I'd love to test this out, unless there exists one already ?

Code:

# KNOWSURETHING

# DREWGRIFFITH15 (C) 2014

declare lower;

input RC1_LEN = 5;

input RC1_SMA = 10;

input RC2_LEN = 5;

input RC2_SMA = 15;

input RC3_LEN = 5;

input RC3_SMA = 20;

input RC4_LEN = 5;

input RC4_SMA = 25;

input KST_SMA = 5;

input FILTER = 0.30; # SIZE of MOVEMENT

input price = close;

DEF RC1 = if price[RC1_LEN] > 0 then (price / price[RC1_LEN] - 1) * 100 else 0;

DEF RC2 = if price[RC2_LEN] > 0 then (price / price[RC2_LEN] - 1) * 100 else 0;

DEF RC3 = if price[RC3_LEN] > 0 then (price / price[RC3_LEN] - 1) * 100 else 0;

DEF RC4 = if price[RC4_LEN] > 0 then (price / price[RC4_LEN] - 1) * 100 else 0;

DEF RCMA1 = SIMPLEMOVINGAVG(RC1,RC1_SMA);

DEF RCMA2 = SIMPLEMOVINGAVG(RC2,RC2_SMA);

DEF RCMA3 = SIMPLEMOVINGAVG(RC3,RC3_SMA);

DEF RCMA4 = SIMPLEMOVINGAVG(RC4,RC4_SMA);

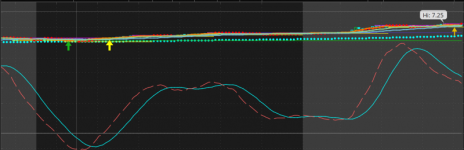

PLOT KST = (RCMA1 * 1) + (RCMA2 * 2) + (RCMA3 * 3) + (RCMA4 * 4);

PLOT SignalLine = SIMPLEMOVINGAVG(KST,9);

PLOT ZeroLine = 0;

PLOT RATING =

IF KST > SignalLine AND KST[1] < SignalLine[1] AND ROUND(KST-KST[1],2) >= FILTER THEN ROUND(KST-KST[1],2)

ELSE IF KST < SignalLine AND KST[1] > SignalLine[1] AND ROUND(KST-KST[1],2) <= -FILTER THEN ROUND(KST-KST[1],2)

#ELSE IF KST > ZeroLine AND KST[1] < ZeroLine AND ROUND(KST-KST[1],2) >= FILTER THEN ROUND(KST-KST[1],2)

#ELSE IF KST < ZeroLine AND KST[1] > ZeroLine AND ROUND(KST-KST[1],2) <= -FILTER THEN ROUND(KST-KST[1],2)

ELSE 0;

KST.SETDEFAULTCOLOR(COLOR.MAGENTA);

SignalLine.SETDEFAULTCOLOR(COLOR.CYAN);

ZeroLine.SETDEFAULTCOLOR(COLOR.DARK_GRAY);

RATING.HIDE();

RATING.HIDEBUBBLE();

Last edited: