#// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

#// © blackcat1402

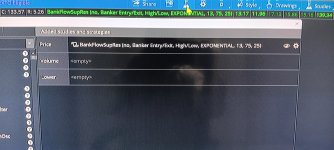

#study("[blackcat] L3 Banker Fund Flow Trend Oscillator", overlay=false)

# Converted and mod by Sam4Cok@Samer800 - 02/2023

declare lower;

#//functions

input BarColor = yes;

input SmoothingLength = 13;

def na = Double.NaN;

def last = IsNaN(close[1]);

#xrf(values, length) =>

script xrf {

input values = close;

input length = 34;

def r_val;# = float(na)

r_val = if length >= 1 then

fold i = 0 to length + 1 with p=values do

if IsNaN(p) or !IsNaN(values[i]) then values[i] else p else Double.NaN;

plot out = r_val;

}

#xsa(src,len,wei) =>

script xsa {

input src = close;

input len = 5;

input wei = 1;

def sumf;# = 0.0

def ma;# = 0.0

def out;# = 0.0

sumf = CompoundValue(1, sumf[1] - src[len] + src , src);

ma = if IsNaN(src[len]) then Double.NaN else sumf / len;

out = if IsNaN(out[1]) then ma else (src * wei + out[1] * (len - wei)) / len;

plot return = out;

}

def wmCal = (close - Lowest(low, 27)) / (Highest(high, 27) - Lowest(low, 27)) * 100;

#//set up a simple model of banker fund flow trend

def fundtrend = (3 * xsa(wmCal, 5, 1) - 2 * xsa(xsa(wmCal, 5, 1), 3, 1) - 50) * 1.032 + 50;

#//define typical price for banker fund

def typ = (2 * close + high + low + open) / 5;

#//lowest low with mid term fib # 34

def lol = Lowest(typ, 34);

#//highest high with mid term fib # 34

def hoh = Highest(typ, 34);

#//define banker fund flow bull bear line

def bullbear = (typ - lol) / (hoh - lol) * 100;

def bullbearline = ExpAverage(bullbear, SmoothingLength);

#//define banker entry signal

def bankerentry = Crosses(fundtrend, bullbearline, CrossingDirection.ABOVE) and bullbearline < 25;

def bankerExit = Crosses(fundtrend, bullbearline, CrossingDirection.BELOW) and bullbearline > 75;

#//banker increase position with green candle

def UpCandle = fundtrend > bullbearline;

def WeakUp = fundtrend < (xrf(fundtrend * 0.95, 1));

def DnCandle = fundtrend < bullbearline;

def WeakDn = fundtrend < bullbearline and fundtrend > (xrf(fundtrend * 0.95, 1));

# Plot the new Chart

#//banker fund entry with yellow candle

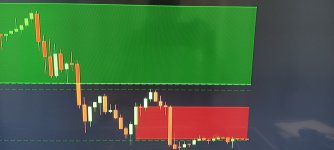

AddChart(high = if bankerExit then 100 else na, low = 0 , open = 100, close = 0,

type = ChartType.CANDLE, growcolor = Color.DARK_RED);

AddChart(high = if bankerentry then 100 else na, low = 0 , open = 100, close = 0,

type = ChartType.CANDLE, growcolor = CreateColor(26, 70, 85));

AddChart(high = if UpCandle then bullbearline else na , low = fundtrend , open = fundtrend, close = bullbearline,

type = ChartType.CANDLE, growcolor = CreateColor(7, 205, 15));

AddChart(high = if WeakUp then bullbearline else na , low = fundtrend , open = fundtrend, close = bullbearline,

type = ChartType.CANDLE, growcolor = CreateColor(188, 245, 188));

AddChart(high = if DnCandle then bullbearline else na , low = fundtrend , open = bullbearline, close = fundtrend,

type = ChartType.CANDLE, growcolor = Color.RED);

AddChart(high = if WeakDn then bullbearline else na , low = fundtrend , open = bullbearline, close = fundtrend,

type = ChartType.CANDLE, growcolor = Color.PINK);

#/overbought and oversold threshold lines

def h1 = if last then na else 80;

def h2 = if last then na else 20;

def h3 = 10;

def h4 = 90;

plot h5 = if last then na else 50;

h5.SetDefaultColor(Color.DARK_GRAY);

# Plot the new Chart

#//banker fund entry with yellow candle

plot SigUp = if bankerentry and !bankerentry[1] then 15 else 0;

plot SigDn = if bankerExit and !bankerExit[1] then 85 else 100;

SigUp.SetDefaultColor(Color.CYAN);

SigDn.SetDefaultColor(Color.MAGENTA);

Alert(bankerentry and !bankerentry[1], " BUY ", Alert.BAR, Sound.Ring);

Alert(bankerExit and !bankerExit[1], " SELL ", Alert.BAR, Sound.Bell);

AddCloud(h2, h3, CreateColor(157, 157, 0));#color=color.CYAN,transp=70)

AddCloud(h4, h1, CreateColor(157, 0 , 157));#=color.fuchsia,transp=70)

AssignPriceColor(if !BarColor then Color.CURRENT else

if bankerentry and !bankerentry[1] then Color.CYAN else

if bankerExit and !bankerExit[1] then Color.MAGENTA else

if bankerentry then Color.CYAN else

if bankerExit then Color.MAGENTA else

if WeakDn then Color.DARK_RED else

if DnCandle then Color.RED else

if WeakUp then Color.DARK_GREEN else

if UpCandle then Color.GREEN else Color.CURRENT);

#---- END CODE

plot OB = if fundtrend > 90 and fundtrend < 100 then 105 else na;

plot OBX = if fundtrend > 100 then 105 else na;

OB.SetDefaultColor(Color.DARK_RED);

OBX.SetDefaultColor(Color.WHITE);

OB.SetPaintingStrategy(PaintingStrategy.POINTS);

OBX.SetPaintingStrategy(PaintingStrategy.POINTS);

plot OSX = if fundtrend < 0 then -5 else na;

plot OS = if fundtrend < 10 and fundtrend > 0 then -5 else na;

OS.SetDefaultColor(Color.DARK_GREEN);

OSX.SetDefaultColor(Color.WHITE);

OS.SetPaintingStrategy(PaintingStrategy.POINTS);

OSX.SetPaintingStrategy(PaintingStrategy.POINTS);

def c = close;

def h = high;

def l = low;

def o = open;

script xrf {

input values = close;

input length = 34;

def r_val = fold i = 0 to length + 1 with p=Double.NaN do

if (IsNaN(p) or !IsNaN(values[i])) then values[i] else p;

plot out = if length >= 1 then r_val else Double.NaN;

}

#xsa(src,len,wei) =>

script xsa {

input src = close;

input len = 5;

input wei = 1;

def sumf = CompoundValue(1, sumf[1] - src[len] + src , src);

def ma = if IsNaN(src[len]) then Double.NaN else sumf / len;

def out = CompoundValue(1, (src * wei + out[1] * (len - wei)) / len, ma);

plot return = out;

}

#----Div-----------

input ShowLastDivLines = yes;

input DivBull = yes; # "Plot Bullish"

input DivBear = yes; # "Plot Bearish"

input PivotLookbackRight = 5; # "Pivot Lookback Right"

input PivotLookbackLeft = 10; # "Pivot Lookback Left"

input MaxLookback = 60; # "Max of Lookback Range"

input MinLookback = 5; # "Min of Lookback Range"

def divSrc = fundtrend;

def maxx = Max(fundtrend, bullbearline);

def minn = Min(fundtrend, bullbearline);

script FindPivots {

input dat = close; # default data or study being evaluated

input HL = 0; # default high or low pivot designation, -1 low, +1 high

input lbL = 5; # default Pivot Lookback Left

input lbR = 1; # default Pivot Lookback Right

##############

def _nan; # used for non-number returns

def _BN; # the current barnumber

def _VStop; # confirms that the lookforward period continues the pivot trend

def _V; # the Value at the actual pivot point

##############

_BN = BarNumber();

_nan = Double.NaN;

_VStop = if !IsNaN(dat) and lbR > 0 and lbL > 0 then

fold a = 1 to lbR + 1 with b=1 while b do

if HL > 0 then dat > GetValue(dat, -a) else dat < GetValue(dat, -a) else _nan;

if (HL > 0) {

_V = if _BN > lbL + 1 and dat == Highest(dat, lbL + 1) and _VStop

then dat else _nan;

} else {

_V = if _BN > lbL + 1 and dat == Lowest(dat, lbL + 1) and _VStop

then dat else _nan;

}

plot result = if !IsNaN(_V) and _VStop then _V else _nan;

}

#_inRange(cond) =>

script _inRange {

input cond = yes;

input rangeUpper = 60;

input rangeLower = 5;

def bars = if cond then 0 else bars[1] + 1;

def inrange = (rangeLower <= bars) and (bars <= rangeUpper);

plot retrun = inrange;

}

def pl_ = findpivots(divSrc, -1, PivotLookbackLeft, PivotLookbackRight);

def ph_ = findpivots(divSrc, 1, PivotLookbackLeft, PivotLookbackRight);

def pl = !IsNaN(pl_);

def ph = !IsNaN(ph_);

def pll = Lowest(divSrc, PivotLookbackLeft + 1);

def phh = Highest(divSrc, PivotLookbackLeft + 1);

def sll = Lowest(l, PivotLookbackLeft + 1);

def shh = Highest(h, PivotLookbackLeft + 1);

#-- Pvt Low

def plStart = if pl then yes else plStart[1];

def plFound = if (plStart and pl) then 1 else 0;

def vlFound1 = if plFound then divSrc else vlFound1[1];

def vlFound_ = if vlFound1 != vlFound1[1] then vlFound1[1] else vlFound_[1];

def vlFound = if !vlFound_ then pll else vlFound_;

def plPrice1 = if plFound then l else plPrice1[1];

def plPrice_ = if plPrice1 != plPrice1[1] then plPrice1[1] else plPrice_[1];

def plPrice = if !plPrice_ then sll else plPrice_;

#-- Pvt High

def phStart = if ph then yes else phStart[1];

def phFound = if (phStart and ph) then 1 else 0;

def vhFound1 = if phFound then divSrc else vhFound1[1];

def vhFound_ = if vhFound1 != vhFound1[1] then vhFound1[1] else vhFound_[1];

def vhFound = if !vhFound_ then phh else vhFound_;

def phPrice1 = if phFound then h else phPrice1[1];

def phPrice_ = if phPrice1 != phPrice1[1] then phPrice1[1] else phPrice_[1];

def phPrice = if !phPrice_ then shh else phPrice_;

#// Regular Bullish

def inRangePl = _inRange(plFound[1], MaxLookback, MinLookback);

def oscHL = divSrc > vlFound and inRangePl;

def priceLL = l < plPrice and divSrc <= 40;

def bullCond = plFound and oscHL and priceLL;

#// Regular Bearish

def inRangePh = _inRange(phFound[1], MaxLookback, MinLookback);

def oscLH = divSrc < vhFound and inRangePh;

def priceHH = h > phPrice and divSrc >= 60;

def bearCond = phFound and oscLH and priceHH;

#------ Bubbles

def bullBub = DivBull and bullCond;

def bearBub = DivBear and bearCond;

AddChartBubble(bullBub, minn, "R", Color.CYAN, no);

AddChartBubble(bearBub, maxx, "R", CreateColor(176, 39, 176), yes);

alert(bullBub, "LONG" ,alert.BAR, sound.Ding);

alert(bearBub, "SHORT" ,alert.BAR, sound.Ring);

##### Lines

def bar = BarNumber();

#-- Bear Line

def lastPhBar = if ph then bar else lastPhBar[1];

def prePhBar = if lastPhBar != lastPhBar[1] then lastPhBar[1] else prePhBar[1];

def priorPHBar = if bearCond then prePhBar else priorPHBar[1];

#-- Bull Line

def lastPlBar = if pl then bar else lastPlBar[1];

def prePlBar = if lastPlBar != lastPlBar[1] then lastPlBar[1] else prePlBar[1];

def priorPLBar = if bullCond then prePlBar else priorPLBar[1];

def lastBullBar = if bullCond then bar else lastBullBar[1];

def lastBearBar = if bearCond then bar else lastBearBar[1];

def hiStart = bar == HighestAll(priorPHBar);

def hiEnd = bar == HighestAll(lastBearBar);

def loStart = bar == HighestAll(priorPLBar);

def loEnd = bar == HighestAll(lastBullBar);

def pivotHigh = if hiStart then maxx else if hiEnd then maxx else na;#if HighPivots then bullbearline else na;

def pivotLow = if loStart then minn else if loEnd then minn else na;

plot PlotHline = if ShowLastDivLines then pivotHigh else na;

PlotHline.EnableApproximation();

PlotHline.SetDefaultColor(Color.MAGENTA);

PlotHline.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

PlotHline.setlineweight(1);

plot PlotLline = if ShowLastDivLines then pivotLow else na;

PlotLline.EnableApproximation();

PlotLline.SetDefaultColor(Color.CYAN);

PlotLline.SetPaintingStrategy(PaintingStrategy.LINE_VS_POINTS);

PlotLline.setlineweight(1);