-

Get $40 off VIP by signing up for a free account! Sign Up

You should upgrade or use an alternative browser.

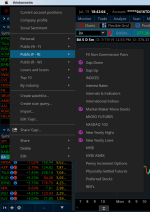

Gap Up & Gap Down Scanner for ThinkorSwim

- Thread starter Likos

- Start date

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

They wrote more than one article but that is the only one that I have printed out. Sorry I don't have the name of the publication.

Also, see a website called virtueofselfishinvesting.com. Those two gentlemen might have some information on that site, as they are the ones that run it. On there they call them "BGU's". It will take some research but it's the only place I know of that has firm rules on purchasing Gap Ups.

After you have reviewed that, you will have better odds of winning on a trade using the scanner that @BenTen pointed to above.

Good investing, Markos

Also, please spend some time reading in our Tutorial Section. You will find many answers to your questions above.

Your question may have already been asked, please use the Search Box above to check that out.

Thanks, Markos

I'm looking at a 5-minute chart. The image attached shows more detail. Price eventually doesn't make a new high on the next candle. Once that happens we are looking for consolidation candles of 3 or more without the price pulling back percentage X. This should alert me of stocks with this pattern.

Here are the rules.

1. Stock must have gapped up or down at least 1% from previous days close.

2. It doesn't take into account pre or post-market activity.

3. Many can consider this a bull or bear flag type of setup.

4. We are however looking for tight consolidation without too much pullback.

I'd appreciate anyone's input on this.

Thanks,

Perky

I need help with building a gap up scanner and as well the opening range breakout scanner. I want those gap up stocks to go through opening range breakout as well(only stocks that appeared in gap up) to enter a long position. I have used the gap up scanner and opening range scanner combined from our site but nothing shows up in the scanner. Can i do it like that. Need help guys.

# choose to scan up down gaps

# 1 = Only up gaps

# 2 = Only down gaps

# 3 = BOTH up and down gaps

input GapDirection = 3;

#set min max gap size you would like.

input minimumPercentFromPriorClose = 1.0;

input minimumDollarsFromPriorClose = 1.0;

input MaximumPercentFromPriorClose = 100.0;

input MaximumDollarsFromPriorClose = 100.0;

# makes sure there is a gap between the currentprice and the prior High/low, not just from the prior close

input OutsideYesterdaysRange = no;

#Looks for only gaps that are gapping up over red candle or gapping downsideGapThreeMethods under green candle, in addition the other criteria, Some people believe this adds "shock value" and forces people to cover their positions, adding momentum in the direction of the gap.

input GapAboveRedOrBeLowGreen = no;

# choose to only look for gapsthat havent filled yet interday

input OnlyGapsThatHaventFilled = no;

# if set to yes then scan will only consider a gap to be filled id the current days price action has touch previous days close.

input GapIsOnlyFilledAtClose = yes;

#Only change these if you are dealing with special marketor know what your doing

input MarketOpenTime = 0930;

input MarketCloseTime = 1600;https://www.wealthydaytrading.com/day-trading-strategies/

K_O_Trader

Member

https://tos.mx/zjXPcci

K_O_Trader

Member

# Average Price Movements

# Assembled by BenTen at useThinkScript.com

# Converted from https://www.tradingview.com/script/eHhGyI6R-CD-Average-Daily-Range-Zones-highs-and-lows-of-the-day/

input aggregationPeriod = AggregationPeriod.DAY;

def open = open(period = aggregationPeriod);

def high = high(period = aggregationPeriod);

def low = low(period = aggregationPeriod);

def dayrange = (high - low);

def r1 = dayrange[1];

def r2 = dayrange[2];

def r3 = dayrange[3];

def r4 = dayrange[4];

def r5 = dayrange[5];

def r6 = dayrange[6];

def r7 = dayrange[7];

def r8 = dayrange[8];

def r9 = dayrange[9];

def r10 = dayrange[10];

def adr_10 = (r1 + r2 + r3 + r4 + r5 + r6 + r7 + r8 + r9 + r10) / 10;

def adr_5 = (r1 + r2 + r3 + r4 + r5) / 5;

def hl1 = (OPEN + (adr_10 / 2));

def ll1 = (OPEN - (adr_10 / 2));

def hl2 = (OPEN + (adr_5 / 2));

def ll2 = (OPEN - (adr_5 / 2));

plot h1 = hl1;

plot l1 = ll1;

plot h2 = hl2;

plot l2 = ll2;

addCloud(h1, h2, color.RED, color.RED);

addCloud(l1, l2, color.GREEN, color.GREEN);

h1.SetDefaultColor(Color.dark_red);

h2.SetDefaultColor(Color.dark_red);

l1.SetDefaultColor(Color.dark_green);

l2.SetDefaultColor(Color.dark_green);supplydemandzones

New member

K_O_Trader

Member

I"m working on finding one, I will post it if/when I find one. BTW I've switched my aggregation period to 1WK. I believe this is the same stradegy that Truetrader.net usesK.O Trader, much respect to you!! Thanks for sharing the code too! The other component that we are looking for is the SCAN to find surging stocks in the first few minutes of opening of regular trading day toward either of the two "zones". There are too many stocks to search individually in the beginning of the trading day to do this manually. Is it possible to have a SCAN to bring to the forefront these surging stocks in the very start of the trading day???

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| A | Three up days in a row with a gap down (and vice versa) | Questions | 1 | |

| S | Identify Gap-Up Pattern | Questions | 6 | |

| M | ES gap for the next day? 4pm or 4:15pm. | Questions | 1 | |

| B | Gap Up % on Watchlist | Questions | 0 | |

|

|

Gap reduction | Questions | 1 |

Similar threads

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

Similar threads

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/