You should upgrade or use an alternative browser.

Ema Crossover Watchlist

- Thread starter rmscripts

- Start date

How can i create a column for Tos to show a 5/8 ema crossover ?

Thanks

The following code should suffice for a Custom Watchlist Column...

def xUp = ExpAverage("data" = CLOSE, "length" = 5) crosses above ExpAverage("data" = CLOSE, "length" = 8);

def xDn = ExpAverage("data" = CLOSE, "length" = 5) crosses below ExpAverage("data" = CLOSE, "length" = 8);

AddLabel(yes, if xUp then "xUp" else if xDn then "xDn" else " ", Color.CURRENT);

AssignBackgroundColor(if xUp then Color.GREEN else if xDn then Color.RED else Color.GRAY);I am trying to do something extremely similar so I didn’t want to create a new thread. The column shows all results as gray if I use this exact code and it shows all results as black if I use my code attached screenshot.The following code should suffice for a Custom Watchlist Column...

Ruby:def xUp = ExpAverage("data" = CLOSE, "length" = 5) crosses above ExpAverage("data" = CLOSE, "length" = 8); def xDn = ExpAverage("data" = CLOSE, "length" = 5) crosses below ExpAverage("data" = CLOSE, "length" = 8); AddLabel(yes, if xUp then "xUp" else if xDn then "xDn" else " ", Color.CURRENT); AssignBackgroundColor(if xUp then Color.GREEN else if xDn then Color.RED else Color.GRAY);

For my particular instance, I am trying to create a column in my watchlist that shows “bullish" if EMA4 is currently above EMA21 and “bearish” if EMA4 is currently below EMA21 for specific timeframes. Any help with this syntax would be huge.

Attachments

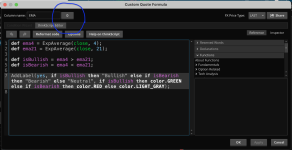

def ema4 = ExpAverage(close, 4);

def ema21 = ExpAverage(close, 21);

def isBullish = ema4 > ema21;

def isBearish = ema4 < ema21;

AddLabel(yes, if isBullish then "Bullish" else if isBearish then "Bearish" else "Neutral", if isBullish then color.GREEN else if isBearish then color.RED else color.LIGHT_GRAY);Attachments

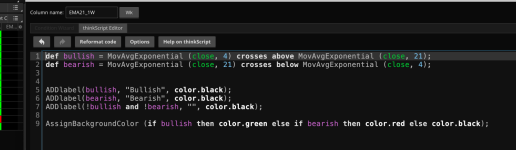

def EMA4 = ExpAverage(close, 4);

def EMA21 = ExpAverage(close, 21);

def Bullish = EMA4 > EMA21;

def Bearish = EMA4 < EMA21;

ADDlabel(bullish, "Bullish", color.black);

ADDlabel(bearish, "Bearish", color.black);

ADDlabel(!bullish and !bearish, "", color.black);

AssignBackgroundColor (if bullish then color.green else if bearish then color.red else color.black);Attachments

I just tested now and compared both the Watchlist data with each ticker's Chart. This worked perfect. Thank you so much for the help! Here is my code below for anyone that likes the look. Screenshot attached.

Code:def EMA4 = ExpAverage(close, 4); def EMA21 = ExpAverage(close, 21); def Bullish = EMA4 > EMA21; def Bearish = EMA4 < EMA21; ADDlabel(bullish, "Bullish", color.black); ADDlabel(bearish, "Bearish", color.black); ADDlabel(!bullish and !bearish, "", color.black); AssignBackgroundColor (if bullish then color.green else if bearish then color.red else color.black);

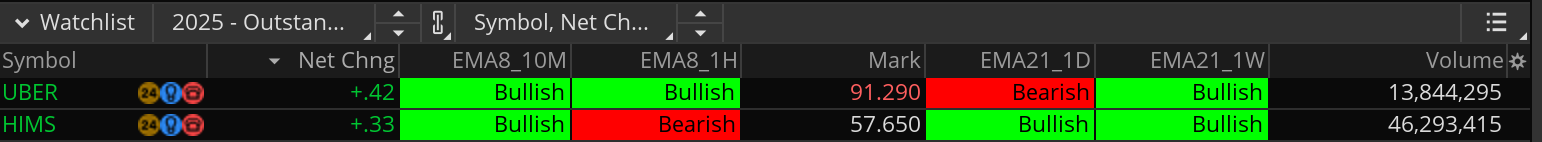

For some columns you’re using the 8 I see? Can you talk a bit about your experience with choosing the aggs and the ema’s ? Are you waiting for a stacked alignement to take positions? Obviously a cross happening on the 10m will lag against the hourly, so just curious on the approach. Thanks!

Yes. I am pretty much trading with a hybrid approach.For some columns you’re using the 8 I see? Can you talk a bit about your experience with choosing the aggs and the ema’s ? Are you waiting for a stacked alignement to take positions? Obviously a cross happening on the 10m will lag against the hourly, so just curious on the approach. Thanks!

EMA8_10M - Is the current Ask price above the 8 EMA over a 10 minute period?

EMA8_1H - Is the current Ask price above the 8 EMA over a 60 minute period? (lately I’ve been using 30 minutes)

EMA21_1D - Is the 4 EMA currently above the 21 EMA on the Daily timeframe?

EMA21_1W - Is the 4 EMA currently above the 21 EMA on the Weekly timeframe?

For a bigger picture, at minimum, I won’t enter any trades unless the Daily and Weekly are both “Bullish” when I’m looking to buy CALLS and both Bearish when I’m looking to buy PUTS.

For a smaller picture, I use the EMA8 columns for spotting entries with recent trend. I definitely try to look for “stacked" alignment.

Could you kindly provide the EMA Custom Watchlist referenced above? Thank you!Yes. I am pretty much trading with a hybrid approach.

EMA8_10M - Is the current Ask price above the 8 EMA over a 10 minute period?

EMA8_1H - Is the current Ask price above the 8 EMA over a 60 minute period? (lately I’ve been using 30 minutes)

EMA21_1D - Is the 4 EMA currently above the 21 EMA on the Daily timeframe?

EMA21_1W - Is the 4 EMA currently above the 21 EMA on the Weekly timeframe?

For a bigger picture, at minimum, I won’t enter any trades unless the Daily and Weekly are both “Bullish” when I’m looking to buy CALLS and both Bearish when I’m looking to buy PUTS.

For a smaller picture, I use the EMA8 columns for spotting entries with recent trend. I definitely try to look for “stacked" alignment.

Could you kindly provide the EMA Custom Watchlist referenced above? Thank you!

Here is the watchlist: https://usethinkscript.com/threads/ema-crossover-watchlist.21049/#post-154968

The OP uses different lengths dependent on the conditions outlines in the post that you have linked.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

| S | a fast EMA crossover with VWAP as a trend filter for scalping? | Questions | 1 | |

| M | combine 2 indicators for 3 EMA crossover | Questions | 5 | |

| M | EMA crossover stop and take profit | Questions | 10 | |

| A | 9 EMA crossover | Questions | 1 | |

|

|

EMA 20/50 crossover Scanner | Questions | 2 |

Similar threads

-

a fast EMA crossover with VWAP as a trend filter for scalping?

- Started by Sonybash

- Replies: 1

-

-

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

Similar threads

-

a fast EMA crossover with VWAP as a trend filter for scalping?

- Started by Sonybash

- Replies: 1

-

-

-

-

Similar threads

-

a fast EMA crossover with VWAP as a trend filter for scalping?

- Started by Sonybash

- Replies: 1

-

-

-

-

The Market Trading Game Changer

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/