Why have 5 indicators on your screen when you can have just one! Let's do a Fusion.

mod note:

Python:

# Unified Signal (MACD + RSI + ATR + VWAP + Volume Pressure)

# + MACD Slope/Momentum + RSI Momentum ZLEMA + Adaptive EMA(8) Weight

# Accuracy features: dynamic majority, price confirmation, cooldown, optional ATR gate

# Outputs: BUY (1), SELL (-1), NONE (0) and colors price bars

# Tuning tips:

# Fewer whipsaws → raise confirmLen to 3 or cooldownBars to 3.

# More signals → lower majorityFrac to 0.6 or disable useATRGate.

# If volume pressure is noisy on your tickers → increase pressureEMA to 8–10 and/or pressureThreshold to ~0.12.

# Hidden Intent Composite (MACD/RSI/ATR + 12 Signals) - Fixed

# Clean compile: no AddChartColor, no invalid VWAP params, no ternary operator.

# Version 1.1

declare lower;

#-------------------------

# -------- Inputs --------

#-------------------------

input rsiBuy = 55;

input rsiSell = 45;

input atrLength = 14;

# Feature toggles

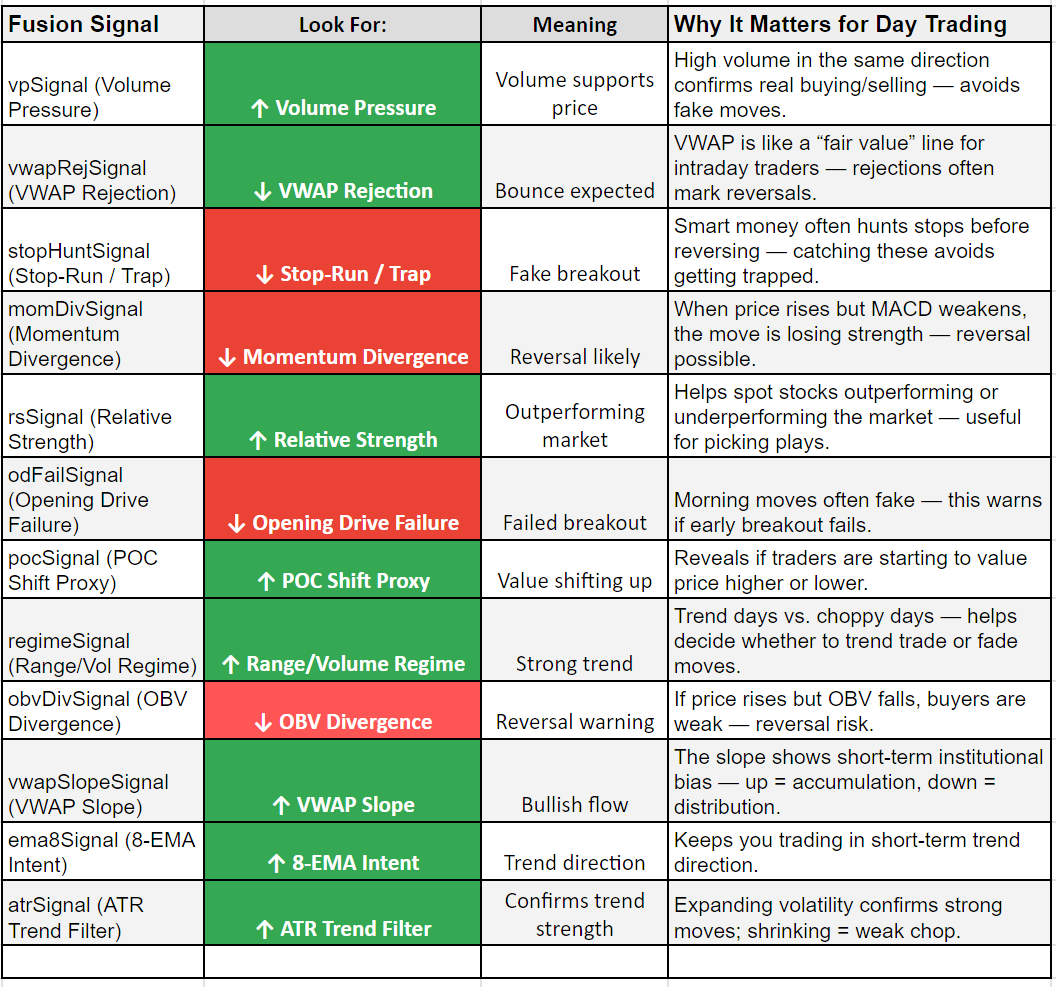

input useVolumePressure = yes; # (1)

input useVWAPRejection = yes; # (4)

input useStopHuntReversal = yes; # (5)

input useMomentumVolumeDiv = yes; # (10)

input useRelativeStrength = yes; # (11)

input useOpeningDriveFailure = yes; # (12)

input usePOCShiftProxy = yes; # (7) (lightweight proxy, not VolumeProfile)

input useRangeVolRegime = yes; # (9)

input useOBVDivergence = yes; # (3)

input useVWAPSlopeShift = yes; # extra context

input useEMA8Intent = yes; # your 8-EMA “3-vote” rule

input useATRTrendFilter = yes; # ATR% slope

# Weights

input wVolumePressure = 2;

input wVWAPRejection = 2;

input wStopHuntReversal = 2;

input wMomentumVolumeDiv = 2;

input wRelativeStrength = 2;

input wOpeningDriveFailure = 2;

input wPOCShiftProxy = 2;

input wRangeVolRegime = 1;

input wOBVDivergence = 2;

input wVWAPSlopeShift = 1;

input wEMA8Intent = 3;

input wATRTrendFilter = 1;

# Relative Strength

input rsSymbol = "QQQ";

input rsLen = 20;

# Opening Drive window (minutes after 09:30)

input odMinutes = 30;

# Smoothing

input smoothEMA = 5;

# Visuals

input showBubbles = no;

input paintBars = yes; # set yes to color price bars

input showComponents = no;

input showScoreLabel = yes;

#-------------------------

# ----- Base Series ------

#-------------------------

def na = Double.NaN;

def c = close;

def o = open;

def h = high;

def l = low;

def v = volume;

# MACD

def macdDiff = MACD()."Diff";

# RSI

def rsi = RSI();

# ATR & ATR%

def atr = ATR(length = atrLength);

def atrPct = if c != 0 then atr / c * 100 else 0;

# EMA8

def ema = ExpAverage(c, 20);

# ---------- Custom Session VWAP (RTH reset at 09:30) ----------

def newDay = GetDay() <> GetDay()[1];

def rthStart = SecondsFromTime(0930) == 0;

def sessionReset = newDay or rthStart;

def tp = (h + l + c) / 3;

def cumPV = if sessionReset then tp * v else cumPV[1] + tp * v;

def cumV = if sessionReset then v else cumV[1] + v;

def vwap = if cumV > 0 then cumPV / cumV else c;

# OBV (simple)

def obv = TotalSum(Sign(c - c[1]) * v);

# Relative Strength vs benchmark

def rs = c / close(rsSymbol);

def rsMA = Average(rs, rsLen);

def rsMA_slope = rsMA - rsMA[1];

# Helpers

def trange = h - l;

def body = AbsValue(c - o);

def upperWick = if c >= o then h - c else h - o;

def lowerWick = if c >= o then o - l else c - l;

# Opening Drive window (first N minutes from 09:30)

def inOD = SecondsFromTime(0930) >= 0 and SecondsFromTime(0930) < odMinutes * 60;

#-------------------------

# -- Hidden Intent Logic -

#-------------------------

# (1) Volume Pressure vs Price Direction

def rawVP = if trange > 0 then ((c - o) / trange) * v else 0;

def vpEMA = ExpAverage(rawVP, smoothEMA);

def priceDir = c - c[1];

def vpSignal = if useVolumePressure then

if vpEMA > 0 and priceDir >= 0 then 1 else

if vpEMA < 0 and priceDir <= 0 then -1 else 0

else 0;

# (4) VWAP Rejections (within 0.1*ATR and wick-dominant rejection)

def nearVWAP = AbsValue(c - vwap) <= (atr * 0.1);

def rejectUp = nearVWAP and c > vwap and lowerWick > body;

def rejectDn = nearVWAP and c < vwap and upperWick > body;

def vwapRejSignal = if useVWAPRejection then

if rejectUp then 1 else

if rejectDn then -1 else 0

else 0;

# (5) Stop-run traps (liquidity hunts)

input swingLen = 10;

def swingHigh = Highest(h[1], swingLen);

def swingLow = Lowest(l[1], swingLen);

def stopRunUp = h > swingHigh and c < swingHigh;

def stopRunDn = l < swingLow and c > swingLow;

def stopHuntSignal = if useStopHuntReversal then

if stopRunUp then -1 else

if stopRunDn then 1 else 0

else 0;

# (10) Momentum divergence (price HH/LL vs MACD Diff)

def hh = h > Highest(h[1], 5);

def ll = l < Lowest(l[1], 5);

def macdLowerHigh = macdDiff < macdDiff[1] and macdDiff[1] > macdDiff[2];

def macdHigherLow = macdDiff > macdDiff[1] and macdDiff[1] < macdDiff[2];

def momDivSignal = if useMomentumVolumeDiv then

if hh and macdLowerHigh then -1 else

if ll and macdHigherLow then 1 else 0

else 0;

# (11) Relative Strength slope

def rsSignal = if useRelativeStrength then

if rsMA_slope > 0 then 1 else

if rsMA_slope < 0 then -1 else 0

else 0;

# (12) Opening Drive Failure (simple ORB logic)

rec orh = if inOD then Max(if IsNaN(orh[1]) then h else orh[1], h) else orh[1];

rec orl = if inOD then Min(if IsNaN(orl[1]) then l else orl[1], l) else orl[1];

def brokeUpOD = !inOD and c[1] > orh and orh != 0;

def failedUp = brokeUpOD and c < orh;

def brokeDnOD = !inOD and c[1] < orl and orl != 0;

def failedDn = brokeDnOD and c > orl;

def odFailSignal = if useOpeningDriveFailure then

if failedUp then -1 else

if failedDn then 1 else 0

else 0;

# (7) POC Shift Proxy (lightweight): use rolling VWAP vs rolling mean price

input pocLookback = 50;

def meanPrice = Average(c, pocLookback);

def pocSignal = if usePOCShiftProxy then

if vwap > meanPrice and vwap[1] <= meanPrice[1] then 1 else

if vwap < meanPrice and vwap[1] >= meanPrice[1] then -1 else 0

else 0;

# (9) Range/Volume regime

def trueRange = TrueRange(h, c, l);

def rangeExp = trueRange > Average(trueRange, 14);

def volExp = v > Average(v, 20);

def regimeSignal = if useRangeVolRegime then

if rangeExp and !volExp then -1 else

if rangeExp and volExp then 1 else 0

else 0;

# (3) OBV divergence proxy

def priceUp2 = c > c[1] and c[1] > c[2];

def priceDn2 = c < c[1] and c[1] < c[2];

def obvDown = obv < obv[1];

def obvUp = obv > obv[1];

def obvDivSignal = if useOBVDivergence then

if priceUp2 and obvDown then -1 else

if priceDn2 and obvUp then 1 else 0

else 0;

# VWAP slope shift

def vwapSlope = vwap - vwap[1];

def vwapSlopeSignal = if useVWAPSlopeShift then

if vwapSlope > 0 then 1 else

if vwapSlope < 0 then -1 else 0

else 0;

# EMA8 intent (3-vote if both O & C align)

def ema8Signal = if useEMA8Intent then

if c > ema then 1 else

if c < ema then -1 else 0

else 0;

# ATR trend filter

def atrSlope = atrPct - atrPct[1];

def atrSignal = if useATRTrendFilter then

if atrSlope > 0 then 1 else

if atrSlope < 0 then -1 else 0

else 0;

#-------------------------

# ---- Scoring & Plots ---

#-------------------------

def scoreRaw =

vpSignal * wVolumePressure +

vwapRejSignal * wVWAPRejection +

stopHuntSignal * wStopHuntReversal +

momDivSignal * wMomentumVolumeDiv +

rsSignal * wRelativeStrength +

odFailSignal * wOpeningDriveFailure +

pocSignal * wPOCShiftProxy +

regimeSignal * wRangeVolRegime +

obvDivSignal * wOBVDivergence +

vwapSlopeSignal * wVWAPSlopeShift +

ema8Signal * wEMA8Intent +

atrSignal * wATRTrendFilter;

def safeScoreRaw = if IsNaN(scoreRaw) then 0 else scoreRaw;

def scoreEMA = ExpAverage(safeScoreRaw, smoothEMA);

plot Composite = scoreEMA;

Composite.SetLineWeight(2);

Composite.AssignValueColor(

if scoreEMA > 0 then Color.GREEN

else if scoreEMA < 0 then Color.RED

else Color.GRAY

);

plot ZeroLine = 0;

ZeroLine.SetDefaultColor(Color.GRAY);

ZeroLine.SetStyle(Curve.SHORT_DASH);

plot Thrust = scoreRaw;

Thrust.SetPaintingStrategy(PaintingStrategy.HISTOGRAM);

Thrust.SetLineWeight(2);

Thrust.AssignValueColor(

if scoreRaw > 0 then Color.GREEN

else if scoreRaw < 0 then Color.RED

else Color.DARK_GRAY

);

# Optional components (thin debug lines)

def showC = showComponents;

plot pVP = if showC then vpSignal else na;

plot pVWAP = if showC then vwapRejSignal else na;

plot pStop = if showC then stopHuntSignal else na;

plot pDiv = if showC then momDivSignal else na;

plot pRS = if showC then rsSignal else na;

plot pOD = if showC then odFailSignal else na;

plot pPOC = if showC then pocSignal else na;

plot pReg = if showC then regimeSignal else na;

plot pOBV = if showC then obvDivSignal else na;

plot pVSlp = if showC then vwapSlopeSignal else na;

plot pE8 = if showC then ema8Signal else na;

plot pATR = if showC then atrSignal else na;

pVP.SetDefaultColor(Color.CYAN);

pVWAP.SetDefaultColor(Color.YELLOW);

pStop.SetDefaultColor(Color.LIGHT_RED);

pDiv.SetDefaultColor(Color.WHITE);

pRS.SetDefaultColor(Color.LIGHT_GREEN);

pOD.SetDefaultColor(Color.MAGENTA);

pPOC.SetDefaultColor(Color.ORANGE);

pReg.SetDefaultColor(Color.LIGHT_GRAY);

pOBV.SetDefaultColor(Color.PINK);

pVSlp.SetDefaultColor(Color.LIGHT_ORANGE);

pE8.SetDefaultColor(Color.CYAN);

pATR.SetDefaultColor(Color.LIGHT_GRAY);

pVP.SetLineWeight(1);

pVWAP.SetLineWeight(1);

pStop.SetLineWeight(1);

pDiv.SetLineWeight(1);

pRS.SetLineWeight(1);

pOD.SetLineWeight(1);

pPOC.SetLineWeight(1);

pReg.SetLineWeight(1);

pOBV.SetLineWeight(1);

pVSlp.SetLineWeight(1);

pE8.SetLineWeight(1);

pATR.SetLineWeight(1);

#-------------------------

# ---- Visual Cues -------

#-------------------------

AddChartBubble(showBubbles and rejectUp, scoreRaw, "VWAP↑Reject", Color.GREEN, yes);

AddChartBubble(showBubbles and rejectDn, scoreRaw, "VWAP↓Reject", Color.RED, no);

AddChartBubble(showBubbles and (hh and macdLowerHigh), scoreRaw, "Mom Div (Bear)", Color.RED, no);

AddChartBubble(showBubbles and (ll and macdHigherLow), scoreRaw, "Mom Div (Bull)", Color.GREEN, yes);

#-------------------------

# ---- Price Bar Paint ---

#-------------------------

AssignPriceColor(

if paintBars then

if scoreEMA > 0 then Color.Cyan

else if scoreEMA < 0 then Color.Red

else Color.GRAY

else Color.CURRENT

);

#-------------------------

# ------ Label -----------

#-------------------------

def bullCount =

Max(0, if IsNaN(vpSignal) then 0 else vpSignal) + Max(0, vwapRejSignal) + Max(0, stopHuntSignal) + Max(0, momDivSignal) +

Max(0, rsSignal) + Max(0, odFailSignal) + Max(0, pocSignal) + Max(0, regimeSignal) +

Max(0, obvDivSignal) + Max(0, vwapSlopeSignal) + Max(0, ema8Signal) + Max(0, atrSignal);

def bearCount =

Max(0, if IsNaN(vpSignal) then 0 else -vpSignal) + Max(0, -vwapRejSignal) + Max(0, -stopHuntSignal) + Max(0, -momDivSignal) +

Max(0, -rsSignal) + Max(0, -odFailSignal) + Max(0, -pocSignal) + Max(0, -regimeSignal) +

Max(0, -obvDivSignal) + Max(0, -vwapSlopeSignal) + Max(0, -ema8Signal) + Max(0, -atrSignal);

AddLabel(showScoreLabel,

"Intent " + AsText(Round(scoreEMA, 1)) +

" | Bull " + bullCount + " vs Bear " + bearCount +

" | MACDdiff " + AsText(Round(macdDiff, 2)) +

" | RSI " + AsText(Round(rsi, 1)) +

" | ATR% " + AsText(Round(atrPct, 2)) + "%",

if scoreEMA > 0 then Color.GREEN else if scoreEMA < 0 then Color.RED else Color.GRAY);

Last edited by a moderator: