Hi @john3 can you expand on the Bollinger Bands and RSI combo approach?Another simple, robust strategy that makes sense is Bollinger Bands and RSI combo. That said, trading without the VWAP is kind of like trying to catch a rabbit with your eyes closed. VWAP is the only indicator that works the same regardless of a time frame. The Volume profile is another one, but in Ninja not in TOS. TOS does not use the true volume profile, it is aggregated by time, but it is still usable.

The VWAP is as close to the holy grail as it gets. It gives you everything you want, Volume, Volatility and Trend. VWAP and RSI is another great combination.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Donchian Strategy seemingly wildly successful For ThinkOrSwim

- Thread starter RickK

- Start date

- Status

- Not open for further replies.

New Indicator: Buy the Dip

Check out our Buy the Dip indicator and see how it can help you find profitable swing trading ideas. Scanner, watchlist columns, and add-ons are included.

Join useThinkScript to post your question to a community of 21,000+ developers and traders.

Not only that (about the VWAP), but I've noticed an interesting thing about price action on the futures (mostly /ES). Have you noticed that probably about 70 percent of the time during the last hour of trading, price will either take off in its developed trend, OR (way more often) it will magnet back to the VWAP. Especially when the VWAP and the 200EMA are close to each other. When this happens, the last 30 min of the day will have price bouncing in the channel between the VWAP and the 200. In 2 years of watching it closely, I've noted this with certainty. Do you agree?

The short answer is no.

200 EMA on what time frame? Why EMA and not SMA or a gadzillion others MAs? As far as I know, most pros. use SMAs for key MAs such as 20, 50, 200. But regardless, the 200 EMA is where we get in ambiguous territory. Remember the VWAP is the same on any time frame, moving averages are not. MAs can be used in a certain way, but I recommend sticking with and developing the core strategy around something objectives, such as the VWAP with its deviation bands and the volume profile, or other things I have already mentioned.

If you see a pattern, it has to make an objective sense. If the pattern is consistent and real, the price is doing it because of something. What is it? Most of the time it is not a moving average. Remember, VWAP has standard deviation bands, three of them on each side and the volume profile has VAH, VAL, and POC. Then we have time frames, Daily Weekly, etc. Then we have traditional pivots that are widely followed, then we have Daily, Weekly, etc high/low, then we have RSI which all pros use.

In short, there are many objective reasons why the price is doing what it is doing. One other thing, the last 30 minutes of trading is not for amateurs. A lot of things influence the close of the futures. I would stick with the basics during the day and stay away from the close and an opening range (first 15/30 minutes).

Hi @john3 can you expand on the Bollinger Bands and RSI combo approach?

The basic idea is to confirm the BB signal with RSI. If both agree, trade, if not, no trade. Obviously, there are many variables, such as the time frame and which BB base to use, but that is up to an individual to figure out. It has to make sense to you and you have to be comfortable with it to be consistent.

@diazlaz By "confirm" I mean an overbought/oversold condition, not trading in the "normal" range. The tradable signal has to be an end of either overbought or oversold and both have to agree. But I would not trade it in isolation, those signals might be coincidental, the price might be reacting to the VWAP and its deviation bands, the volume profile levels or both.

You can trade anything you want to trade, including stocks, of course. And with a recent release, they've added options.

The only options I see are options on Futures!

Their website and brokerages only say Futures, Options (on Futures), and Forex. I don't see anything about Stocks/Securities. I don't want to open another brokerage account if I can't trade the NYSE and NASDAQ. But I need some of Ninja trader's functionality.

https://ninjatrader.com/

@TrueDepth

First of all, you can use TD Ameritade data feed to trade stocks with Ninja.

Second, here is a list of Ninja's data providers, some of them support equities.

How to import a stock list.

First of all, you can use TD Ameritade data feed to trade stocks with Ninja.

Second, here is a list of Ninja's data providers, some of them support equities.

How to import a stock list.

