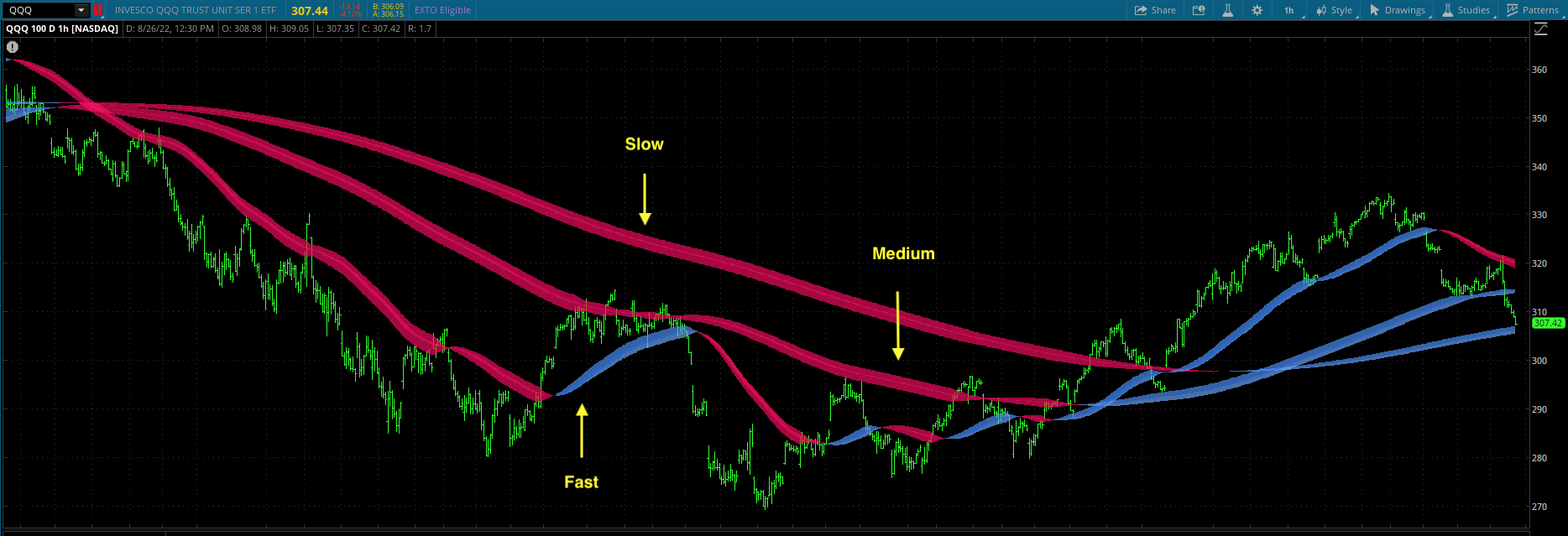

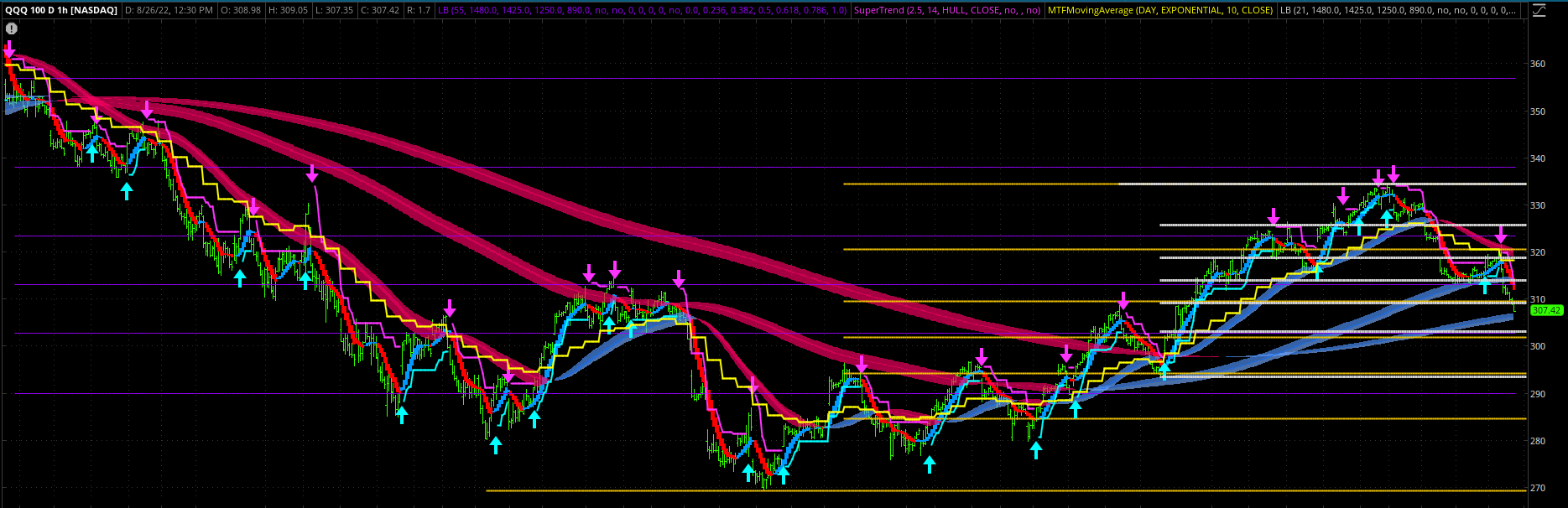

This strategy consists of several indicators formulated into a single system, primarily using a MT4 indicator called Heiken Ashi Entry/Exit that I converted for ToS. It can work on all timeframes, but it is exponentially effective on 1h, 4h, & 1d charts for swing trading. It's recommended that this system is used for trading high-trending instruments - I use it only on QQQ, SPY, /ES, & AAPL. Don't force this system on trading any stock/instrument on any timeframe. All indicators/settings and rules for this system will be explained with setup shown in a sequential order. However, preferences for the specific settings are to each trader's own. All examples will be based on a 100d chart of 1h bars; traders should be aware that indicator settings might vary depending on the timeframe being used.

Plot #2 medium: Exponential w/ period1 of 200, Exponential w/ period2 of 50

Plot #3 fast: Exponential w/ period1 of 50, Exponential w/ period2 of 20

*Indicator provides excellent support/resistance for swing trading, as well as showing the short, middle, & long term trends

[/IMG]

[/IMG]

Credit to Sam4COK:

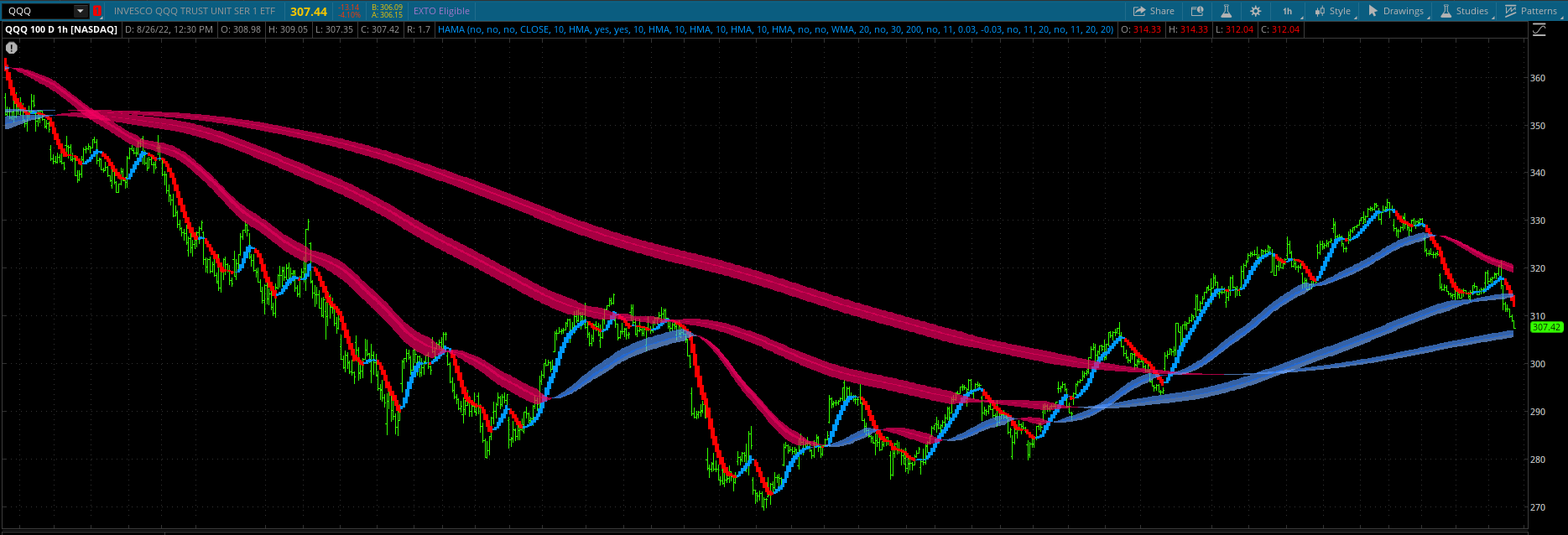

2) Settings for NSDT HAMA Candles:

Trend source - close

HAMA length - 10

HAMA type - HMA

HAMA bar - yes

HAMA ma - yes

Open, High, Low, Close length - 10

Open, High, Low, Close types - HMA

All filters & other plots- off

All globals/colors - only red/blue - no various colors for neutral & different bear/bull bars etc to eliminate extra noise for swing trading. If it's a bear bar it's red & if it's a bull bar it's blue. Neutral bars are blue.

*Indicator works in unison with the ribbons & eliminates more noise

[/IMG]

[/IMG]

Credit to Linus:

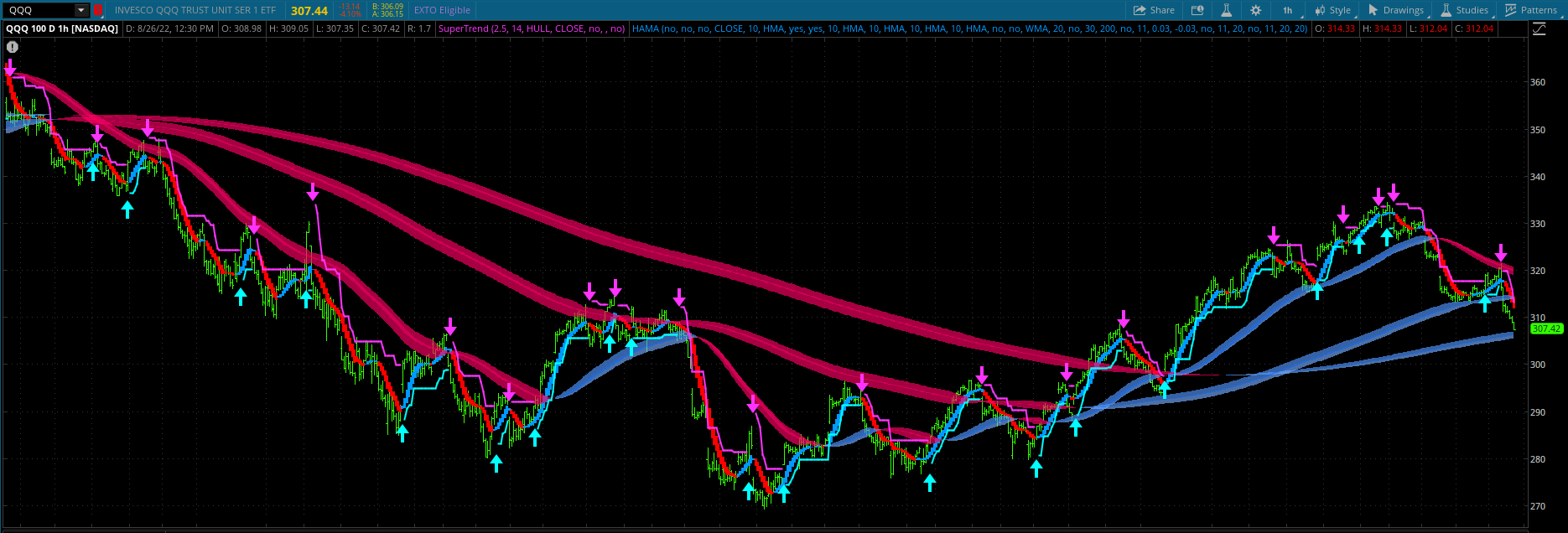

3) Settings for SuperTrend:

ATR mult - 2.5

ATR length - 14

ATR type - Hull

Pivot - close

*Indicator's importance speaks for itself

[/IMG]

[/IMG]

Credit to BenTen:

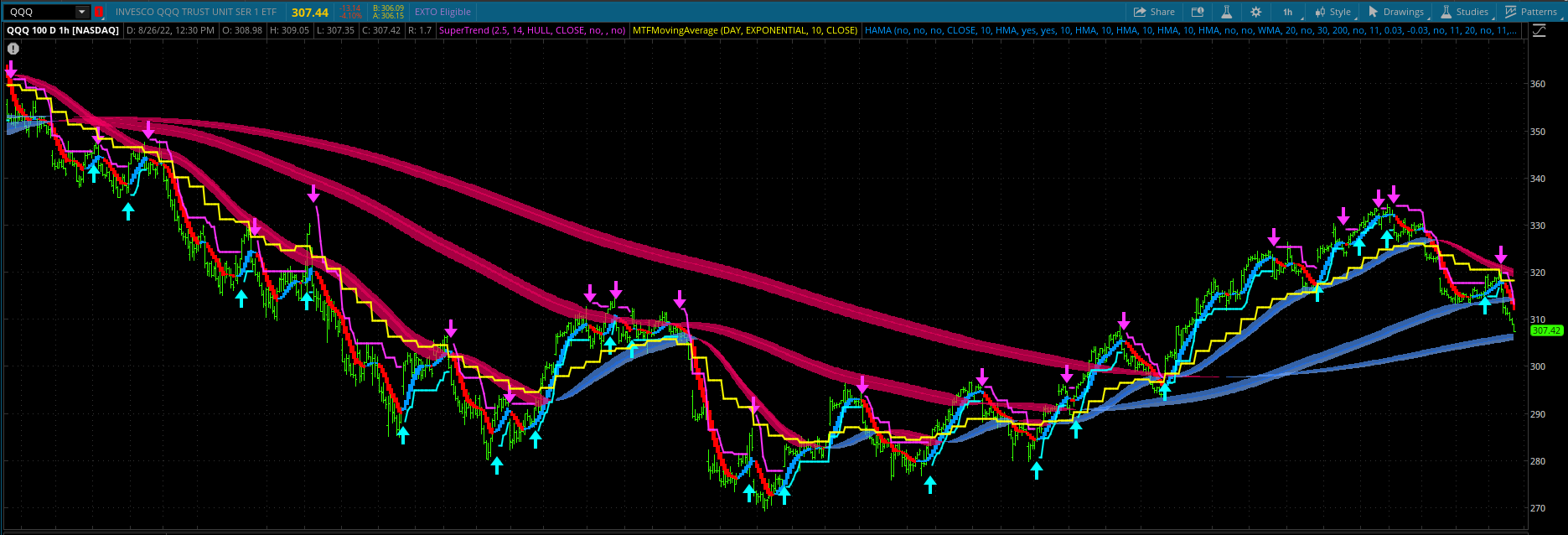

4) Settings for MTF Moving Average:

Period - day

Type - exponential

Length - 10

Priceclose - close

*Indicator might not be necessary, but the stepped display helps provide solid visual from a different perspective in terms of trend w/ the fast ribbon

[/IMG]

[/IMG]

Credit to Mobius:

5) Settings for Limbo Bars:

Plot #1 - bars for fib 1-7 & AH-XL - 55 (purple & yellow)

Plot #2 - bars for AH-XL - 21 (white & no fib plot)

Plot #1 & Plot #2 - everything else deselected

*Indicator is vital to help strengthen resistance/support signals along with the ribbons, especially the when price/bar hits both at the same time in terms of confluence

[/IMG]

[/IMG]

Credit to DaysOff:

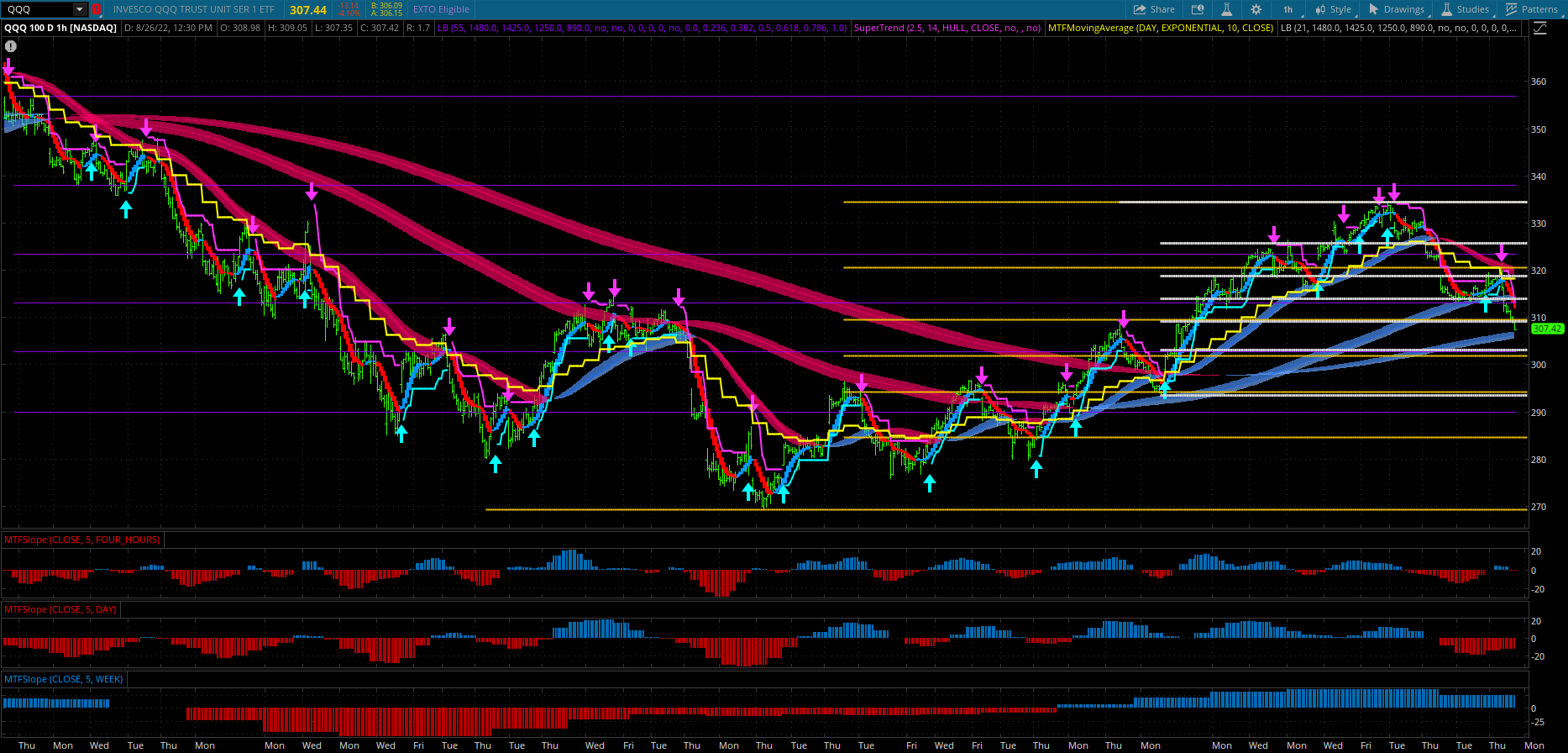

6) Settings for MTF Moving Average Slope Histogram:

Plot #1 - price Close, length 5, agg 4h

Plot #2 - price Close, length 5, agg 1d

Plot #3 - price Close, length 5, agg 1w

*Note that I don't include the timeframe that is the same as the chart, in this case a 1h slope indicator. I start the slope indicator with the next sequential timeframe being 4h; it's just a personal preference of mine.

