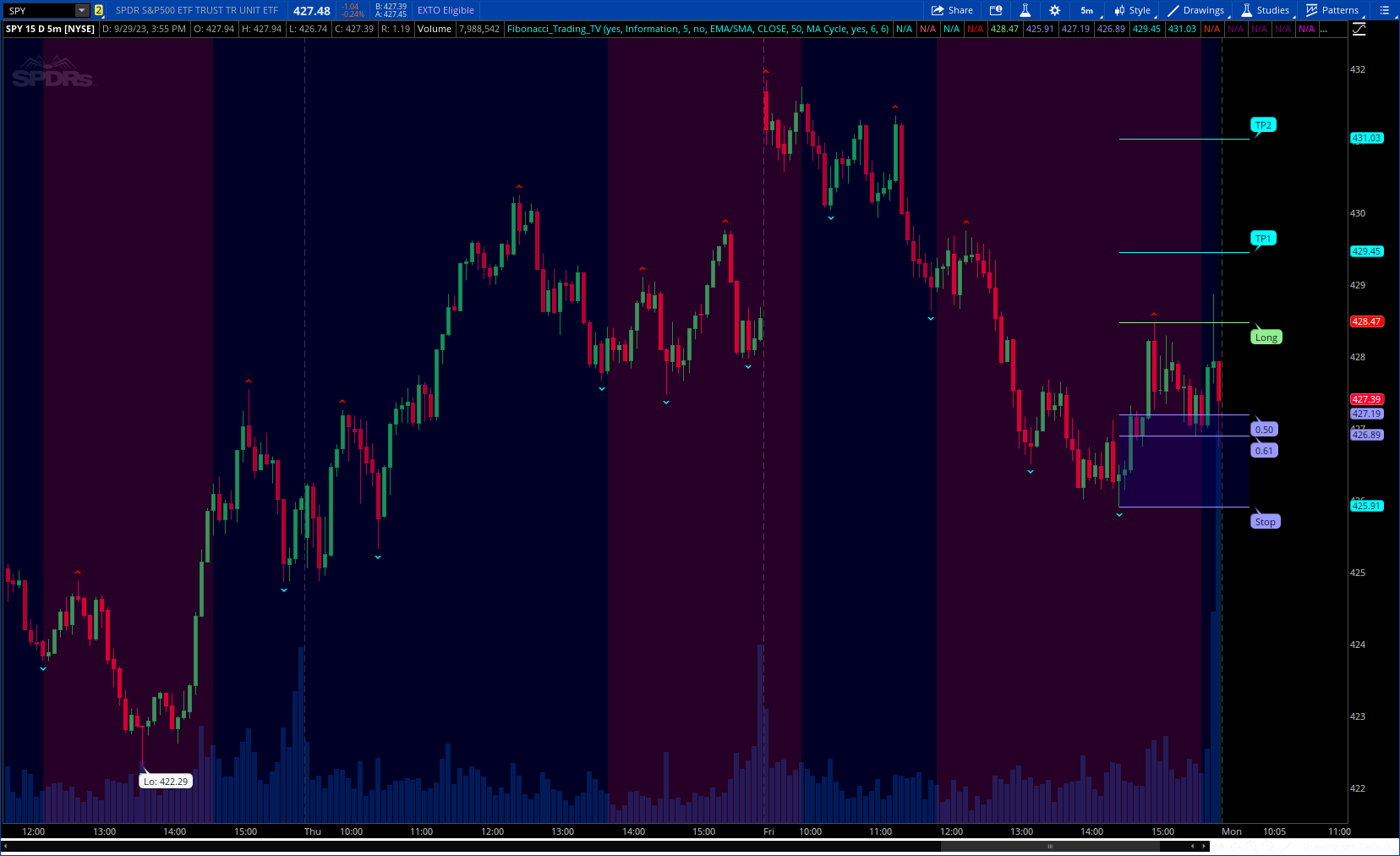

This simple script draw Fibonacci Retracement to define pullback level and draw Fibonacci Extension to define target level of a upward wave or doward wave

CODE:

CSS:

# https://www.tradingview.com/v/kLsYz4jj/

#//@inno14

#//Fibonacci Trading

# Converted by Sam4Cok@Samer800 - 10/2023

#indicator('Fibonacci Trading', overlay=true, max_l

input FillBackground = yes;

input showBubbles = {Default "Information", "Price Value", "Don't Show"};

input extendLineBy = 5;

input ShowMovAvg = yes;

input maCycleSetup = {Default "EMA/SMA", "EMA/RMA"};

input source = close;

input MovAvgPeriod = 50;

input trading_setup = {Default "MA Cycle", "Long Only","Short Only","Both"};

input showFractals = yes;

input NoOfBarsFromTheLeftOfFractal = 6;

input NoOfBarsFromTheRightOfFractal = 6;

def na = Double.NaN;

def pos = Double.POSITIVE_INFINITY;

def neg = Double.NEGATIVE_INFINITY;

def left = NoOfBarsFromTheLeftOfFractal;

def right = NoOfBarsFromTheRightOfFractal;

def info = showBubbles==showBubbles."Information";

def noLab = showBubbles!=showBubbles."Don't Show";

def emasma = maCycleSetup==maCycleSetup."EMA/SMA";

DefineGlobalColor("bgUp", CreateColor(0, 0, 127));

DefineGlobalColor("bgDn", CreateColor(127, 0, 127));

def ema = ExpAverage(source, MovAvgPeriod);

def sma = Average(source, MovAvgPeriod);

def rma = WildersAverage(source, MovAvgPeriod);

def ma2 = if emasma then sma else rma;

def _c = ema - ma2;

def bgCol = if !FillBackground then na else

if _c > 0 then 1 else -1;

plot movAvg1 = if ShowMovAvg then ema else na;

plot movAvg2 = if ShowMovAvg then ma2 else na;

movAvg1.SetDefaultColor(Color.CYAN);

movAvg2.SetDefaultColor(GetColor(2));

AddCloud(if bgCol > 0 then pos else neg, if bgCol > 0 then neg else pos,

GlobalColor("bgUp"), GlobalColor("bgDn"));

script isFractal {

input x = close;

input Left = 6;

input Right = 6;

def hiBar = GetMaxValueOffset(x, Left + Right + 1);

def isFractal = hibar == Right;

plot out = isFractal;

}

script Lab {

input val = close;

def cond = isNaN(val) and !isNaN(val[1]);

def lab1 = if cond then val[1] else Double.NaN;

def lab2 = Round(lab1, 2);

plot out = lab2;

}

Script DrawLine {

input fromCond = no;

input toCond = no;

input endVal = close;

input extend = 6;

def last = isNaN(close);

def bar = AbsValue(BarNumber());

def fromBar = highestAll(fromCond);

def toVal = endVal;

def line1 = inertiaAll(toVal,2);

def line = highestAll(line1);

plot out = if bar > fromBar-1 and !last[extend] then line else Double.NaN;

}

def long_; def short_;

Switch (trading_setup) {

Case "Long Only" :

long_ = yes;

short_ = no;

Case "Short Only" :

long_ = no;

short_ = yes;

Case "Both" :

long_ = yes;

short_ = yes;

Default :

if _c > 0 {

long_ = yes;

short_ = no;

} else {

long_ = no;

short_ = yes;

}

}

def long = long_;

def short = short_;

def sF = isFractal(-low, Left, Right);

def rF = isFractal(high, Left, Right);

def support = if !support[1] then low else

if sF then low[Right] else support[1];

def resistance = if !resistance[1] then high else

if rF then high[Right] else resistance[1];

def fraLo = if sF then low[Right] else na;

def fraHi = if rF then high[Right] else na;

plot FractalLo = if showFractals then fraLo[-Right] else na; # "Fractal Low"

plot FractalHi = if showFractals then fraHi[-Right] else na; # "Fractal High"

FractalLo.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_DOWN);

FractalHi.SetPaintingStrategy(PaintingStrategy.BOOLEAN_WEDGE_Up);

FractalLo.SetDefaultColor(Color.CYAN);

FractalHi.SetDefaultColor(Color.RED);

#/Value & Index

def bar_index = AbsValue(BarNumber());

def ph = rF;

def ph_val = if ph then resistance else ph_val[1];

def res = ph_val;

def ph_index = if ph then bar_index - Right else ph_index[1];

def pl = sF;

def pl_val = if pl then support else pl_val[1];

def sup = pl_val;

def pl_index = if pl then bar_index - Right else pl_index[1];

#//Long setup

def long_sup_index; def long_sup_val; def long_res_val;

if pl_index < ph_index {

long_sup_index = pl_index;

long_sup_val = pl_val;

long_res_val = ph_val;

} else {

long_sup_index = long_sup_index[1];

long_sup_val = long_sup_val[1];

long_res_val = if long_sup_index==long_sup_index[1] then long_res_val[1] else na;

}

#//Short setup

def short_res_index; def short_res_val; def short_sup_val;

if pl_index > ph_index {

short_res_index = ph_index;

short_res_val = ph_val;

short_sup_val = pl_val;

} else {

short_res_index = short_res_index[1];

short_res_val = short_res_val[1];

short_sup_val = if short_res_index==short_res_index[1] then short_sup_val[1] else na;

}

#//Short Condition

def short_cond = (source < short_res_val and Short);

#//Long Condition

def long_cond = (source > long_sup_val and Long);

#//Resistance Line

def long_res_x1 = long_sup_index;

def long_res_y1 = if long_cond then long_res_val else na;

def long_res_x2 = bar_index;

def long_res_y2 = long_res_y1;

#//Support Line

def long_sup_x1 = long_sup_index;

def long_sup_y1 = if Long then long_sup_val else na;

def long_sup_x2 = bar_index;

def long_sup_y2 = long_sup_y1;

#//Fib50 Line

def long_fib50_x1 = long_sup_index;

def long_fib50_y1 = if long_cond then (long_res_y1 + long_sup_y1) *0.5 else na;

def long_fib50_x2 = bar_index;

def long_fib50_y2 = long_fib50_y1;

#//Fib618 Line

def long_fib618_x1 = long_sup_index;

def long_fib618_y1 = if long_cond then

long_res_y1-(long_res_y1-long_sup_y1)*0.618 else na;

def long_fib618_x2 = bar_index;

def long_fib618_y2 = long_fib618_y1;

#//tp1

def long_tp1_x1 = long_sup_index;

def long_tp1_y1 = if long_cond then

long_res_y1+(long_res_y1-long_sup_y1)*0.382 else na;

def long_tp1_x2 = bar_index;

def long_tp1_y2 = long_tp1_y1;

#//tp2

def long_tp2_x1 = long_sup_index;

def long_tp2_y1 = if long_cond then

long_res_y1+(long_res_y1-long_sup_y1) else na;

def long_tp2_x2 = bar_index;

def long_tp2_y2 = long_tp2_y1;

#// Short Resistance Line

def short_res_x1 = short_res_index;

def short_res_y1 = if Short then short_res_val else na;

def short_res_x2 = bar_index;

def short_res_y2 = short_res_y1;

#// Short Support Line

def short_sup_x1 = short_res_index;

def short_sup_y1 = if short_cond then short_sup_val else na;

def short_sup_x2 = bar_index;

def short_sup_y2 = short_sup_y1;

#//Short Fib50 Line

def short_fib50_x1 = short_res_index;

def short_fib50_y1 = if short_cond then (short_res_y1+short_sup_y1)*0.5 else na;

def short_fib50_x2 = bar_index;

def short_fib50_y2 = short_fib50_y1;

#//Short Fib618 Line

def short_fib618_x1 = short_res_index;

def short_fib618_y1 = if short_cond then

short_sup_y1+(short_res_y1-short_sup_y1)*0.618 else na;

def short_fib618_x2 = bar_index;

def short_fib618_y2 = short_fib618_y1;

#// Short tp1

def short_tp1_x1 = short_res_index;

def short_tp1_y1 = if short_cond then

short_sup_y1-(short_res_y1-short_sup_y1)*0.382 else na;

def short_tp1_x2 = bar_index;

def short_tp1_y2 = short_tp1_y1;

#// Short tp2

def short_tp2_x1 = short_res_index;

def short_tp2_y1 = if short_cond then

short_sup_y1-(short_res_y1-short_sup_y1) else na;

def short_tp2_x2 = bar_index;

def short_tp2_y2 = short_tp2_y1;

#-- Long

def BreakEve = DrawLine(long_res_x1, long_res_x2, long_res_y2, extendLineby);

def Inval = DrawLine(long_sup_x1, long_sup_x2, long_sup_y2, extendLineby);

def lvl500 = DrawLine(long_fib50_x1, long_fib50_x2, long_fib50_y2, extendLineby);

def lvl618 = DrawLine(long_fib618_x1,long_fib618_x2, long_fib618_y2, extendLineby);

def tp1 = DrawLine(long_tp1_x1, long_tp1_x2, long_tp1_y2, extendLineby);

def tp2 = DrawLine(long_tp2_x1, long_tp2_x2, long_tp2_y2, extendLineby);

#-- Short

def sBreakEve = DrawLine(short_sup_x1, short_sup_x2, short_sup_y2, extendLineby);

def sInval = DrawLine(short_res_x1, short_res_x2, short_res_y2, extendLineby);

def slvl500 = DrawLine(short_fib50_x1, short_fib50_x2, short_fib50_y2, extendLineby);

def slvl618 = DrawLine(short_fib618_x1,short_fib618_x2,short_fib618_y2, extendLineby);

def stp1 = DrawLine(short_tp1_x1, short_tp1_x2, short_tp1_y2, extendLineby);

def stp2 = DrawLine(short_tp2_x1, short_tp2_x2, short_tp2_y2, extendLineby);

#-- Long

plot BreakEven = BreakEve;

plot Invalid = Inval;

plot Level500 = lvl500;

plot Level618 = lvl618;

plot ProfLong1 = tp1;

plot profLong2 = tp2;

#-- Short

plot sBreakEven = sBreakEve;

plot sInvalid = sInval;

plot sLevel500 = slvl500;

plot sLevel618 = slvl618;

plot sProfLong1 = stp1;

plot sprofLong2 = stp2;

BreakEven.SetDefaultColor(Color.LIGHT_GREEN);

Invalid.SetDefaultColor(Color.VIOLET);

Level500.SetDefaultColor(Color.VIOLET);

Level618.SetDefaultColor(Color.VIOLET);

ProfLong1.SetDefaultColor(Color.CYAN);

ProfLong2.SetDefaultColor(Color.CYAN);

sBreakEven.SetDefaultColor(Color.LIGHT_RED);

sInvalid.SetDefaultColor(Color.PLUM);

sLevel500.SetDefaultColor(Color.PLUM);

sLevel618.SetDefaultColor(Color.PLUM);

sProfLong1.SetDefaultColor(Color.MAGENTA);

sProfLong2.SetDefaultColor(Color.MAGENTA);

AddCloud(Level500, Invalid, GlobalColor("bgUp"));

AddCloud(sInvalid , sLevel500 , GlobalColor("bgDn"));

#-- LAbel

AddChartBubble(noLab and Lab(ProfLong2), Lab(ProfLong2),

if info then "TP2" else "$" + Lab(ProfLong2), Color.CYAN);

AddChartBubble(noLab and Lab(ProfLong1), Lab(ProfLong1),

if info then "TP1" else "$" + Lab(ProfLong1), Color.CYAN);

AddChartBubble(noLab and Lab(BreakEven), Lab(BreakEven),

if info then "Long" else "$" + Lab(BreakEven), Color.LIGHT_GREEN, no);

AddChartBubble(noLab and Lab(Level500), Lab(Level500),

if info then "0.50" else "$" + Lab(Level500), Color.VIOLET, no);

AddChartBubble(noLab and Lab(Level618), Lab(Level618),

if info then "0.61" else "$" + Lab(Level618), Color.VIOLET, no);

AddChartBubble(noLab and Lab(Invalid), Lab(Invalid),

if info then "Stop" else "$" + Lab(Invalid), Color.VIOLET, no);

AddChartBubble(noLab and Lab(sInvalid), Lab(sInvalid),

if info then "Stop" else "$" + Lab(sInvalid), Color.PLUM);

AddChartBubble(noLab and Lab(sLevel618), Lab(sLevel618),

if info then "0.61" else "$" + Lab(sLevel618), Color.PLUM);

AddChartBubble(noLab and Lab(sLevel500), Lab(sLevel500),

if info then "0.50" else "$" + Lab(sLevel500), Color.PLUM);

AddChartBubble(noLab and Lab(sBreakEven), Lab(sBreakEven),

if info then "Short" else "$" + Lab(sBreakEven), Color.LIGHT_RED);

AddChartBubble(noLab and Lab(sProfLong1), Lab(sProfLong1),

if info then "TP1" else "$" + Lab(sProfLong1), Color.MAGENTA, no);

AddChartBubble(noLab and Lab(sProfLong2), Lab(sProfLong2),

if info then "TP2" else "$" + Lab(sProfLong2), Color.MAGENTA, no);

#-- END of CODE