bigmit2011

New member

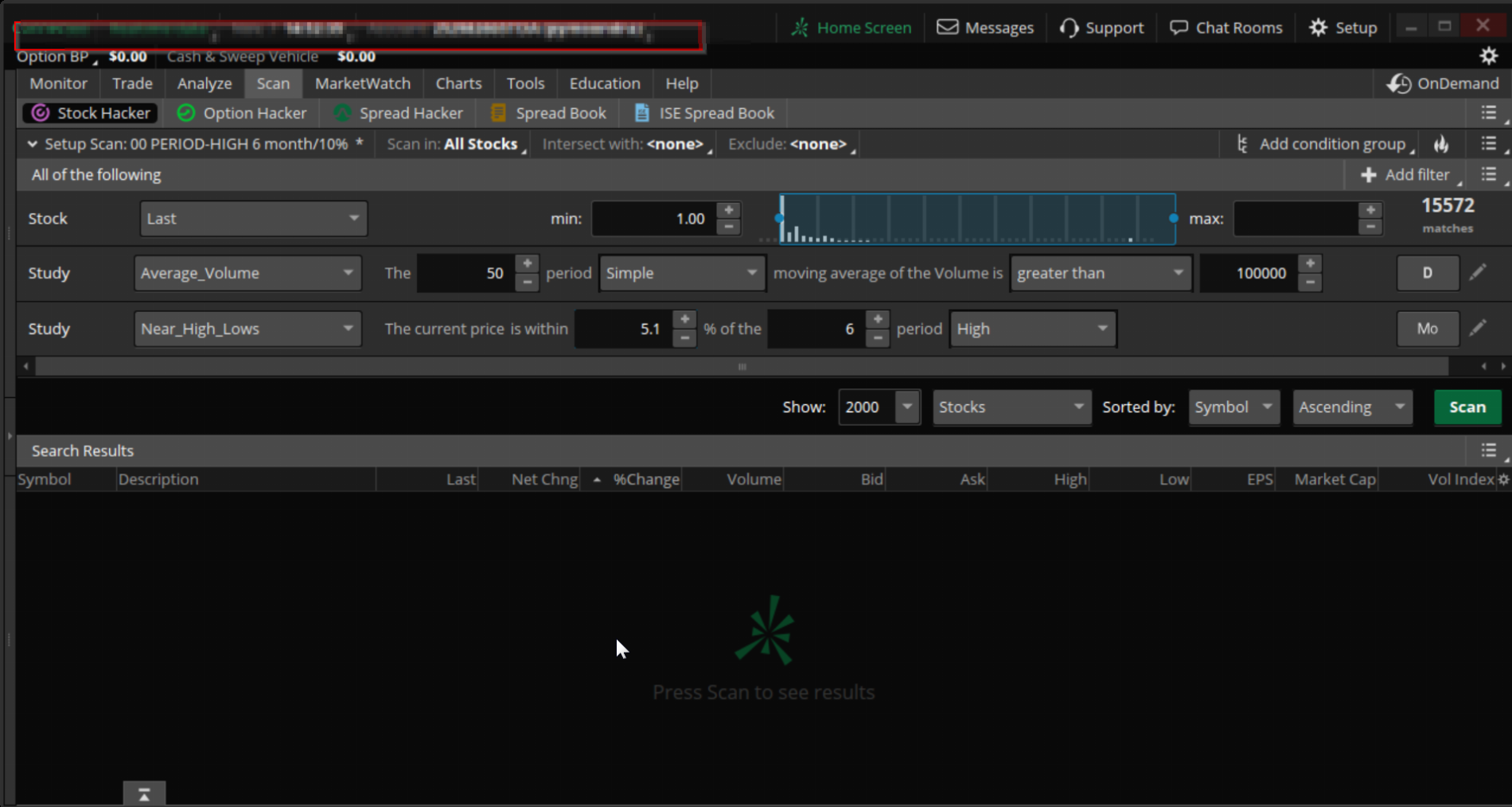

So I'm trying to write a custom study for a script.

The script is looking for stocks within X% of 6 month high.

However the custom study wants to add a condition to the above script.

If today's close pricing is the new 6 month high, and

today's change is 2x ATR, I want it be filtered out from the scan.

To get stocks within x percent 6 month high, I am using the study, near high lows

Now I just need a condition that if today's close is the new 6 month high, I want if filtered from my scan if change is 2x ATR;

Here is my attempt, those I am a little shaky with the if statement as I don't have an else clause.

In this situaton I will need to use two aggregations, month and daily.

ATR is using daily, while high is monthly.

How should I handle this?

Thank you.

The script is looking for stocks within X% of 6 month high.

However the custom study wants to add a condition to the above script.

If today's close pricing is the new 6 month high, and

today's change is 2x ATR, I want it be filtered out from the scan.

To get stocks within x percent 6 month high, I am using the study, near high lows

Now I just need a condition that if today's close is the new 6 month high, I want if filtered from my scan if change is 2x ATR;

Here is my attempt, those I am a little shaky with the if statement as I don't have an else clause.

Code:

def high = Highest(close[1], 6);

def is_high = close equal to high

def length = 14;

def atr = average((high - low)/close, length);

def cond = change < 2 * atr;

plot scan = if is_high cond else 0;In this situaton I will need to use two aggregations, month and daily.

ATR is using daily, while high is monthly.

How should I handle this?

Thank you.