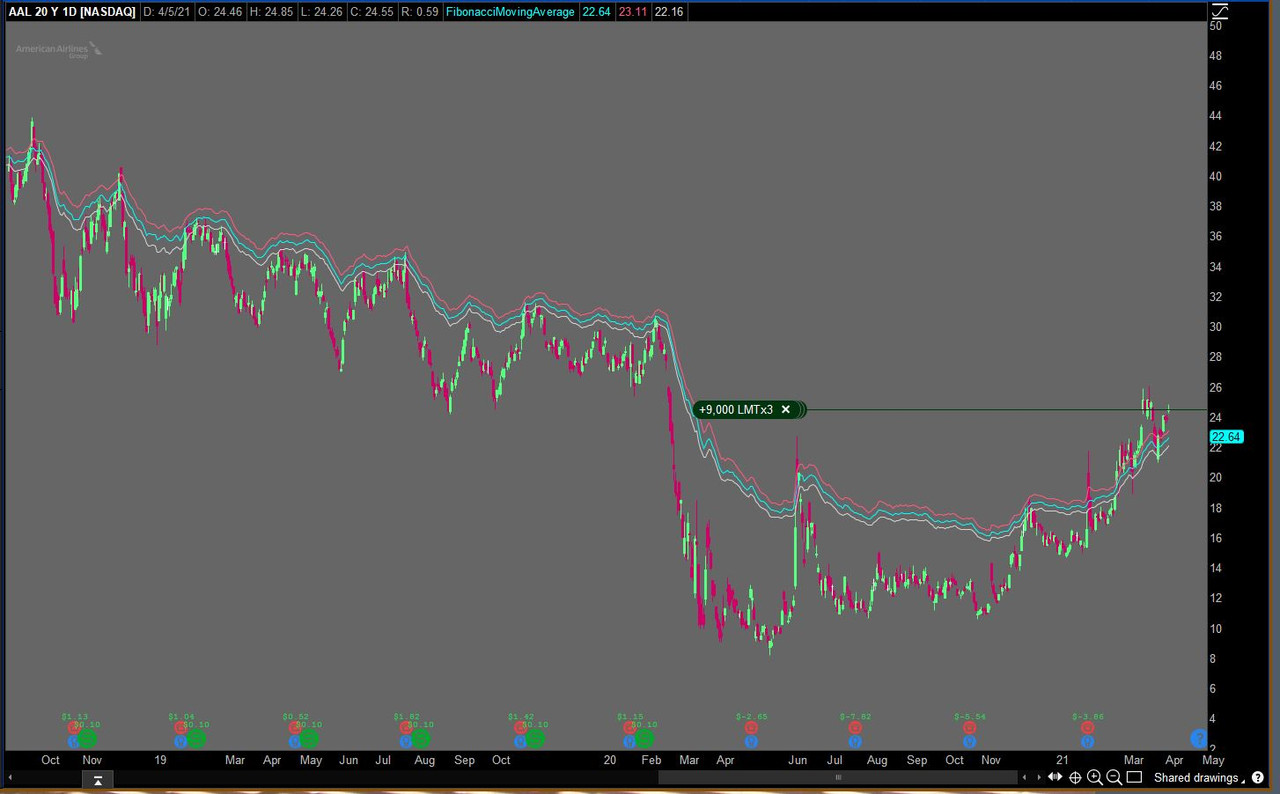

Fibonacci Moving Average

Code:

#Fibonacci Moving Average

#Based Upon https://medium.datadriveninvestor.c...e-new-trading-horizons-in-python-f2d0f8c86222

script fib{

input d = close;

def ema2 = ExpAverage(d, 2);

def ema3 = ExpAverage(d, 3);

def ema5 = ExpAverage(d, 5);

def ema8 = ExpAverage(d, 8);

def ema13 = ExpAverage(d, 13);

def ema21 = ExpAverage(d, 21);

def ema34 = ExpAverage(d, 34);

def ema55 = ExpAverage(d, 55);

def ema89 = ExpAverage(d, 89);

def ema144 = ExpAverage(d, 144);

def ema233 = ExpAverage(d, 233);

def ema377 = ExpAverage(d, 377);

def ema610 = ExpAverage(d, 610);

def ema987 = ExpAverage(d, 987);

def ema1597 = ExpAverage(d, 1597);

def sumema = ema2 + ema3 + ema5 + ema8 + ema13 + ema21 + ema34 + ema55 + ema89 + ema144 + ema233 + ema377 + ema610 + ema987 + ema1597;

plot fibavg = sumema / 15;

}

plot fibma_close = fib(close);

plot fibma_high = fib(high);

plot fibma_low = fib(low);

Last edited by a moderator: