B-rad

New member

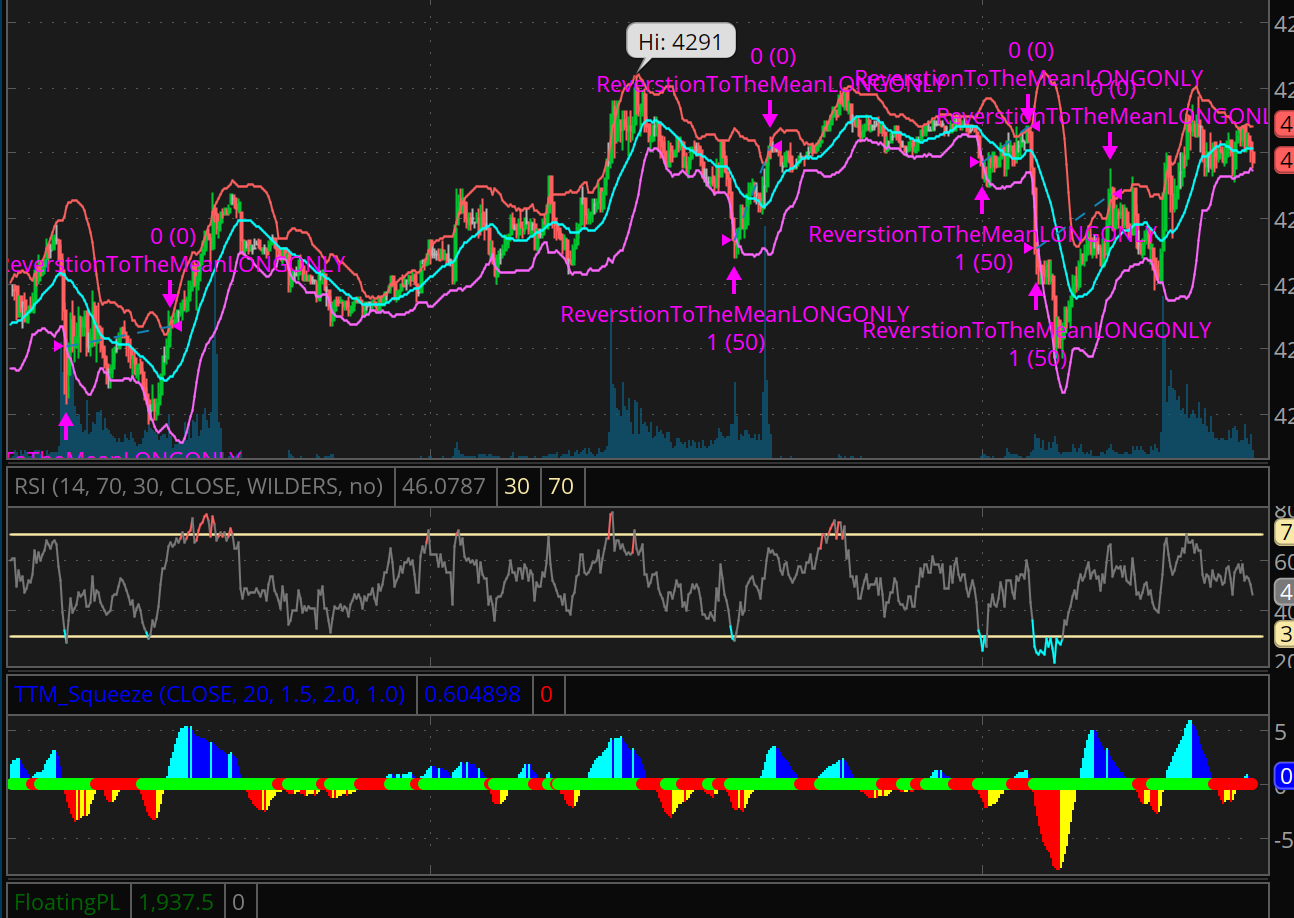

I have managed to learn some thinkscript basics and frankensteined some code together to create a profitable strategy when backtested. My issue is that when I change the backtest into a regular study (with indicators for entry and exit points) it seems that something is lost in translation.

The strategy is a simple one I found on a free youtube video from John Carter involving a regression to the mean, and I have now modified slightly. The three required conditions for an long entry are:

Note how the down arrows are referencing every instance where price is above the upper bollinger band whereas -below in strategies- they only fire after an entry point is signaled.

I have had this same issue with other code on different strategies as well. I don't know, maybe I should have paid more attention to my high school geometry teacher when she was taking about 'If and only if' logical statements..... Any ideas?

The strategy is a simple one I found on a free youtube video from John Carter involving a regression to the mean, and I have now modified slightly. The three required conditions for an long entry are:

- RSI below 30

- Not in a TTM squeeze

- and the current price below the lower bollinger band

#bollingerbands

input price = close;

input displace = 0;

input length = 20;

input Num_Dev_Dn = -2.0;

input Num_Dev_up = 2.0;

input averageType = AverageType.SIMPLE;

def sDev = StDev(data = price[-displace], length = length);

def MidLine = MovingAverage(averageType, data = price[-displace], length = length);

def LowerBand = MidLine + Num_Dev_Dn * sDev;

def UpperBand = MidLine + Num_Dev_up * sDev;

#bollingerbandsEND

#RSI

input length2 = 14;

input over_Bought = 70;

input over_Sold = 30;

input price2 = close;

input averageType2 = AverageType.WILDERS;

input showBreakoutSignals = no;

def NetChgAvg = MovingAverage(averageType2, price2 - price2[1], length);

def TotChgAvg = MovingAverage(averageType2, AbsValue(price2 - price2[1]), length);

def ChgRatio = if TotChgAvg != 0 then NetChgAvg / TotChgAvg else 0;

def RSI = 50 * (ChgRatio + 1);

def OverSold = over_Sold;

def OverBought = over_Bought;

def UpSignal = if RSI crosses above OverSold then OverSold else Double.NaN;

def DownSignal = if RSI crosses below OverBought then OverBought else Double.NaN;

#RSI END

#ttmsqueeze start

input price3 = close;

input length3 = 20;

input Num_Dev_Dn3 = -2.0;

input Num_Dev_up3 = 2.0;

input averageType3 = AverageType.SIMPLE;

input displace3 = 0;

def sDev3 = StDev(data = price3[-displace], length = length3);

def MidLineBB = MovingAverage(averageType, data = price3[-displace3], length = length);

def LowerBandBB = MidLineBB + Num_Dev_Dn * sDev3;

def UpperBandBB = MidLineBB + Num_Dev_up * sDev3;

input factorhigh = 1.0;

input factormid = 1.5;

input factorlow = 2.0;

input trueRangeAverageType3 = AverageType.SIMPLE;

def shifthigh = factorhigh * MovingAverage(trueRangeAverageType3, TrueRange(high, close, low), length3);

def shiftMid = factormid * MovingAverage(trueRangeAverageType3, TrueRange(high, close, low), length);

def shiftlow = factorlow * MovingAverage(trueRangeAverageType3, TrueRange(high, close, low), length);

def average = MovingAverage(averageType, price3, length3);

def Avg = average[-displace];

def UpperBandKCLow = average[-displace] + shiftlow[-displace];

def LowerBandKCLow = average[-displace] - shiftlow[-displace];

def UpperBandKCMid = average[-displace] + shiftMid[-displace];

def LowerBandKCMid = average[-displace] - shiftMid[-displace];

def UpperBandKCHigh = average[-displace] + shifthigh[-displace];

def LowerBandKCHigh = average[-displace] - shifthigh[-displace];

def K = (Highest(high, length3) + Lowest(low, length3)) /

2 + ExpAverage(close, length3);

def momo = Inertia(price3 - K / 2, length3);

def pos = momo >= 0;

def neg = momo < 0;

def up = momo >= momo[1];

def dn = momo < momo[1];

def presqueeze = LowerBandBB > LowerBandKCLow and UpperBandBB < UpperBandKCLow;

def originalSqueeze = LowerBandBB > LowerBandKCMid and UpperBandBB < UpperBandKCMid;

def ExtrSqueeze = LowerBandBB > LowerBandKCHigh and UpperBandBB < UpperBandKCHigh;

def PosUp = pos and up;

def PosDn = pos and dn;

def NegDn = neg and dn;

def NegUp = neg and up;

def squeezeline = 0;

def momentum = momo;

#ttmsqueezeEND

Def longEntryPoint = if !presqueeze and !originalsqueeze and !extrsqueeze and (price <= lowerband) and (price > oversold) then 1 else 0;

Def longExitPoint = price >= upperband;

plot Longentry = if longentrypoint and !longentrypoint[1] then 1 else 0;

Longentry.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

Plot Longexit = if longexitpoint then 1 else 0;

Longentry.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

Note how the down arrows are referencing every instance where price is above the upper bollinger band whereas -below in strategies- they only fire after an entry point is signaled.

I have had this same issue with other code on different strategies as well. I don't know, maybe I should have paid more attention to my high school geometry teacher when she was taking about 'If and only if' logical statements..... Any ideas?