Miami51961

Member

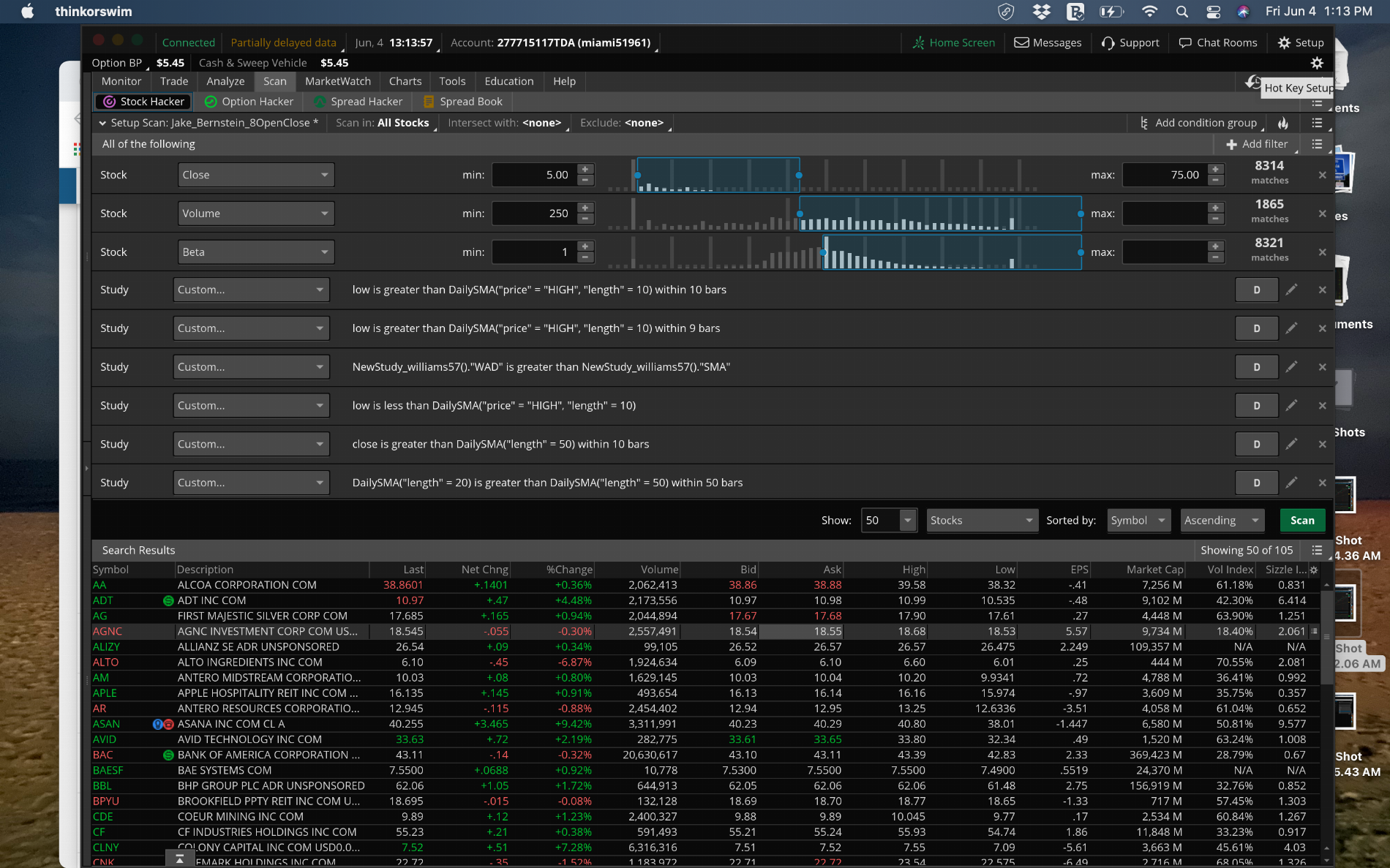

I was looking to develop a scan for Jake Bersiens MA average channel strategy. I made a scan in the TOS scanner, but it does not do the consecutive days right. The scan is for two consecutive days above the 10 MA of the highs followed by a dip (low) below the 10 MA high channel touching or close to the 8 days MA of the low. I am new to coding, so I have an idea how to do the consecutive day part. I want to only look no more than 10 days back as this a good time frame for the price to correct back to the channel bottom. Any help would be appreciated, and if more information is needed, please let me know