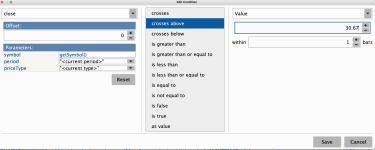

Hi everyone, first time usethinkscript forum poster here. I've been learning paper trading for options using thinkorswim for a little while, and I'm trying to figure out how to accurately trigger a position entry. The thinkorswim software seems a bit buggy, but it's more probable that I simply don't quite understand it in complete depth yet. I've been getting entry triggers that don't conform to the conditions I want. Some seem to trigger randomly. Basically, I want the order to trigger when the stock price either crosses above (for calls) or below (for puts) the threshold of the previous trading day's high or low stock price, but not if it gaps past the previous day's high/low. I only want the entry to trigger if the direction the stock is going is in a favorable direction for the option trade. As you can see from the screenshots I took in thinkorswim, the configuration I have is set up to trigger when the close crosses above a price threshold on the one minute candle. I've previously had the price high/low rather the close trigger it, but I've been getting behavior that I don't expect or understand. Sometimes it seems to trigger correctly, and other times it doesn't. I can't figure out why, either. For example, take the INTC trade that triggered today. Even though the price of INTC opened above 30.67, and the 1m candle was actually red with a close lower than the high, the order triggered after the first minute. I do want quick entries on the 1m time scale, but I don't want it to trigger unless my conditions are met.

Questions: does the 1m trigger w the 2:59 candle from the previous trading day? Do i need to adjust the condition wizard in a certain way?

If anybody has en explanatoin or just a simple fix that is not obvious to me, I would greatly appreciate it!

Thanks

Questions: does the 1m trigger w the 2:59 candle from the previous trading day? Do i need to adjust the condition wizard in a certain way?

If anybody has en explanatoin or just a simple fix that is not obvious to me, I would greatly appreciate it!

Thanks

Attachments

Last edited by a moderator: