Given the following normalizing script:

Is there a way to create an unbounded Max input while the Min input remains at zero? Essentially I want to take input Max = 100; and remove the 100 limitation to provide for max values well in excess of 100...

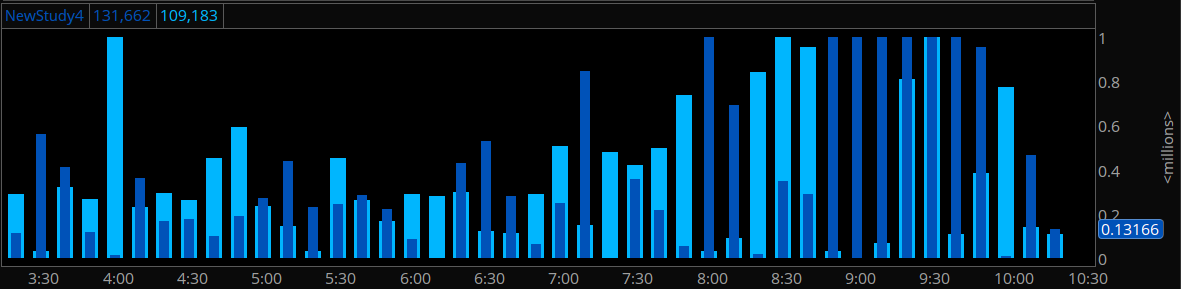

For example, let's say I need to normalize a Volume plot...a Max input value of 100 is obviously not going to cut it. If I hard-code in an arbitrary amount...say 1,000,000...I'll be capping the Volume and preventing the proper display of any values in excess of 1,000,000...

There are a number of volume values above in excess of 1,000,000 being cut off..Do you think there might be a workaround?

Thanks in advance for your time and anticipated potential feedback/solution to this matter. It is much appreciated

Code:

script normalizePlot {

input data = close;

input Min = 0;

input Max = 100;

input length = 50;

def hhData = Highest(data, length);

def llData = Lowest(data, length);

plot resized = (((Max - Min) * (data - llData)) /

(hhData - llData)) + Min;

}Is there a way to create an unbounded Max input while the Min input remains at zero? Essentially I want to take input Max = 100; and remove the 100 limitation to provide for max values well in excess of 100...

For example, let's say I need to normalize a Volume plot...a Max input value of 100 is obviously not going to cut it. If I hard-code in an arbitrary amount...say 1,000,000...I'll be capping the Volume and preventing the proper display of any values in excess of 1,000,000...

Code:

declare lower;

script normalizePlot {

input data = close;

input Min = 0;

input Max = 1000000;

input length = 50;

def hhData = Highest(data, length);

def llData = Lowest(data, length);

plot resized = (((Max - Min) * (data - llData)) /

(hhData - llData)) + Min;

}

def O = open;

def H = high;

def C = close;

def L = low;

def V = volume;

# Unfilled Gap down: Use prior close as high

def equivHi = if H < C[1] then C[1] else H;

# Unfilled Gap up: Use prior close as low

def equivLo = if L > C[1] then C[1] else L;

def Buying2 = Round(V * (C - equivLo) / (equivHi - equivLo), 0);

def Selling2 = Round(V * (equivHi - C) / (equivHi - equivLo), 0);

# Selling Volume

plot SV2 = normalizePlot(Selling2);

SV2.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

SV2.SetDefaultColor(CreateColor(0, 82, 184));

SV2.SetLineWeight(1);

#SV2.hide();

# Buying Volume

plot BV2 = normalizePlot(Buying2);

BV2.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

BV2.SetDefaultColor(CreateColor(0, 182, 254));

BV2.SetLineWeight(5);

#BV2.hide();There are a number of volume values above in excess of 1,000,000 being cut off..Do you think there might be a workaround?

Thanks in advance for your time and anticipated potential feedback/solution to this matter. It is much appreciated