*Indicator is 100% essential for a swing trading system - when you swing trade you are essentially trading the slopes

[/IMG]

[/IMG]

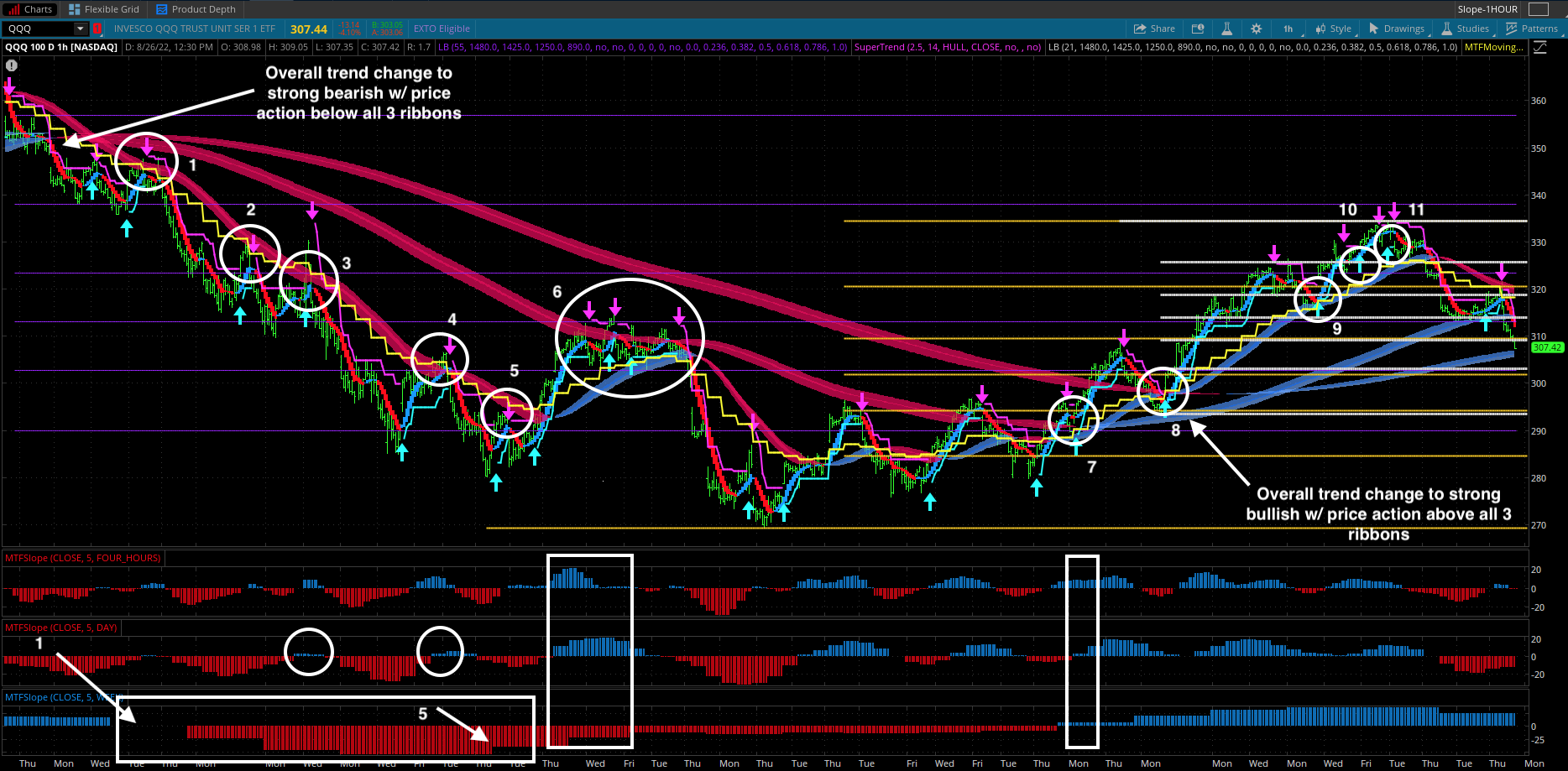

Rules for Heiken Ashi Entry/Exit system (see pic below for reference when going over each rule):

1) Taking positions/trades during strong bearish trend: when the highest timeframe (week) is bearish (red) for the lower MTF slope study - sell/short the rips when the price/bar meets resistance at the fast moving Heiken Ashi ribbon with SuperTrend down signal - as noted by white circles. You want the middle timeframe (day) to be bearish (red) or relatively flat if weak bullish (blue). The sell/short signal is stronger when the price/bar meets resistance at both the ribbon and fib level at the same time as you can see at circles 3 and 4 - this helps making confident trades since the the middle 1d timeframe is weak bullish/flat/blue at those specific points. If price/bar meets both indicators of resistance, I use it as confirmation to negate the weak bullish signal and enter my short/sell position. You will notice that for circles 1 and 5, the highest timeframe (week) slope changed. For circle 1, the slope went from bullish/blue to neutral/black - but you know this is still mostmlikely confirmation of the transition to a strong bearish trend since the price/bar broke below all 3 ribbons earlier. For circle 5, the bearish slope moved up one level indicating a possible start to a more bullish trend - if you still took this trade it might have ended in a loss or broke even, but this is why you have your stops - let the winners ride and cut the losses short. You would have had 4/5 winners.

2) Taking positions/trades during weak/neutral bearish/bullish trend: when price/bars break through 1st major resistance ribbon/level, I still sell/short the rips if there are still 2 upper resistance levels/ribbons to break through. I scale my profits and sell 1/3rd of my position on first profitable bar (in this case the first profitable down bar since I'm shorting/selling), the next 1/3rd on the next profitable bar, and the last 1/3rd at my stop. In circle 6, you will see that the price action was sandwiched and bouncing between the two ribbons, which resulted in a classic bull trap. This is why I always sell the last 1/3rd of my position at the next stop if price/bars are between to ribbons like this - in hopes of catching major profits if in fact a big sell off does occur from the bull trap. The same goes for the opposite - I'll buy the dip if there are still 2 lower resistance levels/ribbons to break through, but will sell the last 1/3rd of my position at the next stop in hopes of catching profits from a bear trap. In the rectangle below circle 6, one thing to look for is a sudden increase in the 4h & 1d timeframes bullish/blue bars - this sudden and not gradual increase in the 2 lower timeframes is an indication that a bull trap might be in the near future. Same goes for the opposite resulting in a bear trap.

3) Taking positions/trades during the start of an overall trend change: at circle 7 all 3 of the slopes are newly blue - I always take these trades & let them ride to the next stop. 95% of the time this means your next buy or sell trade will be when the overall trend has changed to strong bullish/bearish w/ price/bar being above or below all 3 ribbons. Same goes for the opposite in taking short positions if all 3 slopes are newly red. This is why it's important to use this system for high-trending instruments and not just any stock/instrument as you will get false signals from the 3 slope indicators if there isn't confluence.

4) Taking positions/trades during strong bullish trend: the opposite of the first rule mentioned above. If you do buy the dip from a SuperTrend signal without the price/bar hitting resistance level/ribbon or fib, make sure to use your stops to cut your losses as shown in circles 10 & 11, but let the winners ride as shown in circles 8 & 9.

Bonus note: pay attention to circle 6 & the price action after circle 11 - just as there was a rapid breakthrough of the 1st resistance level/ribbon leading up to circle 6, there was also a rapid breakthrough of the 1st resistance level/ribbon after circle 11. However, notice the price/bars also rapidly broke through the 2nd resistance level/ribbon with the 3rd resistance level/ribbon now being tested. The fib level is practically at the same level as circle 6 - this could be a bear trap soon. This is just another thing to be aware of when recent price action is highly active in contact with resistance levels that are parallel to a past area of high confluence like circle 6.

[/IMG]

[/IMG]

Plot #1 slow: Exponential w/ period1 of 250, Exponential w/ period2 of 200#Converted MT4 HeikinAshi_EntryExit Indicator

#MikeLikesAnacottSteel

#8-27-2022

#MT4 indicator source: https://forex-station.com/app.php/attach/file/3349947

input MaMethod1 = AverageType.EXPONENTIAL;

input MaPeriod = 40;

input MaMethod2 = AverageType.EXPONENTIAL;

input MaPeriod2 = 1;

def maOpen = MovingAverage(MaMethod1, Open, MaPeriod);

def maClose = MovingAverage(MaMethod1, Close, MaPeriod);

def maLow = MovingAverage(MaMethod1, Low, MaPeriod);

def maHigh = MovingAverage(MaMethod1, High, MaPeriod);

def haClose=(maOpen+maHigh+maLow+maClose)/4;

def haOpen=(GetValue(haOpen, 1)+GetValue(haClose, 1))/2;

def haHigh=Max(maHigh, Max(haOpen, haClose));

def haLow=Min(maLow, Min(haOpen, haClose));

def ExtMapBuffer7;

def ExtMapBuffer8;

if(haOpen<haClose)

{

ExtMapBuffer7=haLow;

ExtMapBuffer8=haHigh;

}

else

{

ExtMapBuffer7=haHigh;

ExtMapBuffer8=haLow;

}

def ExtMapBuffer5=haOpen;

def ExtMapBuffer6=haClose;

Plot ExtMapBuffer1 = MovingAverage(MaMethod2, ExtMapBuffer7, MaPeriod2);

Plot ExtMapBuffer2 = MovingAverage(MaMethod2, ExtMapBuffer8, MaPeriod2);

Plot ExtMapBuffer3 = MovingAverage(MaMethod2, ExtMapBuffer5, MaPeriod2);

Plot ExtMapBuffer4 = MovingAverage(MaMethod2, ExtMapBuffer6, MaPeriod2);

ExtMapBuffer1.SetDefaultColor(Color.RED);

ExtMapBuffer1.SetPaintingStrategy(PaintingStrategy.LINE);

ExtMapBuffer1.SetLineWeight(1);

ExtMapBuffer2.SetDefaultColor(Color.BLUE);

ExtMapBuffer2.SetPaintingStrategy(PaintingStrategy.LINE);

ExtMapBuffer2.SetLineWeight(1);

ExtMapBuffer3.SetDefaultColor(Color.RED);

ExtMapBuffer3.SetPaintingStrategy(PaintingStrategy.LINE);

ExtMapBuffer3.SetLineWeight(1);

ExtMapBuffer4.SetDefaultColor(Color.BLUE);

ExtMapBuffer4.SetPaintingStrategy(PaintingStrategy.LINE);

ExtMapBuffer4.SetLineWeight(1);

AddCloud(ExtMapBuffer1, ExtMapBuffer2, CreateColor(255,0,102), CreateColor(0, 102, 255));

AddCloud(ExtMapBuffer1, ExtMapBuffer4, CreateColor(255,0,102), CreateColor(0, 102, 255));

AddCloud(ExtMapBuffer2, ExtMapBuffer1, CreateColor(0, 1-2, 255), CreateColor(255,0,102));

AddCloud(ExtMapBuffer2, ExtMapBuffer3, CreateColor(0, 102, 255), CreateColor(255,0,102));

AddCloud(ExtMapBuffer3, ExtMapBuffer4, CreateColor(255,0,102), CreateColor(0, 102, 255));

Plot #2 medium: Exponential w/ period1 of 200, Exponential w/ period2 of 50

Plot #3 fast: Exponential w/ period1 of 50, Exponential w/ period2 of 20

*Indicator provides excellent support/resistance for swing trading, as well as showing the short, middle, & long term trends

Credit to Sam4COK:

#study("NSDT HAMA Candles", overlay=true)

#//The follow gradient code is taken from the Pinecoders Gradient Framework example.

#//https://www.tradingview.com/script/hqH4YIFa-Color-Gradient-Framework-PineCoders/

#https://www.tradingview.com/script/k7nrF2oI-NSDT-HAMA-Candles/

# included SSL Channel https://www.tradingview.com/script/6y9SkpnV-SSL-Channel/

# Youtube strategy#Converted by Sam4Cok @ 07/2022

#Ver 1.1 by Sam4Cok @ 07/2022 -- Added Filters (ADX / TDFI / Range Indicator and options to Show/Hide indicators

#Ver 1.2 by Sam4COK @ 07/2022 -- Added Background Color, RSI Filter, signal enhancment.

#//INPUTS

input ColorBar = no;

input showArrow = yes;

input BackgroundColor = no;

### NSDT ###

input TrendSource = close;

input HAMALength = 69;

input HAMAType = {default EMA, WMA, SMA, HMA};

input HAMABar = yes;

input HAMAMa = yes;

#//MA INFO

input OpenLength = 25; #"Length Open"

input OpenType = {default EMA, SMA, WMA, HMA}; #"Type Open"

input HighLength = 20; #"Length High"

input HighType = {default EMA, SMA, WMA, HMA}; #"Type High"

input LowLength = 20; #"Low"

input LowType = {default EMA, SMA, WMA, HMA}; #"Type Low"

input CloseLength = 20; #"Length Close"

input CloseType = {default EMA, SMA, WMA, HMA}; #"Close"

### SSL1Source ###

input ShowSSL = yes; #(true, "Highlight State ?")

input SSLWicks = no;#(false, "Take Wicks into Account ?")

input SSLType = {WMA, default SMA, EMA, HMA};

input SSL_MaLength = 69; #"MA "Channel ?

### RSI ###

input RSIFilter = no;

input RSILength = 30;

input RSIMovAvg = 200;

### TDFI ###

input TDFIFilter = no;

input TDFIPeriod = 11; # "Lookback"

input TDFIAbove = 0.03; # "Filter High"

input TDFIBelow = -0.03; # "Filter Low"

### ADX ###

input ADXFilter = no;

input ADXLength = 11;

input ADXLimit = 20;

### Range Indicator

input RangeIndicatorFilter = no;

input RILength = 11;

input RangeLimit = 20;

input RangeSmoothing = 5;

##################

def na = Double.NaN;

########## Colors ########

DefineGlobalColor("Bull" , CreateColor(38, 166, 154)); # HAMA GREEN - Teal

DefineGlobalColor("Bear" , CreateColor(239, 83, 80)); # HAMA Red

DefineGlobalColor("WeakBull" , CreateColor(204, 204, 0)); # HAMA DARK Yellow

DefineGlobalColor("WeakBear" , CreateColor(255, 128, 0)); # HAMA Orange

DefineGlobalColor("Neutral" , CreateColor(255, 255, 0)); # HAMA Yellow

DefineGlobalColor("BullBar" , CreateColor(0, 255, 0)); # GREEN

DefineGlobalColor("WeakBullBar" , CreateColor(0, 128, 0)); # Dark GREEN

DefineGlobalColor("BearBar" , CreateColor(255, 0, 0)); # Red

DefineGlobalColor("WeakBearBar" , CreateColor(128, 0, 0)); # DARK RED

DefineGlobalColor("NeutralBar" , CreateColor(255, 255, 0)); # yellow

DefineGlobalColor("BGBull" , CreateColor (153, 255, 153));

DefineGlobalColor("BGBear" , CreateColor (255, 153, 153));

#////////////////////////////////////////////////////////////////////////////////

#mat(source, length, type) =>

script mat {

input source = close;

input length = 69;

input type = "EMA";

def mat;

mat =

if type == "SMA" then SimpleMovingAvg(source, length) else

if type == "EMA" then ExpAverage(source, length) else

if type == "WMA" then WMA(source, length) else

if type == "HMA" then WMA(2 * WMA(source, length / 2) - WMA(source, length), Round(Sqrt(length)))

else Double.NaN;

plot result = mat;

}

def ma = WMA(TrendSource, HAMALength);

#//GRADIENT AREA

def center = ExpAverage(ma, 3);

def xUp = ma crosses above center;

def xDn = ma crosses below center;

def chg = ma - ma[1];

def up = chg > 0;

def dn = chg < 0;

def srcBull = ma > center;

def srcBear = ma < center;

#### TREND####

def StrongUP = srcBull and up;

def WeakUp = srcBull and dn;

def StrongDN = srcBear and dn;

def WeakDN = srcBear and up;

def Neutral = xUp or xDn or !StrongUP and !StrongDN and !WeakUp and !WeakDN;

def SourceClose = (open + high + low + close) / 4;

def LengthClose = CloseLength;

def SourceOpen = CompoundValue(1, (SourceOpen[1] + SourceClose[1]) / 2, SourceClose) ;

def LengthOpen = OpenLength;

def SourceHigh = Max(Max(high, SourceOpen), SourceClose);

def LengthHigh = HighLength;

def SourceLow = Min(Min(low, SourceOpen), SourceClose);

def LengthLow = LowLength;

#funcCalcMA1(type1, src1, len1) =>

script funcCalcMA1 {

input type1 = "EMA";

input src1 = close;

input len1 = 0;

def funcCalcMA1;

funcCalcMA1 = if type1 == "SMA" then SimpleMovingAvg(src1, len1) else

if type1 == "EMA" then ExpAverage(src1, len1) else WMA(src1, len1);

plot result = funcCalcMA1;

}

#funcCalcOpen(TypeOpen, SourceOpen, LengthOpen) =>

script funcCalcOpen {

input TypeOpen = "EMA";

input SourceOpen = close;

input LengthOpen = 0;

def funcCalcOpen;

funcCalcOpen = if TypeOpen == "SMA" then SimpleMovingAvg(SourceOpen, LengthOpen) else

if TypeOpen == "EMA" then ExpAverage(SourceOpen, LengthOpen) else WMA(SourceOpen, LengthOpen);

plot result = funcCalcOpen;

}

#funcCalcHigh(TypeHigh, SourceHigh, LengthHigh) =>

script funcCalcHigh {

input TypeHigh = "EMA";

input SourceHigh = close;

input LengthHigh = 0;

def funcCalcHigh;

funcCalcHigh = if TypeHigh == "SMA" then SimpleMovingAvg(SourceHigh, LengthHigh) else

if TypeHigh == "EMA" then ExpAverage(SourceHigh, LengthHigh) else WMA(SourceHigh, LengthHigh);

plot result = funcCalcHigh;

}

#funcCalcLow(TypeLow, SourceLow, LengthLow) =>

script funcCalcLow {

input TypeLow = "EMA";

input SourceLow = close;

input LengthLow = 0;

def funcCalcLow;

funcCalcLow = if TypeLow == "SMA" then SimpleMovingAvg(SourceLow, LengthLow) else

if TypeLow == "EMA" then ExpAverage(SourceLow, LengthLow) else WMA(SourceLow, LengthLow);

plot result = funcCalcLow;

}

#funcCalcClose(TypeClose, SourceClose, LengthClose) =>

script funcCalcClose {

input TypeClose = "EMA";

input SourceClose = close;

input LengthClose = 0;

def funcCalcClose;

funcCalcClose = if TypeClose == "SMA" then SimpleMovingAvg(SourceClose, LengthClose) else

if TypeClose == "EMA" then ExpAverage(SourceClose, LengthClose) else WMA(SourceClose, LengthClose);

plot result = funcCalcClose;

}

# Plot the new Chart

def CandleOpen = funcCalcOpen(OpenType, SourceOpen, LengthOpen);

def CandleHigh = funcCalcHigh(HighType, SourceHigh, LengthHigh);

def CandleLow = funcCalcLow(LowType, SourceLow, LengthLow);

def CandleClose = funcCalcClose(CloseType, SourceClose, LengthClose);

def MAValue = funcCalcMA1(HAMAType, TrendSource, HAMALength);

plot MALine = if HAMAMa then MAValue else na;

MALine.SetStyle(Curve.FIRM);

MALine.AssignValueColor( if StrongUP then GlobalColor("Bull") else

if WeakUp then GlobalColor("WeakBull") else

if StrongDN then GlobalColor("Bear") else

if WeakDN then GlobalColor("WeakBear") else GlobalColor("Neutral"));

MALine.SetLineWeight(1);

# Plot STRONG UP

def UpO1;

def UpH1;

def UpL1;

def UpC1;

if StrongUP and HAMABar

then {

UpO1 = if CandleOpen < CandleClose then CandleClose else CandleOpen;

UpH1 = if CandleHigh > CandleClose then CandleClose else CandleHigh;

UpL1 = if CandleLow < CandleOpen then CandleOpen else CandleLow;

UpC1 = if CandleOpen < CandleClose then CandleOpen else CandleClose;

} else

{

UpO1 = na;

UpH1 = na;

UpL1 = na;

UpC1 = na;

}

# Plot WEAK UP

def UpO;

def UpH;

def UpL;

def UpC;

if WeakUp and HAMABar

then {

UpO = if CandleOpen < CandleClose then CandleClose else CandleOpen;

UpH = if CandleHigh > CandleClose then CandleClose else CandleHigh;

UpL = if CandleLow < CandleOpen then CandleOpen else CandleLow;

UpC = if CandleOpen < CandleClose then CandleOpen else CandleClose;

} else

{

UpO = na;

UpH = na;

UpL = na;

UpC = na;

}

# Plot WEAK DOWN

def DnO;

def DnH;

def DnL;

def DnC;

if WeakDN and HAMABar

then {

DnO = if CandleOpen < CandleClose then CandleClose else CandleOpen;

DnH = if CandleHigh > CandleOpen then CandleOpen else CandleHigh;

DnL = if CandleLow < CandleClose then CandleClose else CandleLow;

DnC = if CandleOpen < CandleClose then CandleOpen else CandleClose;

} else

{

DnO = na;

DnH = na;

DnL = na;

DnC = na;

}

# Plot STRONG DOWN

def DnO1;

def DnH1;

def DnL1;

def DnC1;

if StrongDN and HAMABar

then {

DnO1 = if CandleOpen < CandleClose then CandleClose else CandleOpen;

DnH1 = if CandleHigh > CandleOpen then CandleOpen else CandleHigh;

DnL1 = if CandleLow < CandleClose then CandleClose else CandleLow;

DnC1 = if CandleOpen < CandleClose then CandleOpen else CandleClose;

} else

{

DnO1 = na;

DnH1 = na;

DnL1 = na;

DnC1 = na;

}

# Plot Neutral

def NuO;

def NuH;

def NuL;

def NuC;

if Neutral and HAMABar

then {

NuO = if CandleOpen < CandleClose then CandleClose else CandleOpen;

NuH = if CandleHigh > CandleOpen then CandleOpen else CandleHigh;

NuL = if CandleLow < CandleClose then CandleClose else CandleLow;

NuC = if CandleOpen < CandleClose then CandleOpen else CandleClose;

} else

{

NuO = na;

NuH = na;

NuL = na;

NuC = na;

}

# Plot the new Chart

AddChart(high = UpH1, low = UpL1, open = UpO1, close = UpC1,

type = ChartType.CANDLE, growcolor = GlobalColor("Bull"));

AddChart(high = UpH , low = UpL , open = UpO, close = UpC,

type = ChartType.CANDLE, growcolor = GlobalColor("WeakBull"));

AddChart(high = DnH1, low = DnL1, open = DnO1, close = DnC1,

type = ChartType.CANDLE, growcolor = GlobalColor("Bear"));

AddChart(high = DnH , low = DnL , open = DnO, close = DnC,

type = ChartType.CANDLE, growcolor = GlobalColor("WeakBear"));

AddChart(high = NuH , low = NuL , open = NuO, close = NuC,

type = ChartType.CANDLE, growcolor = GlobalColor("Neutral"));

########

#indicator("SSL Channel", by MissTricky)

#https://www.tradingview.com/script/6y9SkpnV-SSL-Channel/

def ma1 = mat(high,SSL_MaLength, SSLType);

def ma2 = mat(low ,SSL_MaLength, SSLType);

def Hlv1 = if (if SSLWicks then high else close) > ma1 then 1 else

if (if SSLWicks then low else close) < ma2 then -1 else Hlv1[1];

def Hlv = Hlv1;

def sslUp = if Hlv < 0 then ma2 else ma1;

def sslDown = if Hlv < 0 then ma1 else ma2;

def SSLBull = Hlv1 > 0 and Hlv1[1] < 0;

def SSLBear = Hlv1 < 0 and Hlv1[1] > 0;

plot highLine = if ShowSSL then sslUp else na;

plot lowLine = if ShowSSL then sslDown else na;

highLine.AssignValueColor(if Hlv > 0 then Color.GREEN else color.RED);

lowLine.AssignValueColor( if Hlv > 0 then Color.GREEN else color.RED);

highLine.AssignValueColor(if Hlv > 0 then Color.GREEN else Color.RED);

lowLine.AssignValueColor( if Hlv > 0 then Color.GREEN else Color.RED);

AddCloud (highLine, lowLine, Color.DARK_GREEN, Color.DARK_RED, no);

##### RSI

def RSIup = WildersAverage(Max(close - close[1], 0), rsiLength);

def RSIdown = WildersAverage(-Min(close - close[1], 0), rsiLength);

def RSIvalue = if RSIdown == 0 then 100 else if RSIup == 0 then 0 else 100 - (100 / (1 + RSIup / RSIdown));

def RSIAvg = SimpleMovingAvg(RSIvalue, RSIMovAvg);

def RSI = if RSIvalue > RSIAvg then 1 else

if RSIvalue < RSIAvg then -1 else na;

##### TDFI

def mma = ExpAverage(close * 1000, TDFIPeriod);

def smma = ExpAverage(mma, TDFIPeriod);

def impetmma = mma - mma[1];

def impetsmma = smma - smma[1];

def divma = AbsValue(mma - smma);

def averimpet = (impetmma + impetsmma) / 2;

def tdf = Power(divma, 1) * Power(averimpet, 3);

def TDFIvalue = tdf / Highest(AbsValue(tdf), TDFIPeriod * 3);

def TDFI = if TDFIvalue > TDFIAbove then 1 else

if TDFIvalue < TDFIBelow then -1 else na;

###### ADX Filter

def ADXvalue = DMI(ADXLength, AverageType.WILDERS).ADX;

def ADX = if ADXvalue >= ADXlimit then 1 else na;

###### Range Indicator

def data = TrueRange(high, close, low) / if close > close[1] then (close - close[1]) else 1;

def hData = Highest(data, RILength);

def lData = Lowest(data, RILength);

def range = 100 * (data - lData) / if hData > lData then (hData - lData) else 1;

def RIvalue = ExpAverage(range, RangeSmoothing);

def RI = if RIvalue >= Rangelimit then 1 else na;

### Signal###

def UpOpen = if CandleOpen < CandleClose then CandleClose else CandleOpen;

def UpHigh = if CandleHigh > CandleClose then CandleClose else CandleHigh;

def UpLow = if CandleLow < CandleOpen then CandleOpen else CandleLow;

def UpClose= if CandleOpen < CandleClose then CandleOpen else CandleClose;

def DnOpen = if CandleOpen < CandleClose then CandleClose else CandleOpen;

def DnHigh = if CandleHigh > CandleOpen then CandleOpen else CandleHigh;

def DnLow = if CandleLow < CandleClose then CandleClose else CandleLow;

def DnClose= if CandleOpen < CandleClose then CandleOpen else CandleClose;

def HAMAHigh = close > CandleLow;

def HAMALow = low < DnLow;

def SigUp = if TDFIFilter then (SSLBull and close > MAValue and HAMAHigh and TDFI > 0)

else (SSLBull and close > MAValue and HAMAHigh);

def SigUp1 = if ADXFilter then SigUp and ADX else SigUp;

def SigUp2 = if RangeIndicatorFilter then SigUp1 and RI else SigUp1;

def SignalUp = if RSIFilter then SigUp2 and RSI > 0 else SigUp2;

def SigDN = if TDFIFilter then (SSLBear and close < MAValue and HAMALow and TDFI < 0)

else (SSLBear and close < MAValue and HAMALow);

def SigDn1 = if ADXFilter then SigDn and ADX else SigDn;

def SigDn2 = if RangeIndicatorFilter then SigDn1 and RI else SigDn1;

def SignalDn = if RSIFilter then SigDn2 and RSI < 0 else SigDn2;

plot Arrow_Up = if showArrow and SignalUp then low else na;

plot Arrow_Dn = if showArrow and SignalDn then high else na;

Arrow_Up.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

Arrow_Up.SetDefaultColor(Color.WHITE);

Arrow_Up.SetLineWeight(3);

Arrow_Dn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

Arrow_Dn.SetDefaultColor(Color.YELLOW);

Arrow_Dn.SetLineWeight(3);

##### Background & Price Color

AssignPriceColor(if ColorBar then

if Neutral then GlobalColor("NeutralBar") else

if StrongUP and close < UpHigh then GlobalColor("WeakBullBar") else

if StrongUP and close > UpHigh then GlobalColor("BullBar") else

if StrongDN and close < DnLow then GlobalColor("BearBar") else

if StrongDN and close > DnLow then GlobalColor("WeakBearBar") else

Color.DARK_ORANGE else Color.CURRENT);

AssignBackgroundColor(if BackgroundColor then

if StrongUP and close > UpHigh then GlobalColor("BGBull") else

if StrongDN and close < DnLow then GlobalColor("BGBear") else

Color.CURRENT else Color.CURRENT);

### ENd ####

2) Settings for NSDT HAMA Candles:

Trend source - close

HAMA length - 10

HAMA type - HMA

HAMA bar - yes

HAMA ma - yes

Open, High, Low, Close length - 10

Open, High, Low, Close types - HMA

All filters & other plots- off

All globals/colors - only red/blue - no various colors for neutral & different bear/bull bars etc to eliminate extra noise for swing trading. If it's a bear bar it's red & if it's a bull bar it's blue. Neutral bars are blue.

*Indicator works in unison with the ribbons & eliminates more noise

Credit to Linus:

## START STUDY

## SuperTrend

## linus, 2014-07-21, v0.5

#hint: thinkScript adaptation of SuperTrend. /n The speed of the trend changes are controlled by adjusting the ATR input parameters.

#hint atrMult: Multiple to scale the Average True Range (ATR) value. (Smaller numbers will produce faster trend changes.)

input atrMult = 2.5;

#hint atrLength: ATR moving average period length.

input atrLength = 14;

#hint atrType: ATR moving average type.

input atrType = AverageType.WILDERS;

#hint pivot: Bar pivot used for trend points. (Default is hl2)

input pivot = hl2;

#hint label: Show Profit/Loss label.

input label = Yes;

#hint prompt: Text to show in front of label.

input prompt = "";

#hint bubbles: Show Profit/Loss bubbles.

input bubbles = Yes;

def atr = MovingAverage(atrType, TrueRange(high, close, low), atrLength) * atrMult;

def prUp = pivot + atr;

def prDn = pivot - atr;

# rTrend stores the current trend value and direction. (The direction is currently up if rTrend[1] is positive and down if rTrend[1] is negative, therefore AbsValue is used to compare rTrend values when the trend is down.)

def rTrend = compoundValue(1,

# Trending Up

if rTrend[1] > 0 then

# If close is below trend then switch to downtrend (negative)

if close < Max(prDn[1], rTrend[1]) then -prUp

# ...else adjust new uptrend value.

else Max(prDn, rTrend[1])

# Trending Down

else if rTrend[1] < 0 then

# If close is above trend then switch to uptrend (positive)

if close > Min(prUp[1], AbsValue(rTrend[1])) then prDn

# ...else adjust new downtrend value.

else -Min(prUp, AbsValue(rTrend[1]))

else rTrend[1]

, pivot);

# The Trend plot skips a bar whenever the trend direction changes.

plot Trend = if Sign(rTrend) == Sign(rTrend[1]) then absValue(rTrend) else Double.NaN;

Trend.DefineColor("Up", Color.CYAN);

Trend.DefineColor("Dn", Color.MAGENTA);

Trend.AssignValueColor(if rTrend > 0 then Trend.Color("Up") else Trend.Color("Dn"));

Trend.HideBubble();

# Show arrows when the trend changes:

plot Up = if rTrend crosses above 0 then rTrend else Double.NaN;

Up.SetDefaultColor(Trend.Color("Up"));

Up.SetPaintingStrategy(PaintingStrategy.ARROW_UP);

Up.SetLineWeight(2);

Up.HideBubble();

plot Dn = if rTrend crosses below 0 then AbsValue(rTrend) else Double.NaN;

Dn.SetDefaultColor(Trend.Color("Dn"));

Dn.SetPaintingStrategy(PaintingStrategy.ARROW_DOWN);

Dn.SetLineWeight(2);

Dn.HideBubble();

def orderDir = compoundValue(1, if !isNaN(Up) then 1 else if !isNaN(Dn) then -1 else orderDir[1], 0);

def isOrder = orderDir crosses 0;

def orderCount = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder then orderCount[1] + 1 else orderCount[1], 0);

def orderPrice = if isOrder then if isNaN(open[-1]) then close else open[-1] else orderPrice[1];

def profitLoss = if !isOrder or orderCount == 1 then 0 else if orderDir > 0 then orderPrice[1] - orderPrice else if orderDir < 0 then orderPrice - orderPrice[1] else 0;

def profitLossSum = compoundValue(1, if isNaN(isOrder) then 0 else if isOrder then profitLossSum[1] + profitLoss else profitLossSum[1], 0);

AddLabel(label, prompt + orderCount + " orders | P/L " + AsDollars((profitLossSum / tickSize()) * tickValue()), if profitLossSum > 0 then Color.GREEN else if profitLossSum < 0 then Color.RED else Color.GRAY);

AddChartBubble(bubbles and isOrder and orderDir > 0, low, profitLoss, Color.GREEN, 0);

AddChartBubble(bubbles and isOrder and orderDir < 0, high, profitLoss, Color.RED, 1);

## END STUDY

3) Settings for SuperTrend:

ATR mult - 2.5

ATR length - 14

ATR type - Hull

Pivot - close

*Indicator's importance speaks for itself

Credit to BenTen:

# MTF Moving Average

input Period = aggregationPeriod.HOUR;

input AvgType = averageType.SIMPLE;

input Length = 50;

input priceclose = close;

plot AVG = MovingAverage(AvgType, close(period = Period), Length);

AVG.setdefaultcolor(color.yellow);

4) Settings for MTF Moving Average:

Period - day

Type - exponential

Length - 10

Priceclose - close

*Indicator might not be necessary, but the stepped display helps provide solid visual from a different perspective in terms of trend w/ the fast ribbon

Credit to Mobius:

# Limbo_Bars

# Mobius

# V05.02.2016

# Added Labels for Epocs and near term fibonacci retracements

#hint:<b> Limbo Bars</b>\n Limbo series: Closing for each year in chart aggregation (gray short dashed lines)\n Clustered Multiple year closings (Solid gray thick lines)\n Highest to lowest Fib Sequence for chart agg (thin light green lines)\n Highest to lowest Fib Sequence for adjustable Stochastic Pivots (long gray dashes)\n Sub-Fib Sequences for Current years 68.2 to 100 and 0 (small dashes)

declare Once_per_bar;

input numBars = 21; #hint numbars: bars for near term fib levels

input ClusterValue_1 = 1480.00; #hint ClusterValue_1: Multiple year closing proximity line

input ClusterValue_2 = 1425.00; #hint ClusterValue_2: Multiple year closing proximity line

input ClusterValue_3 = 1250.00; #hint ClusterValue_3: Multiple year closing proximity line

input ClusterValue_4 = 890.00; #hint ClusterValue_4: Multiple year closing proximity line

input showValues = no;

input showBarNumbers = no;

input TrendResistanceStart = 0;

input TrendResistanceEnd = 0;

input TrendSupportStart = 0;

input TrendSupportEnd = 0;

input BubbleOn = yes;

# Study Definitions

def o = open;

def h = high;

def l = low;

def c = close;

def bar = BarNumber();

def yearstart = GetYear() * 10000 + 101;

def tradingDays = CountTradingDays(yearstart, GetYYYYMMDD());

def Coeff_1 = .236;

def Coeff_2 = .382;

def Coeff_3 = .500;

def Coeff_4 = .618;

def Coeff_5 = .786;

#Epoc definitions: Years closing values for the last 20 years

script Epoc {

input year = 1;

def bar = barNumber();

def yearone = CompoundValue(1, if GetYear() == GetLastYear() - year

then bar[1] + 2

else yearone[1], 1);

def y1 = CompoundValue(1, if bar == yearone

then (close[1])

else y1[1], Double.NaN);

plot y1Line = if IsNaN(y1) then Double.NaN else y1;

}

# Start Epocs Plot Sequence

plot y1L = Epoc(year = 1);

y1L.SetStyle(Curve.SHORT_DASH);

y1L.SetDefaultColor(CreateColor(50, 75, 10));

y1L.SetLineWeight(2);

AddChartBubble(if BubbleOn then y1L and isNaN(y1L[1]) else double.nan, y1L, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y2Line = Epoc(year = 2);

y2Line.SetStyle(Curve.SHORT_DASH);

y2Line.SetDefaultColor(CreateColor(50, 75, 10));

y2Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y2Line and isNaN(y2Line[1]) else double.nan, y2Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y3Line = Epoc(year = 3);

y3Line.SetStyle(Curve.SHORT_DASH);

y3Line.SetDefaultColor(CreateColor(50, 75, 10));

y3Line.SetLineWeight(1);

AddChartBubble(if BubbleOn then y3Line and isNaN(y3Line[1]) else double.nan, y3Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y4Line = Epoc(year = 4);

y4Line.SetStyle(Curve.SHORT_DASH);

y4Line.SetDefaultColor(CreateColor(50, 75, 10));

y4Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y4Line and isNaN(y4Line[1]) else double.nan, y4Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y5Line = Epoc(year = 5);

y5Line.SetStyle(Curve.SHORT_DASH);

y5Line.SetDefaultColor(CreateColor(50, 75, 10));

y5Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y5Line and isNaN(y5Line[1]) else double.nan, y5Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y6Line = Epoc(year = 6);

y6Line.SetStyle(Curve.SHORT_DASH);

y6Line.SetDefaultColor(CreateColor(50, 75, 10));

y6Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y6Line and isNaN(y6Line[1]) else double.nan, y6Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y7Line = Epoc(year = 7);

y7Line.SetStyle(Curve.SHORT_DASH);

y7Line.SetDefaultColor(CreateColor(50, 75, 10));

y7Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y7Line and isNaN(y7Line[1]) else double.nan, y7Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y8Line = Epoc(year = 8);

y8Line.SetStyle(Curve.SHORT_DASH);

y8Line.SetDefaultColor(CreateColor(50, 75, 10));

y8Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y8Line and isNaN(y8Line[1]) else double.nan, y8Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y9Line = Epoc(year = 9);

y9Line.SetStyle(Curve.SHORT_DASH);

y9Line.SetDefaultColor(CreateColor(50, 75, 10));

y9Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y9Line and isNaN(y9Line[1]) else double.nan, y9Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y10Line = Epoc(year = 10);

y10Line.SetStyle(Curve.SHORT_DASH);

y10Line.SetDefaultColor(CreateColor(50, 75, 10));

y10Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y10Line and isNaN(y10Line[1]) else double.nan, y10Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y11Line = Epoc(year = 11);

y11Line.SetStyle(Curve.SHORT_DASH);

y11Line.SetDefaultColor(CreateColor(50, 75, 10));

y11Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y11Line and isNaN(y11Line[1]) else double.nan, y11Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y12Line = Epoc(year = 12);

y12Line.SetStyle(Curve.SHORT_DASH);

y12Line.SetDefaultColor(CreateColor(50, 75, 10));

y12Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y12Line and isNaN(y12Line[1]) else double.nan, y12Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y13Line = Epoc(year = 13);

y13Line.SetStyle(Curve.SHORT_DASH);

y13Line.SetDefaultColor(CreateColor(50, 75, 10));

y13Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y13Line and isNaN(y13Line[1]) else double.nan, y13Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y14Line = Epoc(year = 14);

y14Line.SetStyle(Curve.SHORT_DASH);

y14Line.SetDefaultColor(CreateColor(50, 75, 10));

y14Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y14Line and isNaN(y14Line[1]) else double.nan, y14Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y15Line = Epoc(year = 15);

y15Line.SetStyle(Curve.SHORT_DASH);

y15Line.SetDefaultColor(CreateColor(50, 75, 10));

y15Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y15Line and isNaN(y15Line[1]) else double.nan, y15Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y16Line = Epoc(year = 16);

y16Line.SetStyle(Curve.SHORT_DASH);

y16Line.SetDefaultColor(CreateColor(50, 75, 10));

y16Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y16Line and isNaN(y16Line[1]) else double.nan, y16Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y17Line = Epoc(year = 17);

y17Line.SetStyle(Curve.SHORT_DASH);

y17Line.SetDefaultColor(CreateColor(50, 75, 10));

y17Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y17Line and isNaN(y17Line[1]) else double.nan, y17Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y18Line = Epoc(year = 18);

y18Line.SetStyle(Curve.SHORT_DASH);

y18Line.SetDefaultColor(CreateColor(50, 75, 10));

y18Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y18Line and isNaN(y18Line[1]) else double.nan, y18Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y19Line = Epoc(year = 19);

y19Line.SetStyle(Curve.SHORT_DASH);

y19Line.SetDefaultColor(CreateColor(50, 75, 10));

y19Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y19Line and isNaN(y19Line[1]) else double.nan, y19Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

plot y20Line = Epoc(year = 20);

y20Line.SetStyle(Curve.SHORT_DASH);

y20Line.SetDefaultColor(CreateColor(50, 75, 10));

y20Line.SetLineWeight(2);

AddChartBubble(if BubbleOn then y20Line and isNaN(y20Line[1]) else double.nan, y20Line, AsPrice(getYear()) + " Open", CreateColor(50, 75, 10));

# End Year Lines

# Plot Year Closing Cluster Values

Plot Cluster1 = ClusterValue_1;

Cluster1.SetStyle(Curve.Firm);

Cluster1.SetLineWeight(3);

Cluster1.SetDefaultColor(CreateColor(50,50,50));

Plot Cluster2 = ClusterValue_2;

Cluster2.SetStyle(Curve.Firm);

Cluster2.SetLineWeight(3);

Cluster2.SetDefaultColor(CreateColor(50,50,50));

Plot Cluster3 = ClusterValue_3;

Cluster3.SetStyle(Curve.Firm);

Cluster3.SetLineWeight(3);

Cluster3.SetDefaultColor(CreateColor(50,50,50));

Plot Cluster4 = ClusterValue_4;

Cluster4.SetStyle(Curve.Firm);

Cluster4.SetLineWeight(3);

Cluster4.SetDefaultColor(CreateColor(50,50,50));

# First Wave Fibonacci Retracement

script Fibs {

input C0 = 0.000;

def o = open;

def h = high;

def l = low;

# Get highest and lowest on chart

def a = HighestAll(h);

def b = LowestAll(l);

# Get the bar numbers at the highest and lowest points

def barnumber = BarNumber();

def c = if h == a

then barnumber

else Double.NaN;

def d = if l == b

then barnumber

else Double.NaN;

def highnumber = CompoundValue(1, if IsNaN(c)

then highnumber[1]

else c, c);

def highnumberall = HighestAll(highnumber);

def lownumber = CompoundValue(1, if IsNaN(d)

then lownumber[1]

else d, d);

def lownumberall = LowestAll(lownumber);

# Determine Slope Delta

def upward = highnumberall > lownumberall;

def downward = highnumberall < lownumberall;

# Define X

def x = AbsValue(lownumberall - highnumberall );

# Get Slope for either direction

def slope = (a - b) / x;

def slopelow = (b - a) / x;

# Get Day

def day = GetDay();

def month = GetMonth();

def year = GetYear();

def lastDay = GetLastDay();

def lastmonth = GetLastMonth();

def lastyear = GetLastYear();

def isToday = If(day == lastDay and

month == lastmonth and

year == lastyear, 1, 0);

def istodaybarnumber = HighestAll(if isToday

then barnumber

else Double.NaN);

# Calculations for line between extremes

def line = b + (slope * (barnumber - lownumber));

def linelow = a + (slopelow * (barnumber - highnumber));

def currentlinelow = if barnumber <= lownumberall

then linelow

else Double.NaN;

def currentline = if barnumber <= highnumberall

then line

else Double.NaN;

def FibFan = if downward

then currentlinelow

else if upward

then currentline

else Double.NaN;

# Rise of line between Extremes

def range = a - b;

plot Fib1 = fold i = 1 to 100

with p = FibFan

while (downward and

barnumber >= highnumberall and

barnumber <= istodaybarnumber)

or

(upward and

barnumber >= lownumberall and

barnumber <= istodaybarnumber)

do if downward

then HighestAll((b + (range * C0)))

else if upward

then HighestAll(a - (range * C0))

else Double.NaN;

}

# Start Plot Sequence

input C0 = 0.000;

input C1 = .236;

input C2 = .382;

input C3 = .500;

input C4 = .618;

input C5 = .786;

input C6 = 1.000;

def TotalBars = HighestAll(bar);

def HHbar = if high == highestAll(high)

then bar

else HHbar[1];

def LLbar = if low == lowestAll(low)

then bar

else LLbar[1];

def firstBar = if HHbar > LLbar

then LLbar

else if HHbar < LLbar

then HHbar

else Double.NaN;

def BubbleLocation = if bar - (firstBar + HHbar) == LLBar

then LLbar

else if bar - (firstBar + LLbar) == HHBar

then HHbar

else double.nan;

plot fib1 = Round(fibs(C0 = C0), 3);

fib1.SetDefaultColor(Color.Red);

AddChartBubble((if BubbleOn then BubbleLocation else double.nan), fib1

, (c0 * 100) + "% $" + fib1, color.gray, yes);

plot fib2 = Round(fibs(C0 = C1), 3);

fib2.SetDefaultColor(Color.Red);

AddChartBubble((if BubbleOn then BubbleLocation else double.nan), fib2

, (c1 * 100) + "% $" + fib2, color.gray, yes);

plot fib3 = Round(fibs(C0 = C2), 3);

fib3.SetDefaultColor(Color.Red);

AddChartBubble((if BubbleOn then BubbleLocation else double.nan), fib3

, concat( (c2 * 100), "%"), color.gray, yes);

plot fib4 = Round(fibs(C0 = C3), 3);

fib4.SetDefaultColor(Color.Red);

AddChartBubble((if BubbleOn then BubbleLocation else double.nan), fib4

, (c3 * 100) + "% $" + fib4, color.gray, yes);

plot fib5 = Round(fibs(C0 = C4), 3);

fib5.SetDefaultColor(Color.Red);

AddChartBubble((if BubbleOn then BubbleLocation else double.nan), fib5

, (c4 * 100) + "% $" + fib5 , color.gray, yes);

plot fib6 = Round(fibs(C0 = C5), 3);

fib6.SetDefaultColor(Color.Red);

AddChartBubble((if BubbleOn then BubbleLocation else double.nan), fib6

, (c5 * 100) + "% $" + fib6, color.gray, yes);

plot fib7 = Round(fibs(C0 = C6), 3);

fib7.SetDefaultColor(Color.Red);

AddChartBubble((if BubbleOn then BubbleLocation else double.nan), fib7

, (c6 * 100) + "% $" + fib7, color.gray, yes);

# Second Wave Fib Series

def UserSetResistance = TrendResistanceStart > 0 and

TrendResistanceEnd > 0;

def UserSetSupport = TrendSupportStart > 0 and

TrendSupportEnd > 0;

def PH;

def PL;

def isHigherThanNextBars = fold i = 1 to numBars + 1

with p = 1

while p

do h > GetValue(h, -i);

PH = if UserSetResistance and

( bar == TrendResistanceStart or

bar == TrendResistanceEnd )

then h

else if !UserSetResistance and

(bar > numBars and

h == Highest(h, numBars) and

isHigherThanNextBars)

then h

else Double.NaN;

def isLowerThanNextBars = fold j = 1 to numBars + 1

with q = 1

while q

do l < GetValue(low, -j);

PL = if UserSetSupport and

( bar == TrendSupportStart or

bar == TrendSupportEnd )

then l

else if !UserSetSupport and

(bar > numBars and

l == Lowest(l, numBars) and

isLowerThanNextBars)

then l

else Double.NaN;

def PHBar = if UserSetResistance

then TrendResistanceEnd

else if !IsNaN(PH)

then bar

else PHBar[1];

def PLBar = if UserSetSupport

then TrendSupportEnd

else if !IsNaN(PL)

then bar

else PLBar[1];

def PHL = if !IsNaN(PH)

then PH

else PHL[1];

def priorPHBar = if UserSetResistance

then TrendResistanceStart

else if PHL != PHL[1]

then PHBar[1]

else priorPHBar[1];

def PLL = if !IsNaN(PL)

then PL

else PLL[1];

def priorPLBar = if UserSetSupport

then TrendSupportStart

else if PLL != PLL[1]

then PLBar[1]

else priorPLBar[1];

def isFinalTwoHighPivots = bar >= HighestAll(priorPHBar);

def isFinalTwoLowPivots = bar >= HighestAll(priorPLBar);

def ResistanceFinishOffset = if isFinalTwoHighPivots

then bar - PHBar

else 0;

def ResistanceStartOffset = if isFinalTwoHighPivots

then bar - priorPHBar

else 0;

def ResistanceSlope = (GetValue(PH, ResistanceFinishOffset) -

GetValue(PH, ResistanceStartOffset)) /

(PHBar - priorPHBar);

def SupportFinishOffset = if isFinalTwoLowPivots

then bar - PLBar

else 0;

def SupportStartOffset = if isFinalTwoLowPivots

then bar - priorPLBar

else 0;

def SupportSlope = (GetValue(PL, SupportFinishOffset) -

GetValue(PL, SupportStartOffset)) /

(PLBar - priorPLBar);

def ResistanceExtend = if bar == HighestAll(PHBar)

then 1

else ResistanceExtend[1];

def SupportExtend = if bar == HighestAll(PLBar)

then 1

else SupportExtend[1];

plot pivotHigh = if isFinalTwoHighPivots

then PH

else Double.NaN;

def pivotHighLine = if PHL > 0 and

isFinalTwoHighPivots

then PHL

else double.NaN;

plot ResistanceLine = pivotHigh;

plot ResistanceExtension = if ResistanceExtend

then (bar - PHBar) * ResistanceSlope + PHL

else Double.NaN;

plot pivotLow = if isFinalTwoLowPivots

then PL

else Double.NaN;

def pivotLowLine = if PLL > 0 and

isFinalTwoLowPivots

then PLL

else double.NaN;

plot SupportLine = pivotLow;

plot SupportExtension = if SupportExtend

then (bar - PLBar) * SupportSlope + PLL

else Double.NaN;

plot BN = bar;

plot A_H = if isNaN(PivotHighline)

then PivotHighLine[1]

else HighestAll(PivotHighLine);

A_H.SetDefaultColor(Color.Yellow);

plot X_L = if isNaN(PivotLowLine)

then PivotLowLine[1]

else LowestAll(PivotLowLine);

X_L.SetDefaultColor(Color.Yellow);

def A = A_H;

def B = X_L;

def X = ( ((c - X_L) / (A_H - X_L))) + c;

plot SeventyEight = (((a - b) * Coeff_5) + B);

plot SixtyOne = (((a - B) * Coeff_4) + B);

plot Fifty = (a + B) * Coeff_3;

plot ThirtyEight = ((a - B) * Coeff_2) + B;

plot TwentyThree = ((a - B) * Coeff_1) + B;

pivotHigh.SetDefaultColor(Color.Yellow);

pivotHigh.SetPaintingStrategy(PaintingStrategy.VALUES_ABOVE);

pivotHigh.SetHiding(!showValues);

pivotLow.SetDefaultColor(Color.Yellow);

pivotLow.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

pivotLow.SetHiding(!showValues);

ResistanceLine.EnableApproximation();

ResistanceLine.SetDefaultColor(GetColor(5));

ResistanceExtension.SetDefaultColor(GetColor(5));

SupportLine.EnableApproximation();

SupportLine.SetDefaultColor(GetColor(5));

SupportExtension.SetDefaultColor(GetColor(5));

BN.SetDefaultColor(GetColor(0));

BN.SetHiding(!showBarNumbers);

BN.SetPaintingStrategy(PaintingStrategy.VALUES_BELOW);

SeventyEight.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

SeventyEight.SetDefaultColor(Color.Yellow);

SixtyOne.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

SixtyOne.SetDefaultColor(Color.Yellow);

Fifty.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

Fifty.SetDefaultColor(Color.Yellow);

ThirtyEight.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

ThirtyEight.SetDefaultColor(Color.Yellow);

TwentyThree.SetPaintingStrategy(PaintingStrategy.HORIZONTAL);

TwentyThree.SetDefaultColor(Color.Yellow);

AddChartBubble(if BubbleOn then isNaN(close[10]) and !isNaN(close[11]) else double.nan,

A_H,

"Fib " + 1,

color.yellow,

yes);

AddChartBubble(if BubbleOn then isNaN(close[10]) and !isNaN(close[11]) else double.nan,

SeventyEight,

"Fib " + Coeff_5,

color.yellow,

yes);

AddChartBubble(if BubbleOn then isNaN(close[10]) and !isNaN(close[11]) else double.nan,

SixtyOne,

"Fib " + Coeff_4,

color.yellow,

yes);

AddChartBubble(if BubbleOn then isNaN(close[10]) and !isNaN(close[11]) else double.nan,

Fifty,

"Fib " + Coeff_3,

color.yellow,

yes);

AddChartBubble(if BubbleOn then isNaN(close[10]) and !isNaN(close[11]) else double.nan,

ThirtyEight,

"Fib " + Coeff_2,

color.yellow,

yes);

AddChartBubble(if BubbleOn then isNaN(close[10]) and !isNaN(close[11]) else double.nan,

TwentyThree,

"Fib " + Coeff_1,

color.yellow,

yes);

AddChartBubble(if BubbleOn then isNaN(close[10]) and !isNaN(close[11]) else double.nan,

X_L,

"Fib " + 0,

color.yellow,

yes);

# Fibonacci Time Series

def bar1 = firstbar;

def bars = CompoundValue(1, if isNaN(bars[1])

then firstbar + 2

else if bar >= firstbar + 2

then bars[1] + 1

else 0,firstbar +2);

def coeff = Sqrt(5);

def n = Floor(log(bars * coeff + 0.5) / log((1 + Sqrt(5)) / 2));

def inSeries = n != n[1] and bars >= firstbar;

def Series = if inSeries

then bars

else Double.NaN;

#AddVerticalLine(Series, "FTS: ( " + Series + ")", Color.Blue, Curve.Short_Dash);

# End Code Limbo Bars V05

5) Settings for Limbo Bars:

Plot #1 - bars for fib 1-7 & AH-XL - 55 (purple & yellow)

Plot #2 - bars for AH-XL - 21 (white & no fib plot)

Plot #1 & Plot #2 - everything else deselected

*Indicator is vital to help strengthen resistance/support signals along with the ribbons, especially the when price/bar hits both at the same time in terms of confluence

Credit to DaysOff:

# MTF Moving Average Slope Histogram

# DaysOff

declare lower;

input price = close;

input length = 20;

input agg = AggregationPeriod.FIFTEEN_MIN;

def avg = hullMovingAvg(close(period = agg), length);

plot height = avg - avg[length];

height.setPaintingStrategy(PaintingStrategy.HISTOGRAM);

height.DefineColor("height >= 0" , Color.GREEN);

height.DefineColor("height < 0", Color.RED);

height.assignValueColor(if height >= 0 then height.color("height >= 0") else height.color("height < 0"));

6) Settings for MTF Moving Average Slope Histogram:

Plot #1 - price Close, length 5, agg 4h

Plot #2 - price Close, length 5, agg 1d

Plot #3 - price Close, length 5, agg 1w

*Note that I don't include the timeframe that is the same as the chart, in this case a 1h slope indicator. I start the slope indicator with the next sequential timeframe being 4h; it's just a personal preference of mine.

*Indicator is 100% essential for a swing trading system - when you swing trade you are essentially trading the slopes

Rules for Heiken Ashi Entry/Exit system (see pic below for reference when going over each rule):

1) Taking positions/trades during strong bearish trend: when the highest timeframe (week) is bearish (red) for the lower MTF slope study - sell/short the rips when the price/bar meets resistance at the fast moving Heiken Ashi ribbon with SuperTrend down signal - as noted by white circles. You want the middle timeframe (day) to be bearish (red) or relatively flat if weak bullish (blue). The sell/short signal is stronger when the price/bar meets resistance at both the ribbon and fib level at the same time as you can see at circles 3 and 4 - this helps making confident trades since the the middle 1d timeframe is weak bullish/flat/blue at those specific points. If price/bar meets both indicators of resistance, I use it as confirmation to negate the weak bullish signal and enter my short/sell position. You will notice that for circles 1 and 5, the highest timeframe (week) slope changed. For circle 1, the slope went from bullish/blue to neutral/black - but you know this is still mostmlikely confirmation of the transition to a strong bearish trend since the price/bar broke below all 3 ribbons earlier. For circle 5, the bearish slope moved up one level indicating a possible start to a more bullish trend - if you still took this trade it might have ended in a loss or broke even, but this is why you have your stops - let the winners ride and cut the losses short. You would have had 4/5 winners.

2) Taking positions/trades during weak/neutral bearish/bullish trend: when price/bars break through 1st major resistance ribbon/level, I still sell/short the rips if there are still 2 upper resistance levels/ribbons to break through. I scale my profits and sell 1/3rd of my position on first profitable bar (in this case the first profitable down bar since I'm shorting/selling), the next 1/3rd on the next profitable bar, and the last 1/3rd at my stop. In circle 6, you will see that the price action was sandwiched and bouncing between the two ribbons, which resulted in a classic bull trap. This is why I always sell the last 1/3rd of my position at the next stop if price/bars are between to ribbons like this - in hopes of catching major profits if in fact a big sell off does occur from the bull trap. The same goes for the opposite - I'll buy the dip if there are still 2 lower resistance levels/ribbons to break through, but will sell the last 1/3rd of my position at the next stop in hopes of catching profits from a bear trap. In the rectangle below circle 6, one thing to look for is a sudden increase in the 4h & 1d timeframes bullish/blue bars - this sudden and not gradual increase in the 2 lower timeframes is an indication that a bull trap might be in the near future. Same goes for the opposite resulting in a bear trap.

3) Taking positions/trades during the start of an overall trend change: at circle 7 all 3 of the slopes are newly blue - I always take these trades & let them ride to the next stop. 95% of the time this means your next buy or sell trade will be when the overall trend has changed to strong bullish/bearish w/ price/bar being above or below all 3 ribbons. Same goes for the opposite in taking short positions if all 3 slopes are newly red. This is why it's important to use this system for high-trending instruments and not just any stock/instrument as you will get false signals from the 3 slope indicators if there isn't confluence.

4) Taking positions/trades during strong bullish trend: the opposite of the first rule mentioned above. If you do buy the dip from a SuperTrend signal without the price/bar hitting resistance level/ribbon or fib, make sure to use your stops to cut your losses as shown in circles 10 & 11, but let the winners ride as shown in circles 8 & 9.

Bonus note: pay attention to circle 6 & the price action after circle 11 - just as there was a rapid breakthrough of the 1st resistance level/ribbon leading up to circle 6, there was also a rapid breakthrough of the 1st resistance level/ribbon after circle 11. However, notice the price/bars also rapidly broke through the 2nd resistance level/ribbon with the 3rd resistance level/ribbon now being tested. The fib level is practically at the same level as circle 6 - this could be a bear trap soon. This is just another thing to be aware of when recent price action is highly active in contact with resistance levels that are parallel to a past area of high confluence like circle 6.