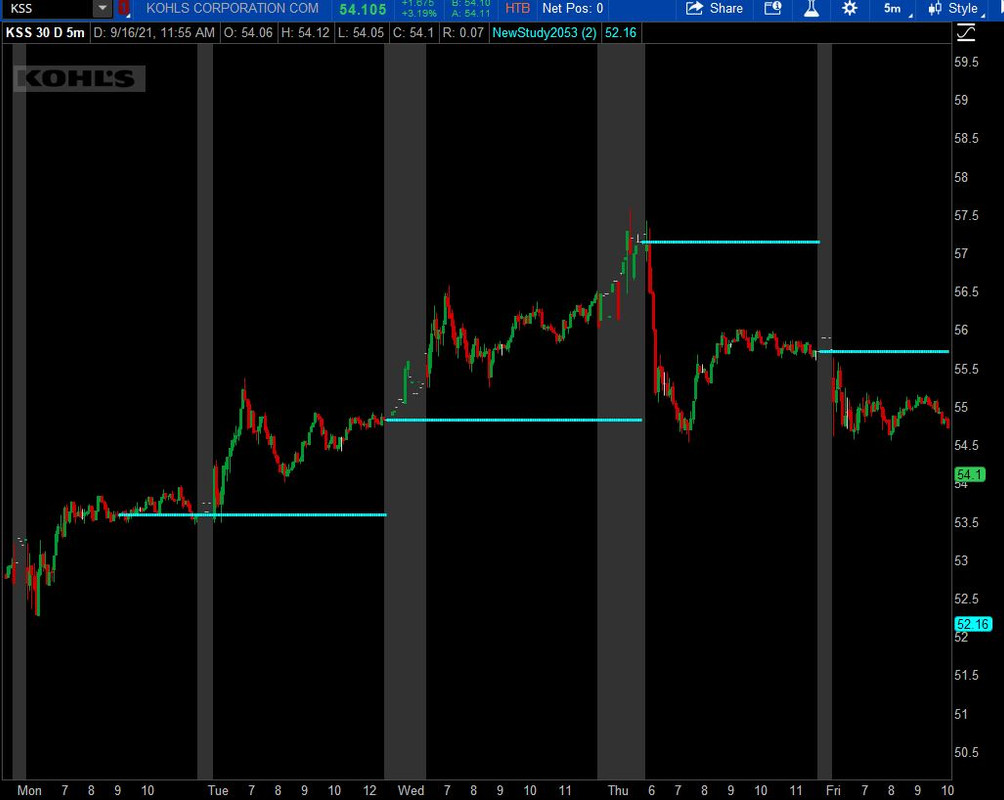

This is my version of code. but its not even close to that in the picture in plotting the lines.

input LookFrontPeriod = 50;

def vClose = Round(Close, 1);

def vOpen = Round(Open, 1);

def bn = barnumber();

def nan = double.NaN;

#--------------------------------------------------------------

def _CloseInPeriod = vClose;

#--------------------------------------------------------------

##Logic: for every bar's close value, look front LookFrontPeriod bars for same close, if true then return close else move ahead one bar front

def marketClose1 = if _CloseInPeriod == _CloseInPeriod[LookFrontPeriod] then _CloseInPeriod else nan;

def marketClose1bn = if _CloseInPeriod == _CloseInPeriod[LookFrontPeriod] then bn else marketClose1bn[1];

##if above def is true then capture the close price of the bar where the def first is true

def _markedClose1 = vClose == marketClose1;

def _markedClose1bn = bn == marketClose1bn;

##Loop until no close price exist on the chart i.e until last bar of the chart

rec _lastMarkedLow1 = CompoundValue(1, if IsNaN(_markedClose1) then _lastMarkedLow1[1] else if _markedClose1 then vClose else _lastMarkedLow1[1], vClose);

rec _lastMarkedLow1bn = CompoundValue(1, if IsNaN(_markedClose1bn) then _lastMarkedLow1bn[1] else if _markedClose1bn then _markedClose1bn else _lastMarkedLow1bn[1], bn);

#--------------------------------------------------------------

##Plots and formatting

plot SR1 = Lowestall(_lastMarkedLow1);

#plot SR1 = Highestall(_lastMarkedLow1);

#SR1.SetStyle(Curve.Short_Dash);

SR1.SetLineWeight(1);

#SR1.SetDefaultColor(color.gray);

SR1.AssignValueColor(if vClose == SR1 then color.gray else

if vClose > SR1 then Color.Dark_Green else

if vClose < SR1 then Color.Dark_Red else color.gray);

AssignPriceColor(if vClose == SR1 then color.magenta else color.current);

Ruby:

Ruby: