Lunvrsolace

New member

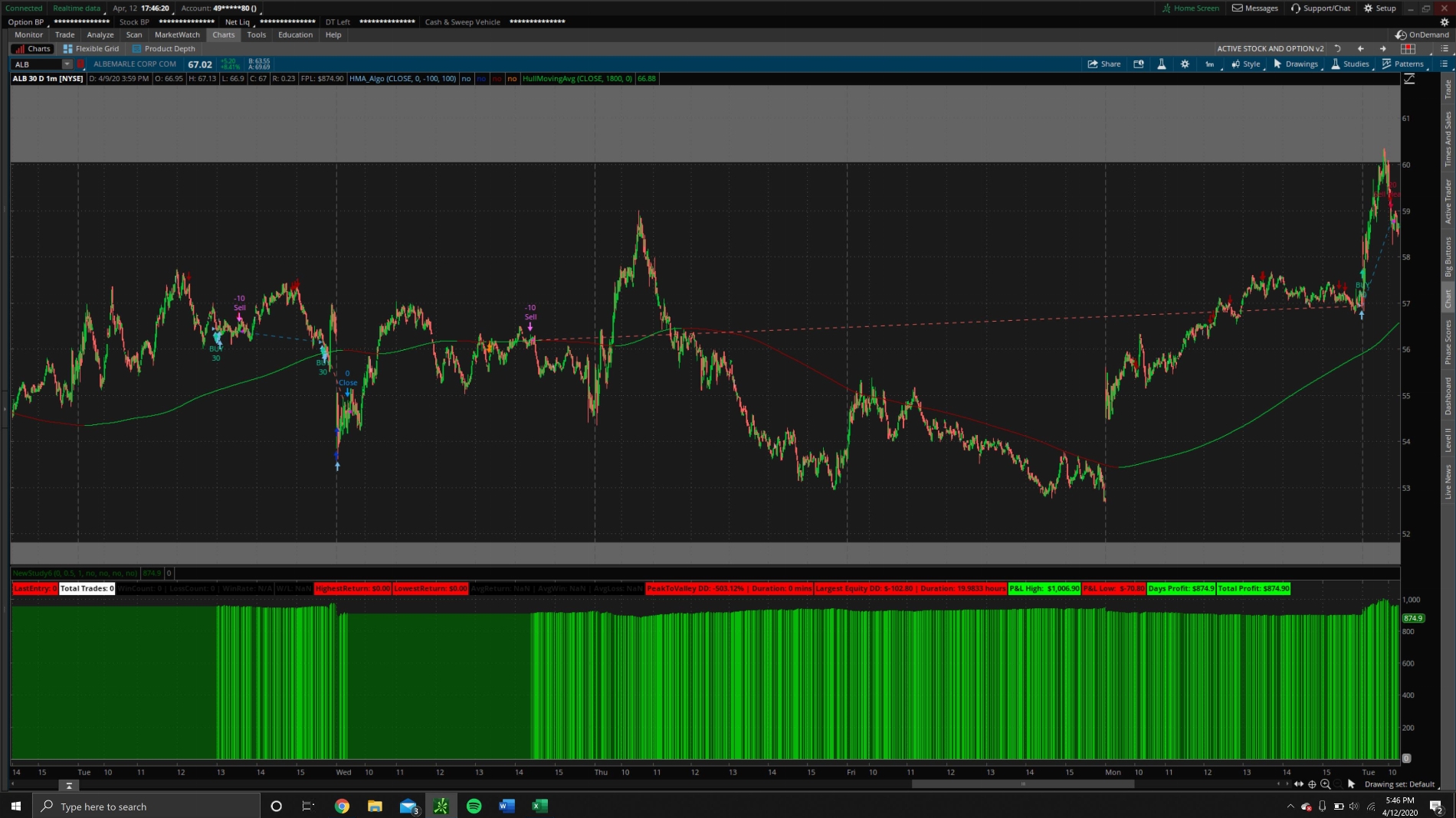

Hey guys i've been working on a HMA strategy for tos. the problem right now is is i dont know how to set a strategy condition that says you can only long as the next order after the last trade closed Or to not trigger a sell signal until there’s at least been 1 buy signal before..

I've been back testing the code to see its accuracy and i see that it keeps getting caught in short positions at the beginning of an uptrend if it has enough strength.

Opened a short position right after a 'Close"

Same thing here. basically want the strategy to be inactive until there's a "buy" or "avg down" after a "close"

Heres Code that can be used as a study on the 1Min Chart

Heres the code to be used as the strategy on the 1Min Chart

I've been back testing the code to see its accuracy and i see that it keeps getting caught in short positions at the beginning of an uptrend if it has enough strength.

