Day of Week Gap Analytics is generally understudied,

This Gap Analytics study complement's @mashume's work by tracking the cumulative ticks gained/lost on gap bars segmented by DAY OF WEEK.

https://usethinkscript.com/threads/...forms-well-on-a-particular-day-of-year.16929/

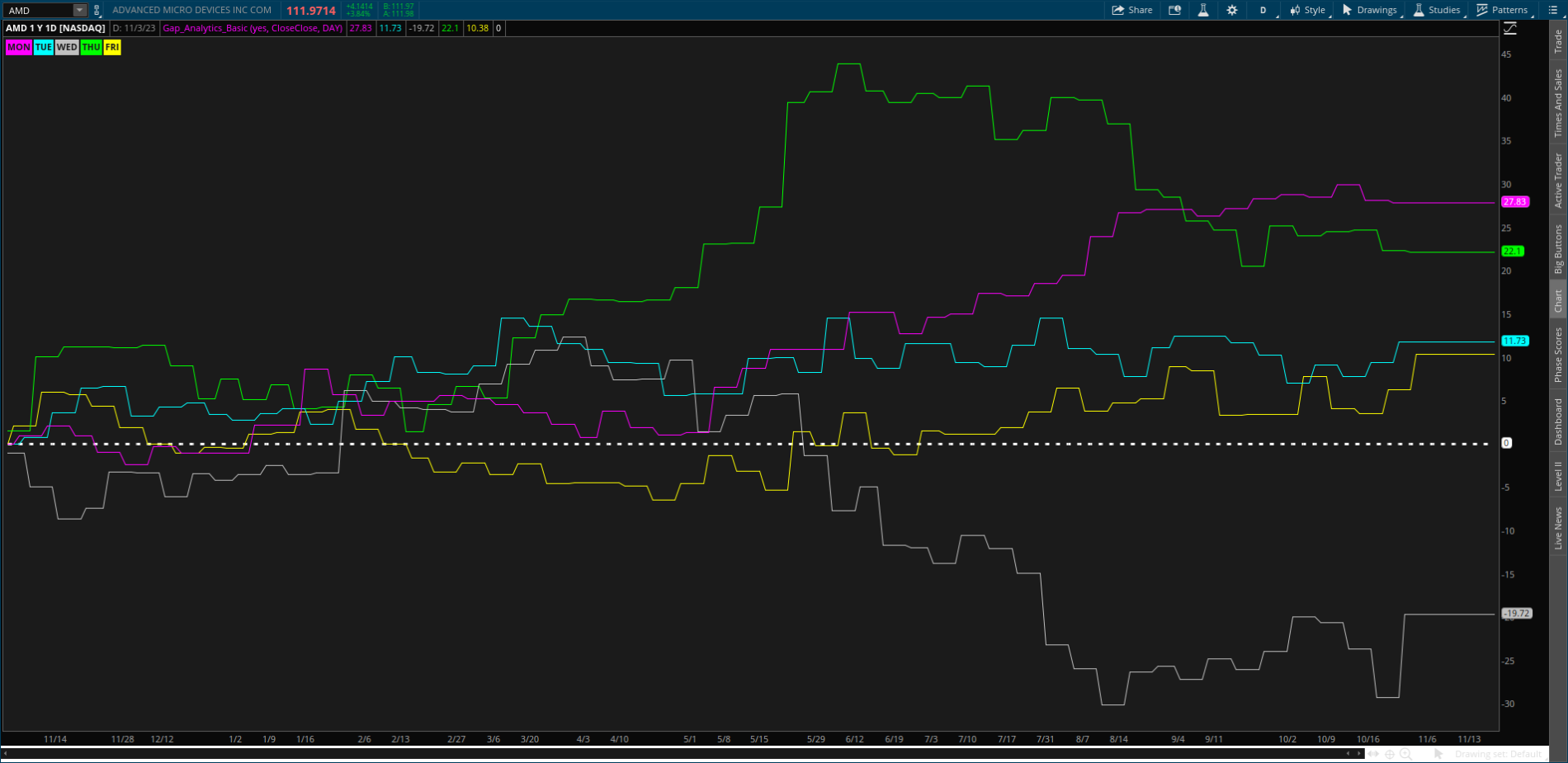

3 types of analysis can be run: Close-Close, Close-Open, Open-Close. Clarifying equity expansion/contraction by DAY OF WEEK is it's primary value - perhaps use it to complement your other trading tools. Example use: $AMD Daily, 1 Year chart - Close-Close analysis. Significant equity expansion is from Wednesday to Monday. > *Buy near Wednesday's Close - *Sell the following Monday before the Close IF consistent with your primary indicators. Hope the community finds some value in the study.

This Gap Analytics study complement's @mashume's work by tracking the cumulative ticks gained/lost on gap bars segmented by DAY OF WEEK.

https://usethinkscript.com/threads/...forms-well-on-a-particular-day-of-year.16929/

3 types of analysis can be run: Close-Close, Close-Open, Open-Close. Clarifying equity expansion/contraction by DAY OF WEEK is it's primary value - perhaps use it to complement your other trading tools. Example use: $AMD Daily, 1 Year chart - Close-Close analysis. Significant equity expansion is from Wednesday to Monday. > *Buy near Wednesday's Close - *Sell the following Monday before the Close IF consistent with your primary indicators. Hope the community finds some value in the study.

Ruby:

#Gap Analytics Study

#Ommni007, 11/3/23 Free to share within UseThinkscript Community

#Change log: 11/3/23 Trimmed to basic version

#hint: Tracks the cumulative ticks gained/lost on gap bars segmented by DAY OF WEEK.

