# weis_wave_3peaks_00d

#https://usethinkscript.com/threads/display-values-of-last-3-peaks-of-weis-wave.14482/

#Questions UnAnswered Graveyard

#UnAnswered Display values of last 3 peaks of Weis Wave

#SimpleStock Feb 14, 2023

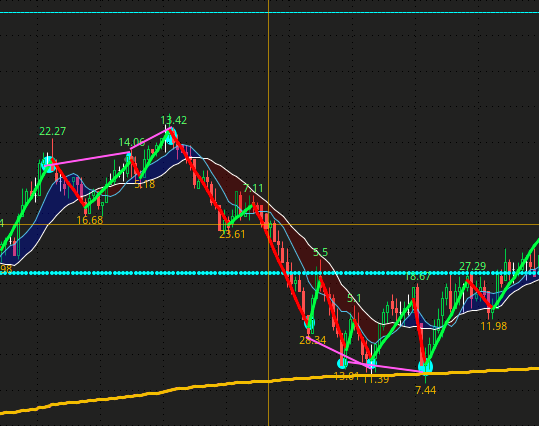

#Would it be possible to display values of last 3 peaks/valleys of price and volume with Addlabel or any other methods in the Weis Wave Zig Zag with Volume indicator ?

#https://usethinkscript.com/threads/weis-wave-volume-indicator-for-thinkorswim.72/#post-308

#BTW it will help us with identifying divergences easily. Three higher peaks with lower volumes and lower valleys with lower volume.

#Attached is ES from 2/13/23

#-------------------------------

#https://usethinkscript.com/threads/weis-wave-volume-indicator-for-thinkorswim.72/#post-308

#Weis Wave Volume Indicator for ThinkorSwim

#BenTen Feb 25, 2019

#Here is the Weis Wave Volume indicator for ThinkorSwim converted from the Lazy Bear's version over at TradingView. In addition, I also found another indicator called Weis Wave Volume with ZigZag so I'll include that in this post as well.

#---------------------------------

# Weis Wave Zig Zag with Volume

#Note: The Weis Wave indicator shows price waves associated with the Weis Wave Volume lower indicator.

#Note: The reversalAmount: Indicate the minimum amount price must reverse before an inflection point can be formed. This value should be set the same on the lower Weis Wave Volume indicator.

declare upper;

input price = hlc3;

input reversalAmount = 1.0;

input reversalMode = {default price, percent};

input displayMode = {default volume, barNumber, barTotal, none};

def mode = if reversalMode == reversalMode.price then ZigZagTrendSign(price = price, reversalAmount=reversalAmount) else ZigZagTrendPercent(price = price, reversalAmount=reversalAmount);

def inflection = if reversalMode == reversalMode.price then if !isNan(ZigZagSign(price = price, reversalAmount=reversalAmount)) then 1 else 0 else if !isNan(ZigZagPercent(price = price, reversalAmount=reversalAmount)) then 1 else 0;

rec trend = if inflection==1 and mode ==-1 then 1 else if inflection==1 and mode==1 then -1 else trend[1];

plot wave = if reversalMode == reversalMode.price then ZigZagSign(price = price, reversalAmount=reversalAmount) else ZigZagPercent(price = price, reversalAmount=reversalAmount);

wave.EnableApproximation();

wave.AssignValueColor(if trend[1] == 1 then color.green else color.red);

wave.SetLineWeight(3);

rec upWaveVolume = if inflection == 1 and trend == 1 and close > open then volume else if inflection == 1 and trend == 1 and close <= open then 0 else if trend == 1 or (inflection == 1 and trend == -1 and close >= open) then upWaveVolume[1] + volume else 0;

rec downWaveVolume = if inflection == 1 and trend == -1 and close < open then volume else if inflection == 1 and trend == -1 and close >= open then 0 else if trend == -1 or (inflection == 1 and trend == 1 and close <= open) then downWaveVolume[1] + volume else 0;

rec barsUp = if inflection == 1 and trend == 1 and close > open then 1 else if inflection == 1 and trend == 1 and close <= open then 0 else if trend == 1 or (inflection == 1 and trend == -1 and close >= open) then barsUp[1] + 1 else 0;

rec barsDown = if inflection == 1 and trend == -1 and close < open then 1 else if inflection == 1 and trend == -1 and close >= open then 0 else if trend == -1 or (inflection == 1 and trend == 1 and close <= open) then barsDown[1] + 1 else 0;

plot uCount = if (displayMode == displayMode.barNumber and barsUp) then barsUp else double.nan;

uCount.SetPaintingStrategy(paintingStrategy.VALUES_BELOW);

uCount.SetDefaultColor(color.dark_green);

plot dCount = if (displayMode == displayMode.barNumber and barsDown) then barsDown else double.nan;

dCount.SetPaintingStrategy(paintingStrategy.VALUES_ABOVE);

dCount.SetDefaultColor(color.red);

plot uCountTot = if (displayMode == displayMode.barTotal and barsDown == 1 and barsUp==0) then barsUp[1] else double.nan;

uCountTot.SetPaintingStrategy(paintingStrategy.VALUES_ABOVE);

uCountTot.SetDefaultColor(color.dark_green);

plot dCountTot = if (displayMode == displayMode.barTotal and barsDown==0 and barsUp==1) then barsDown[1] else double.nan;

dCountTot.SetPaintingStrategy(paintingStrategy.VALUES_BELOW);

dCountTot.SetDefaultColor(color.red);

plot uVol = if (displayMode == displayMode.volume and barsDown == 1 and barsUp==0) then upWaveVolume[1] else double.nan;

uVol.SetPaintingStrategy(paintingStrategy.VALUES_ABOVE);

uVol.SetDefaultColor(color.dark_green);

plot dVol = if (displayMode == displayMode.volume and barsUp == 1 and barsDown==0) then downWaveVolume[1] else double.nan;

dVol.SetPaintingStrategy(paintingStrategy.VALUES_BELOW);

dVol.SetDefaultColor(color.red);

#------------------------------------------

# display values of last 3 peaks/valleys of price and volume

# trend:

# peak = -1

# valley = +1

# on last bar = can be either +or-

def na = double.nan;

def bn = barnumber();

def lastbn = HighestAll(If(IsNaN(close), 0, bn));

def lastbar = if (bn == lastbn) then 1 else 0;

#def lastbar = !isnan(close[0]) and isnan(close[-1]);

def peakcnt = if bn == 1 then 0

else if isnan(wave) or isnan(trend) then peakcnt[1]

else if lastbar then peakcnt[1]

else if !isnan(wave) and trend == -1 then peakcnt[1] + 1

else peakcnt[1];

def valleycnt = if bn == 1 then 0

else if isnan(wave) or isnan(trend) then valleycnt[1]

else if lastbar then valleycnt[1]

else if !isnan(wave) and trend == 1 then valleycnt[1] + 1

else valleycnt[1];

def peakmax = highestall(peakcnt);

def valleymax = highestall(valleycnt);

def peakrevcnt = peakmax - peakcnt + 1;

def valleyrevcnt = valleymax - valleycnt + 1;

input qty_of_last_peaks_valleys = 2;

def q = qty_of_last_peaks_valleys;

# max of 4

def p1pr = if bn == 1 then 0 else if q >= 1 and peakrevcnt == 1 and peakrevcnt[1] != 1 then close else p1pr[1];

def p2pr = if bn == 1 then 0 else if q >= 2 and peakrevcnt == 2 and peakrevcnt[1] != 2 then close else p2pr[1];

def p3pr = if bn == 1 then 0 else if q >= 3 and peakrevcnt == 3 and peakrevcnt[1] != 3 then close else p3pr[1];

def p4pr = if bn == 1 then 0 else if q >= 4 and peakrevcnt == 4 and peakrevcnt[1] != 4 then close else p4pr[1];

def p1vol = if bn == 1 then 0 else if q >= 1 and peakrevcnt == 1 and peakrevcnt[1] != 1 then volume else p1vol[1];

def p2vol = if bn == 1 then 0 else if q >= 2 and peakrevcnt == 2 and peakrevcnt[1] != 2 then volume else p2vol[1];

def p3vol = if bn == 1 then 0 else if q >= 3 and peakrevcnt == 3 and peakrevcnt[1] != 3 then volume else p3vol[1];

def p4vol = if bn == 1 then 0 else if q >= 4 and peakrevcnt == 4 and peakrevcnt[1] != 4 then volume else p4vol[1];

def v1pr = if bn == 1 then 0 else if q >= 1 and valleyrevcnt == 1 and valleyrevcnt[1] != 1 then close else v1pr[1];

def v2pr = if bn == 1 then 0 else if q >= 2 and valleyrevcnt == 2 and valleyrevcnt[1] != 2 then close else v2pr[1];

def v3pr = if bn == 1 then 0 else if q >= 3 and valleyrevcnt == 3 and valleyrevcnt[1] != 3 then close else v3pr[1];

def v4pr = if bn == 1 then 0 else if q >= 4 and valleyrevcnt == 4 and valleyrevcnt[1] != 4 then close else v4pr[1];

def v1vol = if bn == 1 then 0 else if q >= 1 and valleyrevcnt == 1 and valleyrevcnt[1] != 1 then volume else v1vol[1];

def v2vol = if bn == 1 then 0 else if q >= 2 and valleyrevcnt == 2 and valleyrevcnt[1] != 2 then volume else v2vol[1];

def v3vol = if bn == 1 then 0 else if q >= 3 and valleyrevcnt == 3 and valleyrevcnt[1] != 3 then volume else v3vol[1];

def v4vol = if bn == 1 then 0 else if q >= 4 and valleyrevcnt == 4 and valleyrevcnt[1] != 4 then volume else v4vol[1];

def bubx = 2;

def bub = !isnan(close[bubx+1]) and isnan(close[bubx]);

addchartbubble(bub, close[bubx+1],

"Peaks\n" +

"1 " + round(p1pr, 2) + " " + p1vol + "\n" +

"2 " + round(p2pr, 2) + " " + p2vol + "\n" +

"3 " + round(p3pr, 2) + " " + p3vol + "\n" +

"4 " + round(p4pr, 2) + " " + p4vol + "\n"

, color.yellow, yes);

addchartbubble(bub, close[bubx+1],

"Valleys\n" +

"1 " + round(v1pr, 2) + " " + v1vol + "\n" +

"2 " + round(v2pr, 2) + " " + v2vol + "\n" +

"3 " + round(v3pr, 2) + " " + v3vol + "\n" +

"4 " + round(v4pr, 2) + " " + v4vol + "\n"

, color.yellow, no);

#------------------------------------

input test1 = no;

addchartbubble(test1, low*0.995,

wave + " w\n" +

trend + " t\n" +

peakmax + " pm\n" +

peakcnt + " pc\n" +

peakrevcnt + " pr\n" +

"----\n" +

valleymax + " vm\n" +

valleycnt + " v\n" +

valleyrevcnt + " vr"

, color.yellow, no);

input test2 = no;

addchartbubble(test2, low*0.995,

wave + " w\n" +

trend + " t\n" +

#peakmax + " pm\n" +

#peakcnt + " pc\n" +

peakrevcnt + " pr\n" +

#close + "\n" +

"----\n" +

#valleymax + " vm\n" +

#valleycnt + " v\n" +

valleyrevcnt + " vr"

, color.yellow, no);

#

#