp = if showBand and upCondLine then sabresUp5 else na;

plot tgUp = if showBand and upCondLine then sabresUp6 else na;

stUp.SetStyle(Curve.SHORT_DASH);

tgUp.SetStyle(Curve.SHORT_DASH);

LineUp1.SetDefaultColor(GlobalColor("colUp"));

LineUp2.SetDefaultColor(GlobalColor("colUp"));

stUp.SetDefaultColor(GlobalColor("colUp"));

tgUp.SetDefaultColor(GlobalColor("colUp"));

CurveUp3.SetStyle(Curve.SHORT_DASH);

CurveUp4.SetStyle(Curve.SHORT_DASH);

CurveUp1.SetDefaultColor(GlobalColor("colUp"));

CurveUp2.SetDefaultColor(GlobalColor("colUp"));

CurveUp3.SetDefaultColor(GlobalColor("dcolUp"));

CurveUp4.SetDefaultColor(GlobalColor("dcolUp"));

AddCloud(CurveUp1, CurveUp2, GlobalColor("colUp"));

AddCloud(LineUp2, LineUp1, GlobalColor("colUp"));

#-- END of CODE