SCALPER

New member

Hello,

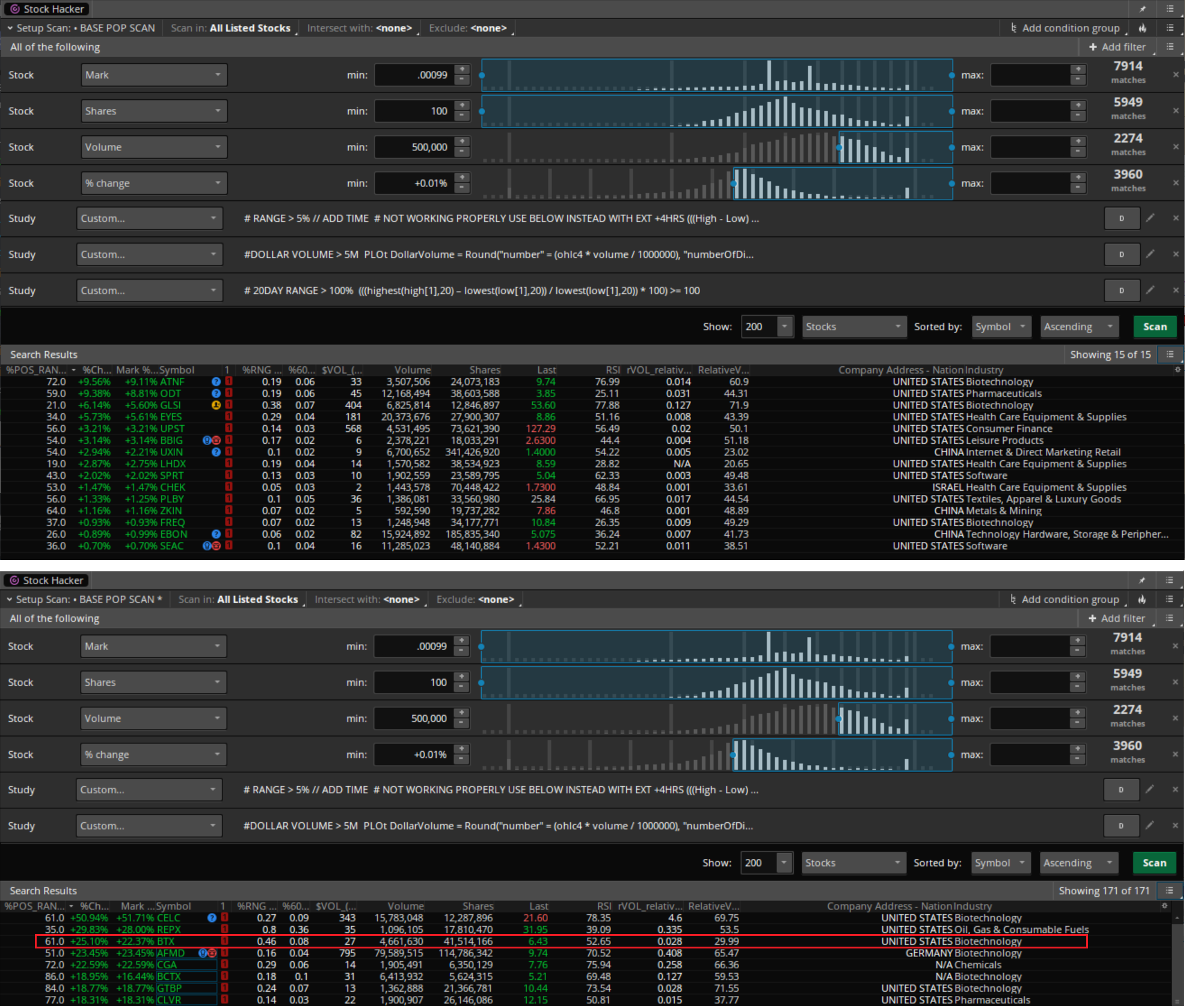

Today 4/9/21, I found an error / omission using the following daily range script -

(((highest(high[1],20) – lowest(low[1],20)) / lowest(low[1],20)) * 100) >= 100

Specifically, it omitted BTX with a 20 day range from 3.59 - 10.28 or 186.4%

Any help with a modification or working script is greatly appreciated.

Direct link to the Scan Query

Screenshots of the results w/ and w/out the script -

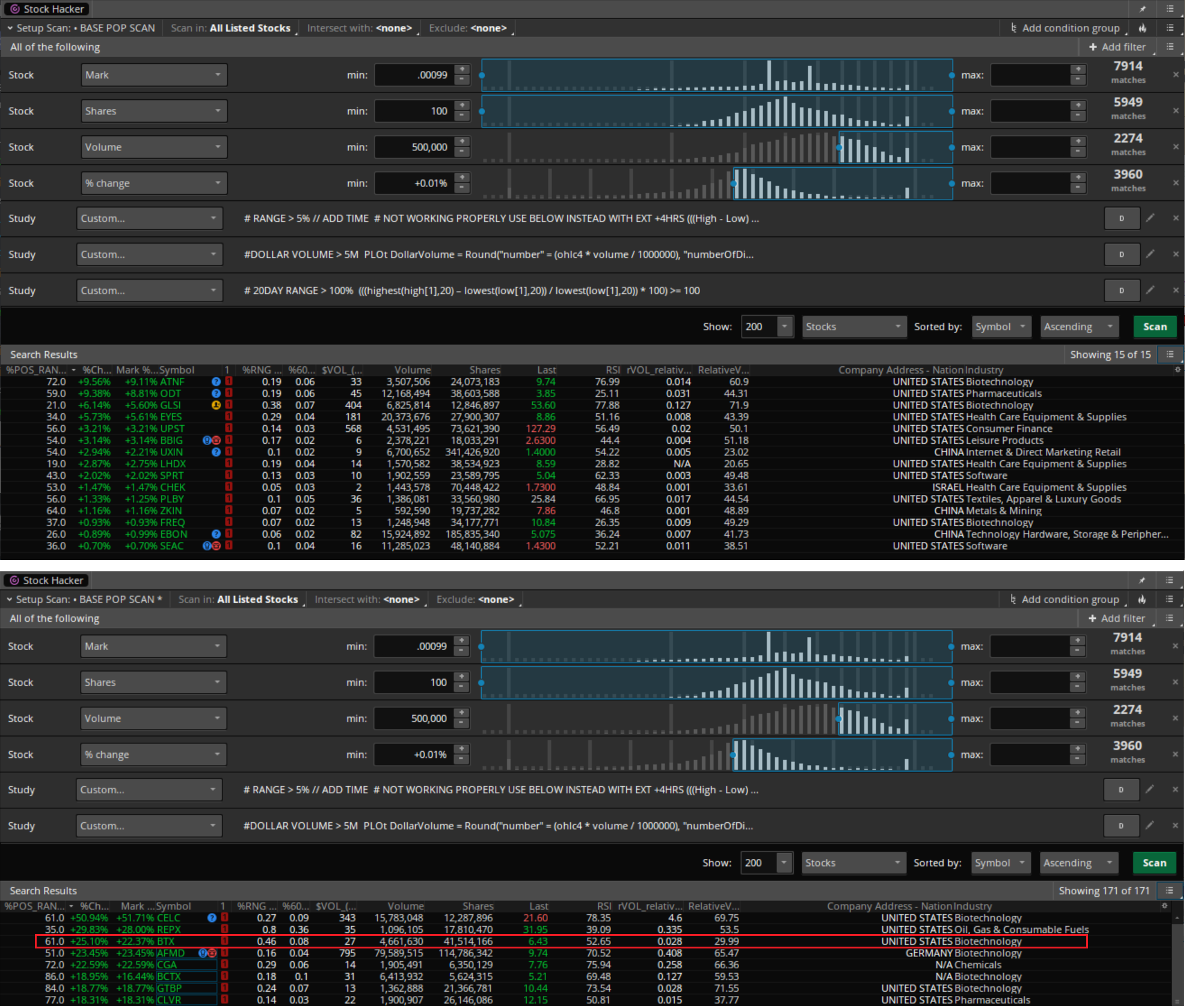

Today 4/9/21, I found an error / omission using the following daily range script -

(((highest(high[1],20) – lowest(low[1],20)) / lowest(low[1],20)) * 100) >= 100

Specifically, it omitted BTX with a 20 day range from 3.59 - 10.28 or 186.4%

Any help with a modification or working script is greatly appreciated.

Direct link to the Scan Query

Screenshots of the results w/ and w/out the script -