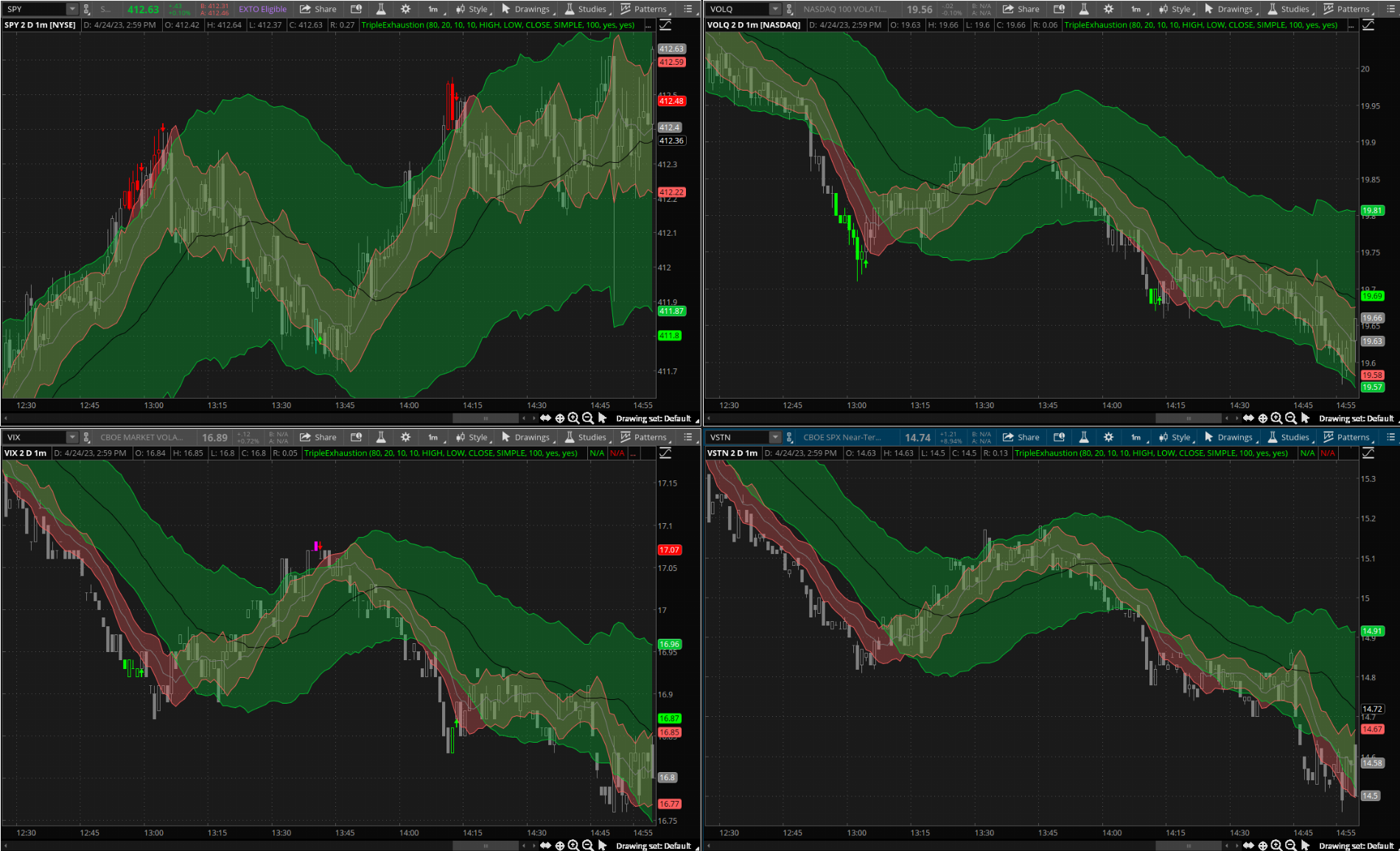

Volatility indices can be combined with indicators to give some useful info on market direction. I've started using @MorayTheEel 's excellent Keltner Channels with Wilder Average on VIX, VOLQ, VSTN, etc. Combined with the Triple Exhaustion indicator, it makes some very good calls. A low on VIX confirms a high on SPY; high on VIX confirms low on SPY.

Keltner w Wilder: https://usethinkscript.com/threads/hurst-cycle-channel-clone-for-thinkorswim.14575/

Triple Exhaustion length is set to 100.

shared chart links:

SPY: https://tos.mx/hdHqAZO

VIX: https://tos.mx/ZObTYOm

Keltner w Wilder: https://usethinkscript.com/threads/hurst-cycle-channel-clone-for-thinkorswim.14575/

Triple Exhaustion length is set to 100.

shared chart links:

SPY: https://tos.mx/hdHqAZO

VIX: https://tos.mx/ZObTYOm

Last edited by a moderator: