M_Morisette

Member

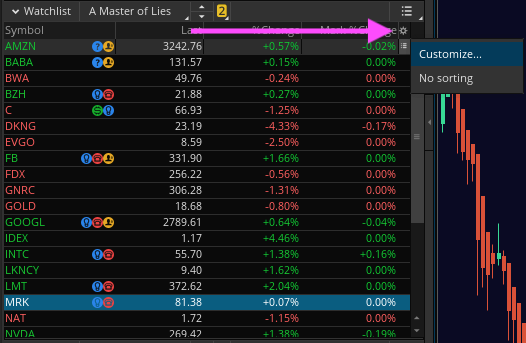

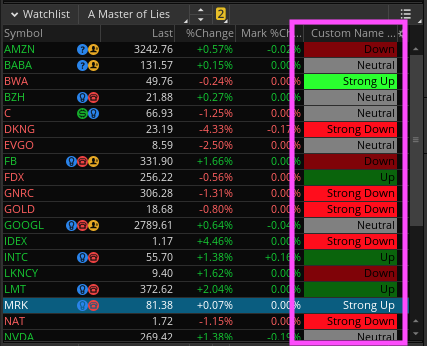

LABEL ADDED AS A WATCHLIST COLUMN FOR EASY PICKINS

I'm a fan of this indicator:

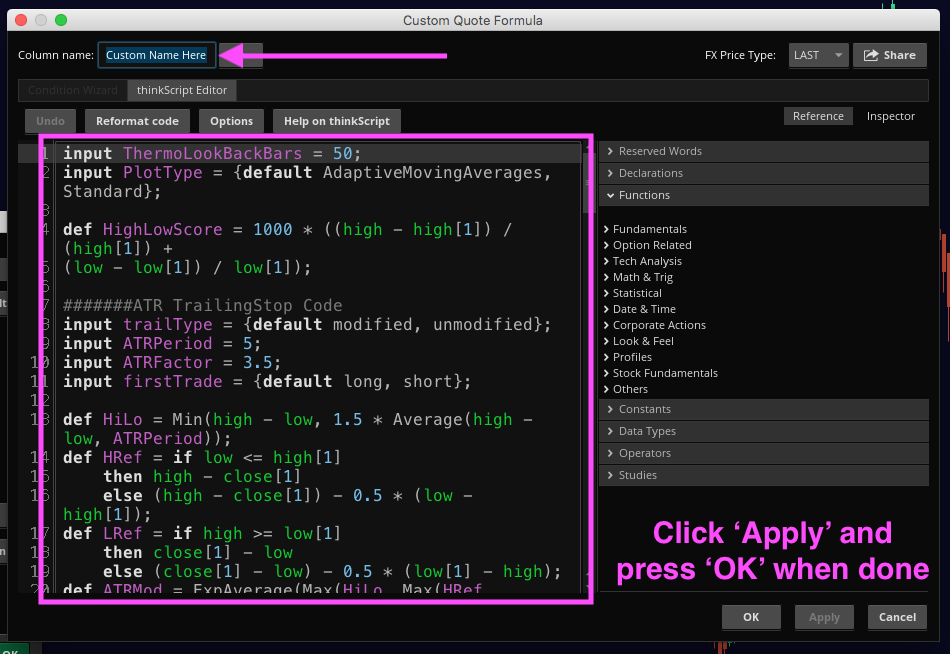

https://usethinkscript.com/threads/...or-with-buy-sell-signals-for-thinkorswim.226/

so I added it as a column in my watchlist.

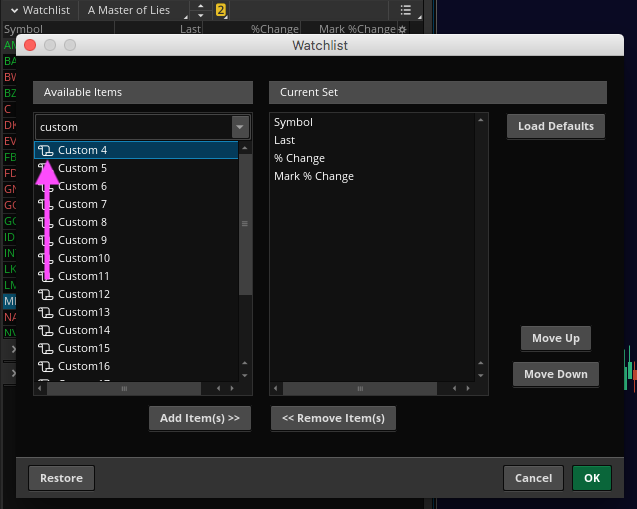

1. Click Gear -> Click Customize...

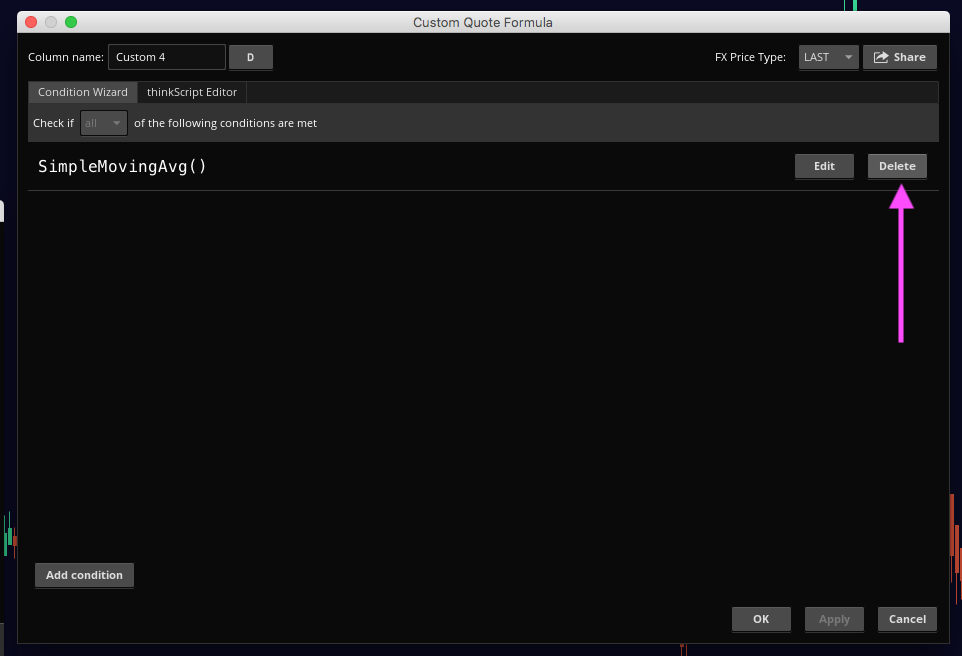

2. Search 'custom' and click the script icon for one of the options. I used 'Custom 4'

3. Delete the default study/condition.

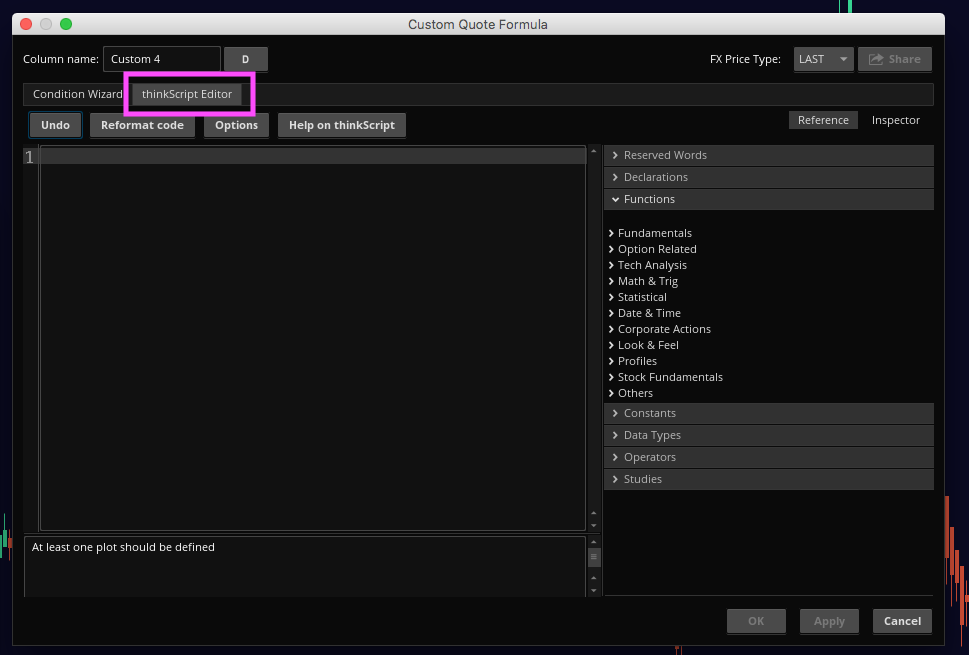

4. Click 'thinkScript Editor' tab

5. Add a name and remember it to add it later -> paste in the script -> click 'Apply' and 'OK'

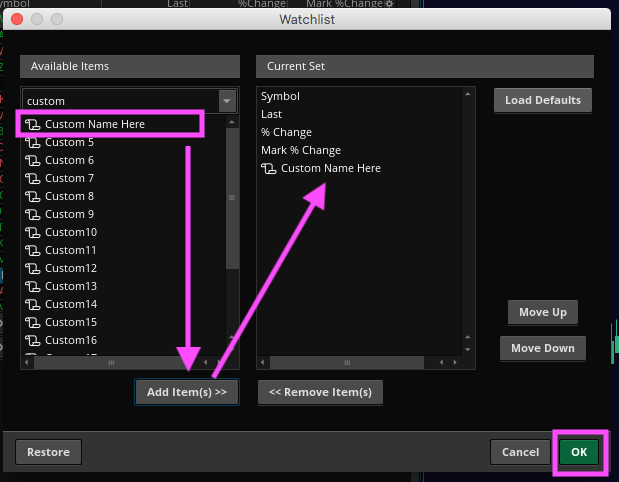

6. Find what you just created and add it to the columns in 'Current Set'

7. Valla

I'm a fan of this indicator:

https://usethinkscript.com/threads/...or-with-buy-sell-signals-for-thinkorswim.226/

so I added it as a column in my watchlist.

1. Click Gear -> Click Customize...

2. Search 'custom' and click the script icon for one of the options. I used 'Custom 4'

3. Delete the default study/condition.

4. Click 'thinkScript Editor' tab

5. Add a name and remember it to add it later -> paste in the script -> click 'Apply' and 'OK'

Code:

input ThermoLookBackBars = 50;

input PlotType = {default AdaptiveMovingAverages, Standard};

def HighLowScore = 1000 * ((high - high[1]) / (high[1]) +

(low - low[1]) / low[1]);

#######ATR TrailingStop Code

input trailType = {default modified, unmodified};

input ATRPeriod = 5;

input ATRFactor = 3.5;

input firstTrade = {default long, short};

def HiLo = Min(high - low, 1.5 * Average(high - low, ATRPeriod));

def HRef = if low <= high[1]

then high - close[1]

else (high - close[1]) - 0.5 * (low - high[1]);

def LRef = if high >= low[1]

then close[1] - low

else (close[1] - low) - 0.5 * (low[1] - high);

def ATRMod = ExpAverage(Max(HiLo, Max(HRef, LRef)), 2 * ATRPeriod - 1);

def loss;

switch (trailType) {

case modified:

loss = ATRFactor * ATRMod;

case unmodified:

loss = ATRFactor * Average(TrueRange(high, close, low), ATRPeriod);

}

rec state = {default init, long, short};

rec trail;

switch (state[1]) {

case init:

if (!IsNaN(loss)) {

switch (firstTrade) {

case long:

state = state.long;

trail = close - loss;

case short:

state = state.short;

trail = close + loss;

}

} else {

state = state.init;

trail = Double.NaN;

}

case long:

if (close > trail[1]) {

state = state.long;

trail = Max(trail[1], close - loss);

}

else {

state = state.short;

trail = close + loss;

}

case short:

if (close < trail[1]) {

state = state.short;

trail = Min(trail[1], close + loss);

}

else {

state = state.long;

trail = close - loss;

}

}

def BuySignal = Crosses(state == state.long, 0, CrossingDirection.ABOVE);

def SellSignal = Crosses(state == state.short, 0, CrossingDirection.ABOVE);

plot TrailingStop = trail;

TrailingStop.Hide();

####End ATR Trailing Stop Code

def A = Highest(high[1], ThermoLookBackBars);

def B = Lowest(low[1], ThermoLookBackBars);

def FiftyTwoWeekHigh = A;

def FiftyTwoWeekLow = B;

def FiftyTwoWeekScore = 10 * (((high

- FiftyTwoWeekHigh) / FiftyTwoWeekHigh) +

((low - FiftyTwoWeekLow) / FiftyTwoWeekLow));

def ThermoScore = ExpAverage(HighLowScore + FiftyTwoWeekScore, ThermoLookBackBars);

input FastLengthShort = 5;

input SlowLengthShort = 15;

input EffRatioShort = 10;

input FastLengthLong = 10;

input SlowLengthLong = 25;

input EffRatioLong = 5;

def AMA = MovAvgAdaptive(ThermoScore, FastLengthShort, SlowLengthShort, EffRatioShort);

def AMA2 = MovAvgAdaptive(ThermoScore, FastLengthLong, SlowLengthLong, EffRatioLong);

plot Line1;

Line1.Hide();

plot Line2;

Line2.Hide();

switch (PlotType) {

case AdaptiveMovingAverages:

Line1 = AMA;

Line2 = AMA2;

case Standard:

Line1 = ThermoScore;

Line2 = ThermoScore;

}

def InvisibleLine = close * 0;

plot Line3 = InvisibleLine;

Line3.Hide();

def Buy = Line1 > 0 and Line2 < 0 and state == state.long;

def StrongBuy = Line1 > 0 and Line2 >= 0 and state == state.long;

def Sell = Line1 < 0 and Line2 > 0 and state == state.short;

def StrongSell = Line1 < 0 and Line2 <= 0 and state == state.short;

AddLabel(yes, Concat("", (

if Buy then "Up"

else if StrongBuy then "Strong Up"

else if Sell then "Down"

else if StrongSell then "Strong Down"

else "Neutral"

)),

Color.BLACK

);

AssignBackgroundColor(

if Buy then Color.DARK_GREEN

else if StrongBuy then Color.GREEN

else if Sell then Color.DARK_RED

else if StrongSell then Color.RED

else Color.GRAY

);6. Find what you just created and add it to the columns in 'Current Set'

7. Valla

Last edited by a moderator: