Author Message:

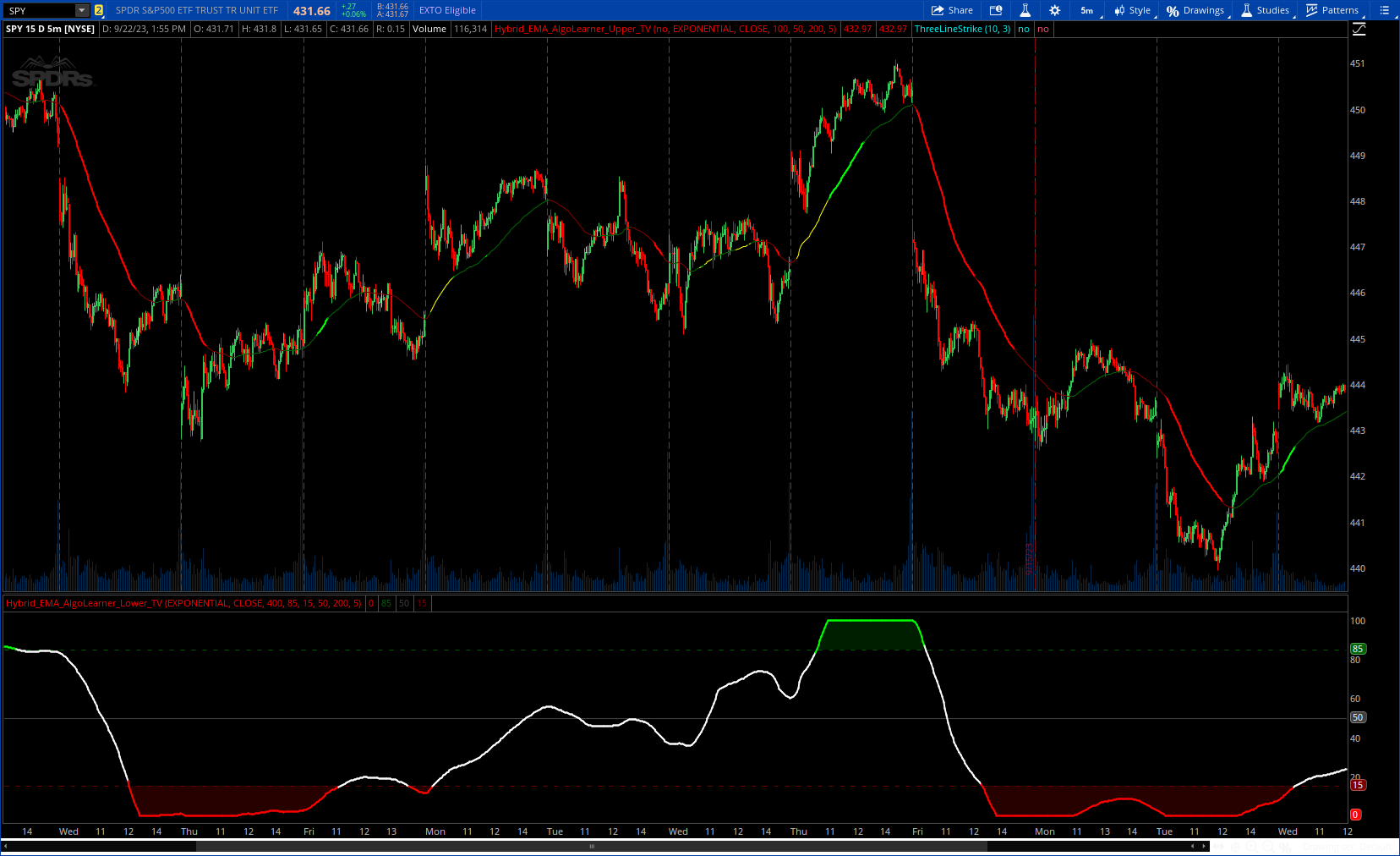

Innovative trading indicator that utilizes a k-NN-inspired algorithmic approach alongside traditional Exponential Moving Averages (EMAs) for more nuanced analysis. While the algorithm doesn't actually employ machine learning techniques, it mimics the logic of the k-Nearest Neighbors (k-NN) methodology. The script takes into account the closest 'k' distances between a short-term and long-term EMA to create a weighted short-term EMA. This combination of rule-based logic and EMA technicals offers traders a more sophisticated tool for market analysis.

More Details : https://www.tradingview.com/v/4jhuhtMN/

- Not Typical -

Upper CODE:

CSS:

#/ https://www.tradingview.com/v/4jhuhtMN/

#// © Uldisbebris

#indicator("Hybrid EMA AlgoLearner", shorttitle="Hybrid EMA AlgoLearner", overlay=false)

# Converted and mod by Sam4Cok@Samer800 - 09/2023

input showSignals = no;

input MovAvgType = AverageType.EXPONENTIAL;

input source = close;

input lookback = 100;

input shortTermPeriod = 50;

input longTermPeriod = 200;

input NumberOfNeighbors = 5;

def na = Double.NaN;

def last = isNaN(Close);

def k = NumberOfNeighbors;

#// Calculate EMAs

def shortEma = MovingAverage(MovAvgType, source, shortTermPeriod);

def longEma = MovingAverage(MovAvgType, source, longTermPeriod);

def shortTermEma = shortEma;

def longTermEma = longEma;

#// Custom k-NN Algorithm for weighted EMA

def dist = fold i = 1 to lookback with p do #// Loop through past 100 data points

max(p, AbsValue(shortTermEma - longTermEma[i]));

def distances = dist;

#def k_distances = fold i1 = 0 to k with p1 do

# max(p1, distances[i1]);

#// Calculate weighted EMA based on closest k distances

def weightEma = fold j = 0 to k with q do

q + shortTermEma[j] * GetValue(distances, j);

def totalWeight = fold j1 = 0 to k with q1 do

q1 + GetValue(distances, j1);

def weightShortTermEma = weightEma / totalWeight;

def WeightedEma = weightShortTermEma;

#/ Instead of all the history, only look at the last N bars.

def cond = close - WeightedEma;# then k+1 else k;

def Predect = fold n = 0 to k with s do

s + if GetValue(cond, n) < GetValue(distances,fold n1 = 0 to n + 1 with s1 do

if GetValue(distances, n1) > GetValue(distances, n1+1) then s1 else s1 +1)

then GetValue(cond, n) else s;

def sumv = Predect;#sum(Predect, k) * 5 ;

def dir = if sumv < 0 then -1 else

if sumv > 0 then 1 else 0;

def bar = barNumber();

def sumDir = fold m = 0 to k+1 with r do

r + dir[m];

def extUp = dir > 0 and sumv > (k + 1);

def extDn = dir < 0 and sumv < (-k - 1);

def secLine = extUp or extDn;

#//== plot

plot emaplot = WeightedEma; # 'Scaled Weighted Short-Term EMA'

emaplot.AssignValueColor(if extUp then Color.GREEN else

if extDn then Color.RED else

if dir > 0 then Color.DARK_GREEN else

if dir < 0 then Color.DARK_RED else Color.YELLOW);

plot emaplot2 = if secLine then WeightedEma else na;

emaplot2.SetLineWeight(2);

emaplot2.AssignValueColor(if extUp then Color.GREEN else Color.RED);

AddChartBubble(showSignals and extUp and !extUp[1] and sumDir > k/2, low, "B", Color.GREEN, no);

AddChartBubble(showSignals and extDn and !extDn[1] and sumDir < k/2, high, "S", Color.RED, yes);

#-- END of CODELower CODE:

CSS:

#/ https://www.tradingview.com/v/4jhuhtMN/

#// © Uldisbebris

#indicator("Hybrid EMA AlgoLearner", shorttitle="Hybrid EMA AlgoLearner", overlay=false)

# Converted and mod by Sam4Cok@Samer800 - 09/2023

declare lower;

input MovAvgType = AverageType.EXPONENTIAL;

input source = close;

input lookbackPeriod = 400;#, 'lookbackPeriod')

input Overbought = 85;

input Oversold = 15;

input shortTermPeriod = 50;

input longTermPeriod = 200;

#// k-N parameter

input NumberOfNeighbors = 5;#, 'K - Number of neighbors')

def na = Double.NaN;

def last = isNaN(Close);

#// Calculate EMAs

def shortTermEma = MovingAverage(MovAvgType, source, shortTermPeriod);

def longTermEma = MovingAverage(MovAvgType, source, longTermPeriod);

#// Custom k-NN Algorithm for weighted EMA

def dist = fold i = 1 to 100 with p do #// Loop through past 100 data points

Max(p, AbsValue(shortTermEma - longTermEma[i]));

def distance = dist;

#// Calculate weighted EMA based on closest k distances

def weightEma = fold j = 0 to NumberOfNeighbors with q do

q + shortTermEma[j] * distance[j];

def totalWeight = fold j1 = 0 to NumberOfNeighbors with q1 do

q1 + distance[j1];

def weightShortTermEma = weightEma / totalWeight;

#/ Instead of all the history, only look at the last N bars.

def minEma = lowest(weightShortTermEma, lookbackPeriod);

def maxEma = highest(weightShortTermEma, lookbackPeriod);

def scaledWeightShortTermEma = (weightShortTermEma - minEma) / (maxEma - minEma) * 100;

def col = if scaledWeightShortTermEma >= Overbought then 1 else

if scaledWeightShortTermEma <= Oversold then -1 else 0;

#//== plot

plot emaplot = scaledWeightShortTermEma; # 'Scaled Weighted Short-Term EMA'

plot upLvl = if last then na else Overbought;

plot midLinePlot = if last then na else 50;

plot dnLvl = if last then na else Oversold;

emaplot.SetLineWeight(2);

emaplot.AssignValueColor(if col > 0 then Color.GREEN else

if col < 0 then Color.RED else Color.WHITE);

upLvl.SetDefaultColor(Color.DARK_GREEN);

midLinePlot.SetDefaultColor(Color.DARK_GRAY);

dnLvl.SetDefaultColor(Color.DARK_RED);

upLvl.SetStyle(Curve.SHORT_DASH);

dnLvl.SetStyle(Curve.SHORT_DASH);

AddCloud(if col>0 then emaplot else na, Overbought, Color.DARK_GREEN);

AddCloud(if col<0 then Oversold else na, emaplot, Color.DARK_RED);

#-- END of CODE