#hint i_type: The type of analysis to run. Options are: <b>CloseOpen</b> (current open minus previous close), <b>OpenClose</b> (current close versus current open), and <b>CloseClose</b> (current close versus previous close)

declare lower;

#INPUTS

input i_print_day_labels = YES;

input i_type = {default CloseOpen, OpenClose, CloseClose};

input timeFrame = {default DAY, WEEK, MONTH};

#LOGIC

def v_tick_size = TickSize();

def v_contract_roll = HasContractChangeEvent();

def v_weekday = GetDayOfWeek(GetYYYYMMDD());

def v_gap_up;

def v_gap_down;

switch (i_type)

{

case CloseOpen:

if open(period = timeFrame) > close(period = timeFrame)[1] and !v_contract_roll

then {

v_gap_up = 1;

}

else {

v_gap_up = 0;

}

if open(period = timeFrame) < close(period = timeFrame)[1] and !v_contract_roll

then {

v_gap_down = 1;

}

else {

v_gap_down = 0;

}

case OpenClose:

if close(period = timeFrame) > open(period = timeFrame)

then {

v_gap_up = 1;

}

else {

v_gap_up = 0;

}

if close(period = timeFrame) < open(period = timeFrame)

then {

v_gap_down = 1;

}

else {

v_gap_down = 0;

}

case CloseClose:

if close(period = timeFrame) > close(period = timeFrame)[1] and !v_contract_roll

then {

v_gap_up = 1;

}

else {

v_gap_up = 0;

}

if close(period = timeFrame) < close(period = timeFrame)[1] and !v_contract_roll

then {

v_gap_down = 1;

}

else {

v_gap_down = 0;

}

}

def v_gap_size;

switch (i_type)

{

case CloseOpen:

if (v_gap_up or v_gap_down)

then {

v_gap_size = (open(period = timeFrame) - close(period = timeFrame)[1]) / v_tick_size;

}

else {

v_gap_size = 0;

}

case OpenClose:

if (v_gap_up or v_gap_down)

then {

v_gap_size = (close(period = timeFrame) - open(period = timeFrame)) / v_tick_size;

}

else {

v_gap_size = 0;

}

case CloseClose:

if (v_gap_up or v_gap_down)

then {

v_gap_size = (close(period = timeFrame) - close(period = timeFrame)[1]) / v_tick_size;

}

else {

v_gap_size = 0;

}

}

#ACCUMULATE THE GAPS THEMSELVES (IN TICKS). GAPS UP ARE ADDITIVE, GAPS DOWN ARE SUBTRACTIVE.

def v_mon_gap;

def v_tue_gap;

def v_wed_gap;

def v_thu_gap;

def v_fri_gap;

if v_weekday == 1 and (v_gap_up or v_gap_down)

then {v_mon_gap = v_mon_gap[1] + v_gap_size;}

else {v_mon_gap = v_mon_gap[1];}

if v_weekday == 2 and (v_gap_up or v_gap_down)

then {v_tue_gap = v_tue_gap[1] + v_gap_size;}

else {v_tue_gap = v_tue_gap[1];}

if v_weekday == 3 and (v_gap_up or v_gap_down)

then {v_wed_gap = v_wed_gap[1] + v_gap_size;}

else {v_wed_gap = v_wed_gap[1];}

if v_weekday == 4 and (v_gap_up or v_gap_down)

then {v_thu_gap = v_thu_gap[1] + v_gap_size;}

else {v_thu_gap = v_thu_gap[1];}

if v_weekday == 5 and (v_gap_up or v_gap_down)

then {v_fri_gap = v_fri_gap[1] + v_gap_size;}

else {v_fri_gap = v_fri_gap[1];}

def v_avg_gap_mon = TotalSum(AbsValue(v_mon_gap-v_mon_gap[1]))/TotalSum(v_mon_gap <> v_mon_gap[1]);

def v_avg_gap_tue = TotalSum(AbsValue(v_tue_gap-v_tue_gap[1]))/TotalSum(v_tue_gap <> v_tue_gap[1]);

def v_avg_gap_wed = TotalSum(AbsValue(v_wed_gap-v_wed_gap[1]))/TotalSum(v_wed_gap <> v_wed_gap[1]);

def v_avg_gap_thu = TotalSum(AbsValue(v_thu_gap-v_thu_gap[1]))/TotalSum(v_thu_gap <> v_thu_gap[1]);

def v_avg_gap_fri = TotalSum(AbsValue(v_fri_gap-v_fri_gap[1]))/TotalSum(v_fri_gap <> v_fri_gap[1]);

#PLOTS

plot p_mon_gap = Round(v_mon_gap * v_tick_size,2);

plot p_tue_gap = Round(v_tue_gap * v_tick_size,2);

plot p_wed_gap = Round(v_wed_gap * v_tick_size,2);

plot p_thu_gap = Round(v_thu_gap * v_tick_size,2);

plot p_fri_gap = Round(v_fri_gap * v_tick_size,2);

plot p_zero = 0;

#PLOT STYLES & SETTINGS

p_mon_gap.SetDefaultColor(Color.MAGENTA);

p_tue_gap.SetDefaultColor(Color.CYAN);

p_wed_gap.SetDefaultColor(Color.LIGHT_GRAY);

p_thu_gap.SetDefaultColor(Color.GREEN);

p_fri_gap.SetDefaultColor(Color.YELLOW);

p_zero.SetStyle(Curve.SHORT_DASH);

p_zero.SetDefaultColor(Color.WHITE);

p_zero.SetLineWeight(3);

AddLabel(i_print_day_labels, "MON", Color.MAGENTA);

AddLabel(i_print_day_labels, "TUE", Color.CYAN);

AddLabel(i_print_day_labels, "WED", Color.LIGHT_GRAY);

AddLabel(i_print_day_labels, "THU", Color.GREEN);

AddLabel(i_print_day_labels, "FRI", Color.YELLOW);

Last edited by a moderator: