Author message:

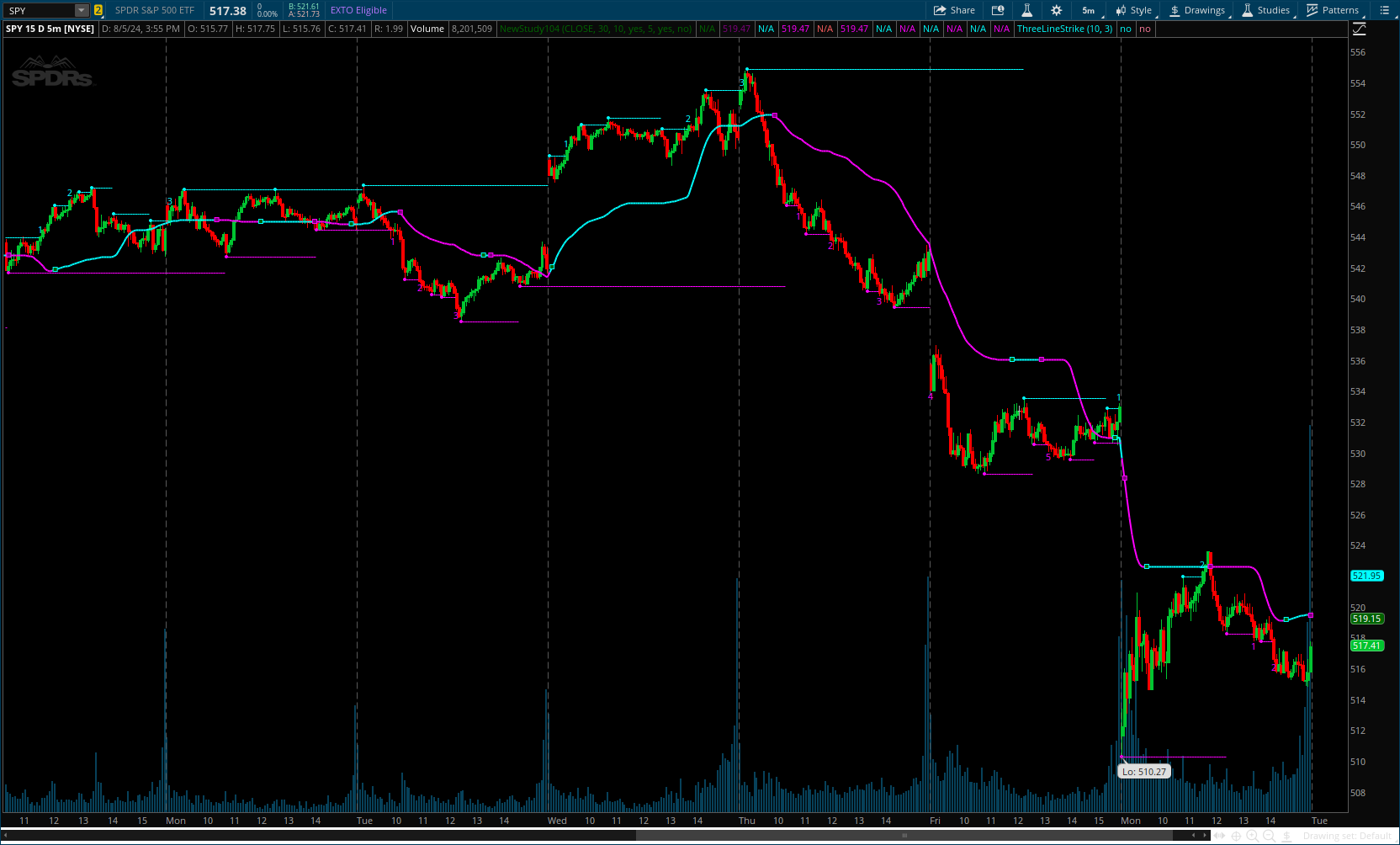

The LOWESS (Locally Weighted Scatterplot Smoothing) [ChartPrime] indicator is an advanced technical analysis tool that combines LOWESS smoothing with a Modified Adaptive Gaussian Moving Average. This indicator provides traders with a sophisticated method for trend analysis, pivot point identification, and breakout detection.

Read more: https://www.tradingview.com/script/...ly-Weighted-Scatterplot-Smoothing-ChartPrime/

CODE:

CSS:

#// Indicator for TOS

#// © ChartPrime

#indicator("LOWESS (Locally Weighted Scatterplot Smoothing) [ChartPrime]", "Lowess & GaussianMA [ChartPrime]"

# Converted by Sam4Cok@Samer800 - 08/2024

input source = close;

input GaussianLength = 30; # "LOWESS (Locally Weighted Scatterplot Smoothing)"

input lowessLength = 10;

input showPivotsLines = yes;

input pivotsLength = 5; # "Pivots"

input showCountBreaks = no; # "Count Breaks"

input showGaussianScatterplot = no; # "Gaussian Scatterplot")

def na = Double.NaN;

def last = isNaN(close);

def leftBars = Max(pivotsLength, 2);

#-- Functions

script rising{

input src = close;

input len = 20;

def rising = fold i = 0 to len with p=1 while p do

GetValue(src, i) >= GetValue(src, i + 1);

plot out = rising;

}

script falling{

input src = close;

input len = 20;

def falling = fold i = 0 to len with p=1 while p do

GetValue(src, i) <= GetValue(src, i + 1);

plot out = falling;

}

script Pivot {

input series = close;

input leftBars = 10;

input rightBars = 10;

input isHigh = yes;

def na = Double.NaN;

def HH = series == Highest(series, leftBars + 1);

def LL = series == Lowest(series, leftBars + 1);

def pivotRange = (leftBars + rightBars + 1);

def leftEdgeValue = if series[pivotRange] == 0 then na else series[pivotRange];

def pvtCond = !IsNaN(series) and !IsNaN(leftEdgeValue);

def barIndexH = if pvtCond then

fold i = 1 to rightBars + 1 with p=1 while p do

series > GetValue(series, - i) else na;

def barIndexL = if pvtCond then

fold j = 1 to rightBars + 1 with q=1 while q do

series < GetValue(series, - j) else na;

def PivotPoint;

if isHigh {

PivotPoint = if HH and barIndexH then series else na;

} else {

PivotPoint = if LL and barIndexL then series else na;

}

plot pvt = PivotPoint;

}

script lowess {

input src = close;

input length = 10;

def sum_w = fold i = 0 to length-1 with p do

p + Power(1 - Power(i / length, 3), 3);

def sum_wx = fold i1 = 0 to length-1 with p1 do

p1 + i1 * Power(1 - Power(i1 / length, 3), 3);

def sum_wy = fold i2 = 0 to length-1 with p2 do

p2 + src[i2] * Power(1 - Power(i2 / length, 3), 3);

def a = sum_wy / sum_w;

def b = sum_wx / sum_w;

def lowess = a + b * (length - 1) / 2000;

plot out = lowess;

}

#//@function Calculates Modified Adaptive Gaussian Moving Average

script GaussianMA {

input src = close;

input length = 30;

def nATR = ATR(Length = length);

def stdv = StDev(src, length);

def sigma = (nATR + stdv) / 2; #// Volatility adaption

def sigmaM = sigma * 2;

def hh = Highest(src, length);

def ll = Lowest(src, length);

def sumOfWeights = fold j = 0 to length with q do

q + Exp(-Power(((j - length) / sigmaM), 2) / 2);

def gma1 = fold i = 0 to length with p do

p + (Exp(-Power(((i - length) / sigmaM), 2) / 2)) *

(Max(hh[i], hh) + Min(ll[i], ll));

def gma = (gma1 / sumOfWeights) / 2;

plot out = gma;

}

#// Calculate pivot high and low

def rightBars = leftBars - 2;

def ph = pivot(high[-rightBars], leftBars, rightBars, yes);

def pl = pivot(low[-rightBars], leftBars, rightBars, no);

# // Gaussian MA plot

def gma = GaussianMA(source, GaussianLength);

def smoothed = lowess(gma, lowessLength);

def smoothed1 = smoothed[2];

#// Determine color for smoothed line based on its direction

def gmaCol = Random() * 255;

def raisUp = rising(smoothed, 2);

def fallDn = falling(smoothed,2);

def smoothedCol = if raisUp then 1 else

if fallDn then -1 else smoothedCol[1];

def crossUp = smoothedCol>0 and (smoothedCol!=smoothedCol[1]);

def crossDn = smoothedCol<0 and (smoothedCol!=smoothedCol[1]);

#// 𝙑𝙄𝙎𝙐𝘼𝙇𝙄𝙕𝘼𝙏𝙄𝙊𝙉

plot dirUp1 = if crossUp then smoothed else na;

plot dirDn1 = if crossDn then smoothed else na;

plot dirUp = if crossUp then smoothed else na;

plot dirDn = if crossDn then smoothed else na;

plot GaussianMovAvg = if showGaussianScatterplot then gma else na; # "Gaussian Moving Average"

plot smoothedMovAvg = if yes then smoothed else na; # "Gaussian Moving Average"

GaussianMovAvg.AssignValueColor(CreateColor(gmaCol, gmaCol, gmaCol));

GaussianMovAvg.SetPaintingStrategy(PaintingStrategy.POINTS);

smoothedMovAvg.SetLineWeight(2);

smoothedMovAvg.AssignValueColor(if smoothedCol>0 then Color.CYAN else

if smoothedCol<0 then Color.MAGENTA else Color.DARK_GRAY);

dirUp.SetLineWeight(3);

dirDn.SetLineWeight(3);

dirUp1.SetPaintingStrategy(PaintingStrategy.SQUARES);

dirDn1.SetPaintingStrategy(PaintingStrategy.SQUARES);

dirUp1.SetDefaultColor(Color.DARK_GREEN);

dirDn1.SetDefaultColor(Color.PLUM);

dirUp.SetPaintingStrategy(PaintingStrategy.SQUARES);

dirDn.SetPaintingStrategy(PaintingStrategy.SQUARES);

dirUp.SetDefaultColor(Color.CYAN);

dirDn.SetDefaultColor(Color.MAGENTA);

# Draw Line

#// Draw lines and labels for pivot highs

def condH = !isNaN(ph[rightBars]) and smoothedCol[-rightBars] > 0;

def lbl_h;

def line_h;

def crossedUp;

def cnt_Up;

if condH and !crossedUp[1] {

line_h = high;

lbl_h = high;

crossedUp = no;

cnt_Up = 0;

} else if (close > line_h[1]) or cnt_Up[1] >= 300 {

line_h = na;

lbl_h = no;

crossedUp = yes;

cnt_Up = 0;

} else {

line_h = if line_h[1] then line_h[1] else close;

lbl_h = no;

crossedUp = no;

cnt_Up = cnt_Up[1] + 1;

}

#// Draw lines and labels for pivot lows

def condL = !isNaN(pl[rightBars]) and smoothedCol[-rightBars] < 0;

def lbl_l;

def line_l;

def crossedDn;

def cnt_Dn;

if condL and !crossedDn[1]{

line_l = low;

lbl_l = low;

crossedDn = no;

cnt_Dn = 0;

} else if (close < line_l[1]) or cnt_Dn[1] >= 300 {

line_l = na;

lbl_l = no;

crossedDn = yes;

cnt_Dn = 0;

} else {

line_l = if line_l[1] then line_l[1] else close;

lbl_l = no;

crossedDn = no;

cnt_Dn = cnt_Dn[1] + 1;

}

plot pvtLineUp = if showPivotsLines and !last and line_h then line_h else na;

plot pvtLineDn = if showPivotsLines and !last and line_l then line_l else na;

plot pointUp = if lbl_h then lbl_h else na;

plot pointDn = if lbl_l then lbl_l else na;

pointUp.SetPaintingStrategy(PaintingStrategy.POINTS);

pointUp.SetDefaultColor(Color.CYAN);

pvtLineUp.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pvtLineUp.SetDefaultColor(Color.CYAN);

pointDn.SetPaintingStrategy(PaintingStrategy.POINTS);

pointDn.SetDefaultColor(Color.MAGENTA);

pvtLineDn.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

pvtLineDn.SetDefaultColor(Color.MAGENTA);

#// Counts

def count_Up; def count_Dn;

if crossedUp {

count_dn = 0;

count_up = count_up[1] + 1;

} else if crossedDn {

count_dn = count_dn[1] + 1;

count_up = 0;

} else {

count_dn = count_dn[1];

count_up = count_up[1];

}

plot cntUp = if showCountBreaks and crossedUp then count_up else na;

plot cntDn = if showCountBreaks and crossedDn then count_dn else na;

cntUp.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

cntDn.SetPaintingStrategy(PaintingStrategy.VALUES_Below);

cntUp.SetDefaultColor(Color.CYAN);

cntDn.SetDefaultColor(Color.MAGENTA);

#-- END of CODE