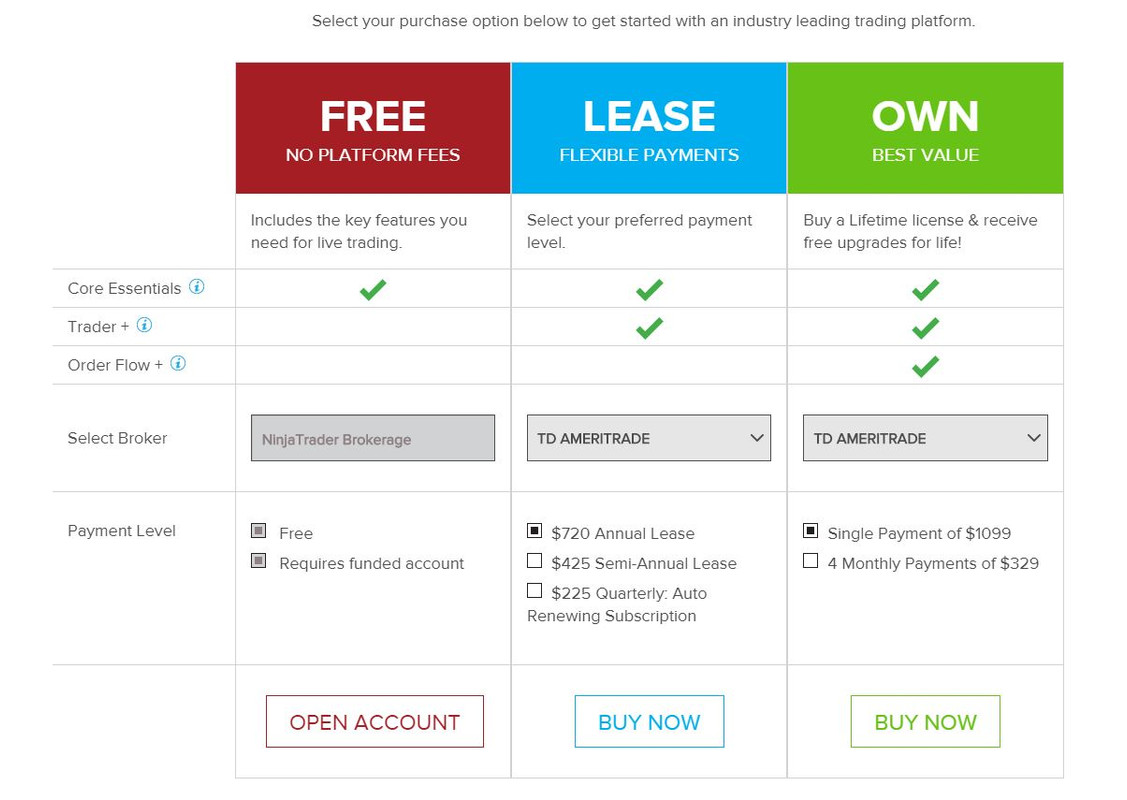

I see where you can use other brokers such as TDAmeritrade with NinjaTrader, however you have to buy the software for $1,099 or lease.

To use the software for free ( doesn't include Trader+ addons), you have to use their broker.Their broker is just for Forex or Futures.

I also download their demo with free trial. No stocks will chart.

Have you actually traded stocks on NinjaTrader or were you pulling my chain?

To use the software for free ( doesn't include Trader+ addons), you have to use their broker.Their broker is just for Forex or Futures.

I also download their demo with free trial. No stocks will chart.

Have you actually traded stocks on NinjaTrader or were you pulling my chain?

@TrueDepth Not pulling anything, I was just trying to help. I don't know about the free version I bought the full license and I don't trade stocks, only futures. The best way to find out everything is to call them, they will answer all of your questions.

Before I bought the full license, I asked for a demo license (basically a free trial of the fully functional version, but you obviously cannot trade) that unlocked all of the functionality so that I could try everything. You can do the same thing, call them.

Before I bought the full license, I asked for a demo license (basically a free trial of the fully functional version, but you obviously cannot trade) that unlocked all of the functionality so that I could try everything. You can do the same thing, call them.

@TrueDepth Maybe I'm mistaken, but I do remember charting stocks, such AAPL and TSLA. To chart, you have to download the data first. Don't know if it is only EOD data or intraday also included on the free version, but you need to download it first.

SparkyFlary

Member

The initial entry can sometimes imply that it will be in a trend before most or all indicators have time to give off a signal. I think it's one of those statistical plays where you buy several and hope for the winners to outweigh the losers. The settings are usually 20/21 or 50/55 for those turtle strategies. The biggest difference in all of those donchian or turtle strategies is mostly on the exit plan.This strategy has a lot of issues in non trending markets. Does anyone else have better experience?

I've tried adding VWAP to my WeBull chart and it didn't show up... it seems to only work during shorter timeframes. Am I wrong?Another simple, robust strategy that makes sense is Bollinger Bands and RSI combo. That said, trading without the VWAP is kind of like trying to catch a rabbit with your eyes closed. VWAP is the only indicator that works the same regardless of a time frame. The Volume profile is another one, but in Ninja not in TOS. TOS does not use the true volume profile, it is aggregated by time, but it is still usable.

The VWAP is as close to the holy grail as it gets. It gives you everything you want, Volume, Volatility and Trend. VWAP and RSI is another great combination.

As far as I am aware TOS does not support full auto tradingSlightly related, can you automate actual orders on thinkorswim or would you have to convert to a different platform for that (like Alpaca)?

you can trade stocks on NTIt looks like on Ninjatrader you can only trade Futures or Forex. Not stocks?

There is a good article on Donchian Systems from traders.com Feb 2014 issue. I have a copy in PDF since you need a subscription.

Could you share it please?

RickK

Active member

@Kitchasap , my apologies to you and anyone else. Yes, apparently the link no longer works and I have neither the chart setup or the shared link inside my copy of TOS any longer. I guess that brings this thread to a close.

Thanks for your time@Kitchasap , my apologies to you and anyone else. Yes, apparently the link no longer works and I have neither the chart setup or the shared link inside my copy of TOS any longer. I guess that brings this thread

Here is the code from that issue/strategy:There is a good article on Donchian Systems from traders.com Feb 2014 issue. I have a copy in PDF since you need a subscription.

Tos link: http://tos.mx/s7sg5S

Code:

input length1 = 40;

input length2 = 15;

def buystop = Highest(high, length1)[1];

def sellstop = Lowest(low, length2)[1];

def shortstop = Lowest(low, length1)[1];

def coverstop = Highest(high, length2)[1];

def buy = high > buystop;

def short = low < shortstop;

def sell = low < sellstop;

def cover = high > coverstop;

def position = {default none, long, short};

position = if (buy or (position[1] == position.long and !sell)) then position.long else if (short or (position[1] == position.short and !cover)) then position.short else position.none;

plot BandUp = if position[1] == position.short then coverstop else buystop;

plot BandDown = if position[1] == position.long then sellstop else shortstop;

BandUp.SetDefaultColor(GetColor(1));

BandDown.SetDefaultColor(GetColor(1));

AddOrder(OrderType.BUY_AUTO, buy, tickColor = GetColor(1), arrowColor = GetColor(1), name = "DonchianBuy");

AddOrder(OrderType.SELL_AUTO, short, tickColor = GetColor(1), arrowColor = GetColor(1), name = "DonchianShort");

AddOrder(OrderType.SELL_TO_CLOSE, sell, tickColor = GetColor(1), arrowColor = GetColor(1), name = "DonchianSell");

AddOrder(OrderType.BUY_TO_CLOSE, cover, tickColor = GetColor(1), arrowColor = GetColor(1), name = "DonchianCover");(Be sure to post the code as a STRATEGY and not a study)

- Status

- Not open for further replies.

Ben's Swing Trading Strategy + Indicator

I wouldn't call this a course. My goal is zero fluff. I will jump right into my current watchlist, tell you the ThinkorSwim indicator that I'm using, and past trade setups to help you understand my swing trading strategy.

Similar threads

-

RTH High Low (Murrey Math / Donchian ) Strategy

- Started by RickK

- Replies: 11

-

Repaints Chewie's Super Trend, Hull Average, Donchian Trend Ribbon Trading System for ThinkorSwim

- Started by chewie76

- Replies: 286

-

Suggestions for Renko with Donchian For ThinkOrSwim

- Started by JoeDV

- Replies: 2

-

-

Not the exact question you're looking for?

Start a new thread and receive assistance from our community.

87k+

Posts

1284

Online

Similar threads

-

RTH High Low (Murrey Math / Donchian ) Strategy

- Started by RickK

- Replies: 11

-

Repaints Chewie's Super Trend, Hull Average, Donchian Trend Ribbon Trading System for ThinkorSwim

- Started by chewie76

- Replies: 286

-

Suggestions for Renko with Donchian For ThinkOrSwim

- Started by JoeDV

- Replies: 2

-

-

Similar threads

-

RTH High Low (Murrey Math / Donchian ) Strategy

- Started by RickK

- Replies: 11

-

Repaints Chewie's Super Trend, Hull Average, Donchian Trend Ribbon Trading System for ThinkorSwim

- Started by chewie76

- Replies: 286

-

Suggestions for Renko with Donchian For ThinkOrSwim

- Started by JoeDV

- Replies: 2

-

-

The Market Trading Game Changer

Join 2,500+ subscribers inside the useThinkScript VIP Membership Club

- Exclusive indicators

- Proven strategies & setups

- Private Discord community

- ‘Buy The Dip’ signal alerts

- Exclusive members-only content

- Add-ons and resources

- 1 full year of unlimited support

Frequently Asked Questions

What is useThinkScript?

useThinkScript is the #1 community of stock market investors using indicators and other tools to power their trading strategies. Traders of all skill levels use our forums to learn about scripting and indicators, help each other, and discover new ways to gain an edge in the markets.

How do I get started?

We get it. Our forum can be intimidating, if not overwhelming. With thousands of topics, tens of thousands of posts, our community has created an incredibly deep knowledge base for stock traders. No one can ever exhaust every resource provided on our site.

If you are new, or just looking for guidance, here are some helpful links to get you started.

- The most viewed thread:

https://usethinkscript.com/threads/repainting-trend-reversal-for-thinkorswim.183/ - Our most popular indicator:

https://usethinkscript.com/threads/buy-the-dip-indicator-for-thinkorswim.3553/ - Answers to frequently asked questions:

https://usethinkscript.com/threads/answers-to-commonly-asked-questions.6006/

What are the benefits of VIP Membership?

VIP members get exclusive access to these proven and tested premium indicators: Buy the Dip, Advanced Market Moves 2.0, Take Profit, and Volatility Trading Range. In addition, VIP members get access to over 50 VIP-only custom indicators, add-ons, and strategies, private VIP-only forums, private Discord channel to discuss trades and strategies in real-time, customer support, trade alerts, and much more. Learn all about VIP membership here.

How can I access the premium indicators?

To access the premium indicators, which are plug and play ready, sign up for VIP membership here.