Hey everyone,

I have a question, maybe someone can assist, or give any idea.

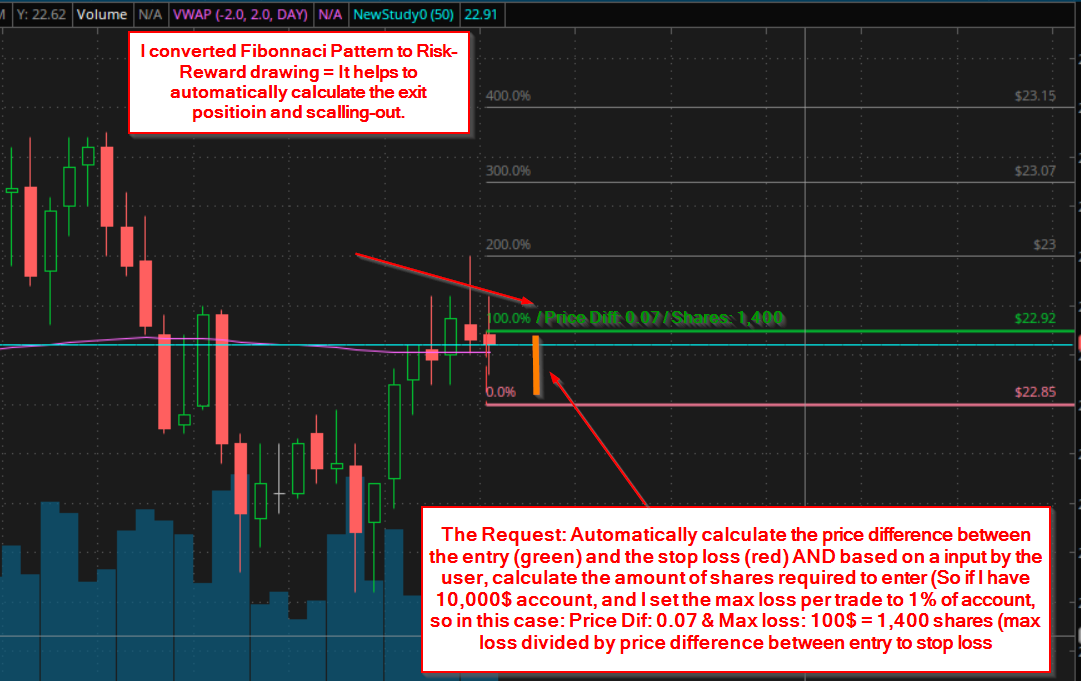

In this image I uploaded you can see what I did, and what I wish it could be:

In short, I would like to fully convert the Fibonacci Retracement tool to a Risk/Reward tool. I did some of it by a simple study edit of that tool, but I wish also to add automatic indications for the "price difference" between the entry and the stop loss with an automatic calculation of the amount of shares you need to buy (based on your risk)

Somebody maybe know some ThinkScript? Or have any Idea where can I find assistance on that?

Many Thanks!!

I have a question, maybe someone can assist, or give any idea.

In this image I uploaded you can see what I did, and what I wish it could be:

In short, I would like to fully convert the Fibonacci Retracement tool to a Risk/Reward tool. I did some of it by a simple study edit of that tool, but I wish also to add automatic indications for the "price difference" between the entry and the stop loss with an automatic calculation of the amount of shares you need to buy (based on your risk)

Somebody maybe know some ThinkScript? Or have any Idea where can I find assistance on that?

Many Thanks!!