Bobbydigital83

Member

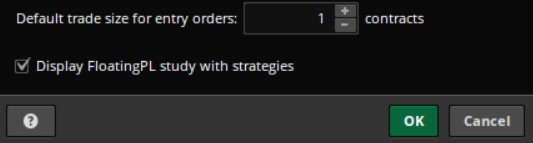

So I ran some backtesting on a strategy using a ETF and I am confused by how can i make the "contracts" amount to make sense with a non futures instrument. Do I simply enter a cash value starting amount instead of "contracts" when backtesting the P&L of a non futures instument? I am confused.