Opened a short position right after a 'Close"

Same thing here. basically want the strategy to be inactive until there's a "buy" or "avg down" after a "close"

Heres Code that can be used as a study on the 1Min Chart

Code:

input price = close;

input displace = 0;

input over_sold = -100;

input over_bought = 100;

def linDev = lindev(price, 1000);

def CCI = if linDev == 0 then 0 else (price - Average(price, 1000)) / linDev / 0.015;

def EMA1 = MovingAverage(AverageType.EXPONENTIAL, price, 90);

def HMA1 = MovingAverage(AverageType.HULL, price, 1800)[-displace];

def HMA2 = MovingAverage(AverageType.HULL, price, 180)[-displace];

def HMA3 = MovingAverage(AverageType.HULL, price, 40)[-displace];

def MainBullishZone = HMA1 > HMA1[6];

def MainBearishZone = HMA1 < HMA1[6];

def SubBullishZone = HMA2 > HMA2[200];

def SubBearishZone = HMA2 < HMA2[35];

def IntraBullishZone = HMA3 > HMA3[10];

def IntraBearishZone = HMA3 < HMA3[10];

plot BUYSignal = MainBullishZone and SubBearishZone and IntraBullishZone and (HMA1 < HMA2) and (HMA1 < HMA3) and (HMA3 < HMA2) and price < HMA3 and price < EMA1 and CCI < 100;

plot AvgDownSignal = MainBullishZone and SubBearishZone and intraBullishZone and price < HMA1 and price < HMA2 and CCI < 100 and HMA2 < HMA2[155];

plot BuyExitSignal = price crosses below HMA2 and MainBullishZone and SubBullishZone and IntraBearishZone and price > HMA1;

plot SELLSignal = MainBearishZone and SubBullishZone and IntraBearishZone and (HMA1 > HMA2) and (HMA1 > HMA3) and (HMA3 > HMA2)and price < HMA3 and price > EMA1 and CCI > -100;

BUYSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

BUYSignal.SetDefaultColor(Color.Blue);

AvgDownSignal.SetpaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_UP);

AvgDownSignal.SetDefaultColor(Color.DARK_GREEN);

BuyExitSignal.SetpaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_down);

BuyExitSignal.SetDefaultColor(Color.DARK_GREEN);

SELLSignal.SetPaintingStrategy(PaintingStrategy.BOOLEAN_ARROW_DOWN);

SELLSignal.SetDefaultColor(Color.RED);Heres the code to be used as the strategy on the 1Min Chart

Code:

##### Betsy #####

#CONSERVATIVE SETTINGS*

# MainLength = 1800

# Sensitivity = 6

#AGGRESSIVE SETTINGS*

# MainLength = 1000

# Sensitivity = 15

input price = close;

input MainLength = 1000;

input Sensitivity = 15;

input BuyAmount = 20;

input SellAmount = 1;

input SellHeavyAmount = 35;

input AvgDownAmount = 20;

def linDev = LinDev(price, 1000);

def CCI = if linDev == 0 then 0 else (price - Average(price, 1000)) / linDev / 0.015;

def CCIDrop = CCI > CCI[1];

def EMA1 = MovingAverage(AverageType.EXPONENTIAL, price, 90);

def HMA1 = MovingAverage(AverageType.HULL, price, MainLength);

def HMA2 = MovingAverage(AverageType.HULL, price, 180);

def HMA3 = MovingAverage(AverageType.HULL, price, 40);

def MainBullishZone = HMA1 > HMA1[Sensitivity];

def MainBearishZone = HMA1 < HMA1[Sensitivity] and CCIDrop;

def SubBullishZone = HMA2 > HMA2[200];

def SubBearishZone = HMA2 < HMA2[35];

def IntraBullishZone = HMA3 > HMA3[10];

def IntraBearishZone = HMA3 < HMA3[10];

def BUYSignal = MainBullishZone and SubBearishZone and IntraBullishZone and (HMA1 < HMA2) and (HMA1 < HMA3) and (HMA3 < HMA2) and price < HMA3 and price < EMA1 and CCI < 100;

def AvgDownSignal = MainBullishZone and SubBearishZone and IntraBullishZone and price < HMA1 and price < HMA2 and CCI < 100 and HMA2 < HMA2[155];

def BuyExitSignal = price crosses below HMA2 and MainBullishZone and SubBullishZone and IntraBearishZone and price > HMA1 and CCI < 100;

def SELLSignal = MainBearishZone and SubBullishZone and IntraBearishZone and (HMA1 > HMA2) and (HMA1 > HMA3) and (HMA3 > HMA2) and price < HMA3 and price > EMA1;

def EmergencySELL = SubBearishZone and CCI < -30;

def EmergencyCOVER = CCI > 5 and CCI < 100 and CCI > CCI[200];

def Short = price crosses below HMA2 and MainBullishZone and SubBullishZone and IntraBearishZone and price > HMA1 and CCI > 140;

input crossingType = {default above, below};

def avg1 = MovingAverage(AverageType.EXPONENTIAL, close, 60);

def avg2 = MovingAverage(AverageType.EXPONENTIAL, close, 180);

def signal = Crosses(avg1, avg2, crossingType == crossingType.above);

def signal2 = avg1 crosses above avg2;

AddOrder(condition = BUYSignal, name = "BUY", price = close, tradeSize = BuyAmount);

AddOrder(condition = AvgDownSignal, name = "AvgDown", tradeSize = AvgDownAmount);

AddOrder(OrderType.SELL_AUTO, BuyExitSignal, name = "Sell", tradeSize = SellAmount);

AddOrder(OrderType.SELL_AUTO, Short, name = "Sell Heavy", tradeSize = SellHeavyAmount);

AddOrder(condition = MainBearishZone, name = "Close", type = OrderType.SELL_TO_CLOSE);

AddOrder(OrderType.BUY_TO_CLOSE, SELLSignal, name = "COVER");

Last edited: