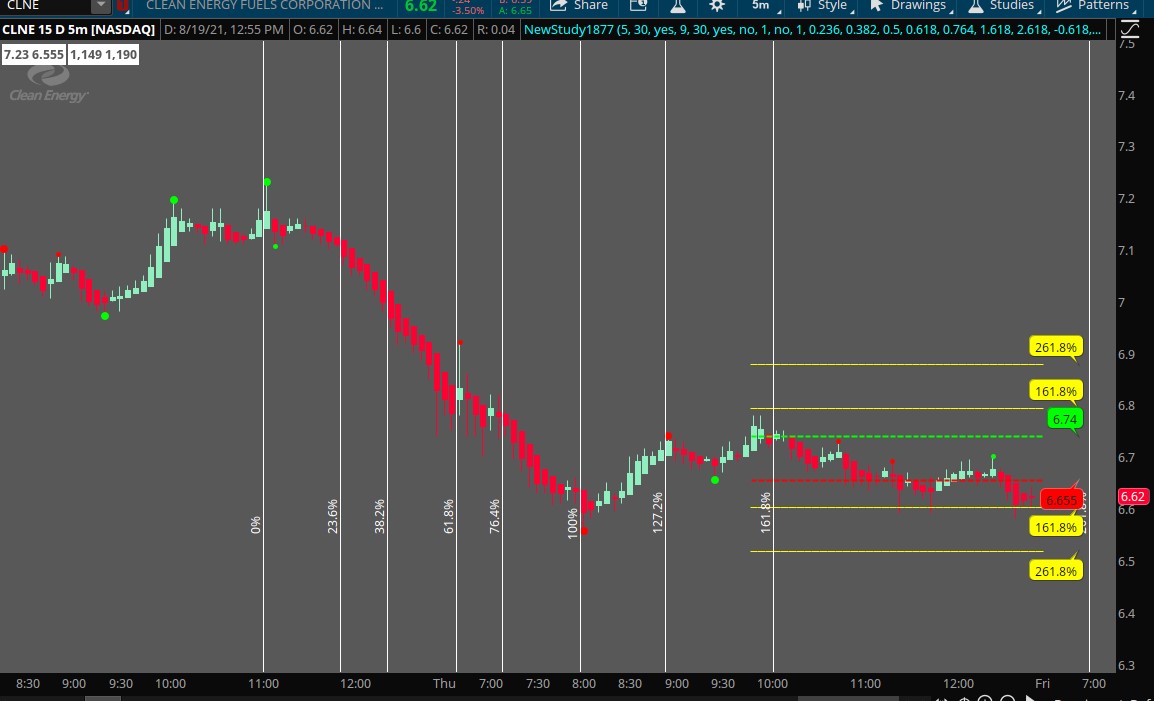

Here is my attempt at Fibonacci Time Ratios using a base of a Swing High/Low study I had previously done.

It uses the input swing1's high and low pivots from one previous swing so that it is not changing while the candles are currently forming. Everything will start at left most high or low in the previous swing at 0% and will extend to a maximum of 4.23%. I have tested it intraday with or without extended hours shown and have felt that without might be better.

There is very little information on this topic that I could find and only found drawing tools rather than code as a basis. So I have no idea whether this is accurate or useful.

It uses the input swing1's high and low pivots from one previous swing so that it is not changing while the candles are currently forming. Everything will start at left most high or low in the previous swing at 0% and will extend to a maximum of 4.23%. I have tested it intraday with or without extended hours shown and have felt that without might be better.

There is very little information on this topic that I could find and only found drawing tools rather than code as a basis. So I have no idea whether this is accurate or useful.

Ruby:

Ruby:#SwingHL_2Levels_Fibs input swing = 9; input maxbars = 30; input showlevels = Yes; def sb = swing; def sf = swing; def na = Double.NaN; def lfor = Lowest(low, sf)[-sf]; def lback = Lowest(low, sb)[1]; def swinglow = if low < lfor and low < lback then 1 else 0; def slow = if swinglow == 1 then low else slow[1]; plot s1 = if swinglow then low else na; def hfor = Highest(high, sf)[-sf]; def hback = Highest(high, sb)[1]; def swinghigh = if high > hfor and high > hback then 1 else 0; def fast = if swinghigh == 1 then high else fast[1]; plot r1 = if swinghigh then high else na; input swing1 = 15; input maxbars1 = 30; input showlevels1 = Yes; def sb1 = swing1; def sf1 = swing1; def lfor1 = Lowest(low, sf1)[-sf1]; def lback1 = Lowest(low, sb1)[1]; def swinglow1 = if low < lfor1 and low < lback1 then 1 else 0; def slow1 = if swinglow1 == 1 then low else slow1[1]; plot s2 = if swinglow1 then low - TickSize() * 0 else na; def hfor1 = Highest(high, sf1)[-sf1]; def hback1 = Highest(high, sb1)[1]; def swinghigh1 = if high > hfor1 and high > hback1 then 1 else 0; def fast1 = if swinghigh1 == 1 then high else fast1[1]; plot r2 = if swinghigh1 then high + TickSize() * 0 else na; r2.SetStyle(Curve.POINTS); r2.SetLineWeight(5); r2.AssignValueColor(if fast1[1] < fast1 then Color.GREEN else if fast1[1] == fast1 then Color.YELLOW else Color.RED); r2.HideBubble(); r1.SetStyle(Curve.POINTS); r1.SetLineWeight(2); r1.AssignValueColor(if fast[1] < fast then Color.GREEN else if fast[1] == fast then Color.YELLOW else Color.RED); r1.HideBubble(); s2.SetStyle(Curve.POINTS); s2.SetLineWeight(5); s2.AssignValueColor(if slow1[1] < slow1 then Color.GREEN else if slow1[1] == slow1 then Color.YELLOW else Color.RED); s2.HideBubble(); s1.SetStyle(Curve.POINTS); s1.SetLineWeight(2); s1.AssignValueColor(if slow[1] < slow then Color.GREEN else if slow[1] == slow then Color.YELLOW else Color.RED); s1.HideBubble(); input showbubbles_r1s1 = no; input bubblefactor = 0; AddChartBubble(showbubbles_r1s1 and r1, high + TickSize() * bubblefactor, "R1", Color.WHITE, yes); AddChartBubble(showbubbles_r1s1 and s1, low - TickSize() * bubblefactor, "S1", Color.WHITE, no); input showbubbles_r2s2 = no; AddChartBubble(showbubbles_r2s2 and r2, high + TickSize() * bubblefactor, "R2", Color.GREEN, yes); AddChartBubble(showbubbles_r2s2 and s2, low - TickSize() * bubblefactor, "S2", Color.RED, no); #Store Previous Data def r2save = if !IsNaN(r2) then r2 else r2save[1]; def s2save = if !IsNaN(s2) then s2 else s2save[1]; def r3save = if (r2save) != r2save[1] then r2save[1] else r3save[1]; def s3save = if (s2save) != s2save[1] then s2save[1] else s3save[1]; AddLabel(1, r3save + " " + s3save, Color.WHITE); def r2bn = if !IsNaN(r2) then BarNumber() else r2bn[1]; def s2bn = if !IsNaN(s2) then BarNumber() else s2bn[1]; def r3bn = if (r2bn) != r2bn[1] then r2bn[1] else r3bn[1]; def s3bn = if (s2bn) != s2bn[1] then s2bn[1] else s3bn[1]; #AddLabel(1, r3bn + " " + s3bn, Color.WHITE); #Fibonacci rec data = CompoundValue(1, if (r2save == high) then data[1] + 1 else data[1], 0); def datacount = (HighestAll(data) - data[1]) + 1 ; input numberfibstoshow = 3; input fib1level = .236; input fib2level = .382; input fibMlevel = .500; input fib3level = .618; input fib4level = .764; input fib5level = 1.618; input fib6level = 2.618; input fib7level = -.618; input fib8level = -1.618; input fib4alevel = 1.272; input fib7alevel = 3.618; input fib8alevel = 4.23; def fibh = max(r2save, s2save); def fibl = min(r2save, s2save); def range = absValue(fibh - fibl); input showfiblines = no; input showfiblinesextreme = yes; plot fibHp = if showfiblinesextreme == no then Double.NaN else if datacount <= numberfibstoshow then fibh else Double.NaN; plot fibLp = if showfiblinesextreme == no then Double.NaN else if datacount <= numberfibstoshow then fibl else Double.NaN; plot fibM = if showfiblines == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fibMlevel else Double.NaN; plot fib1 = if showfiblines == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib1level else Double.NaN; plot fib2 = if showfiblines == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib2level else Double.NaN; plot fib3 = if showfiblines == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib3level else Double.NaN; plot fib4 = if showfiblines == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib4level else Double.NaN; plot fib5 = if showfiblinesextreme == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib5level else Double.NaN; plot fib6 = if showfiblinesextreme == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib6level else Double.NaN; plot fib7 = if showfiblinesextreme == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib7level else Double.NaN; plot fib8 = if showfiblinesextreme == no then Double.NaN else if datacount <= numberfibstoshow then fibl + range * fib8level else Double.NaN; fibHp.SetPaintingStrategy(PaintingStrategy.DASHES); fibLp.SetPaintingStrategy(PaintingStrategy.DASHES); fibHp.SetLineWeight(2); fibLp.SetLineWeight(2); fibM.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib1.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib2.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib3.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib4.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib5.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib6.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib7.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fib8.SetPaintingStrategy(PaintingStrategy.HORIZONTAL); fibHp.SetDefaultColor(Color.GREEN); fibLp.SetDefaultColor(Color.RED); fibM.SetDefaultColor(Color.WHITE); fib1.SetDefaultColor(Color.CYAN); fib2.SetDefaultColor(Color.YELLOW); fib3.SetDefaultColor(Color.YELLOW); fib4.SetDefaultColor(Color.CYAN); fib5.SetDefaultColor(Color.YELLOW); fib6.SetDefaultColor(Color.YELLOW); fib7.SetDefaultColor(Color.YELLOW); fib8.SetDefaultColor(Color.YELLOW); fibHp.HideBubble(); fibLp.HideBubble(); fibM.HideBubble(); fib1.HideBubble(); fib2.HideBubble(); fib3.HideBubble(); fib4.HideBubble(); fib5.HideBubble(); fib6.HideBubble(); fib7.HideBubble(); fib8.HideBubble(); input showfib_bubbles = yes; input n = 5; def n1 = n + 1; AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fibh[n1], fibh[n1], Color.GREEN, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fibl[n1], fibl[n1], Color.RED, no); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib4[n1], "23.6%", Color.CYAN, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib1[n1], "76.4%", Color.CYAN, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib3[n1], "38.2%", Color.YELLOW, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib2[n1], "61.8%", Color.YELLOW, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fibM[n1], "50.0%", Color.WHITE, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib5[n1], "161.8%", Color.YELLOW, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib6[n1], "261.8%", Color.YELLOW, yes); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib7[n1], "161.8%", Color.YELLOW, no); AddChartBubble(showfib_bubbles and !IsNaN(close[n1]) and IsNaN(close[n]), fib8[n1], "261.8%", Color.YELLOW, no); #--------------------------------------------------------- #Fibonacci Time Ratios AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)), " 0%", color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == max(HighestAll(r3bn),highestall(s3bn)), " 100%", color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib1level * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib1level), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib2level * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib2level), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib3level * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib3level), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib4level * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib4level), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib4alevel * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib4alevel), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib5level * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib5level), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib6level * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib6level), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib7alevel * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib7alevel), color = Color.white, stroke = Curve.FIRM); AddVerticalLine(BarNumber() == min(HighestAll(r3bn),highestall(s3bn)) + Round(fib8alevel * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), " "+aspercent(fib8alevel), color = Color.white, stroke = Curve.FIRM); #AddLabel(1, HighestAll(r3bn) + Round(fib1level * AbsValue(HighestAll(r3bn) - (HighestAll(s3bn))), 0), Color.WHITE);

Last edited by a moderator: